Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Discover the USD Q1 2026 outlook, including Fed policy, labor data, technical levels, and potential catalysts driving the U.S. Dollar.

The U.S. Dollar starts 2026 on a cautious footing, with Q1 set to test the impact of monetary policy divergence, labor market signals, and risk sentiment. Daily and weekly timeframes highlight bearish corrective structures unless critical resistance near 100 is reclaimed.

The Fed is widely expected to signal easing through one or two rate cuts in response to moderating inflation and softening employment data, undermining the USD's yield advantage.

Simultaneously, global growth expectations and ongoing geopolitical developments may reduce safe‑haven flows into the dollar. Traders should anticipate volatile swings with a bearish tilt, monitor key levels on DXY, and watch for catalysts that could accelerate either side of the move.

What Could Drive USD in Q1 2026

Impact: A dovish Fed typically weakens the dollar and supports currencies like EUR, GBP, and AUD.

Impact: High sensitivity to U.S. employment releases; surprises can trigger sharp intraday moves.

Impact: Risk appetite swings drive short-term USD flows independent of fundamentals.

Impact: Structural flows create a persistent downward bias, especially on dips.

Daily Timeframe — Short-Term Bias

Daily Bias: Bearish unless daily closes above 100.5 confirm short-term bullish reversal.

Weekly Timeframe — Intermediate Bias

Weekly Bias: Bearish continuation for Q1; stabilization possible only after testing 95–96 support.

Bullish Scenario

Bearish Scenario

Summary Table — Q1 2026

| Timeframe | Bias | Key Levels |

|---|---|---|

| Daily | Bearish/Neutral | 96.5–100.5 |

| Weekly | Bearish | 95–101 |

| Catalysts | Rate cuts, labor data, risk sentiment, FX flows | — |

Q1 Outlook: USD likely to face downside pressure in early 2026 as Fed easing and improving global risk sentiment combine. Traders should watch DXY 96–97 as the key support zone and 100–101 as short-term resistance.

Bank of Japan Governor Kazuo Ueda used his first public appearance in the new year to underscore his intention to keep raising the benchmark rate in a speech to private bankers.

"We will keep raising rates in line with improvement in the economy and inflation," Ueda said Monday in remarks at a New Year's conference hosted by the Japanese Bankers Association. "The appropriate adjustment of monetary easing will lead to the achievement of stable inflation target and longer-term economic growth."

The comments, which came about two weeks after the most recent rate hike, made it clear that Ueda hasn't finished dialing back monetary easing after bringing the rate to the highest since 1995. Shortly before his remarks, the yield on Japan's benchmark 10-year bonds continued its recent ascent, hitting the highest since 1999 due in part to market expectations surrounding further rate increases.

"The mechanism between moderate wage growth and inflation is likely to be maintained," Ueda said.

The BOJ raised its benchmark rate to 0.75% on Dec. 19, the highest level in three decades. Most BOJ watchers expect the next move to come around the middle of the year, while some say there's a risk it could happen sooner due to the weak yen. Japan's currency was trading around 157.15 to the dollar at midday in Tokyo after earlier touching 157.25, the weakest in two weeks.

The yen moved little after Ueda's comments. Its proximity to the key threshold of 160 per dollar is considered by market participants to have been a key factor in the BOJ's rate decision last month.

A weak yen intensifies inflationary pressures via higher import costs. Households have become weary of a prolonged living cost crunch as Japan's key inflation gauge has stayed at or above the BOJ's 2% target for more than three and a half years.

The BOJ delivers its next policy decision on Jan. 23.

Manufacturing conditions across Asean improved in December 2025, supported by stronger output, new orders and rising business confidence, according to S&P Global's Asean Manufacturing Purchasing Managers' Index (PMI).

In a note Monday, S&P Global said the Asean manufacturing sector closed out 2025 with its strongest quarterly performance in four years, despite a slight easing in growth momentum compared with November.

"Although growth momentum eased slightly, reflected in moderated increases in output and new orders, overall expansion remained robust," it said, adding that business sentiment strengthened to a 10-month high.

S&P Global said the sector expanded for a sixth straight month in December, with the headline PMI easing to 52.7 from 53.0 in November, matching the October level.

"While the reading dipped slightly, it continued to reflect sustained and solid improvement in operating conditions and ranked among the highest on record," it said.

It said the latest improvement was driven by strong, though slightly moderated, increases in output and new orders, while the downturn in new export orders persisted but softened in December.

Purchasing activity rose for a fifth consecutive month as manufacturers focused on sourcing raw materials and semi-manufactured goods, with S&P Global noting that the pace of growth was the strongest in more than two-and-a-half years.

Employment continued to expand on a monthly basis since September, with job creation modest but the fastest since February.

S&P Global said firms also reported longer average supplier lead times for a fourth consecutive month in December.

"Tight supply chains, muted job growth and increased new business led to a further accumulation of backlogs, although the rate of increase softened from the previous month's survey record," it said.

On prices, S&P Global said input cost inflation rose sharply and broadly matched the pace seen in November, while output charge inflation was unchanged and remained modest.

"Both price gauges were weaker than their respective historical averages," it said.

It added that Asean manufacturers remained optimistic about the 12-month output outlook.

"The degree of confidence has improved further since October, moving towards the long-run survey average," S&P Global said.

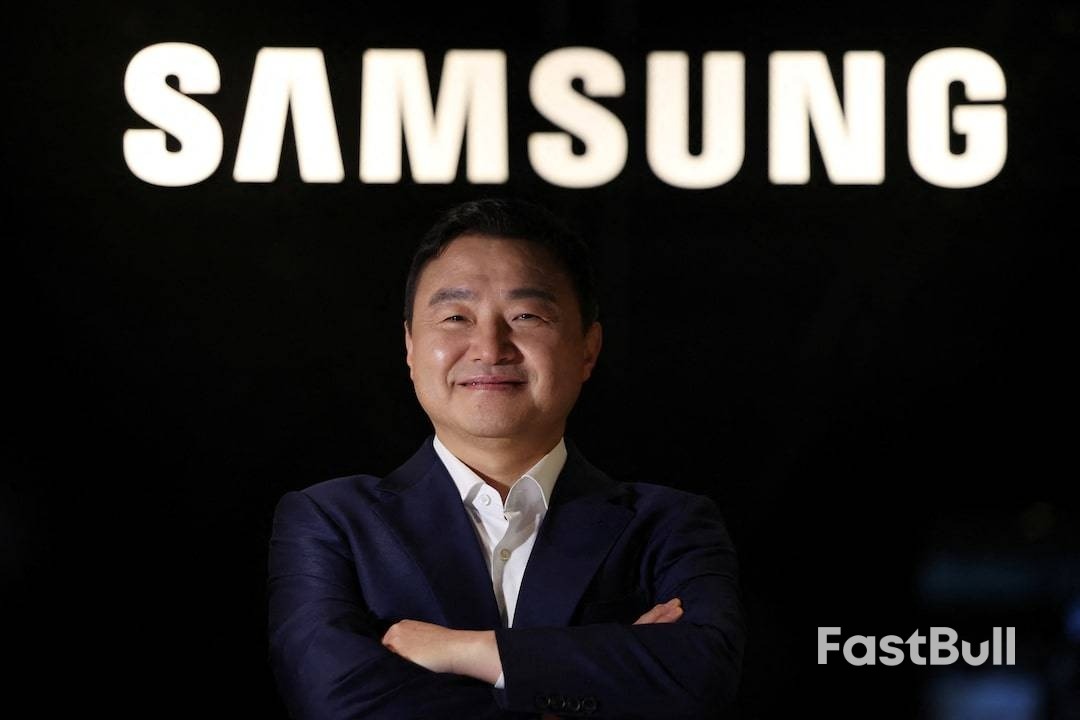

Samsung Electronics plans to double this year the number of its mobile devices with AI features powered by Google's Gemini, its co-CEO said, which would give the U.S. firm an edge over rivals as the global race in artificial intelligence hots up.

The South Korean company, which had rolled out Gemini-backed AI features to about 400 million mobile products, including smartphones and tablets, by last year, plans to boost that figure to 800 million in 2026.

"We will apply AI to all products, all functions, and all services as quickly as possible," T M Roh told Reuters in his first interview since becoming Samsung Electronics opens new tab co-CEO in November.

The plan by the world's largest backer of Google's Android mobile platform is set to give a major boost to its developer Google, which is locked in a race with OpenAI and others to attract more consumer users to their AI model.

Samsung seeks to reclaim its lost crown from Apple (AAPL.O) in the smartphone market and fend off competition from Chinese rivals not only in mobile telephones, but televisions and home appliances, all overseen by Roh.

It will offer integrated AI services across consumer products to widen its lead over Apple in such features, though the latter was set be the top smartphone maker last year, according to market researcher Counterpoint, opens new tab.

Alphabet's (GOOGL.O) Google launched the latest version of Gemini in November, highlighting Gemini 3's lead on several popular industry measures of AI model performance.

In response to Gemini 3, OpenAI CEO Sam Altman reportedly issued an internal "code red," pausing non-core projects and redirecting teams to accelerate development. The ChatGPT maker launched its GPT-5.2 AI model a few weeks later.

Roh expects the adoption of AI to accelerate, as Samsung's surveys on awareness of its Galaxy AI brand jumped to a level of 80% from about 30% in just one year.

"Even though the AI technology might seem a bit doubtful right now, within six months to a year, these technologies will become more widespread," he said.

While search is the most used AI feature on phones, consumers also frequently use a range of generative AI editing and productivity tools for images and others, as well as translation and summary features, he said.

A global shortage of memory chips is a boon to Samsung's mainstay semiconductor business, but pressures margins on the smartphone business, its second largest revenue source.

"As this situation is unprecedented, no company is immune to its impact," Roh said, adding that the crisis affects not only mobile phones but other consumer electronics, from TVs to home appliances.

He did not rule out raising product prices, saying some impact was "inevitable" from a surge in memory chip prices, but Samsung, the world's No.1 TV maker, is working with partners on longer term strategies to minimise the impact.

Market researchers such as IDC and Counterpoint predict the global smartphone market will shrink next year, as the memory chip shortage threatens to drive up phone prices.

Roh said the market for foldable phones that Samsung pioneered in 2019 has been growing slower than expected.

He attributed this to the engineering complexities and lack of applications suitable for the hardware design, but expected the segment to go mainstream in the next two or three years.

A "very high" rate of foldable phone users opt for the same segment for their next purchase, he said, but gave no details.

Samsung controlled nearly two-thirds of the foldable smartphone market in the third quarter of 2025, according to Counterpoint.

But it faces competition from Chinese companies such as Huawei, as well as Apple, expected to launch its first foldable phone this year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up