Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The U.S. Treasury has called on the Bank of Japan to continue tightening its monetary policy to support the normalization of the weak yen and rebalance bilateral trade...

In recent statements, FED Board Member Adriana Kugler said that inflation currently poses a greater risk than weak employment.

Kugler stated that the impact of customs duties on prices has not yet been fully seen, and said, “Inflation will be the primary effect, other effects will emerge over time.” Kugler said that the inflation experience during the pandemic period still has an impact on expectations, and noted that inflation resulting from customs duties may not be a one-time effect.

“My focus right now is inflation. Once the tariffs are fully in place, we can start talking about other impacts, but that hasn’t happened yet,” Kugler said.

Kugler also noted that the tax regulation that came into effect during the term of President Donald Trump may not have a contractionary effect in general, but rather a demand-stimulating effect, which could put pressure on prices.

Kugler also touched on the labor market, noting that unemployment is still at historically low levels, and that the decrease in immigrant inflows could further tighten the labor market. Kugler said that these effects could begin to be felt in some sectors towards the end of the year, and that it was too early to expect large-scale job losses due to artificial intelligence.

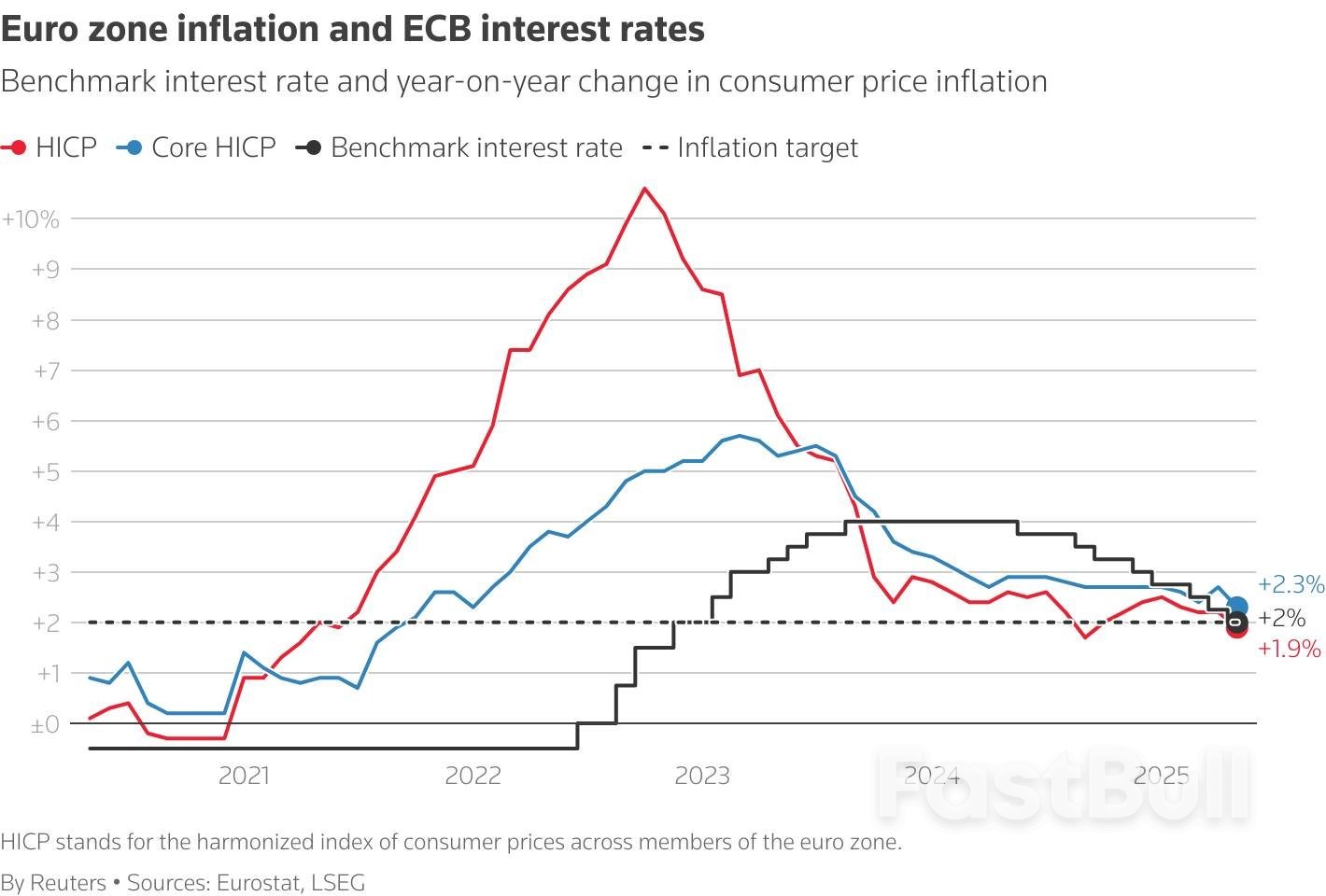

The European Central Bank cut interest rates as expected on Thursday but hinted at a pause in its year-long easing cycle after inflation finally returned to its 2% target.

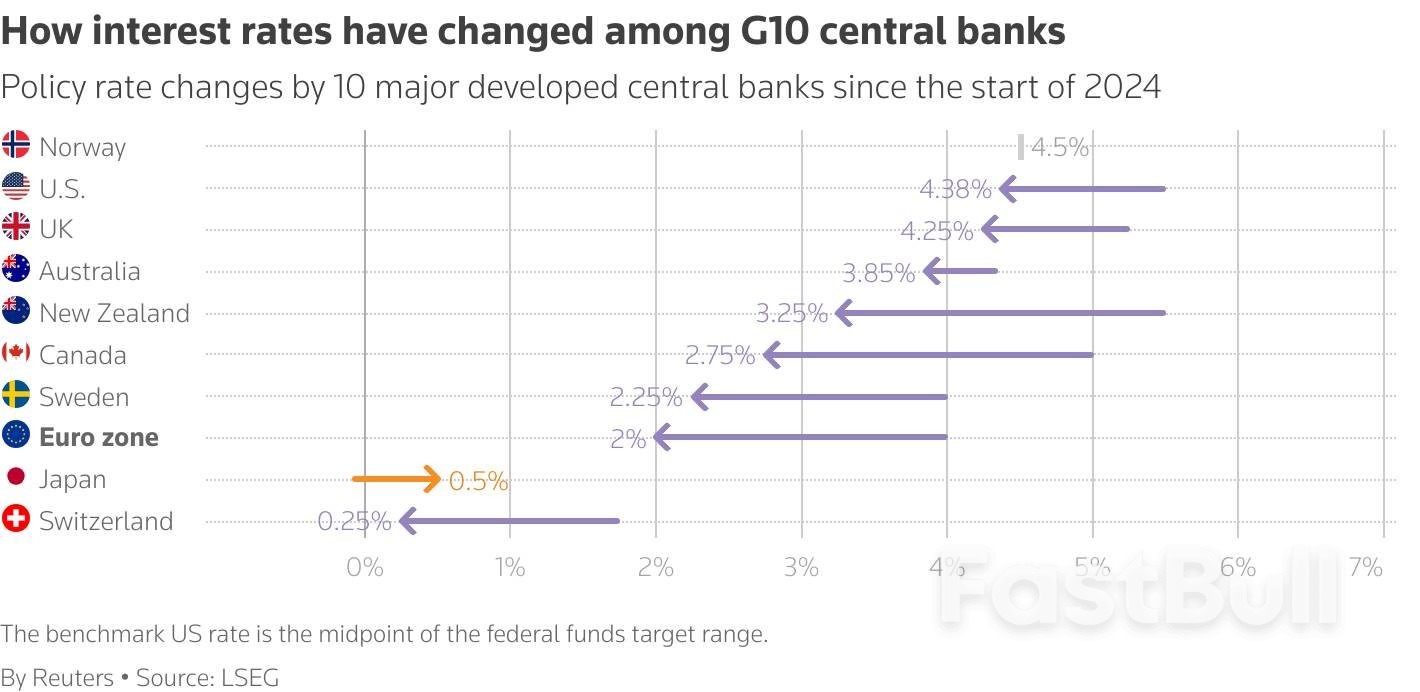

The ECB has lowered borrowing costs eight times, or by 2 percentage points since last June, seeking to prop up a euro zone economy that was struggling even before erratic U.S. economic and trade policies dealt it further blows.

With inflation now just below 2%, ECB President Christine Lagarde said the central bank for the 20 countries that share the euro was in a "good position" with the current rate path, a signal investors took to mean a break in cuts, if not an end to policy easing.

Sources close to the discussion also said the time has come for at least a break since the ECB has already done the legwork in taming inflation and additional support was not needed for now, especially since little new data would be available by the July meeting.

Speaking to Reuters on condition of anonymity, four sources with direct knowledge of the discussion said there was broad agreement around the table about sitting tight in July, and a few even made the case for a longer pause, barring unexpected market turbulence.

Lagarde was less explicit but also hinted at steady policy at the next meeting.

"We are well-positioned after that 25 basis point rate cut and with the rate path as it is," Lagarde told a press conference. "With today's cut, at the current level of interest rates, we believe we are in a good position."

The interest rate path implied by markets sees a pause in July and anticipates just one more cut in the deposit rate toward the end of the year, possibly in December.

"I think we are getting to the end of a monetary policy cycle that was responding to compounded shocks, including COVID, including the war in Ukraine, the illegitimate war in Ukraine, and the energy crisis," Lagarde said.

Economists also saw her words as a clear indication of a pause and some even bet that the ECB's most aggressive easing cycle since the global financial crisis of 2008-2009 might be at a close.

"We think the ECB is done cutting rates now, but this view is contingent on no major negative surprises surfacing and economic outlook to gradually become more robust in line with the ECB's forecasts," Nordea said in a note to clients.

Thursday's decision was virtually unanimous, and the sources said only Austria's Robert Holzmann objected. Holzmann did not return calls seeking comment.

"Our central view is that today's cut is likely the last for some time," HSBC said in a note.

Lagarde also said the euro zone appeared to be attracting more foreign investment, a sign of growing investor confidence and part of the reason why the euro has firmed so much since the U.S. administration embarked on its global trade war.

But there is exceptional uncertainty in the outlook.

Falling energy prices and a stronger euro could put further downward pressure on inflation, said Lagarde, adding that effect could be reinforced if higher tariffs led to lower demand for euro exports and re-routing of overcapacity to Europe.

Depending on the outcome of the trade war with the United States, inflation and growth could significantly differ from projections, the ECB said, as it took the unusual step of releasing alternative scenarios to its forecasts.

The case for a pause rests on the premise that the short- and medium-term prospects for the currency bloc differ greatly and may require different policy responses.

Inflation is set to dip in the short term and undershoot the ECB's target next year, but increased government spending and higher trade barriers will add to price pressures later.

The added complication is that monetary policy impacts the economy with a 12-to-18 month lag, so support approved now could be giving help to a bloc that no longer needs it.

"In our baseline, we expect the ECB to pause at the July meeting and deliver a final rate cut in September," PIMCO portfolio manager Konstantin Veit said. "A more recessionary configuration will likely be needed for the ECB to go faster and further in this cutting cycle."

Acknowledging near-term weakness, the ECB cut its inflation projection for next year.

U.S. President Donald Trump's tariffs are already damaging activity and will have a lasting impact even if an amicable resolution is found, given the hit to confidence and investment.

Most economists think inflation could fall below the ECB's 2% target next year, triggering memories of the pre-pandemic decade when price growth persistently undershot 2%, even if projections show it back at target in 2027.

Further ahead, the outlook changes significantly.

The European Union is likely to retaliate against any permanent U.S. tariffs, raising the cost of trade. Firms could relocate some activity to avoid trade barriers but changes to corporate value chains are also likely to raise costs.

Higher European defence spending, particularly by Germany, and the cost of the green transition could add to inflation while a shrinking workforce due to an ageing population will keep wage pressures elevated.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up