Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Ethereum Drops Below $2300, Down 2.43% In The Past Hour] February 3, According To Htx Market Data, Ethereum Fell Below $2,300, Now Trading At $2,298.77, Down 2.43% In The Past Hour

[Hamas: Ready To Transfer Gaza Strip Administration] On February 2nd Local Time, Hamas Spokesman Hazem Qasim Issued A Statement Saying That Hamas Has Completed The Necessary Procedures Concerning The Gaza Strip Administration And Is Ready To Transfer It To The Palestinian Technical Bureaucratic Committee. The Statement Said That A Committee Composed Of Representatives From Various Factions, Families, And Civil Society In The Gaza Strip Will Oversee The Transfer Process. The Statement Called On All Parties To Facilitate The Work Of The Technical Bureaucratic Committee In Order To Initiate The Gaza Reconstruction Process

Vietnam Industry Ministry: Imposes Temporary Anti-Dumping Tariffs On Colourless Float Glass From Indonesia, Malaysia

[Trump Team Transfers Wallet To Bitgo Custodial Wallet Holding 5.267M Trump, Equivalent To $22.44M] February 3Rd, According To Onchain Lens Monitoring, Meme Coin Trump Team Allocation Wallet Transferred 5,267,000 Trump To Bitgo Custody Wallet, Worth Approximately 22.44 Million US Dollars

China Central Bank Injects 105.5 Billion Yuan Via 7-Day Reverse Repos At 1.40% Versus Prior 1.40%

Taiwan Overnight Interbank Rate Opens At 0.805 Percent (Versus 0.805 Percent At Previous Session Open)

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Treasury adjusted Q1 borrowing, projected Q2 needs, drawing market focus to refunding plans and policy shifts.

The U.S. Treasury has slightly lowered its borrowing estimate for the first quarter, now expecting to raise $574 billion, a $3 billion decrease from its November forecast. The revision comes as a larger opening cash balance helped cushion a projected decline in net cash flows.

Alongside its first-quarter plans, the Treasury announced it expects to borrow $109 billion in the second quarter. The department aims to maintain a cash balance of $850 billion by the end of March and increase it to $900 billion by the end of June.

While the headline borrowing figure for the current quarter is down, the adjustment is primarily due to the higher-than-anticipated cash on hand at the start of the period. When this factor is excluded, the borrowing estimate is actually $19 billion higher than projected in November.

Analysts noted that the updated forecasts signal continuity. "The estimates reflect little change from November and, thus, present little risk of any changes to coupon auction sizes in the near term," wrote Thomas Simons, chief U.S. economist at Jefferies, in a research note.

In the final quarter of 2025, the Treasury borrowed $550 billion in privately-held net marketable debt, concluding the period with a cash balance of $873 billion.

This was a departure from its November estimate, which had projected $569 billion in borrowing against an assumed end-of-December cash balance of $850 billion. The $20 billion reduction in borrowing was attributed mainly to stronger-than-expected net cash flows, moderated by the higher ending cash balance. Excluding the cash balance effect, actual borrowing was $42 billion lower than initially announced.

With the latest borrowing estimates released, the bond market's attention is now fixed on the Treasury's quarterly refunding announcement scheduled for Wednesday. This release will provide concrete financing plans for the first and second quarters.

The consensus expectation is that the Treasury will hold its note and bond auction sizes steady for the eighth consecutive quarter.

Investors will be watching closely for any guidance on the department's next moves. Key questions include whether the Treasury will offer more details on future increases in coupon issuance or if it might signal cuts in long-end issuance. A reduction in long-term debt sales would align with the Trump administration's stated goal of lowering long-term borrowing costs.

However, analysts believe a policy shift is unlikely for now. "There is no reason to expect that the Treasury will cut back on coupon issuance any time soon," Simons commented. He added that while Treasury Secretary Scott Bessent has previously expressed a desire to reduce long-end issuance, "there are still too many unknowns in the outlook to justify reducing coupon auction sizes."

A sweeping trade deal announced by U.S. President Donald Trump and Indian Prime Minister Narendra Modi aims to redirect global crude oil flows, but the plan is poised to collide with the fundamental laws of market economics.

Following tense negotiations, the agreement includes a commitment from India to purchase over $500 billion worth of U.S. energy, technology, and agricultural products. In exchange, the U.S. will lower its tariff on Indian goods from 25% to 18%.

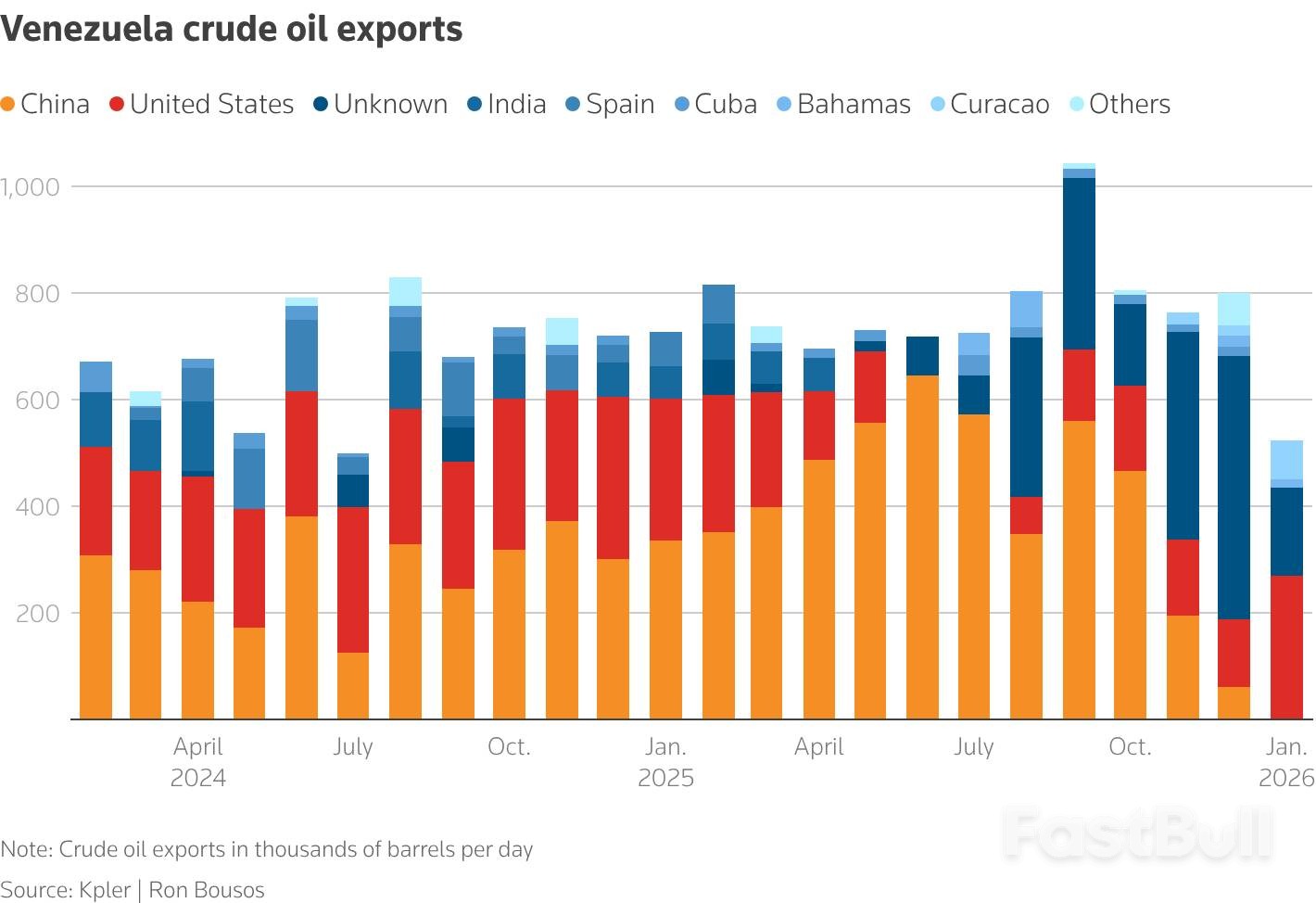

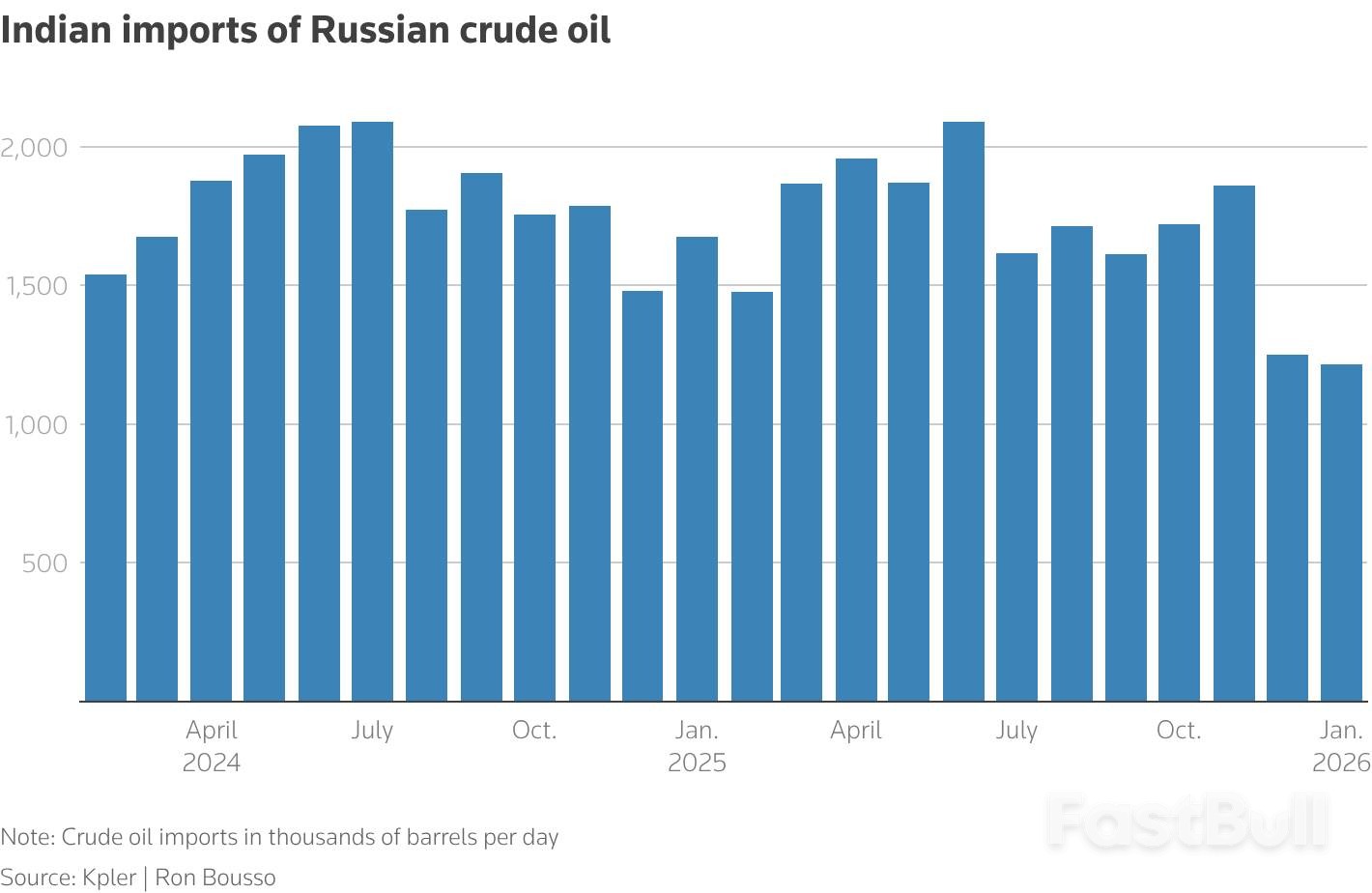

A key component of the deal involves India, the world's third-largest oil importer, ceasing its purchases of Russian crude. Instead, it will buy "much more" oil from the United States and potentially Venezuela. While the pact serves clear U.S. strategic interests, its real-world execution faces significant economic headwinds.

This agreement advances two major White House objectives.

First, the administration seeks to revitalize Venezuela's struggling oil industry. This follows Washington's move to take effective control of the country's oil sector after the seizure of President Nicolas Maduro last month.

Second, the deal is designed to tighten the economic squeeze on Moscow. By pushing Russian crude out of Asia—one of its last major markets following Western sanctions over the war in Ukraine—the Trump administration hopes to further limit Russia's export revenues.

The pact underscores a willingness to use U.S. geopolitical influence to shape global markets. However, political directives often struggle to override powerful market incentives.

Efforts are underway to revive Venezuela's energy sector, including moves to sell up to 50 million barrels of crude, reform hydrocarbon laws to attract investment, and ease some sanctions. Asia, particularly China and India, might seem like a natural destination for this oil. China bought over half of Venezuela's crude exports last year, and India was a major buyer before Trump imposed a 25% tariff in March on countries purchasing Venezuelan oil.

Despite this, several factors limit Venezuela's ability to become a dominant supplier to India.

Production and Export Constraints

Venezuelan oil production remains limited at around 900,000 barrels per day (bpd) and is expected to take months, if not years, to recover fully. Although exports jumped to approximately 800,000 bpd in January from 498,000 bpd in December, sustained growth is needed to clear stored inventory and reverse previous production cuts.

The Economics of Sanctioned Crude

The more significant issue is simple economics. Venezuelan oil was previously attractive to Asian buyers primarily because sanctions forced it to be sold at steep discounts.

Recently, when cargoes of heavy Venezuelan crude were offered to Asian buyers at a $5 per barrel discount to the Brent benchmark, they were rejected. Traders noted the markdown was insufficient to make the heavy, sulfurous crude competitive with other available grades. Unless Venezuelan output rises so much that U.S. refiners cannot absorb it—forcing producers to offer larger discounts—Asia is likely to remain a marginal market.

Pivoting India toward U.S. oil presents its own set of challenges. Last year, India's price-sensitive buyers purchased an average of only 320,000 bpd of U.S. oil, valued at around $7.5 billion. A significant increase appears unfeasible due to higher freight costs and the fact that the U.S. government has limited ability to control private market dynamics.

India, once the top buyer of discounted Russian crude after 2022, did reduce its purchases after the Trump administration doubled duties on Indian imports to 50% in August. This was followed by U.S. sanctions on Russia's top oil companies, Rosneft and Lukoil, in October and new EU restrictions on fuels made from Russian crude.

As part of the new trade deal, the White House confirmed it will drop the additional 25% tariff.

Even with past pressure, India imported 1.2 million bpd of Russian crude in January, accounting for over a fifth of its total imports. While this is down from the 2025 average of 1.7 million bpd, it is far from zero. The primary reason is the compelling price.

Russian oil is currently being offered at a discount of more than $20 to Brent—the steepest markdown since April 2023. While Indian refiners heavily focused on exports to Europe, like Reliance Industries' Jamnagar complex, are unlikely to resume large-scale Russian purchases due to EU rules, refiners serving India's domestic market will find such discounts difficult to resist.

Ultimately, economics will likely prevail over politics. While the U.S. wields significant influence, even President Trump cannot single-handedly steer crude flows in a highly liquid and transparent global oil market.

New Delhi may also push back against U.S. pressure to prioritize lower domestic fuel prices, a critical issue for any government. In the end, price signals—not political directives—will determine the final destination of Russian and Venezuelan oil barrels.

The Trump administration's strategy for securing peace in Ukraine hinges on a core belief: that renewed economic ties between the U.S. and Russia can prevent future conflict while enriching American investors. This vision frames trade as the ultimate guarantor of stability.

However, veterans of Russia’s complex economic landscape are deeply skeptical. They warn that the notion of trade guaranteeing peace is a familiar but flawed assumption, and that viewing Russia as an untapped economic goldmine is a dangerous miscalculation.

"Investing in Russia will be a very, very difficult environment for a very long time," said Chris Weafer, CEO of the Russia-focused business consultancy Macro-Advisory.

For months, the United States, Ukraine, and Russia have been engaged in peace negotiations. Despite Russian objections to key Ukrainian demands, the U.S. has remained optimistic. The latest talks, originally set for February 1, were rescheduled for later in the week.

A central figure in this push is Steve Witkoff, a real-estate developer, friend of President Donald Trump, and the chief U.S. envoy on the Ukraine war. He has openly promoted the idea that post-peace trade deals would create a powerful deterrent against future hostilities.

"If everybody's prospering and they're all a part of it, and there's upside for everybody, that's going to naturally be a bulwark against future conflicts there," Witkoff told the Wall Street Journal in November.

The administration also appears enticed by the potential profits. "Russia has so many vast resources, vast expanses of land," Witkoff noted. President Trump has echoed this optimism, stating in February of last year that he and Russian President Vladimir Putin were discussing "major economic development transactions" between the two nations.

Despite this confidence, analysts argue that economic incentives are unlikely to override the Kremlin's core security concerns. Tatiana Stanovaya, a senior fellow at the Carnegie Russia Eurasia Center, explained that any U.S. actions perceived as a threat—from troop placements in the Baltics to missile defense systems in Romania—would still provoke a strong reaction from Moscow, regardless of trade ties.

For those who witnessed Russia's economic evolution in the 1990s and 2000s, the Trump administration's thinking feels like history repeating itself.

"Here we are once again, thinking that business can transform political relationships," said Charles Hecker, a geopolitical risk consultant who was a managing partner at Control Risks in Moscow from 2000 to 2008. "And I think the answer to that assumption is that actually, no, it can't."

After the Soviet Union's collapse in 1991, U.S. direct investment in Russia surged from $1.7 billion in 1999 to $20.8 billion in 2009, according to U.S. Department of Commerce data. The European Union's engagement was even deeper, with Russia ranking among its top five trading partners in 2021.

But as Putin's foreign policy hardened and civil society faced crackdowns, investor sentiment soured. Russia's 2014 occupation of Crimea was a turning point. "It changed our perspective of Russia—even though many of us should have known better," said Ed Verona, a former senior executive at ExxonMobil Russia and past head of the U.S.-Russia Business Council. "We deceived ourselves into thinking that, through engagement and appeals to mutual self-interest, things would go in the right direction."

The administration’s vision of Russia as a major investment opportunity may also be overstated. Russia's pre-war GDP in 2021 was approximately $1.83 trillion, which was less than Italy's in the same year. Weighed down by heavy military spending, low oil prices, and Western sanctions, Russia’s economy is projected to grow by just 1% this year.

Weafer noted that even if a peace deal were signed tomorrow, Russia's high military spending would likely continue as it works to replace massive equipment and personnel losses. "There will only be a very gradual kind of shifting of state resources to economic recovery," he said.

The Perils of a Politicized Market

Furthermore, Russia's investment climate remains notoriously risky. Powerful, politically connected figures often dominate business dealings, creating a hazardous environment for outsiders.

The case of Michael Calvey, a prominent American investor who spent decades promoting foreign investment in Russia, serves as a cautionary tale. In 2019, he was arrested over a business dispute orchestrated by his Russian partners. Despite interventions from influential Russians, including Kirill Dmitriev—Witkoff's current Kremlin contact—Calvey endured a grueling legal ordeal before being allowed to leave the country in 2022.

"You really need to do your due diligence," Weafer advised.

Experts believe Russia will be most receptive to companies in state-critical industries like oil, gas, nuclear power, critical minerals, and agriculture. As the world's second-largest gas producer and third-largest oil producer, Russia offers lucrative opportunities in these sectors. Weafer noted that investments in these areas are often safer because they involve dealing directly with the Russian state rather than private partners.

Energy companies are accustomed to navigating high-stakes political environments. "They're used to playing at a very high level of geopolitics," Hecker observed. The Kremlin has already appeared to use energy assets as a bargaining chip. In August 2025, on the same day as a peace meeting with Trump, Putin signed a law that could help ExxonMobil regain shares in a major gas project.

However, many major U.S. firms are likely to proceed with extreme caution. Verona pointed out the significant reputational risk of doing business in Russia. "I don't think [companies] would want to sully their reputation just for some good trading opportunities, especially if sanctions are still [in force], if not from the U.S., then by the European Union," he said.

Weafer added, "Most will wait until they are convinced that the risk of a further outbreak of war is minimal."

A Special Lane for Trump's Allies?

While many established companies may hesitate, some businessmen aligned with Trump are already exploring deals. The Wall Street Journal reported that at least two Trump allies have been in investment talks with Russia. Gentry Beach, a friend of Donald Trump Jr., has discussed buying a stake in a Russian Arctic gas development. Stephen P. Lynch, a Trump donor with a history of investing in Russia, has reportedly sought to purchase the Nord Stream 2 pipeline.

This dynamic may resonate with the Kremlin, where the economy is dominated by business leaders with personal connections to Putin. Verona suggested that Moscow would likely protect Trump-connected investors from predatory local partners, making a peace deal a potentially lucrative opportunity for a select few.

Gold and silver prices just experienced a historic pullback, marked by the most dramatic two-day sell-off in decades. Yet, despite the market turmoil, analysts widely believe the precious metals' bull run is far from over, with many forecasting fresh record highs later this year.

The numbers behind the recent drop are staggering. On January 30, spot gold prices plunged nearly 10%—the steepest single-day fall since 1983. The move shattered the historic $5,000 per ounce milestone reached just days earlier, erasing a significant portion of the year's gains.

Silver fared even worse, plummeting 27% in the same session in its largest downfall on record. Across the last two trading sessions, gold lost more than 13% of its value, while silver tumbled by nearly 34%.

Despite the sharp decline, most analysts are framing this as a temporary correction rather than a long-term reversal.

"Although the fall was large and fast, it should also be remembered that we are currently at the same levels we saw just three weeks ago," noted independent analyst Ross Norman. "This is a significant correction but it does not, by any stretch of the imagination, signify the bull run has ended."

Analysts point to an overextended rally that left gold vulnerable to a pullback. The price retreated nearly $900 from a record peak of $5,594.82 to around $4,700. The immediate catalysts for the sell-off were twofold:

1. A New Fed Chair Nomination: U.S. President Donald Trump's nomination of Kevin Warsh to lead the Federal Reserve sparked the initial move.

2. Increased Trading Costs: CME Group followed by raising margin requirements on precious metals futures, making it more expensive to hold positions.

According to analysts at WisdomTree, this pullback could discourage short-term speculative buying. In turn, this may create an opportunity for long-term strategic buyers to re-enter the market and re-allocate their portfolios.

Independent metals trader Tai Wong suggested that gold prices could now enter a period of consolidation before resuming their upward trend in the coming weeks and months.

Driving the bullish outlook is the market's expectation that the Federal Reserve will cut interest rates twice this year. Lower rates typically boost the appeal of non-yielding assets like gold.

Major financial institutions remain confident in gold's long-term trajectory, with several high-profile price targets for later this year:

• UBS: Analyst Giovanni Staunovo forecasts gold will reach a new record high above $6,200 per ounce.

• JP Morgan: The bank expects gold to hit $6,300 per ounce by the end of the year.

• Deutsche Bank: Citing sustained investor demand, the bank reiterated its forecast for gold to reach $6,000 this year.

Near-Term Volatility Remains a Risk

However, not everyone is convinced the worst is over. Some analysts caution that market volatility may persist, and the sell-off could have further to run.

"It is far too early to suggest gold has found a bottom yet," warned Fawad Razaqzada, a market analyst at City Index and FOREX.com.

Meanwhile, expectations for silver remain mixed, reflecting its dual status as both a safe-haven precious metal and a crucial industrial component.

President Donald Trump announced on Monday that the United States and India have agreed on a trade framework that places energy supply at the heart of their economic relationship. The deal aims to cut U.S. tariffs on Indian products in exchange for New Delhi expanding its purchases of American oil and gas.

According to Trump, the deal lowers U.S. tariffs on Indian imports to 18% and removes an additional duty previously tied to India's procurement of Russian oil.

In return, Prime Minister Narendra Modi has reportedly agreed to several commitments:

• Sharply reduce purchases of Russian crude oil.

• Shift toward U.S. energy supply.

• Increase purchases of American technology and agricultural products.

Indian officials have not yet confirmed the specific details or the timeline for these changes.

The framework’s focus on oil highlights India's significant role as a major buyer of Russian crude since 2022, a trend that has reshaped global tanker flows. Washington has increasingly viewed India's energy relationship with Russia as a political matter, using trade negotiations to encourage a pivot to alternative suppliers.

As part of the talks, Trump suggested India would be permitted to buy oil from Venezuela, framing it as a substitute for barrels from Russia and Iran. This remark hints at potential flexibility in U.S. sanctions enforcement, though no formal policy change has been announced. Venezuela remains under U.S. sanctions, with oil exports restricted by limited licenses. It is unclear if a specific authorization for India has been granted or if the comment was part of a negotiating strategy.

The timing of the deal is notable, as India's crude imports are approaching record levels. January volumes are projected to be the highest on record, driven by strong domestic demand and fuel exports. Russian oil grades continue to dominate India's incremental supply due to their competitive pricing, while U.S. crude has found it difficult to compete without discounts.

The trade framework also includes liquefied natural gas (LNG). India faces a natural gas shortage and is exposed to volatile spot LNG prices, making it keen to secure lower-cost, long-term supply contracts. U.S. LNG exporters view India's growing power demand as a key market, but pricing terms have not yet been finalized.

Workers and retirees from Venezuela's state-run oil company, PDVSA, are watching recent industry reforms with a mix of hope and skepticism. Following U.S. intervention last month, a push to overhaul the sector has many wondering if their declining wages and pensions could finally recover, but confidence is far from universal.

In the oil hub of Maracaibo, some longtime PDVSA employees believe a turnaround could make their jobs and compensation more secure.

"Those of us who are still here have stayed out of love for our work," said one manager with over two decades of experience at PDVSA, who requested anonymity. "We've waited many years to see our oil better paid. Most people are willing to work, though there is still a lot of fear."

This cautious optimism is fueled by the promise that new investment will boost both oil production and paychecks. However, not everyone shares this view.

In nearby Ciudad Ojeda, a town dominated by housing complexes built for oil workers in the 1960s and 70s, many veterans of the industry are wary. They argue that the expected economic boom may not materialize as advertised.

"People in general are living an illusion created by U.S. propaganda about the economic boom Venezuela will supposedly see," said Jose Luis Galindo, a PDVSA retiree.

This skepticism is rooted in years of economic decline, with analysts estimating that inflation hit 400% last year.

Another veteran, 71-year-old Ender Perea, who worked at PDVSA for 38 years, believes foreign companies have their own agenda. Global oil firms are "not coming to rescue (PDVSA), they're coming to invest to open up fields," he commented.

The changes are driven by a new energy-industry reform bill that passed last week. The legislation is designed to revitalize Venezuela's oil and gas production by attracting foreign investment after two decades of state control.

Key components of the reform include:

• Cutting taxes for energy producers.

• Granting autonomy to private companies.

• Allowing for the transfer of assets.

The policy marks a significant shift away from the nationalization era, which saw the government expropriate assets from foreign firms, including U.S. giants Exxon Mobil and ConocoPhillips.

These reforms follow the U.S. capture of President Nicolas Maduro last month. Subsequently, U.S. President Donald Trump announced a plan for Washington to guide the country from afar, proposing a $100 billion energy reconstruction plan he said would benefit Venezuela and its people.

Interim President Delcy Rodriguez, who has been negotiating oil sales deals with the U.S. since Maduro's removal, has expressed support for the plan. While some workers are hopeful, the path forward remains highly uncertain, and the debate over whether this new era will bring prosperity or simply new problems continues in the heart of Venezuela's oil country.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up