Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

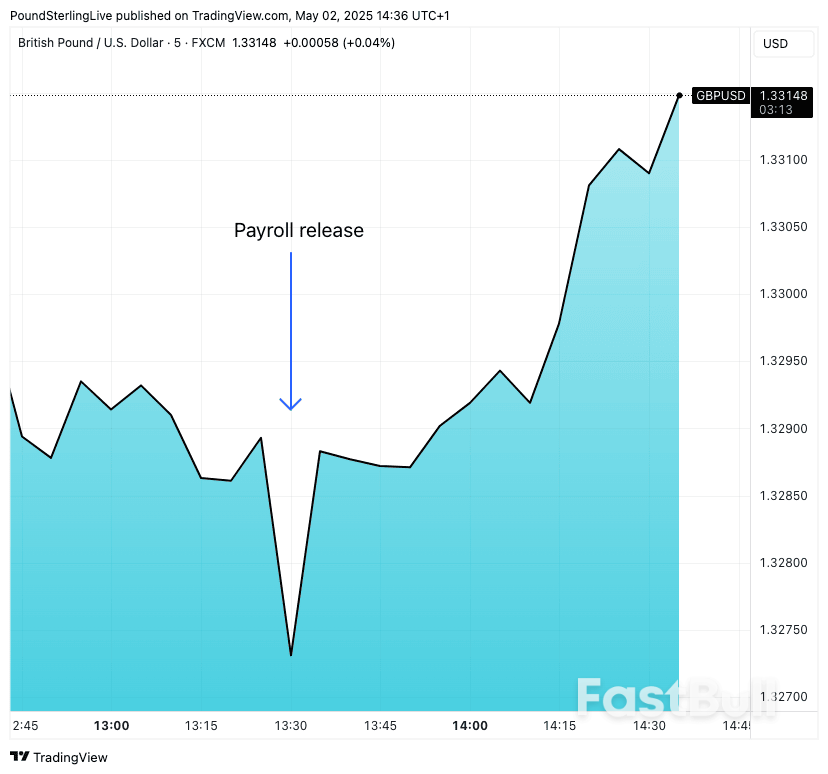

U.S. stocks surged as April jobs beat expectations and China trade talks showed promise. The Dow jumped 400+ points, led by tech gains, despite Apple and Chevron underperforming on earnings concerns.

Russia will help the Taliban authorities in Afghanistan fight against the Afghan branch of Islamic State, Moscow's special representative for the country told the RIA state news agency on Friday.

Zamir Kabulov, a former Russian ambassador in Kabul, referred to Islamic State Khorasan (ISIS-K) as the "common enemy" of Moscow and Kabul.

"We see and appreciate the efforts that the Taliban are making in the fight against the Afghan wing of ISIS," Kabulov told RIA in an interview.

"We will provide our best assistance to the authorities of (Afghanistan) through specialised structures."

No country currently recognises the Taliban government that seized power in August 2021 as U.S.-led forces staged a chaotic withdrawal from Afghanistan after 20 years of war.

Kabulov's comments underscore the dramatic rapprochement in recent years between Moscow and Kabul, which President Vladimir Putin said last year was now Russia's "ally" in combating terrorism.

Russia last month formally removed the Taliban from its list of terrorist organisations, to which it had been added in 2003.

Russia has been left reeling from multiple Islamic State (ISIS)-linked attacks, including the shooting of 145 people last March which was claimed by ISIS. U.S. officials said they had intelligence indicating ISIS-K was responsible.

The Taliban says it is working to wipe out the group's presence in Afghanistan.

Kabulov said Moscow and Kabul were building up ties in multiple spheres and told RIA that Russia had offered to accredit an Afghan ambassador in Moscow and was waiting for Kabul's response.

He said Moscow's suspension of the ban on the Taliban "finally removes all obstacles to full cooperation between our countries in various fields".

"The arrival of the Afghan ambassador in Moscow will put a final end to this issue."

Russia said last month it aims to strengthen trade, business and investment ties with Kabul, leveraging Afghanistan's strategic position for future energy and infrastructure projects.

Kabulov said joint economic projects would be discussed at a Russia-Afghan business forum later this month in the Russian city Kazan, naming mineral development and gas pipeline projects as possible areas of cooperation.

African nations feeling the pinch intend cutting back on spending, with very real repercussions for citizens.

With their economies taking strain and their ability to raise more revenue highly constrained, Kenya, South Africa, Mozambique and Botswana all announced plans to pare back on planned expenditure over the past week. Ghana did so in March and others are likely to follow suit.

Violent protests erupted in Kenya last year after new levies were introduced, forcing President William Ruto’s administration to backtrack, while opposition from within South Africa’s ruling coalition derailed the National Treasury’s plans to raise value-added tax.

In Mozambique, post-election unrest and a slump in the price of coal, the nation’s biggest export, have led to job losses and a financing crunch. And in Botswana, a collapse in demand for diamonds, the mainstay of the economy, has drained its savings and widened the budget deficit.

The budget cutbacks may be fiscally prudent, but will likely adversely impact investment in health, education and infrastructure that will ultimately be needed to fire up economic growth.

Adding to Africa’s woes are US President Donald Trump’s decision to abruptly end billions of dollars of aid to the developing world and his shakeup of global trade — which looks set to slow demand for key commodities and strip many nations of their preferential access to the world’s biggest market.

The International Monetary Fund said it expects sub-Saharan Africa’s gross domestic product to expand 3.8% this year, the least since the coronavirus pandemic struck in 2020.

The region’s post-pandemic recovery has been overtaken by recent events, and it faces “yet another shock in the form of an abrupt shift in the external economic landscape,’’ the lender said. It warned that these developments will particularly affect countries “facing a funding squeeze and higher borrowing costs that in many cases is constraining their ability to finance essential services and development needs.’’

The outlook looks bleak indeed.

The global trade war is beginning to hit demand across sectors that lean on fossil fuels just as producers embark on their biggest output increase in almost three years — with further gains possible.

Big oil users — including shipping and haulage companies, chemicals makers and airlines — are using quarterly earnings calls to warn of stuttering consumption amid uncertainty caused by sweeping tariffs imposed last month.

Several US airlines have withdrawn earnings guidance amid soft bookings for domestic and short-haul flights. An analysis of US credit and debit card transactions shows observed airline sales in April were down about 7% from a year earlier.

German chemicals giant BASF SE said today that automotive is declining everywhere except China. Its commentary about other segments wasn’t uplifting, either.

In the freight market, more than 40% of container ship capacity between Asia and the US has been canceled for some of the coming weeks.

As a slowdown in shipping into and out of the US starts to bite, fewer trucks and trains will be needed to distribute those goods.

Oil-demand growth estimates have been slashed by the major forecasting agencies and may be cut again this month unless trade deals are done. Wall Street analysts are lowering price forecasts.

That might seem like a signal for oil producers to start trimming supply to stem the slump. But they’re doing the opposite.

The OPEC+ group on May 1 initiated the biggest output increase in nearly three years, raising its production target by 411,000 barrels a day.

That's three times as much as it initially intended under a plan that runs to late next year, and there are signs producers may do something similar for June when they meet Monday.

Saudi Arabia, the group’s de facto leader, appears to be rethinking its policy of bearing the burden of supply cuts to support oil prices for the benefit of others who aren’t pulling their weight.

With mounting evidence of weakening demand and expectations of booming supply, it’s easy to see why prices are languishing.

--Julian Lee, Bloomberg News

Crude shipments from Russia’s Pacific ports hit a record in April, with exports of the key ESPO grade topping 1 million barrels a day for the first time. Flows to India reached an eight-month high and are likely to be revised upward. Kozmino and De Kastri on the mainland, and Prigorodnoye on Sakhalin Island, shipped 1.28 million barrels a day, compared with 1.17 million in March, according to vessel-tracking data compiled by Bloomberg.

Oil headed for a second successive weekly loss as traders weighed signs of a thaw in the US-China trade war and President Donald Trump’s threats toward Iran against the prospect of more supply from the OPEC+ alliance.In Big Oil earnings, Chevron Corp. said it will reduce share buybacks this quarter after crude prices tumbled. Meanwhile, Exxon Mobil Corp. and Shell Plc said they’ll maintain investor returns.

Gold is set for its first back-to-back weekly loss this year as its haven appeal eased on signs of movement in US-China trade negotiations.

US House Republicans plan to raise more than $15 billion in revenue by increasing oil, gas and coal lease sales, among other measures, to help pay for Trump’s tax cuts, according to a document seen by Bloomberg News.

Nuclear power, often criticized as too expensive and too controversial, is emerging as a pivotal solution for energy security, according to Bloomberg’s Merryn Talks Money podcast.

Europe ended winter with its gas storage at the lowest in years. But summer prices at a premium to those for the following winter discouraged injections. Now the dynamics favor replenishment, according to BloombergNEF. Weaker liquefied natural gas demand in Asia should leave greater supply for the continent. The Europe Perimeter is forecast to have storages 88% full by Oct. 1, an increase from the previous 83% target.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up