Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The U.S. economy added more jobs than anticipated in September, although the unemployment rate unexpectedly rose, adding to the uncertainty surrounding the Federal Reserve's policy meeting in December.

The U.S. economy added more jobs than anticipated in September, although the unemployment rate unexpectedly rose, adding to the uncertainty surrounding the Federal Reserve's policy meeting in December.

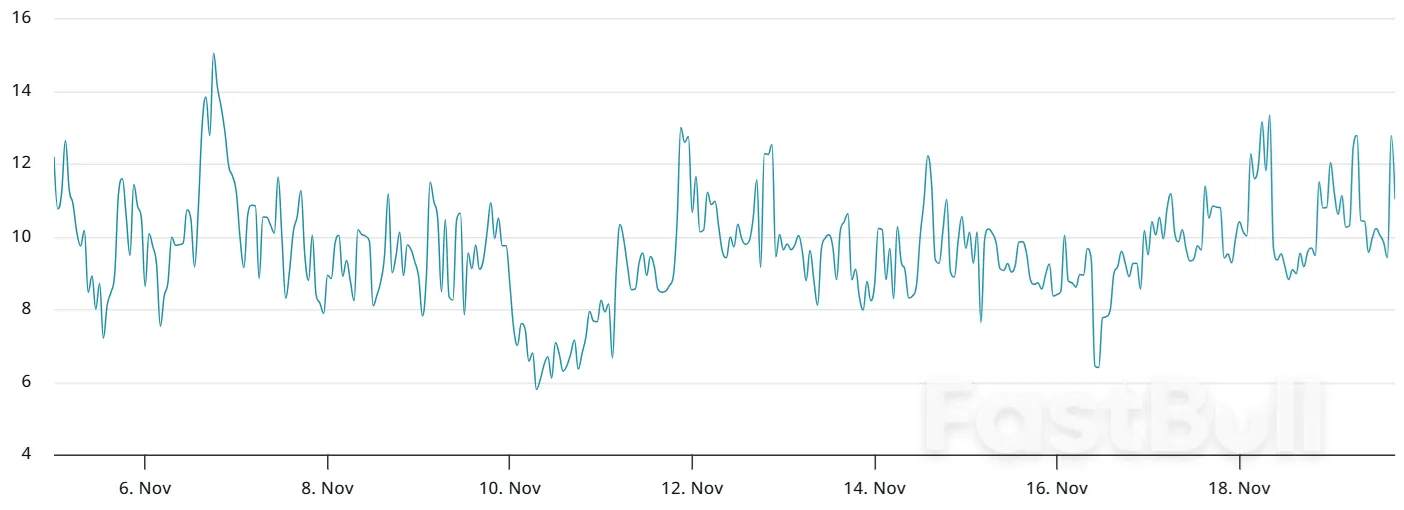

Nonfarm payrolls for the month came in at 119,000, up from a revised drop of 4,000 in August, data from the Labor Department's Bureau of Labor Statistics showed on Thursday.

Economists had anticipated a gain of 50,000 to the September payroll, while the August figure had been previously reported showing a gain of 22,000.

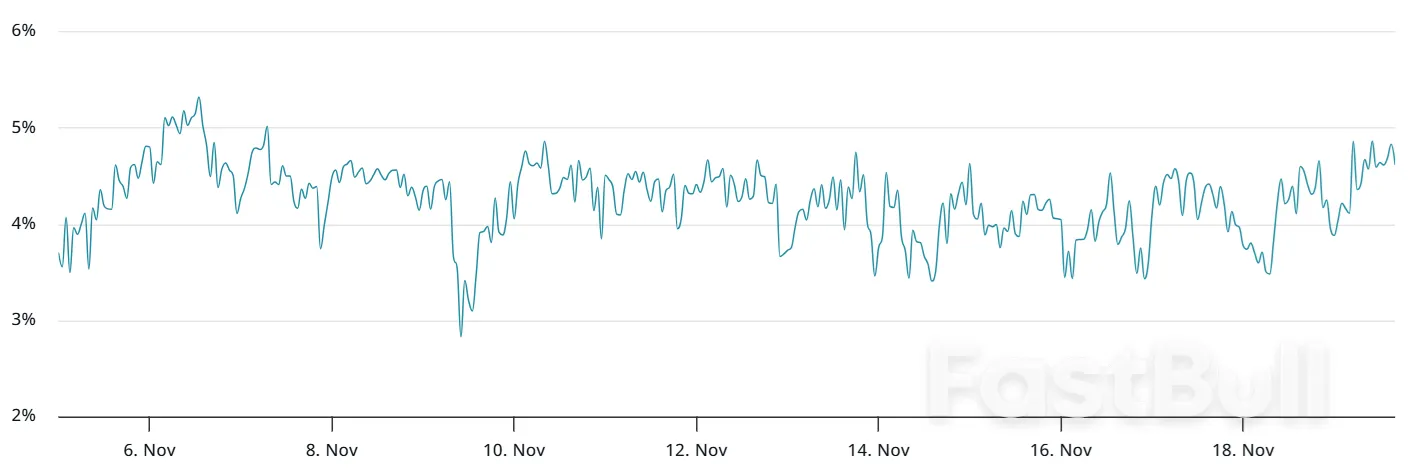

The unemployment rate rose to 4.4%, a four-year high, a gain from the 4.3% level seen the prior month.

Average hourly wage growth rose by 0.2% on a month-on-month basis, a drop from the 0.4% seen in August, and below the expected 0.3% rise.

This report was delayed by the lengthy shutdown of the federal government, which also means October's report will be cancelled and instead combined with November's employment report now due on December 16.

The Fed cut interest rates by 25 basis points at the end of last month, but the minutes of that meeting, released on Wednesday, showed that policymakers were divided over the course of future policy, with "many" participants ruling out a December cut, while "several" saw a cut as likely.

The divide highlighted uncertainty over the U.S. economic outlook and prompted traders to scale back expectations for near-term easing.

Going into this payrolls release, Fed funds futures were pricing a 33% probability of a 25-basis-point cut next month, down from a 50% chance a day earlier, according to the CME Group's FedWatch tool.

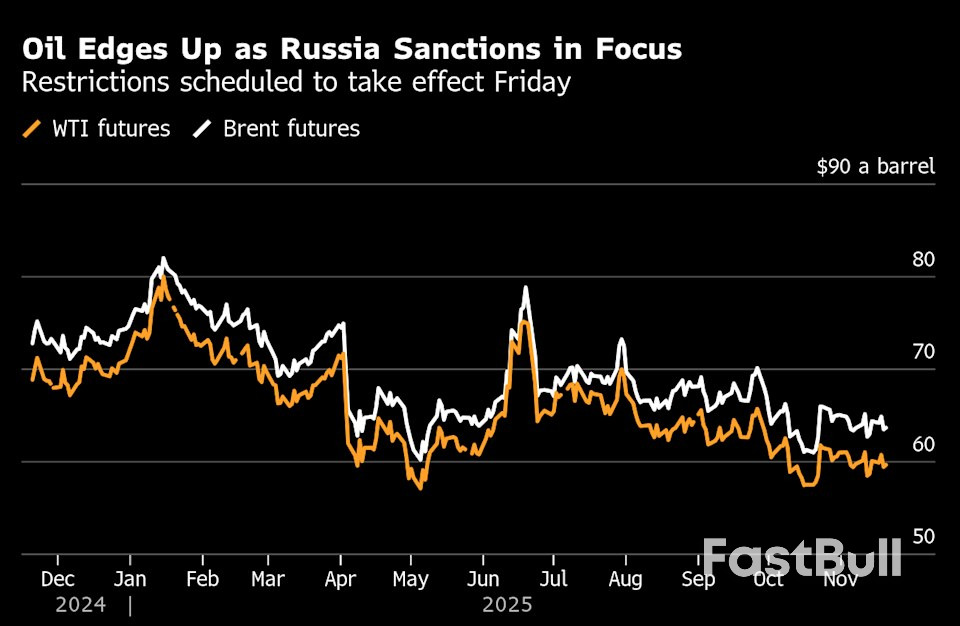

In its latest short term energy outlook (STEO), which was released on November 12, the U.S. Energy Information Administration (EIA) increased its West Texas Intermediate (WTI) spot average price forecast for 2025 and 2026.

According to this STEO, the EIA now sees the WTI spot price averaging $65.15 per barrel in 2025 and $51.26 per barrel in 2026. In its previous STEO, which was released in October, the EIA projected that the WTI spot price would average $65.00 per barrel in 2025 and $48.50 per barrel in 2026. The EIA's September STEO forecast that the WTI spot price average would come in at $64.16 per barrel this year and $47.77 per barrel next year.

A quarterly breakdown included in the EIA's latest STEO projected that the WTI spot price will average $58.65 per barrel in the fourth quarter of 2025, $50.30 per barrel in the first quarter of next year, $50.68 per barrel in the second quarter, and $52.00 per barrel across the third and fourth quarters of 2026.

The EIA's October STEO saw the WTI spot price averaging $58.05 per barrel in the fourth quarter of next year, $47.97 per barrel in the first quarter of next year, $48.33 per barrel in the second quarter, $48.68 per barrel in the third quarter, and $49.00 per barrel in the fourth quarter of 2026.

In its September STEO, the EIA projected that the WTI spot price would come in at $65.14 per barrel in the third quarter of 2025, $55.41 per barrel in the fourth quarter, $45.97 per barrel in the first quarter of next year, $46.33 per barrel in the second quarter, $48.68 per barrel in the third quarter, and $50.00 per barrel in the fourth quarter of 2026.

The EIA's latest STEO showed that the WTI spot price averaged $65.78 per barrel in the third quarter, $64.63 per barrel in the second quarter, and $71.85 per barrel in the first quarter. This STEO also highlighted that the WTI spot price averaged $76.60 per barrel overall in 2024.

In a research note sent to Rigzone by Natasha Kaneva, the head of global commodities strategy at J.P. Morgan, on November 13, J.P. Morgan projected that the WTI crude oil price will average $62 per barrel in 2025 and $53 per barrel in 2026. In that note, J.P. Morgan forecast that the commodity will come in at $57 per barrel in the fourth quarter of this year, $51 per barrel in the first quarter of next year, $53 per barrel across the second and third quarters, and $56 per barrel in the fourth quarter of 2026.

In a report sent to Rigzone by the Standard Chartered team on November 12, Standard Chartered forecast that the NYMEX WTI basis nearby future crude oil price will average $65.40 per barrel in 2025 and $59.90 per barrel in 2026. Standard Chartered projected in that report that the commodity will come in at $61.50 per barrel in the fourth quarter of 2025, $58.50 per barrel in the first quarter of next year, $59.50 per barrel in the second quarter, $60.50 per barrel in the third quarter, and $61.00 per barrel in the fourth quarter of 2026. Standard Chartered also projected in this report that the commodity will average $63.50 per barrel in 2027.

BMI projected that the front month WTI crude price will average $65.00 per barrel in 2025 and $64.00 per barrel in 2026 back in a BMI report sent to Rigzone by the Fitch Group on October 24. BMI is a Fitch Solutions Company, that report highlighted.

Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

WTI Price Chart WTI Price Chart

WTI Price ChartSwiss watch exports fell for a third month as US President Donald Trump's trade tariffs continued to weigh on the industry.

Watch exports fell 4.4% in October from a year earlier to 2.2 billion Swiss francs ($2.7 billion), the Federation of the Swiss Watch Industry said Thursday. Exports to the US — the largest market — slumped 47%. China, though, grew for a second month as exports rose 13%.

Tariffs have been the dominant narrative in the Swiss watch industry since Trump imposed a 39% levy on Switzerland — higher than the European Union and other developed economies — that went into effect on Aug. 7.

Watchmakers and other Swiss exporters finally got some good news last week when the US said it would cut the tariff to 15% — though there is no specific date for the new agreement to take effect.

Many producers had rushed to build up inventory in July to avoid the new levies, which left watchmakers controlled by the likes of Richemont, Swatch Group AG and LVMH, as well as independents including Audemars Piguet, Patek Philippe and Rolex SA, facing diminished margins in their key market.

Manufacturers of watches, machines and precision instruments were among sectors hit hardest by the 39% levy, according to Switzerland's central bank, but the impact has extended beyond them with Switzerland's overall exports to the US also retreating in October.

Speaking on the day the tariff reduction was announced, Breitling AG Chief Executive Officer Georges Kern said he welcomed the cut, though he said the industry wanted to see the original levy of 2% reinstated. Swiss-made watches do not compete with domestic production or jeopardize jobs in the US, he added.

"The Swiss watch industry is further an important employer in the US, both for repair services and retail operations," he said in an interview.

Prices for lower-valued watches rose in October, though that was partially offset by a sharp 7% decline for watches priced at over 3,000 francs, the Federation of the Swiss Watch Industry said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up