Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

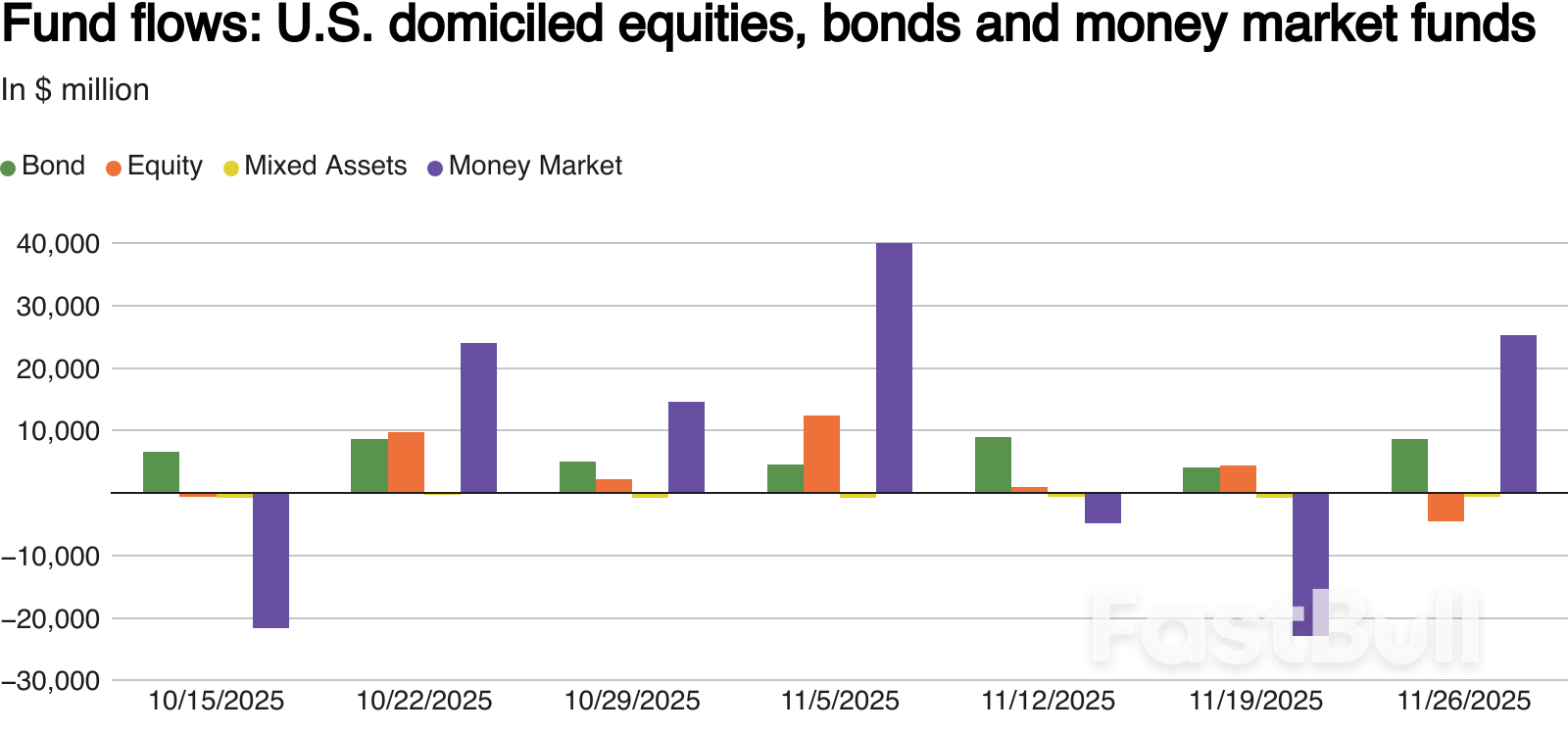

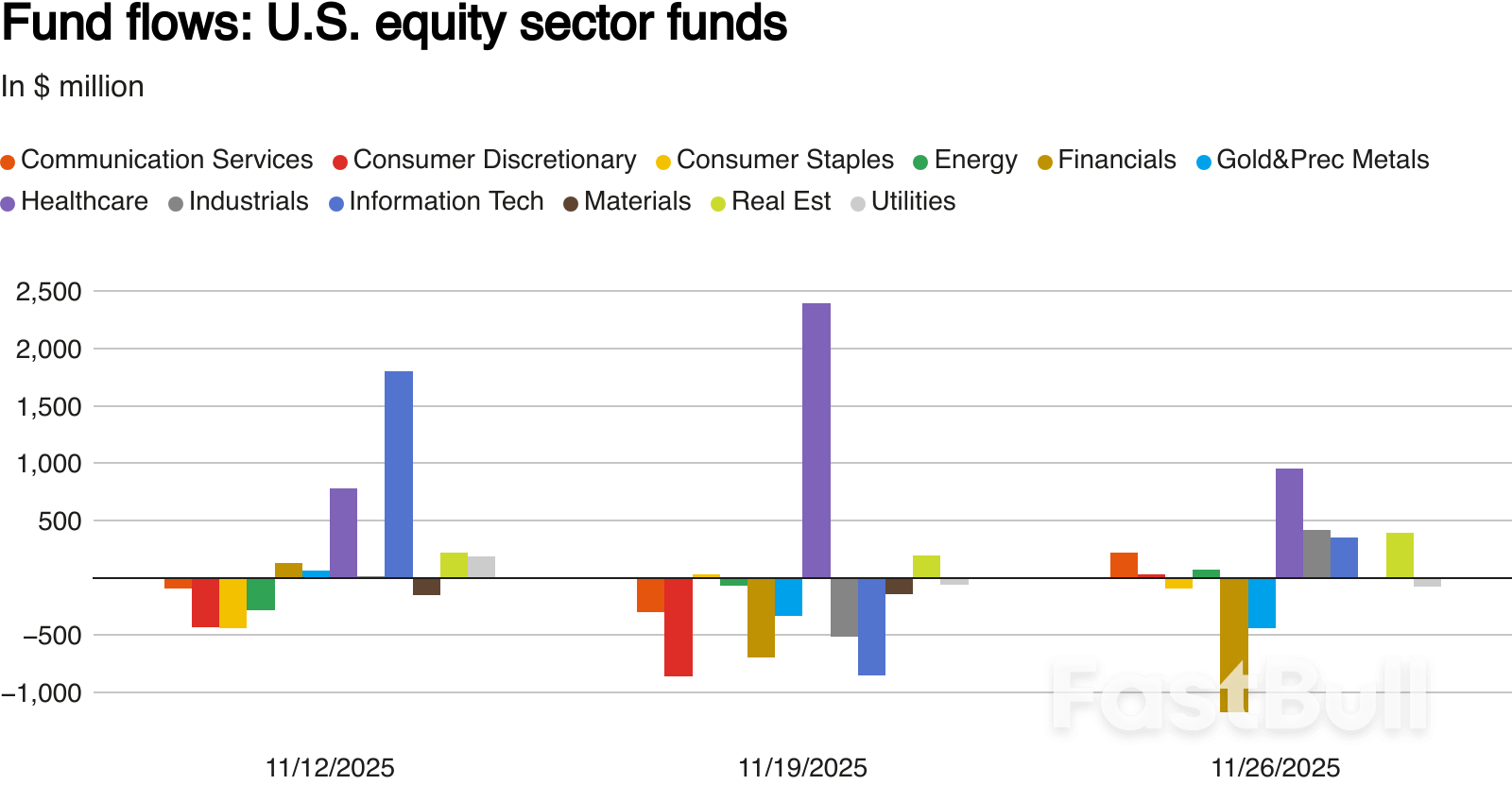

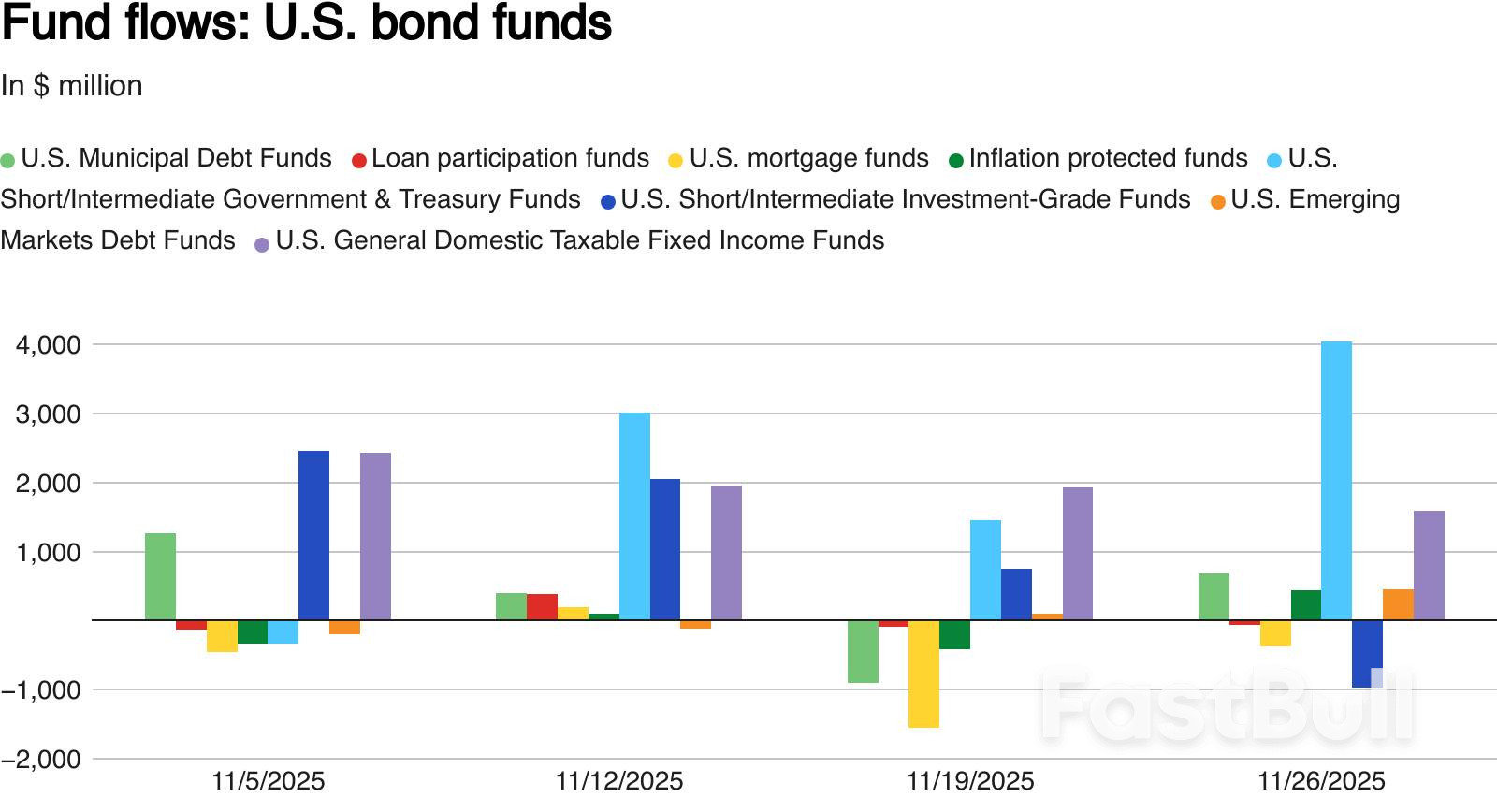

U.S. equity funds saw their first outflow in six weeks as investors took profits amid tech valuation worries, while bond and money-market funds drew strong inflows.

The European Commission should resist automakers' calls to allow cars to run on biofuels beyond 2035 because they are in short supply and not truly carbon-neutral, campaign group T&E said on Thursday.

New vehicles in the European Union must have no carbon dioxide emissions from 2035 under rules designed to boost sales of electric cars and phase out fossil fuels and the internal combustion engine.

However, automakers are pushing the EU executive to grant an exemption to allow carbon-neutral fuels to continue to power internal combustion engines, plug-in hybrids and range extenders. The Commission will unveil measures designed to support the auto sector on December 10.

In a report published on Thursday, T&E pointed to EU law changes in 2018 that limited the use of crop-based fuels, such as from palm oil or soy, favouring used cooking oil, animals and other waste-based sources, which now account for about half of bio-based diesel in the EU.

However, some 60% of biofuels and 80% of used cooking oil are imported, principally from Asia, T&E said, with rising cases of fraud, such as palm oil passed off as waste.

T&E said biofuels made from food crops typically only save 60% of CO2 emissions compared with fossil fuels because of CO2 emitted in their cultivation and transportation. They also risk leading to deforestation.

More advanced fuels made from municipal waste or sewage sludge are more sustainable, the report said, but are not available in sufficient quantities and are already earmarked for aviation and shipping. If road transport were included, EU demand could be from double to nine times the 2050 sustainable supply.

The T&E report said that allowing biofuel in EU cars could increase CO2 emissions by up to 23% in 2050.

The group advises that biofuels should not be part of the post-2035 solution and, if they are, limited to just 5% of sales of cars powered by truly carbon-neutral e-fuels.

Inflation figures from the eurozone's major economies paint a mixed picture of the bloc's price prospects. In Germany, the region's biggest economy, the inflation rate unexpectedly rose to the highest level in nine months.

Mainly driven by food prices, as energy prices fell modestly, EU-harmonised inflation in Germany was 2.6% higher in November compared with the previous year, after inflation hit 2.3% in October of 2025. This is according to preliminary results from the Federal Statistical Office (Destatis).

Month-on-month, the harmonised inflation rate showed that German prices fell by 0.5% in November, from a 0.3% rise in October.

Elsewhere, it appears that Europe's price pressure is cooling following the region's post-pandemic cost-of-living crisis. Preliminary data released on Friday suggests French inflation remains subdued. According to flash estimates from INSEE, the country's EU-harmonised price index is projected to rise by 0.8% year-on-year in November, unchanged from the previous month and down from 1.7% a year earlier.

Economists had expected a stronger increase of 1%.

The stable reading reflects contrasting movements across spending categories: a slowdown in service prices, driven down by communication services, and a more pronounced decrease in manufactured goods prices, offset by a smaller decline in energy prices and a slight acceleration in food prices.

Month-over-month, French prices fell by 0.2% in November, after a 0.1% increase in October. The consensus forecast had pointed to no change.

The decline was driven by lower service prices, particularly in transport and communications, and to a lesser extent by cheaper manufactured goods. Energy prices are expected to rebound, led by petrol products, while tobacco prices are projected to edge higher. Food prices are expected to remain broadly stable.

The EU's third-largest economy showed a similar pattern. Italy's harmonised index of consumer prices fell by 0.2% in November, matching October's decline, according to preliminary figures from the national statistics agency ISTAT.

Annual inflation eased to 1.1% from 1.3% in the previous month, which is its lowest level since October 2024.

Italian inflation remained low as falling energy prices and softer services inflation offset modest rises elsewhere. The largest downward pressures came from steep declines in regulated energy and communication services, alongside slower increases in transport and recreational services.

Only a few categories — mainly processed food and some unregulated energy products — added mild upward pressure.

Spain, the eurozone's fourth-largest economy, recorded somewhat stronger price pressures. The EU-harmonised index of consumer prices was flat in November following a 0.5% rise in October, defying expectations of a 0.2% monthly fall, according to preliminary data from the National Statistics Institute.

However, annual inflation came in higher than expected. The harmonised rate eased to 3.1% from 3.2% in October, compared with a forecast of 2.9%. Price rises for food, transport and other non-energy goods continued to drive inflation.

Friday's figures from the eurozone's major economies will inform the European Central Bank ahead of its meeting in December. The ECB is not expected to cut its key interest rate from the current 2%, with policymakers judging that medium-term inflation targets are broadly being met.

Eurozone inflation stood at 2.1% in October, slightly above the ECB's 2% target, reinforcing the bank's view that price pressures are largely under control after the surge to double-digit highs caused by post-pandemic supply shocks and the energy crisis triggered by Russia's invasion of Ukraine.

Meanwhile, inflation expectations have edged higher. According to a new ECB survey published on Friday, median consumer inflation expectations for the next year rose to 2.8% in October from 2.7% in September. Expectations for three years ahead were unchanged at 2.5%, while five-year-ahead expectations remained steady at 2.2%.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up