Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Weak U.S. jobs data pushed the dollar lower, with markets eyeing a Fed rate cut in September. CPI data this week will decide whether weakness deepens or a rebound toward 98–100 emerges.

It seemed like a good idea at the time. Call a bill “big and beautiful,” repeat the name again and again, and watch the good reviews roll in. Well, that hasn’t happened with President Donald Trump’s signature piece of legislation, which he signed into law on Independence Day.

Not even close.

Trump, who at the time claimed that the bill “was the singular most popular bill ever signed,” now seems to prefer to talk about anything else, leaving the selling to Vice President JD Vance and Treasury Secretary Scott Bessent.

The law is polling badly, both because of Democratic attacks and the reality that the bill really is a transfer of wealth from the poor to the rich. According to KFF, some 46% of adults say the law will hurt them and their family, including 53% of independents.

The president wants a mulligan. It’s out with the old branding and in with the new.

“So the bill, I’m not gonna use the term, ‘great big beautiful bill,’ that was good for getting it approved, but it’s not good for explaining what it’s all about,” Trump said last month. “It’s a massive tax cut for the middle class.” According to the Congressional Budget Office’s analysis, it’s not quite that simple. The poorest Americans will see a $1,200 a year decrease in their income because of cuts to social services like Medicaid and SNAP and middle-income households will see a gain of $800-1,200 a year. The nation’s richest will see a $13,600 boost to their incomes.

But voila, the bill is now supposed to be called the “Working Families Tax Cut Bill” or the “Working Families Tax Plan.” This, after Team Trump huddled with House Republicans last week in a briefing oddly called “Love at First Vote,” according to the New York Times. (More bad branding.)

The hope is that calling the bill by another name will make it smell sweeter: two-thirds of Americans view it unfavorably.

The numbers suggest that their worry isn’t misplaced. Large swaths of the public will take an economic hit because of the bill. According to the CBO, more than a million people will lose health insurance because of changes to Medicaid and to the Affordable Care Act subsidies. One of the most touted provisions, no taxes on tips, would benefit roughly 2% of all households, with a tax cut of $200 to $1,700 according to the Yale Budget Lab.

The administration has forecast an economic boom, even as the latest jobs numbers suggest an economic malaise.

“The ‘One Big Beautiful Bill,’ which has full expensing for factories and equipment, was passed on July 4th,” said Treasury Secretary Scott Bessent, on NBC’s “Meet the Press,” not yet calling the bill by it’s preferred name. “Many companies were holding back then. So, we are going to see construction jobs. And we are going to see manufacturing jobs.”

Secretary of Commerce Howard Lutnick had a similarly rosy forecast, touting the investments and tariff money as a coming boost to the economy.

“This is going to be the greatest growth economy, six months from now, a year from today as these trillions of dollars of plants and factories, you’ve seen all these pictures,” said Lutnick on CNBC on Friday. “There are just so many factories going in. The employment situation is going to be so impressive.”

Trump has been sounding a similar theme, promising a new golden age ahead.

“We’re going to win like you’ve never seen,” Trump said Friday. “Wait until these factories start to open up that are being built all over the country, you’re going to see things happen in this country that nobody expects.”

The operative words here are “six months from now” and “wait.”

On the manufacturing jobs front, anything would be an improvement. According to the latest jobs report, manufacturing jobs decreased by 12,000 in August and are down by 42,000 since April, when Trump announced tariffs. Overall, the unemployment rate rose to 4.3%, with just 22,000 jobs added last month.

And affordability is still an issue for Americans, as consumer prices continue to rise, with energy rising at double the rate of inflation. Some 53% of those surveyed say that the cost of groceries is a major stress, with 33% saying it’s a source of minor stress, according to an AP/NORC poll last month. The cost of housing is a major stress for 47% and a minor source of stress for 27%, according to the poll. Among adults under 45 who are stressed about groceries, 19% are using buy-now-pay-later services to defer payments. And according to a CBS/YouGov poll, 65% of American adults say that Trump’s policies are making food and grocery prices go up.

Put simply, costs and personal debt are creeping up, and Americans are finding it harder to get ahead. Rebranding a bill is easy. Rebranding people’s everyday experiences of the economy is much harder. Just ask Joe Biden.

Late last December, Canadian businessman Kevin O’Leary, affectionately known as Mr. Wonderful, re-opened a longstanding public debate over the idea of “continentalism” in North America.

Within weeks after the re-election of President Donald Trump, O'Leary pitched the merits of an EU-style economic union between Canada and USA.

“I like this idea and at least half of Canadians are interested” he said.

As it happened, the timing of O’Leary’s proposal could not have been worse.The credibility of his idea was instantly undermined by the incoming U.S. President’s controversial insistence that Canada should become the 51st state.After Trump’s inauguration, Washington pivoted to hardball positions on tariffs and trade and it was clear there would be no special concessions for Canada. Signals from D.C. warned of tough USMCA trade negotiations to come.

In March, a beleaguered Justin Trudeau left office and former Bank of England President Mark Carney took over the Liberal Party of Canada. In April, Mr. Carney was elected prime minister, but his party fell short of winning a clear majority in the House of Commons.The new Liberal government immediately adopted an “elbows up” disposition in the brewing trade war with the USA. By the summer of 2025, any talk of a Can-Am economic union was crowded out by strong feelings of resentment and ill will on both sides of the border.

The idea of an EU-style Can-Am union has a long and respectable history and it is well worth revisiting.After the British North America Act of 1867, Canadian scholar Goldwin Smith led a vigorous philosophical movement that supported closer ties with the USA in the form of a continental economic order. Smith defended the concept in a 1891 book titled “Canada and the Canadian Question.” Opposing movements favoured closer ties with the British Empire or total Canadian economic independence. Neither of the latter positions stood the test of time.

Today, the arguments for the development of a Can-Am union are more compelling than ever. Economic integration, the elimination of trade barriers, and the removal of regulatory mismatches could boost cross-border investment well beyond current USMCA levels. A strong shared currency would eliminate exchange rate volatility, reduce transaction costs, and improve price transparency. EU-style citizen mobility could reduce labour shortages, provide enormous opportunities for young workers, increase productivity, and fill demographic gaps created by aging populations.

Infrastructure and environmental coordination would support integrated transportation systems, energy production, and transnational communications networks. Coordinated pollution policies could establish reasonable emissions standards and enhance environmental protection without obstructing sorely needed drilling, mining, and manufacturing initiatives.A larger unified market with consistent rules would incentivize investors. Harmonized policies would secure critical materials and technologies within North America and reduce dependency on hostile suppliers. A Can-Am union would bring together a population of some 388.8 million on 19.82 million square kilometres of territory with and a combined GDP of close to $32 trillion.

In the realm of education, mutual credential recognition, research collaboration, and professional mobility would multiply opportunities in a North American cultural market that could stand up to the Chinese Communist Party and other global influencers.All in all, a new continental order would increase the geopolitical influence and security of citizens in both Canada and the USA. A unified bloc dedicated to Western democratic principles and free enterprise could rival the economic, diplomatic, and military weight of China, Russia, and other totalitarian regimes.

With a southern border wall already in place, our security could be further improved by a joint force that could act against illegal migration and drug smuggling at the water’s edge. Shared intelligence, cybersecurity, and a coordinated military would bolster North America’s defence systems in what has become a dangerous multipolar world.Modelled after EU governance mechanisms, a North American commission or council could allow for cooperative decision-making without sacrificing national sovereignty. If historical adversaries like Germany, France, Italy, Spain, and Portugal can coexist in an economic union, why not Canada and the United States?

As it was in the days of Goldwin Smith, there is still plenty of cross-border resistance to Mr. O’Leary’s continentalist proposal.All manner of entrenched interests regard an economic union as overreach and fear the loss of personal power and control. Big Labour warns of downward pressure on salaries and benefits in an open job market. Canadian politicians fear being overwhelmed in an unbalanced partnership, and American lawmakers are reluctant to support anything that might dilute congressional supremacy.

But facts on the ground are leading to a kinder disposition toward the continental alternative. Among young, ambitious North Americans trapped in a collapsing middle-class there is a powerful yen for greater mobility and the new opportunities that bold change can invoke.

This is especially true on the Canadian side of the border. In 2024 alone, approximately 106,000 Canadians permanently left the country. This figure marked one of the highest outflows in recent memory. Some of the most commonly cited reasons for leaving are the soaring cost of living, low salaries, high taxes, limited career opportunities, and loss of confidence in government institutions. In spite of the anti-American rhetoric constantly served up by Canada’s legacy media, the United States remains the primary destination for departing Canadians. Over a million now live there.

So perhaps it’s time for a second look at Kevin O'Leary’s proposal. As the late British Prime Minister Harold Wilson once asserted: “He who rejects change is the architect of decay. The only human institution which rejects progress is the cemetery.”

Americans grew notably less sanguine about the job market in August and downgraded views of their current financial situations, a report from the New York Federal Reserve Bank showed on Monday.

The regional Fed bank's Survey of Consumer Expectations for August also found essentially stable expectations for future price pressures.

The survey, conducted over the course of last month, flagged a sharp rise in respondents who said finding a new job would be harder if they became unemployed. The expected probability of finding new work in such an event among respondents was 44.9%, the lowest level in the survey since June 2013 and down from 50.7% in July.

Expectations that the unemployment rate will be higher in the future rose in August, as did expectations of future job loss, the probability of which stood at 14.5% of respondents, above the 12-month average of 14%. In August, survey respondents also said they marked down the probability of leaving a job voluntarily.

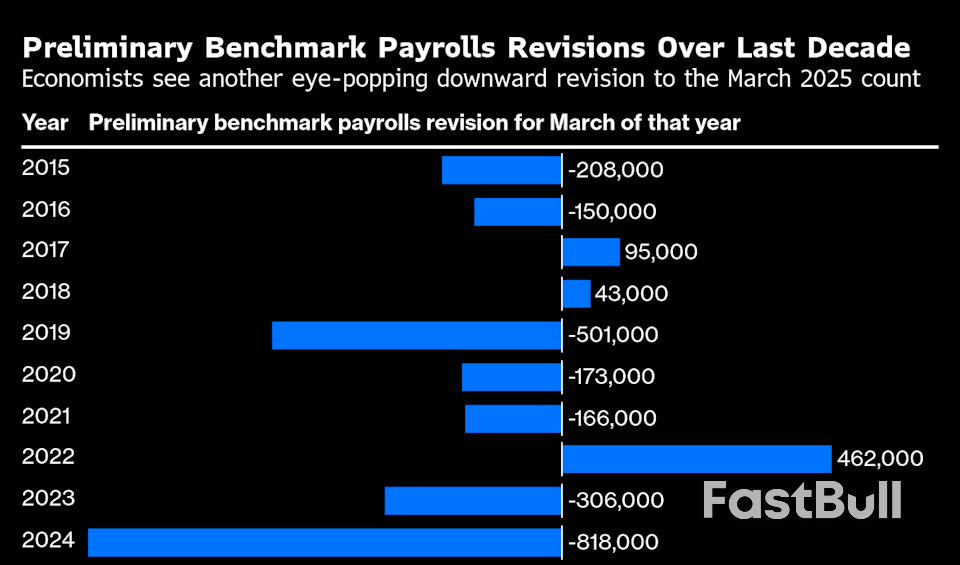

The troubled outlook for hiring is another sign of challenges in the job market. Government data released over the two months has shown a notable deceleration in the rate of job growth amid big downward revisions to previous months' numbers.

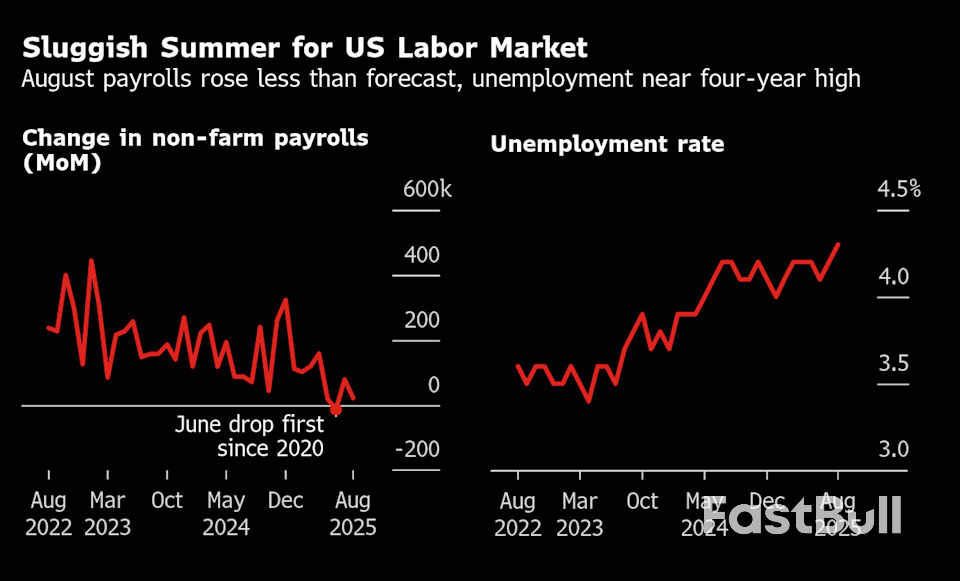

On Friday, the Bureau of Labor Statistics reported that non-farm payrolls rose by a modest 22,000 jobs after increasing by 75,000 in July. The unemployment rate ticked up slightly to 4.3%, which was itself a four-year high. The data also showed that in June the economy lost jobs, something that had not happened in four and a half years.

The worsening outlook for hiring is helping buttress the outlook for a Fed rate cut next week. The U.S. central bank is widely expected to lower its short-term benchmark interest rate by a quarter of a percentage point to the 4.00%-4.25% range at the end of its September 16-17 meeting.

Fed officials worry that President Donald Trump's trade tariffs could further boost already stubborn levels of inflation. But they are also increasingly anxious that the job market is running into trouble, and that's becoming the main focus of monetary policy.

"I've been clear that I think we should be cutting at the next meeting," Fed Governor Christopher Waller said in an interview with CNBC last week. "You want to get ahead of having the labor market go down because usually when the labor market turns bad, it turns bad fast."

The New York Fed survey also found respondents have downgraded their current financial situations, although it added that respondents' "year-ahead expectations about households' financial situations became more dispersed" in August.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up