Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Consumer concerns about inflation have fallen to their lowest level in nearly three years, according to Morgan Stanley’s latest U.S. Consumer Pulse Survey, even as analysts warn that

Consumer concerns about inflation have fallen to their lowest level in nearly three years, according to Morgan Stanley’s latest U.S. Consumer Pulse Survey, even as analysts warn that tariffs could still lead to future price pressures.

In the bank’s 69th monthly survey of around 2,000 consumers conducted between Sept. 25 and 29, 56% of respondents cited inflation as their top concern, down from 60% in August and 63% a year earlier.

“While inflation remains the number one concern for consumers over the next 12 months, the proportion of consumers reporting it as their primary concern has dropped to the lowest level since 2022,” Morgan Stanley said.

The firm cautioned that the improvement might be premature. “Tariff price pass-through is likely not yet complete,” analysts wrote, noting that more than two-thirds of affected firms have yet to raise prices or expect further increases.

The bank’s analysis of corporate transcripts also found that companies are “increasingly discussing flexing pricing power to mitigate the impact of tariffs.”

Consumer sentiment toward the economy and household finances has also improved.

Morgan Stanley said thirty-six percent of respondents expect the economy to improve over the next six months, up from 33% last month, while those expecting conditions to worsen fell to 46% from 49%.

Morgan Stanley said this marks a “notable improvement from -16% last month,” though confidence remains below January highs.

The survey also highlighted the growing role of inheritance in household finances, with 17% of consumers having received one and 14% expecting to.

Morgan Stanley said inheritances are “primarily used for savings, retirement, or investments,” underscoring their link to long-term financial security.

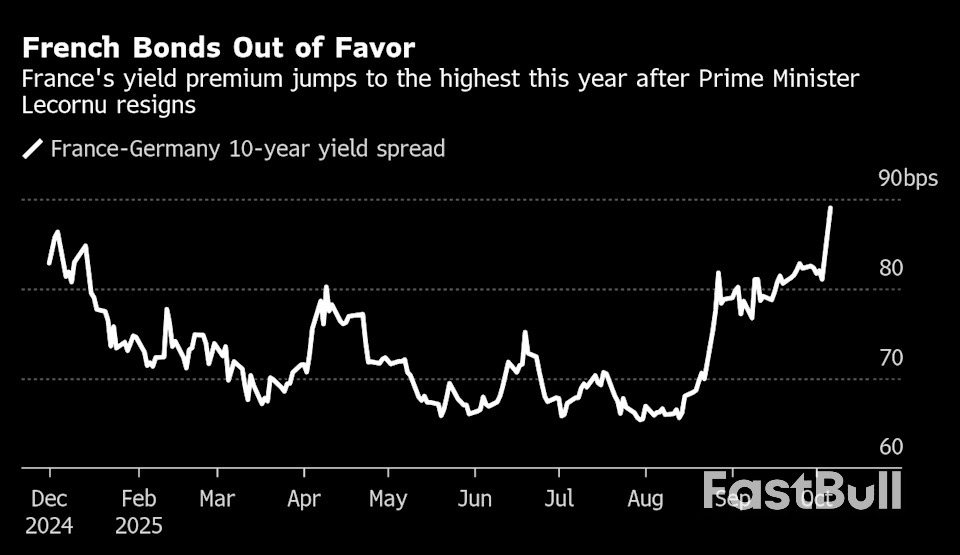

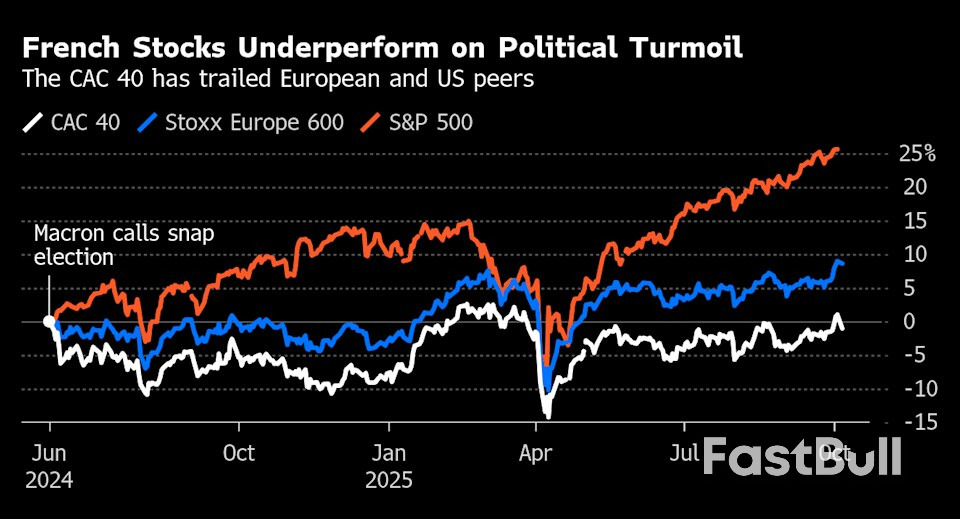

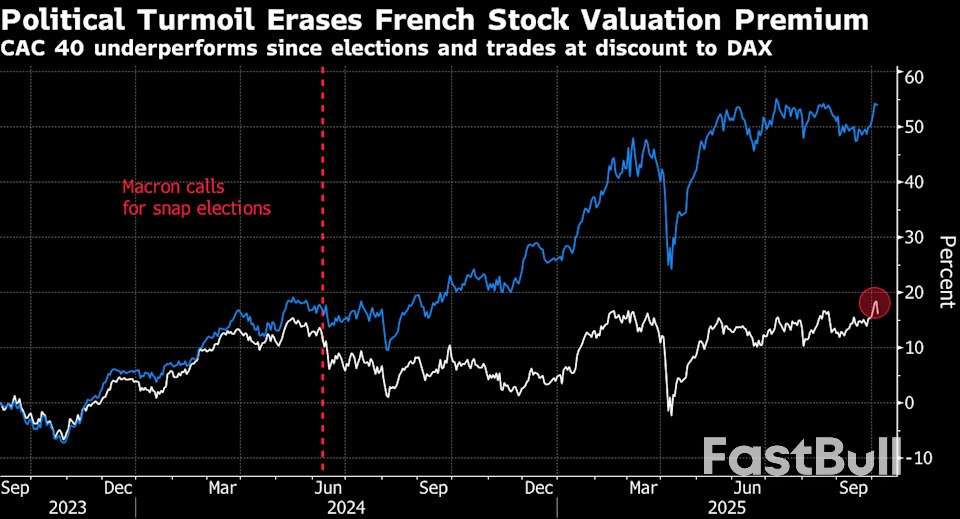

Domestic politics dominated global markets today, driving sharp moves in both European and Asian trading sessions. In Europe, political instability in France rattled sentiment, while in Japan, optimism over new leadership sparked a broad equity surge and a dramatic selloff in the Yen.

In European, CAC 40 slumped and Euro is sold off broadly, after French Prime Minister Sebastien Lecornu and his newly formed government resigned just hours after unveiling their cabinet lineup. The collapse, just 14 hours after formation, deepened France’s ongoing political turmoil and marked the shortest-lived administration in modern history.

Lecornu cited the impossibility of governing amid threats from both coalition partners and the opposition to topple his government. The fallout was immediate, with opposition parties calling on President Macron to resign or trigger early elections. The episode underscores growing public fatigue and political fragmentation that risk eroding investor confidence in French assets.

Yet, Yen’s dramatic selloff overshadowed Europe’s turmoil. The currency plunged below 150 per dollar for the first time since early August and touched a record low versus Euro, as Japanese equities soared. Traders rushed into risk assets, betting that Prime Minister-designate Sanae Takaichi’s incoming administration will prioritize fiscal expansion and encourage continued BoJ accommodation.

The move rippled across bond markets, sending short-term JGB yields to two-week lows as traders cut back expectations for further tightening. Market pricing for a BoJ hike by year-end fell sharply to near 40% from 68% at the end of last week, as confidence grew that the central bank will stay on hold through October.

Governor Kazuo Ueda’s cautious tone in recent weeks aligns with this view, suggesting that policymakers see little urgency to resume tightening. With political stability and fiscal stimulus prospects improving, investors appear comfortable re-engaging in carry trades, accelerating Yen’s decline.

For now, Dollar leads as the day’s strongest performer, followed by Loonie and Aussie. At the other end, Yen remains the weakest, trailed by Euro and Swiss Franc, while Sterling and Kiwi hover mid-pack in largely risk-driven trade.

In Europe, at the time of writing, FTSE is up 0.15%. DAX is up 0.25%. CAC is down -1.27%. UK 10-year yield is up 0.044 at 4.739. Germany 10-year yield is up 0.021 at 2.723. Earlier in Asia, Nikkei rose 4.75%. Hong Kong HSI fell -0.67%. China Shanghai SSE rose 0.52%. Singapore Strait Times rose 0.22%. Japan 10-year JGB yield rose 0.015 to 1.680.

ECB Chief Economist Philip Lane reiterated in a speech today that monetary policy will remain data-driven and meeting-by-meeting, with “no pre-commitment to a particular rate path.” He emphasized said the ECB’s policy decisions will hinge not only on the baseline inflation forecast but also on “shifts in the risk distribution”.

The downside inflation risks outlined in September include a stronger Euro, weaker export demand caused by higher global tariffs, and the possibility of rising market volatility linked to trade tensions.

Conversely, Lane highlighted several upside risks that could keep inflation elevated. These include “fragmentation of global supply chains”; surge in defence and infrastructure spending that boosts medium-term demand; and climate-related disruptions.

He elaborated that persistent Euro movements tends to have “multi-year impact” on both inflation and growth, with the size of the impact depending on its source. Appreciation stemming from external weakness or capital flows tends to depress inflation more sharply. On the other hand, changes driven by domestic demand strength or domestic risk premiums carry a smaller inflationary force.

Investor sentiment in the Eurozone improved in October, with Sentix Investor Confidence Index rising from -9.2 to -5.4, topping forecasts of -7.7. Current Situation Index advanced from -18.8 to -16.0, while Expectations climbed sharply from 0.8 to 5.8.

Sentix said the latest data initially looks like the long-awaited economic turning point, with strong improvements seen across Germany, Austria, and Switzerland as well. However, it cautioned that the improvement may not mark a lasting turnaround. Most country-level readings and the Eurozone composite still sit below August’s levels, implying that September’s pessimism was “negatively exaggerated”.

Meanwhile, Sentix also noted that inflation remains a key worry, with its related index barely rising to -17.75. Still, markets appear to expect that the ECB will maintain a steady policy stance, and perhaps even lean slightly supportive, despite mounting fiscal pressures. Sentix warned that such expectations may have a “limited half-life,” as growing debt levels and persistent inflation could restrain the scope for policy easing in the months ahead.

Eurozone retail sales rose 0.1% mom in August, matching expectations and signaling only a modest pickup in consumer activity. The increase was driven by 0.3% rise in food, drinks, and tobacco sales and 0.4% gain in automotive fuel, partly offset by a -0.1% decline in non-food product demand.

Across the wider European Union, retail sales were flat on the month. Among member states, Lithuania (+1.7%), Cyprus and Malta (+1.5%), and Sweden (+1.1%) posted the strongest gains, while Romania (-4.0%), Poland (-0.8%), and Luxembourg and Portugal (both -0.7%) recorded notable declines.

The BoJ’s Regional Economic Report released today painted a mixed picture of recovery, with assessments for eight regions left unchanged and one downgraded. Most local economies were described as “recovering moderately” or “picking up” .

Businesses in some areas reported that they may scale back wage hikes if tariffs begin to bite into profits, a risk that could slow Japan’s nascent wage-led inflation. Still, several regions pointed to ongoing wage pressures from tight labor markets and rising living costs, suggesting that the underlying trend in income growth remains intact for now.

The survey also revealed continued commitment to capital investment, particularly in automation and IT-related projects, as firms seek efficiency gains. However, a number of companies plan to delay or reassess spending amid uncertainty over global demand and the evolving impact of tariffs.

Oil prices recovered modestly in today after the OPEC+ alliance confirmed a small production increase of 137,000 barrels per day for November, matching the rise announced for October. The restrained decision eased fears of a larger supply boost.

Following Sunday’s ministerial meeting, OPEC+ said the move was made “in view of a steady global economic outlook and current healthy market fundamentals.” The statement emphasized low global inventories as evidence that supply-demand conditions remain tight enough to justify a gradual output approach.

The limited hike contrasts with speculation that major producers—particularly Saudi Arabia and Russia—might push for a faster restoration of supply to reclaim market share. Instead, the decision reflects caution amid volatile demand signals and lingering uncertainty over global growth.

Technically, for WTI oil, some consolidations would be seen above 60.62 temporary low for the near term. But risk will stay on the downside as long as 63.49 minor resistance holds.

Break of 60.62 will resume the whole decline from 78.87. Next target is 100% projection of 71.34 to 61.90 from 66.70 at 57.26. However, firm break of 63.49 will bring stronger rebound back to 66.70 resistance instead.

Daily Pivots: (S1) 0.8704; (P) 0.8717; (R1) 0.8727;

EUR/GBP’s fall from 0.8750 resumed by breaking through 0.8688 and intraday bias is back on the downside for 0.8631 support. Decisive break there will indicate near term reversal and turn outlook bearish. On the upside, though, above 0.8728 will bring retest of 0.8750 first. Firm break there will resume the larger rally towards 0.8867 fibonacci level.

In the bigger picture, rise from 0.8221 medium term bottom is seen as a corrective move. While further rally cannot be ruled out, upside should be limited by 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Considering bearish divergence condition in D MACD, firm break of 0.8631 support will be the first sign that this corrective bounce has completed. Sustained trading below 55 W EMA (now at 0.8539) will confirm, and bring retest of 0.8221 low.

Gold – Chart

Gold – Chart Silver – Chart

Silver – ChartSeveral European companies have frozen hiring or cut jobs this year, citing difficult economic conditions exacerbated by U.S. tariffs.

Here are some of the companies that announced layoffs:

* RENAULT: The French carmaker confirmed it is planning cost cuts but said it has no figures to report yet, on Saturday after a newsletter reported it would cut 3,000 jobs by year-end in support services at its headquarters in the Paris suburb of Boulogne-Billancourt and other locations worldwide.

* BOSCH: The German home appliance manufacturer will cut 13,000 jobs as it battles sluggish demand, high costs and pressure from rivals, it said on September 25.

* DAIMLER TRUCK: The truckmaker confirmed media reports on August 1 that it would cut 2,000 jobs across its plants in the U.S. and Mexico, on top of the previously announced 5,000 job cuts in Germany.

* STELLANTIS: The automaker expanded its voluntary redundancy scheme for Italy, bringing the total planned workforce reduction to almost 2,500 in 2025, it said on June 10.

* VOLKSWAGEN: The company’s CFO said on April 30 it had cut headcount in Germany by around 7,000 since starting cost savings in late 2023.

* VOLVO CARS: The Swedish carmaker will cut 3,000 mostly white-collar jobs as part of a wider restructuring, it said on May 26.

* COMMERZBANK: The German bank said on May 14 it had agreed with the works council on terms to cut around 3,900 jobs by 2028.

* LLOYDS: The British bank will consider the dismissal of around half of 3,000 staff to cut costs, a source familiar with the matter told Reuters on September 4.

* OMV: The Austrian oil and gas company plans to cut 2,000 positions, or a twelfth of its global workforce, the Kurier newspaper reported on September 4.

* STMICROELECTRONICS: The French-Italian chipmaker’s CEO said on June 4 he expected 5,000 staff to leave the company in the next three years, including 2,800 job cuts announced in 2025.

* BURBERRY: The British luxury brand will shed 1,700 jobs or around a fifth of its global workforce to cut costs, it said on May 14.

* LVMH: The Financial Times reported on May 1, citing an internal video, that the luxury group’s wine and spirits unit Moet Hennessy would cut its workforce by about 1,200 employees.

*JUST EAT TAKEAWAY: The food delivery company’s German unit Lieferando plans to cut 2,000 jobs from end-2025 to optimise the model of its delivery service, the company said on July 17.

* LUFTHANSA: The German airline group said on September 28 it would cut 4,000 administrative jobs by 2030.

* NOVO NORDISK: The Danish pharmaceutical company will cut 9,000 jobs globally, the company said on September 10.

Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

WTI Price Chart Brent Price Chart

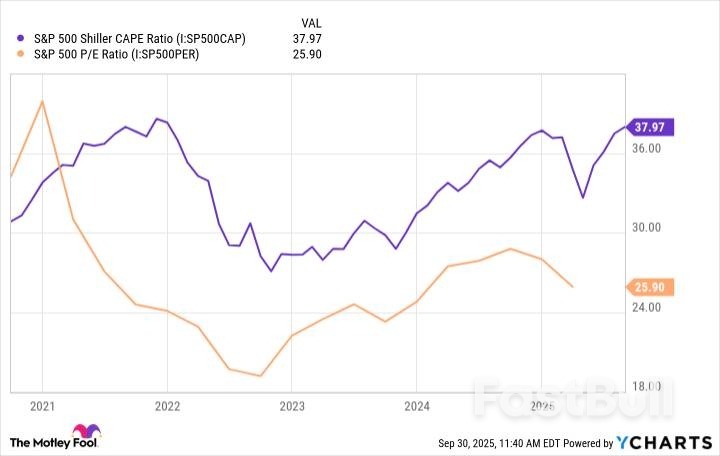

Brent Price ChartThe S&P 500 is back to its glorious self this year, overcoming some challenges a few months ago to rise 14% year to date. It's resilient, like the U.S. economy, driven by the largest of its 500 components.

There are a number of ways to invest in the S&P 500, and one of the most popular methods today is investing in an exchange-traded fund (ETF) that tracks it. The largest one is the Vanguard S&P 500 ETF (VOO 0.01%), which has $1.4 trillion in assets, but there are several others.

You might think it's a great time to buy in as the market rises, but it's not that simple.

The S&P 500 has been a wealth-building machine for decades. It gains on average more than 10% annually; Compounded over time, especially with consistent additions, that turns into a lot of money for investors.

As the market rises, investors can benefit from increasing stock prices. And when you invest in an ETF that tracks the S&P 500, it takes all of the guesswork out of investing.

It also gives you exposure to the best companies on the market today, and since it's a weighted index, it's heavily skewed toward artificial intelligence (AI). The largest companies in the U.S. by market cap are the largest companies in the index, and today, these are all AI companies. The Vanguard ETF's top holdings are Nvidia, Microsoft, Apple, and Amazon, and they collectively account for 25% of the total portfolio.

These stocks have incredible long-term tailwinds. Investing in an S&P 500 ETF gives you access to these opportunities while minimizing the risk of investing in only one company.

That being said, the best time to buy is on the dip, not at the top. The S&P 500 is breaking records all the time these days, and it's near its most expensive valuation. The average S&P price-to-earnings (P/E) ratio is almost 38, a five-year high. The cyclically adjusted P/E ratio, or CAPE ratio, which adjusts for inflation, is also near highs -- outside of a spike in 2021 right before the market crashed.

What does that mean for investors? Nothing concrete, but the nature of the market is that there are always going to be dips, corrections, and even crashes on the way to the top. The market has always recovered and gone on to bigger and better, but as the S&P 500 becomes more and more expensive, the potential for some kind of correction looks likely.

No one knows when there might be a dip, or worse. You can't time the market, and even though it's heading higher today, it could keep that up for a long time. It would be a shame to miss out on the growth because of fear of a correction. Keep in mind the potential for some near-term rebalancing as the market becomes even more expensive.

I would caution anyone who might need their funds in the near future to invest in safe, perhaps dividend-yielding stocks and keep some distance from anything that looks overpriced, including an S&P 500 ETF. But if you're in it for the long term, and you have the ability to weather downturns, it's always a good time to invest in the market, and an S&P 500 ETF is an excellent way to do that.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up