Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ukraine's European allies on Monday said that the war is at a "critical moment" as President Volodymyr Zelenskyy said his country is preparing to share a revised peace plan with the U.S.

Ukraine's European allies on Monday said that the war is at a "critical moment" as President Volodymyr Zelenskyy said his country is preparing to share a revised peace plan with the U.S.

Zelenskyy met with U.K. Prime Minister Keir Starmer, German Chancellor Friedrich Merz and French President Emmanuel Macron in London as the European leaders scrambled to ensure that Ukraine's territorial integrity and future security are not compromised in the face of growing U.S. pressure.

In a statement following the meeting, Starmer's office said the leaders had discussed "the importance of the U.S.-led peace talks for European security" and supported the progress made so far.

"The leaders underscored the need for a just and lasting peace in Ukraine, which includes robust security guarantees," Starmer's representatives added. "The leaders agreed that, while diplomatic efforts continue, Europe must stand with Ukraine, strengthening its ability to defend against relentless attacks."

Starmer, Merz, Macron and Zelenskyy also discussed "positive progress" that had been made on using frozen Russian assets to support Ukraine's reconstruction.

The European Commission, the executive arm of the EU, last week proposed using cash from the balances of European financial institutions holding frozen Russian Central Bank assets to support Ukraine with a "Reparations Loan." It also tabled borrowing the funds from international markets, offering member states an alternative to using Russian capital.

The U.K. prime minister's office noted that those present in Monday's meeting had also joined a call with other European leaders following the initial talks.

"The leaders all agreed that now is a critical moment and that we must continue to ramp up support to Ukraine and economic pressure on Putin to bring an end to this barbaric war," the spokesperson said.

U.S. support remains crucial

As the European leaders reiterated their support for Kyiv, Zelenskyy stressed that Ukraine also remained reliant on input from Washington.

"There are some things which we can't manage without the Americans, some things we can't manage without Europe, that's why we need to make some important decisions," he said, during a press briefing.

However, Merz struck a somewhat cautious tone on U.S. negotiators achieving an imminent breakthrough that would be acceptable to both Ukraine and wider European continent.

"This could be a decisive time for all of us," he told reporters. "We are trying to continue our support for Ukraine, on the other hand we are seeing these talks and decisions between Moscow and the U.S., I'm looking forward to hearing from [Zelenskyy] what the outcome of these talks might be."

The U.K. and France have been leading proponents of a "Coalition of the Willing," a group of countries that could be part of a "reassurance force" in a post-war Ukraine that helps to guarantee its security.

Ukraine is expected to share a revised peace plan with the U.S. after the London talks, according to media reports.

The updated plan consists of 20 points after some "obvious anti-Ukrainian points were removed," Zelenskyy said in comments reported by Sky News. He added that he will share the revised plan with the U.S. today.

On Sunday, Trump claimed Zelenskyy had not yet read the latest U.S.-backed peace plan yet, though it's unclear which version Trump was referring to.

"We all know that the destiny of this country is the destiny of Europe," Merz added on Monday. "Nobody should doubt our support for Ukraine. I'm skeptical about some of the details which we are seeing in the documents coming from the U.S. side, but we have to talk about that, that's why we are here."

Anna Rosenberg, head of geopolitics at Amundi Investment Institute, told CNBC's "Europe Early Edition" on Tuesday that negotiations to bring the war to an end seemed to be "going in circles."

"It's a lot of talking back and forth," she said. "Frankly, sometimes I wonder what they keep on talking about, because the sticking points are always the same. It's about territory and it's about the security guarantees, and the security guarantees are arguably more difficult than the territory, but the territory is also difficult for Ukraine."

Last week, Russian President Vladimir Putin threatened that Moscow would take Ukraine's critical Donbas region "by force" if Ukraine does not concede the territory willingly.

Rosenberg told CNBC on Tuesday that Kyiv is unlikely to give in to that pressure.

"The territory we're talking about is a critical zone of defense for Ukraine, which, if Ukraine gives it up, would make it much easier for Russia to go deeper into Ukraine, because it's a so-called fortress belt of heavy fortification," she explained.

"Behind that fortress belt, there's a plane you can easily enter with military. So, Ukraine is going to hold on to that for as long as they can. They will only give up on the territory once they feel confident. They have security guarantees that will give them confidence that there's not going to be an attack in a couple of months or years down the line."

Lithuania's government on Tuesday declared a state of emergency over smuggler balloons originating in Belarus that have disrupted aviation, and asked parliament to allow the military to operate alongside police and border guards.

Vilnius airport has been closed repeatedly due to the weather balloons, which Lithuania says are sent by smugglers transporting cigarettes and constitute a "hybrid attack" by Belarus, a close ally of Russia.

"The state of emergency is announced not only due to civil aviation disruptions but also due to interests of national security," Interior Minister Vladislav Kondratovic told a government meeting that was streamed live on Tuesday.

Belarus has denied responsibility for the balloons and accused Lithuania of provocations including sending a drone to drop "extremist material", which Lithuania denies.

The Lithuanian government asked parliament to grant the military powers to act in concert with police, border guards and security forces during the state of emergency, as well as on its own, Kondratovic said.

If parliament agrees, the army will be given permission to limit access to a territory, to stop and search vehicles, to perform checks on people, their documents and their belongings, and to detain those resisting or suspected of crimes.

The military would be permitted to use force for these functions, Defence Minister Robertas Kaunas said. The emergency measures will last until the government calls them off.

European Commission President Ursula von der Leyen said on December 1 that the situation at the border was worsening, and called the balloon incursions a "hybrid attack" by Belarus that was "completely unacceptable".

Lithuania also imposed a state of emergency in 2021 in the Belarus border region over what it said was a campaign by Belarus to send migrants across the border illegally.

The following year, opens new tab Vilnius announced a state of emergency following Russia's invasion of Ukraine, over fears that Lithuania could also become a target.

Governor Kazuo Ueda recently discussed Japan's economic resilience amid global trade challenges, specifically referencing the Bank of Japan's monetary policy shifts since March 2024.

This cautious commentary highlights ongoing trade uncertainties and currency market effects, lacking any direct indication of Japan having withstood tariffs without economic fallout.

Governor Kazuo Ueda of the Bank of Japan has addressed Japan's economic state amidst U.S. tariffs. While not claiming the economy has "weathered" the tariffs, he emphasizes moderate recovery despite ongoing uncertainties.

"Japan's economy has recovered moderately, although some weakness has been seen in part... Overseas economies have grown moderately on the whole, although some weakness has been seen in part, reflecting trade and other policies in each jurisdiction." — Bank of Japan Statement

BoJ has initiated a policy normalization path since 2024. While no official declaration on "weathered" tariffs exists, economic policies are rigorously supporting Japan's GDP growth amidst international trade pressures.

Japan's Q3 2025 GDP shows a 0.6% contraction, mainly due to tariff impacts. The U.S. tariff environment remains a significant headwind.

Potential financial outcomes include ongoing BoJ rate adjustments and yen volatility. While immediate crypto impacts are limited, broader economic changes could indirectly affect the sector.

During 2018–2019, U.S. tariffs previously exerted pressure on Japan's export sector. Historical BoJ responses were dovish, providing monetary relief.

Experts at Kanalcoin suggest the BoJ's cautious approach will continue, potentially leading to a scientific monetary response. Citing past trends, experts forecast minimal direct crypto market disruptions.

After what most market participants would describe as an incredibly dull October confab, the ECB's Governing Council aren't especially likely to deliver much more by way of excitement this time around, with policymakers still in a 'good place', and being set to round out the year by standing pat on all policy instruments.

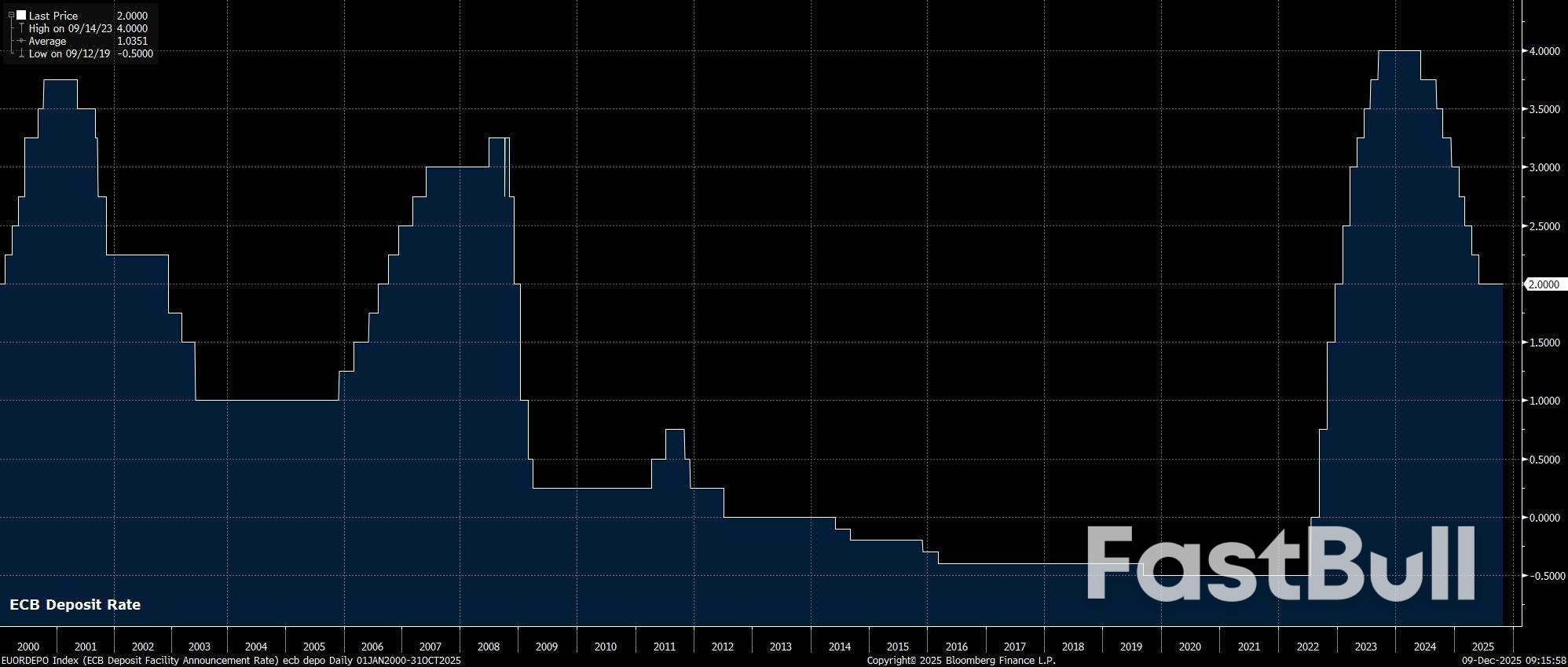

As alluded to above, the ECB's Governing Council are set to stand pat at the conclusion of the December policy meeting, maintaining the deposit rate at 2.00%. Such a decision to stand pat comes not only as the EUR OIS curve discounts next-to-no chance of any further easing, but also amid little indication from any GC members that they presently see a desire to reduce rates further. All signs point to the easing cycle having now come to an end, and 2.00% being this cycle's terminal rate.

That said, the swaps curve has got rather excitable of late, now discounting around a 1-in-5 chance that the ECB will deliver a 25bp hike by the end of next year, spurred on by hawkish comments from Exec. Board member Schnabel in recent days. That pricing does appear rather over-ambitious at this juncture, given the likelihood of a relatively sustained inflation undershoot, hence participants will be watching for any explicit pushback on the idea that policy will be tightened within the next 12 months.

With the GC set to hold all policy settings steady, focus will naturally fall on whether policymakers decide to make any guidance tweaks.

The chances of said tweaks, however, range between 'incredibly slim' and 'none at all', with the accompanying policy statement set to simply reiterate the commentary that has been used for many months, and is now incredibly familiar to all participants. Consequently, the statement will repeat that policymakers will continue to adopt a 'data-dependent' and 'meeting-by-meeting' approach to upcoming decisions, while also making no 'pre-commitment' to a particular policy path.

Perhaps the most interesting area of the December confab will be the updated round of staff macroeconomic projections, particularly the first read on how the projections see the eurozone economy evolving into 2028.

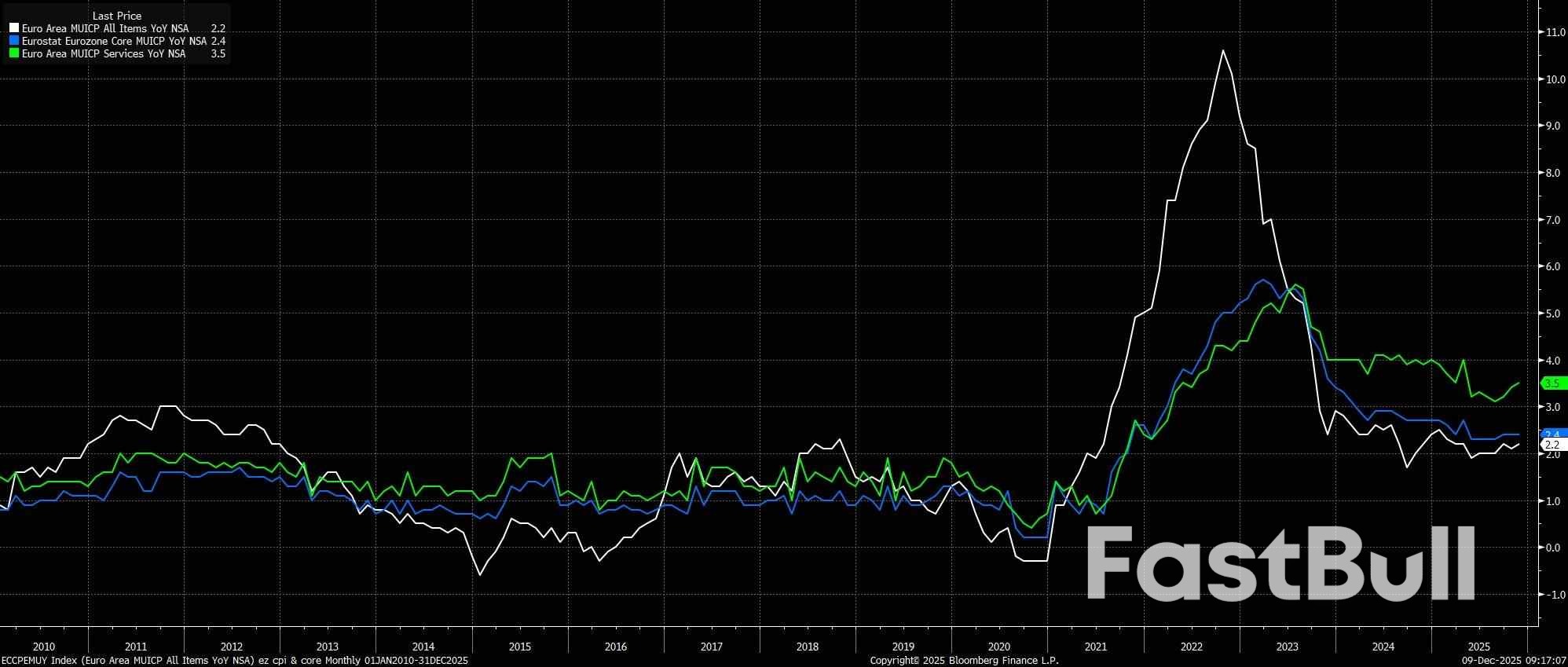

On inflation, the projections are again likely to point to headline CPI undershooting the 2% target both next year, and in 2027. While services inflation has started to bubble away once more in recent months, the beginning of 2026 will see a significant energy-induced base effect impact the data, dragging headline price metrics (much) lower in the first half of the year.

The two key areas of focus for the upcoming inflation projections will be, firstly, whether headline inflation is set to have risen back to 2% by the end of the horizon, in 2028. Secondly, if another undershoot is pencilled in for that year, the question becomes one of whether the Governing Council's doves view that as reason enough to begin pushing for further policy easing, in the early months of next year.

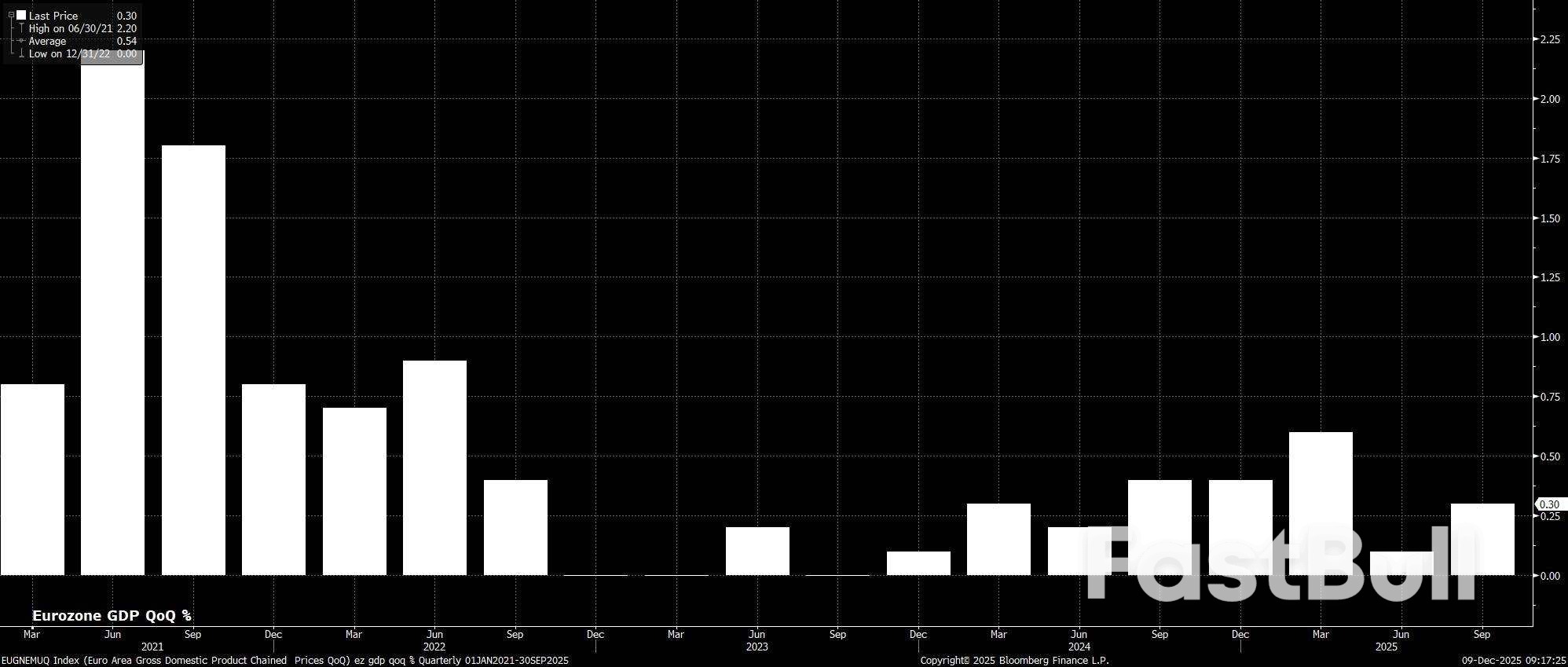

Meanwhile, on growth, there are likely to be relatively little by way of significant changes to the forecast GDP growth path, not least considering that many of the headwinds which have buffeted the eurozone economy in 2025 will increasingly turn to tailwinds as we move into the new year. Said tailwinds are relatively numerous, including increased certainty in terms of global trading relationships (especially with the US), as well as the lagged effects of ECB policy easing, plus a broadly looser fiscal stance next year.

Of course, said fiscal stance will not be entirely equal across the bloc. The vast majority of any fiscal boost next year will come from Germany, where not only is a significant increase on defence and infrastructure spending on the cards, but also a considerable number of tax changes which should provide a boost to personal consumption. That, in turn, at an aggregate level, is likely to offset the impact of further fiscal consolidation in both France, and Italy, which should result in the overall GDP growth forecast remaining broadly unchanged, seeing the eurozone work its way back towards potential growth in 2027 and 2028.

Turning to the post-meeting press conference, it seems highly unlikely that President Lagarde will seek to 'rock the boat' to any significant degree, thus raising the prospect of another turgid and dull affair, in keeping with the remarks delivered last time out, in October.

As a result, it is highly likely that Lagarde will simply reiterate the remarks that she made last time out, namely that policy is still in a 'good place', and that the ECB will ensure policy remains in such a place, while likely also confirming that the December decision to stand pat was a unanimous one.

As always, in addition to the presser, any post-meeting 'sources' stories will also be closely watched, particularly in determining how much weight, if any, policymakers are placing on the 2028 inflation forecasts.

On the whole, the December ECB confab is unlikely to be one that goes down as a game-changer in terms of the broader policy outlook.

While the GC's doves may seek to argue for another rate reduction early next-year, it remains likely that an overwhelming majority of policymakers see little-to-no need to shift to a more accommodative policy stance. Barring a material deterioration in economic growth, policymakers are likely to be relatively comfortable tolerating a modest inflation under-shoot, continuing to place more weight on 'hard' data, as opposed to staff projections.

As such, the base case remains that the ECB's easing cycle has now come to an end, and that the next rate move will indeed be a hike. Such a hike, however, is near-certain not to come next year, with the deposit rate set to remain at 2.00% through the end of 2026, and the matter of policy tightening one that will, eventually, be addressed in 2027.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up