Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

UK's Reeves to present her annual budget on November 26; Sticking to fiscal targets likely to require higher taxes; Tax hike speculation hurting business confidence.

Britain's budget rumour mill was already in full swing well before a date was set on Wednesday, with speculation about tax increases posing a further risk to confidence among businesses and households already anxious about inflation and job losses.

Media reports have suggested finance minister Rachel Reeves is considering new taxes on home sales, ways to make more people pay income tax, changes to pensions relief and possibly new levies on banks and gambling in her annual budget, now set for November 26.

Britain grew faster than any other Group of Seven economy in the first half of 2025, but much of the momentum was driven by higher public spending and a rush by manufacturers to get ahead of U.S. President Donald Trump's import tariffs.

The public finances remain weak and analysts say Reeves will have to raise taxes by at least 20 billion pounds ($27 billion) - and possibly double that - to remain on course to hit her own fiscal targets.

The Confederation of British Industry has already called on the government not to repeat last year's tax increase on employers and in August linked a fall in confidence, investment and activity among services firms to short-term uncertainty.

Last month, the Royal Institution of Chartered Surveyors said talk of new taxes on home sales was causing concern, while some analysts believe a surprise dip in house prices reported this week might be a sign of weakness to come.

And wage data firm Brightmine has said private sector employers are unlikely to raise workers' pay settlements from below-inflation levels until the budget picture becomes clearer.

Neil Bellamy, consumer insights director at GfK, which publishes Britain's longest-running gauge of consumer confidence, said reports about tax increases were probably having an impact on the public mood.

"It's something people are more aware of in terms of how this could impact me directly," he said.

High levels of household savings point to consumer caution, while offering the prospect of stronger spending at some point.

Deutsche Bank analysts said a new "Fear Index" based on the bank's surveys showed British consumers are more anxious than at any point since the pandemic, due to worries about unemployment, higher inflation and the reports of possible tax increases.

For businesses, uncertainty around the budget comes after the shocks of Brexit, COVID-19, the 2022 surge in energy prices and Trump's tariffs.

"If they are in a position to be able to invest, they're still hovering over that button," CBI Chief Economist Louise Hellem said. "They feel that if we just wait a couple of weeks or wait a couple of months, it'll all become a bit clearer. And we never seem to quite get to that point."

Hellem, who once helped prepare annual budgets as a Treasury official, said the government was showing it wanted to create a longer-term strategy for the economy.

It is seeking to streamline the planning system and boost investment - both public and private - in infrastructure.

Hellem also welcomed the government's intention to get more people into work, but said last year's tax increase for employers and uncertainty about plans to give workers more rights risked having the opposite effect.

In her first budget last year, Reeves ordered Britain's biggest tax hikes in three decades, with most of the 40 billion pounds of revenue raisers falling on employers.

She has said no further tax increases on that scale are planned.

Prime Minister Keir Starmer dropped proposals in June for big welfare savings, however, while Britain's fiscal watchdog is expected to lower its economic growth projections, cutting future tax flows.

That leaves Reeves with little option other than to raise taxes to keep on track for her fiscal targets - chief among them a pledge to balance day-to-day spending with revenues by the end of the decade - or risk trouble in the bond market.

Investors remain hyper-sensitive to Britain's big borrowing needs after the 2022 "mini-budget" crisis under former Prime Minister Liz Truss. This week, 30-year borrowing costs hit their highest since 1998 amid a broader government debt sell-off.

The fine margins of error in Reeves' plans for meeting her fiscal rules - which unusually in Britain are assessed twice a year - also raise the risk that similar uncertainty will drag on the economy ahead of future budgets.

That prospect has prompted calls for the eventual restoration of more headroom in budget plans, or more root-and-branch changes to the rules.

"If you want growth to happen, you want firms that are investing to be sure about what's going to happen over the next few years," Stephen Millard, deputy director for macroeconomics at the National Institute of Economic and Social Research, a think tank, said.

But the likelihood of Reeves carving out more headroom in this year's budget is slim because of the political costs of very big tax increases or deep spending cuts, Millard said.

Britain's government might also be tempted to follow the lead of European Union countries which in March agreed they could temporarily spend more on defence without breaking the bloc's rules.

"If we're back into the same conversation in a year's time, I think there will be some honest conversations about whether the fiscal framework is fit for purpose," Sanjay Raja, Deutsche Bank's chief UK economist, said.

Futures linked to the S&P 500 and Nasdaq recovered on Wednesday after Alphabet gained on a favorable antitrust ruling and investors awaited labour market data that could influence the central bank's upcoming interest-rate decision.

Alphabet jumped 6.2% in premarket trading after a Washington judge ruled late on Tuesday Google will not have to sell its Chrome browser, but will have to share data with rivals.

Apple also gained 3.9% as the ruling allowed Google to continue lucrative payments to the iPhone maker.

"This outcome removes a significant legal overhang and signals that the court is willing to pursue pragmatic remedies rather than scorched-earth tactics," said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

"That's a message the rest of Big Tech, many of whom face their own antitrust battles, will be watching closely."

The Job Openings and Labor Turnover Survey report for July, due at 10am ET, marks the first in a series of jobs indicators expected this week that will culminate in Friday's highly anticipated nonfarm payrolls data.

Federal Reserve Chair Jerome Powell's comments at Jackson Hole earlier this month have put the focus squarely on labour market weakness ahead of the central bank's rate decision on September 17.

Following July's weak payrollsdata and massive revisions to previous reports collectively suggesting a cooling labour market, investors are now pricing in a 91.2% chance of a September rate cut, according to data compiled by LSEG.

At 7.14am ET, Dow E-minis YMcv1 were up 14 points, or 0.03%, Nasdaq 100 E-minis NQcv1 were up 172.75 points, or 0.74%, and S&P 500 E-minis EScv1 were up 32.75 points, or 0.51%.

Wall Street closed sharply lower in the first trading session of September, as yields on longer-dated Treasury notes had spiked, pressuring equities.

Yields on the 30-year note hit a more than one-month high on Tuesday after a court ruling last week deemed most of US President Donald Trump's tariffs illegal, reviving some fiscal concerns. It touched 5% earlier on Wednesday and was last at 4.972%.

September has been historically dour for US equities, with the index losing 1.5% in the month on average since the turn of the century, according to data compiled by LSEG.

Department store operator Macy's soared 9.8% after raising its annual forecasts, but discount retailer Dollar Tree dropped 9.2% despite a forecast hike.

As earnings season winds down, investors are watching for commentary on the holiday season shopping outlook to gauge the health of the US consumer. A survey by PwC showed US holiday spending this year was set for its steepest drop since the pandemic.

Fed policymakers Alberto Musalem and Neel Kashkari are scheduled to deliver speeches on the day, potentially offering more clues on monetary policy direction.

In other moves, Zscaler inched 1.1% higher after the cloud security firm forecast annual revenue above estimates.

Key points:

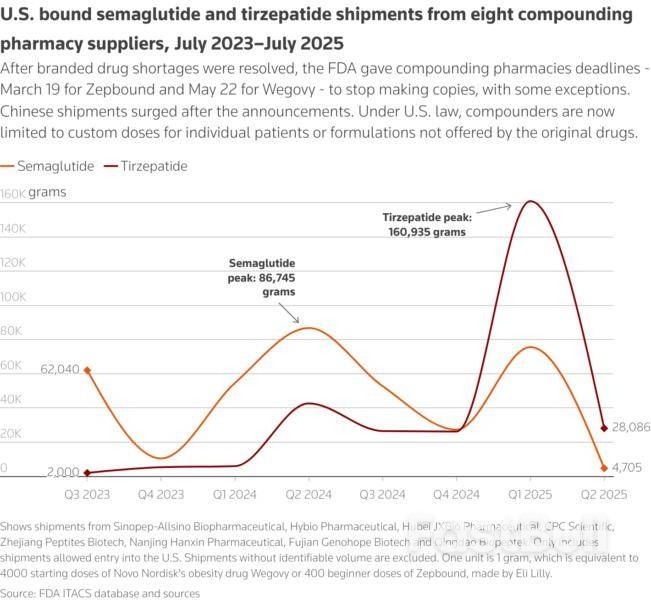

Some Chinese companies now racing to make generic versions of Novo Nordisk'sWegovy also supplied ingredients for more than a billion makeshift doses of weight-loss drugs sold online in the U.S. over the past two years, according to three sources and a Reuters review of shipping and public records.Cheap copies of Wegovy and Eli Lilly'sZepbound are on the retreat in the U.S. as regulators restrict their sale, slowing shipments from Chinese suppliers of the raw ingredients that allowed for explosive growth of the medicines.

Robert Califf, who had two stints leading the U.S. Food and Drug Administration, said never before had a new drug become so wildly popular that the manufacturer simply couldn’t keep up.The shortage opened the door for compounding pharmacies, turbocharged by telehealth firms that flourished during the COVID pandemic, to supply cheap copies to a huge market chasing the promised weight loss.

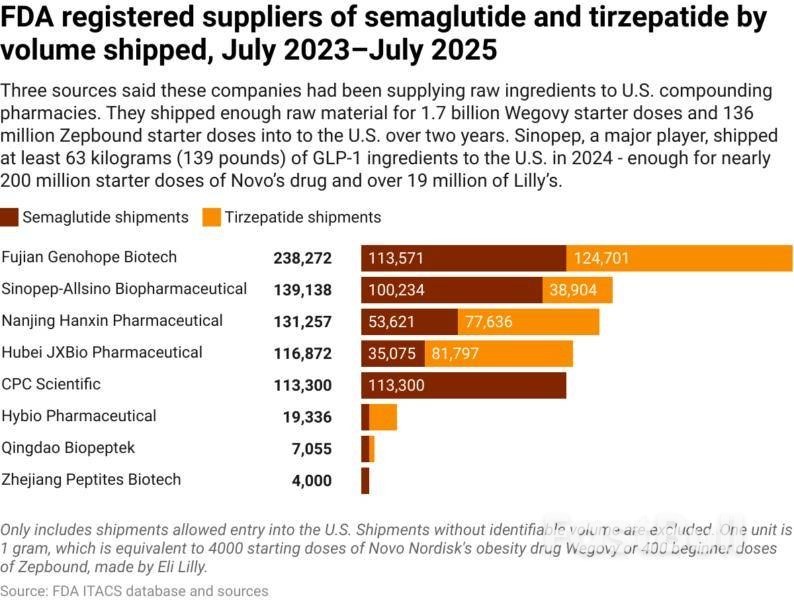

The pivot to FDA-approved generics as patents expire in various countries follows a year of soaring demand for the branded drugs, which have been shown to help people shed as much as 20% of their weight.At least eight Chinese companies, including publicly traded Jiangsu Sinopep-Allsino Biopharmaceuticaland Hybio Pharmaceutical, helped flood the U.S. with raw semaglutide and tirzepatide, the main ingredients in Wegovy and Zepbound, respectively, sources told Reuters. A Reuters analysis of U.S. FDA shipping records backs that up.

Hybio and Sinopep are working to launch their own generic semaglutides, according to one of the sources with knowledge of the efforts and previous Reuters reporting. The source also said Nanjing Hanxin Pharmaceutical and Fujian Genohope Biotech, two of the companies that had supplied compounders, may launch as well.

U.S. law now restricts compounding pharmacies to producing personalized doses for patients who need them, or formulations not offered by the branded medicines.The source with knowledge of the Hybio and Sinopep efforts said that for one Chinese manufacturer, supplying ingredients for compounded weight-loss drugs had been its biggest business. The manufacturer is now targeting markets where Novo's main semaglutide patent is expiring next year, such as Canada and Brazil, to sell the ingredient to generic drugmakers, he said.He said he knew of at least five other Chinese companies known to supply compounding pharmacies that were similarly refocusing on supplying semaglutide for generics.

The switch is unlikely to produce similar explosive growth. Manufacturing semaglutide to its final, injectable form is complex, said a lawyer for a generic drugmaker who asked for anonymity because he was not authorized to discuss the topic.Companies seeking to sell generics also may strike deals with branded companies that delay their market entry.

Compounding of the in-demand weight-loss medicines while the branded drugs were in short supply represented an unprecedented opportunity.In 2024 alone, the eight Chinese companies shipped enough raw material into the U.S. to produce more than 1 billion starter doses of the blockbuster medicines, according to FDA shipping data.Novo's estimate is even higher. It said Chinese companies shipped enough semaglutide into the U.S. in just over six months to make 1.5 billion starter doses of Wegovy, according to a letter submitted to the U.S. Department of Commerce and posted publicly.

In this year's first quarter, with company supply shortages no longer an issue and the FDA pressing for an end to mass compounding, Hybio, Sinopep and others were still bringing in sizable shipments of ingredients to copy both drugs.By the second quarter, shipments had plunged 90% from a year earlier for semaglutide, also the main ingredient in Novo's diabetes treatment Ozempic, and by 34% for tirzepatide used to make Zepbound and Mounjaro copies.

The economics for Chinese companies selling semaglutide to compounders was appealing. A month’s supply of semaglutide powder costs just 7 cents to produce, according to a 2024 report in JAMA. Chinese ingredient makers can sell that for as much as seven times that amount to manufacturers looking to make copies, based on sales figures provided by the source.U.S. compounding pharmacies were selling the injectable drugs for an average of as low as $230 a month, more than half off the branded prices.

The cost to Novo has been high. It missed quarterly sales targets and shares of the Danish drugmaker have been halved this year, contributing to the CEO's May ouster.Records show that Sinopep, Hybio and one other company have started shipping into the U.S. more liraglutide, the main ingredient of an older Novo drug sold under the brand names Victoza and Saxenda that leads to more modest weight loss.Generic versions of liraglutide, available in the U.S. since 2024, are now featured by online telehealth sites that once pushed semaglutide.

A second source, a wholesaler who sells obesity drug ingredients to compounding pharmacies but who was not authorized to speak publicly, said he had seen an uptick in liraglutide sales.Marta Wosinska, a senior fellow at the Brookings Institution who has been tracking the rise of this industry, said shipments of Chinese-made semaglutide exploded not long after the FDA announced the shortages in 2022.

Califf said he expects companies to test the law restricting sales, and that the FDA will set the tone for enforcement with industry guidance. The FDA said it remains committed to using all available tools to oversee the safety and quality of FDA-regulated products.Still, Califf said, the compounding of weight-loss drugs at enormous scale is likely a “once-in-a-decade issue.”

The European Commission is set to present an EU trade accord with South America's Mercosur bloc for approval on Wednesday, hoping to win over the main critics of the deal - France, Poland and European farmers - with promises of safeguards.

The European Union and the bloc of Argentina, Brazil, Paraguay and Uruguay reached the free trade agreement last December, some 25 years after negotiations were launched.

Now it will be put up for consent in the European Union, requiring a vote in the European Parliament and a qualified majority among EU governments, meaning 15 of 27 members representing 65% of the EU population. Neither is a given.

The Commission and proponents such as Germany and Spain say the Mercosur deal offers a way to offset the loss of trade due totariffsimposed by U.S. President Donald Trump and to reduce reliance on China, notably for critical minerals.

France, the EU's largest beef producer, has previously branded the deal "unacceptable", while Poland, another farming heavyweight, has repeatedly expressed its opposition.

Hoping to offset their concerns, the Commission will propose a mechanism whereby preferential Mercosur access for sensitive farm products such as beef could be suspended if the imported market share or volumes rose by 10% or prices fell by that amount, a European official said.

Polish Prime Minister Donald Tusk said on Wednesday that his country continued to oppose the deal, but no longer had other partners to block it. It was then essential to have such a defence measure in place, he said.

The EU executive has said the Mercosur agreement is the largest it has ever agreed in terms of tariff reductions and is a necessary part of the EU's push to diversify trade ties.

Since Trump's re-election last November, the EU has gone into overdrive in seeking trade alliances, accelerating talks with India, Indonesia and the United Arab Emirates and deepening ties with existing free trade partners Britain, Canada and Japan.

The Commission will also present an updated EU-Mexico agreement, struck in January, on Wednesday.

European farmers have repeatedly protested over the Mercosur deal, saying it would lead to cheap imports of South American commodities, notably beef, that do not meet the EU's green and food safety standards. The Commission has denied this is the case.

European green groups also oppose the accord. Friends of the Earth has called it a "climate-wrecking" deal.

They hope it will be blocked, either in the parliament, where the Greens and far right are critics, or by EU governments. However it now appears that there will not be a large enough group of governments to reject the deal.

EU proponents of the deal see Mercosur as a growing market for European cars, machinery and chemicals and a reliable source of critical minerals for its green transition, such as battery metal lithium, for which Europe is now dependent on China.

They also point to agricultural benefits, given the deal would offer greater access and lower tariffs for EU cheeses, ham and wine.

Bitcoin is showing signs of weakness after failing to break through a key resistance level near $110,700. The price touched this area multiple times, but each attempt was followed by a pullback, showing that sellers are still active. As of now, Bitcoin is trading at $111,322, holding just below the resistance zone.

Charts from the BTC/USDT 4-hour timeframe show the asset moving within a downward channel that started forming in mid-August. Repeated rejections at the top of this channel are raising concerns about a possible move back to lower levels. Market watcher Ali pointed out that the resistance near $110,700 has been tested several times but never broken. He stated, “Multiple wicks at this level signal rejection,” suggesting the price may revisit the $107,200 or even the $103,000 range if pressure builds.

Source: Ali Martinez/X

Source: Ali Martinez/XOrder book data from Coinglass shows a wall of sell orders around $112,700, forming another key barrier. Bitcoin has traded in a range between $105,000 and $114,000 since August 27, and the $112,700 zone stands out as an area where buyers have struggled to gain momentum.

According to trader Ted, this level has acted as a ceiling, slowing any upward move. He noted,

“If Bitcoin can reclaim $112,700 more upside is likely.”

A clean break above that price could allow BTC to target $114,000 and $117,000. For now, the price remains capped just under that zone, while support appears to be holding around $107,000.

Fresh data from Binance shows that Bitcoin inflows have hit the highest level on record. Historical comparisons suggest that similar spikes in the past came just before strong upward moves. According to Rekt Fencer, this pattern has been seen before each of Bitcoin’s past local bottoms. “Historically, this happens ONLY before BTC makes new highs,” he said.

While inflows often raise concerns about selling pressure, in some cases they’ve signaled that large buyers are preparing for price moves. This recent surge could be part of a larger accumulation phase, though that remains to be confirmed by price action.

Bitcoin is still stuck in a downward channel and struggling to gain strength above $110,700. Without a break above that level, the bias remains tilted to the downside. If support at $107,200 fails, the next level traders are watching is $103,000.

On the other hand, a clean move above $112,700 would mark a shift and could open the way for higher targets. For now, price movement remains stuck between resistance above and support below, with traders waiting to see which side gives way first.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up