Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

July’s US inflation data came in line with expectations for headline CPI and slightly higher on the core measure, but markets interpreted the release as supportive of a more accommodative Federal Reserve.

July’s US inflation data came in line with expectations for headline CPI and slightly higher on the core measure, but markets interpreted the release as supportive of a more accommodative Federal Reserve. On 12 August, Wall Street indices closed the session with notable gains, reflecting increased investor optimism over the economic outlook and interest rate prospects. The US dollar weakened against major currencies, while US Treasury yields declined. Fed Funds Futures almost fully priced in a 25bp rate cut in September, with markets also increasing bets on further easing before year-end.

The Fed’s dual mandate is shifting further towards prioritising maximum employment, a stance echoed by a growing number of Federal Open Market Committee (FOMC) members. The upcoming Jackson Hole symposium, due at the end of next week, will offer Chair Jerome Powell an opportunity to adjust the policy narrative. Historically, the Central Bankers’ Symposium in the Rocky Mountains has often marked turning points in US monetary policy.

Slower consumer price growth

In July 2025, headline CPI rose by 0.2% m/m compared with 0.3% in June, while the annual rate held steady at 2.7%, in line with forecasts. Core inflation edged up to 0.3% m/m and 3.1% y/y from 0.2% and 2.9% respectively, modestly exceeding expectations on the yearly reading.

Price breakdown – energy falls, food flat

Energy prices fell by 1.1% m/m, while food prices were unchanged. In core goods (excluding vehicles), price growth slowed to +0.2% m/m from +0.55% in June. Increases were seen in furniture (+0.9%), used cars (+0.5%), sporting goods (+0.4%) and clothing (+0.1%). Household appliance prices unexpectedly declined by 0.9%.

Seasonal gains in services

Airfares rose by 4% m/m, while medical services costs increased by 0.7%, largely due to dental services. Shelter costs rose only modestly, by 0.2%.

No tariff-driven inflation pressure

The absence of signs of rising inflationary pressure following President Trump’s tariff measures suggests that businesses are absorbing higher costs in their margins rather than passing them on to consumers. This is supported by the latest NFIB survey, which showed the share of small firms planning price hikes in the next three months falling to 28% from 32%, pointing to demand-side constraints.

Inflation and Fed policy outlook

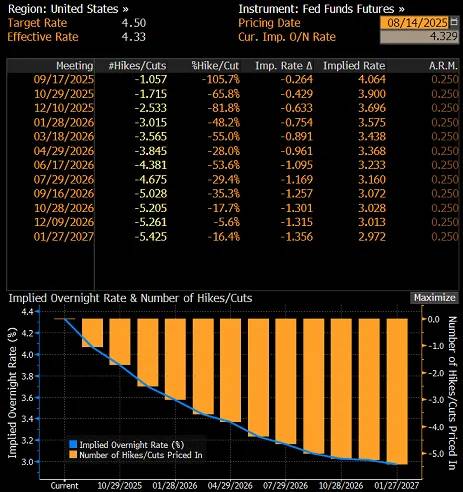

Analysts see little risk of inflation breaching 4% y/y this autumn, with growing odds of a decline below 2% by the end of 2026. The data reinforce expectations for a 25bp Fed rate cut in September, followed by another in December. Fed Funds Futures are currently pricing in 26bp of easing at the 17 September FOMC meeting and a total of 63bp by year-end.

Trump steps up pressure on Powell

President Donald Trump has intensified his calls for swift rate cuts, even suggesting he might sue Fed Chair Jerome Powell, accusing him of incompetence in overseeing building renovations at the central bank.

FOMC members’ comments

Thomas Barkin noted that the balance of risks for the labour market and inflation remains unclear, and that the Fed is well positioned to respond appropriately. Stephen Miran, a new Board Governor appointed by Trump, stated that there is no evidence of tariff-driven inflation, adding that rent increases are partly linked to illegal immigration. Jeff Schmid argued that while growth remains solid, inflation is still too high, warranting a moderately restrictive stance. He added, however, that he would be prepared to change his view should demand weaken materially.

What next for the dollar?

In the week ending 5 August, net short USD positions fell sharply by $4.3bn – the fourth consecutive weekly reduction. The net short now stands at $7bn, down from a local peak of $18.6bn in early July.

It is worth noting that these figures are lagging indicators and do not yet reflect the most recent moves in FX markets. The unwinding of short positions was visible in EUR/USD’s July pullback, although the latest disappointing non-farm payrolls data reignited selling pressure on the dollar. The uptrend in the pair remains technically intact, and August’s inflation figures have only strengthened the likelihood of further gains. The next upside target for EUR/USD is 1.18, with a break above this level opening the way towards 1.20–1.23.

US President Donald Trump recently sent letters to numerous countries announcing extensive “reciprocal tariffs” to take effect on Aug 1, after extending his original July 9 deadline. This drastic move towards protectionism risks damaging America’s most significant economic strength. These policies aim to revive offshored manufacturing jobs and tackle trade deficits through tariffs ranging from 25% to 40% on different countries. However, they fundamentally misapprehend the nature of the US’ economic dominance today.

The Trump administration concentrates on merchandise trade deficits while overlooking the country’s huge services sector surplus. Through economic specialisation, US corporations have generated unprecedented wealth via intellectual property arrangements. American firms excel in providing legal, accounting and advanced banking services internationally. This represents the nation’s genuine competitive edge in global markets today.

Since 1982, the US has experienced current account deficits as companies moved manufacturing operations overseas. Meanwhile, America focused on providing advanced global services to the world. This strategic shift has generated billions in annual revenue for the country. It developed a refined economy based on knowledge and innovation rather than manufacturing.

The US dollar’s position as the world’s reserve currency guarantees that global surpluses are automatically reinvested. Countries with substantial trade surpluses become key purchasers of US Treasury bonds. China, Japan, South Korea, Taiwan, Singapore and Europe supply vital government funding. This extraordinary privilege allows Americans to consume more goods than they produce.

For four decades, foreign capital inflows have supported higher living standards in America. The US provides the world with printed dollars not backed by anything tangible. Workers worldwide labour in factories manufacturing goods that Americans buy through trade. The US issues paper dollars with no gold or precious metal backing at all.

This arrangement has allowed Corporate America to attain trillion-dollar market valuations worldwide. It has created a new class of billionaire oligarchs, like Elon Musk. The system finances the US’ extensive military-industrial complex while boosting the wealth of political figures. Despite these considerable advantages, Trump asserts that other nations have stolen American prosperity.

Tariffs act as taxes levied on importers and consumers, substantially raising expenses. Extremely harsh tariffs, like 145% on Chinese goods, effectively prevent imports. Trump’s advisers celebrate falling imports as wins for American manufacturing interests. However, this approach will inevitably hasten global de-dollarisation as countries search for alternatives.

BRICS nations are actively establishing alternative payment systems that bypass dollar networks entirely. Brazil, Russia, India, China and South Africa are systematically leading these efforts. This initiative directly questions the US’ dependence on financial sanctions as a foreign policy instrument. America’s freezing of Russian sovereign assets has greatly sped up these alternative developments.

Russia’s experience with extensive Western sanctions in 2022 serves as a clear example. Its significant gold reserves proved vital for President Vladimir Putin’s government during sanctions. The country had prudently kept 20% of reserves in physical gold bullion. This physical gold was kept domestically and remained accessible during extensive sanctions.

Trump repeats former president Joe Biden’s mistake by applying punitive tariffs on China through claims of exceptionalism. Both administrations have greatly underestimated China’s economic resilience and strategic responses. China’s counter-tariffs had a substantial impact on US financial markets, adversely affecting farmers and manufacturers. This contradicted confident predictions that China would capitulate swiftly to American pressure.Since his bombastic “Liberation Day” announcement, Trump has stepped back from confrontation. He has temporarily paused tariff enforcement and pledged conciliatory negotiation approaches. These retreats highlight the limits of the US’ economic coercion in practice.

Since 1971, the US has continually led the global economy through its dollar dominance. The Richard Nixon administration abolished gold convertibility and established the dollar-based international system. The world accepted this system while America promoted free trade worldwide. Now, the US government has forsaken its long-standing free trade principles.

Due to their exclusion from US markets, China encounters considerably fewer trade opportunities. China and other countries are likely to reduce their investments in American debt. Limited access to US markets results in fewer dollars being available for investment. Countries are diversifying their reserves into alternative currencies or physical gold instead.

Gold prices have risen sharply as confidence in the dollar system wanes. Central banks around the world have been purchasing gold at unprecedented rates in recent years. This trend highlights increasing worries about the stability of dollar-based systems. The move towards gold signals readiness for a post-dollar international system.

The dollar and US Treasury securities remain relatively stable instruments despite concerns. However, the current stability should not be mistaken for lasting security or dominance. The international community is currently working on alternatives to American financial dominance. Rising gold prices indicate fundamental changes in confidence in the monetary system.We stand at a vital historical crossroads where today’s decisions are of great importance. The shift away from dollar dominance will probably be slow and cautious. However, structural cracks are widening with every shortsighted US policy decision. American protectionist policies are hastening the growth of alternative financial systems worldwide.

A country’s domestic political whims should not entirely dictate its international monetary system. International finance demands stability and predictability that surpasses domestic political considerations. A balanced approach would more accurately reflect today’s diverse global economic landscape. The future international system should effectively accommodate several major economies and currencies.

Spurred on by the U.S. President and Treasury Secretary, expectations for interest rate cuts are reaching a fever pitch, with markets now starting to price in a small chance of a half point cut as soon as next month as they await today's producer price report.

On Wednesday, Scott Bessent said downward revisions to the U.S. payrolls meant the Federal Reserve needed to play catch-up. He said there was a "very good chance" of a 50 basis point reduction in September and that rates should "probably" be 150-175 bps lower.

* Wall Street zoomed to new records on Wednesday, but stock futures stepped back a touch ahead of the PPI report but two-year Treasury yields continued to stalk three-month lows. Even thoughmany Fed officialsare still cautious about the prospects for a half point cut, Wall Street banks are starting to forecast as many as three cuts this year, arguing softer jobs growth, a lack of "pass-through" from tariffs to consumer prices, and a new appointee to the Fed board will tip the balance.

* Thursday's producer price update for July will be important as details feed into the Fed's favored PCE inflation gauge. Annual headline and core PPI inflation are expected to pick up to 2.5% and 2.7%, respectively. Meantime, President Donald Trump said his pick for the next Fed Chair would be named "a little bit earlier" and he'd narrowed it down three or four names, despite indications earlier on Wednesday that as many as a dozen names had been considered.

* Elsewhere, the inflation picture softened further given this week's slide incrude oilprices to two-month lows ahead of the critical U.S.-Russia summit in Alaska tomorrow. Japan's yen jumped to three-week highs, knocking the Nikkei stock index back sharply from record highs, as Bessent also said the Bank of Japan was "behind the curve" in tackling inflation there. Sterling hit six-week highs on the euro after the release of above forecast UK GDP data. Finally, riffing off the week's heady surge in risk appetite and rate cut bets, Bitcoin jumped to a new record high at $124,481.

Bitcoin surged past $124k, setting a new all-time high (ATH) and briefly overtaking Google’s $2.488 trillion market capitalization to become the world’s fifth-most valuable asset.

BTC hit a record high of $124,457.12 in the past 24 hours before pulling back to trade at $121,692 as of 12:28 a.m. EST. The crypto king is up more 1.3% in the past day and 5.8% in the past last week amid buoyant market sentiment.

Investors are betting that lower-than-expected US CPI inflation this week and pressure from President Donald Trump will bring interest rates cuts next month. Trump today called for a one basis point cut, while Treasury Secretary Scott Bessent yesterday urged a 50 basis point cut.

The surge also saw Strategy’s BTC holdings close at a new ATH of $77.2 billion, said executive chair, Michael Saylor, in a post on X.

And according to blockchain analytics firm Arkham Intelligence, the value of Bitcoin held by Elon Musk’s SpaceX also has surpassed $1 billion. The company holds 8,285 Bitcoin.

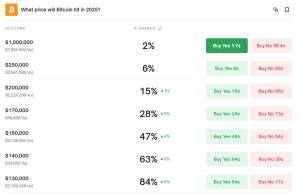

Bitcoin’s ascent may not be over yet, according to bettors on the decentralized platform, Polymarket.

Over the past 24 hours, a contract asking what price Bitcoin will hit saw the odds of $130K to $200K increase. Bets that BTC will surge to $130K before the year is over surged 8%, pushing the odds to 84%.

The next biggest increase was odds around the $140K target being reached. Bettors upped the chances by 6% to 63%.

Meanwhile, odds of $150K, $170K and $200K being reached before the end of the year climbed 4%, 5%, and 1%, respectively. The $150K target has the highest odds of the three, with bettors seeing a 47% chance that BTC could hit this price point.

Analysts also maintain a bullish outlook for BTC, including pseudonymous trader and analyst Rekt Capital, who told his over 556.4K X followers at the start of the week that Bitcoin convincingly breaking above $126K could lead to a parabolic rally.

In that case, he believes the chances are that the BTC price “will go a lot higher and quickly.”

Following Bitcoin’s new ATH, Bitcoin pioneer and JAN3 CEO Samson Mow, who has more than 352k followers on X, said there are now two possible future paths.

In the first one, he said “We Godzilla or Omega up, suck all the oxygen out of the room, and alts drop 30-40%.” The alternative is “Alt mania peaks, triggering a massive selloff as the Bagholder’s Dilemma loses equilibrium, BTC goes down briefly then up again, as alts tank,” he added.

Two possible paths for #Bitcoin now.

1⃣ We Godzilla or Omega up, suck all the oxygen out of the room, and alts drop 30-40%.

2⃣ Alt mania peaks, triggering a massive selloff as the Bagholder's Dilemma loses equilibrium, BTC goes down briefly then up again, as alts tank.

— Samson Mow (@Excellion) August 14, 2025

Mow, known for his work on El Salvador’s Bitcoin strategy and promoting Bitcoin adoption by nations, predicted in an earlier post today that “there will be more Bitcoin ATHs,” but warned that a pullback is likely because altcoins are currently “running too hot right now.”

“Once the altcoin mania passes, Bitcoin will take off,” he said. “This is just how it’s always been.”

Over the last month, the total capitalization for altcoins soared more than 16%, data from TradingView shows. The ETH/BTC ratio also soared over 20% during the same period, which suggests ETH is strengthening against the leading crypto.

Mow commented on the surging ETH/BTC ratio as well, saying that early Bitcoin investors are just using the treasury narrative around ETH to pump its price higher. “Once they’ve gotten it high enough, they’ll dump their ETH” and rotate the gains back into BTC, he said.

Bitcoin ETFs Continue Inflow Streak, But Lag Behind Ethereum Funds

While Mow forecasts a potential rotation from ETH to BTC, US spot Ethereum ETFs (exchange-trade funds) continue to outperform their Bitcoin counterparts.

The BTC funds were able to extend their positive flow streak to 6 days after $86.9 million entered the ETFs’ reserves yesterday. BlackRock’s ETF recorded no new flows for the day, which is a change in the product’s dominant trend seen in recent weeks.

Instead, investors poured capital into Fidelity’s FBTC, Bitwise’s BITB, ARK Invest’s ARKB, Invesco’s BTCO and Grayscale’s BTC.

Over the past week, the Bitcoin ETFs have recorded more than $1.103 billion inflows, according to Farside Investor data.

Institutional investors, however, seemed to have preferred spot Ethereum ETFs over the BTC funds. In just the last 3 days, inflows for the ETH products topped $2.2 billion. Yesterday, BlackRock’s fund pulled in more than $500 million on its own as well.

That’s after the US ETH ETFs started the week off on a strong note, and recorded net daily inflows above $1 billion. Following yesterday’s inflows, the ETH products are also on a 7-day streak.

British goods exports to the United States fell to their lowest level in more than three years in June, according to official data published on Thursday that showed the hit from U.S. President Donald Trump's initial import tariff blitz.

Sales of British goods to the United States fell to 3.9 billion pounds ($5.3 billion) during the month, down by 0.7 billion pounds from May and about 20% lower than a monthly average of 4.9 billion pounds in 2024.

The last time Britain exported fewer goods to the United States - including sales of precious metals which can be volatile - was in February 2022, the Office for National Statistics said.

British Prime Minister Keir Starmer and Trump agreed a trade deal which came into force on June 30 to cut high tariffs on cars and aerospace parts but leaves a 10% tariff on most exports with steel not yet covered.

The ONS reported decreases in exports of all commodities to the United States in June with machinery and transport equipment - including cars which were hit by higher initial U.S. duties - down by 0.2 billion pounds.

The ONS last week said a third of exporting businesses with 10 or more employees reported an impact from the U.S. tariffs.

British imports of U.S. goods increased by 0.2 billion pounds in June, driven by higher aircraft sales, Thursday's data showed.

In the April-to-June period, British exports to the United States fell by more than a quarter, reflecting how many manufacturers rushed to send their products across the Atlantic before Trump's first tariffs blitz in April.

This week, forex traders’ attention is firmly on the AUD/USD market following key news releases from Australia:

→ Tuesday: Interest rate decision. According to ForexFactory, analysts’ forecasts were confirmed as the Reserve Bank of Australia (RBA) cut the cash rate from 3.85% to 3.60%.

→ Today: Labour market statistics revealed that the unemployment rate fell from 4.3% to 4.2%.

This dynamic fundamental backdrop has driven a rich technical setup on the AUD/USD chart, where bearish sentiment currently prevails.

Since last month, AUD/USD price movements have been forming a descending channel (highlighted in red), and this week’s reversal from the August high reinforces its relevance.

Key factors emphasising the market’s bearish bias include:

→ Double top pattern formed by recent highs A and B. Notably, the long upper wicks of the candlesticks reflect increasing selling pressure.

→ The August upward move, marked by purple trendlines, may represent a corrective bear flag within the dominant downtrend.

→ Bearish RSI divergence – present not only between highs A and B, but also relative to the 7 July peak.

Potential Support Levels:

→ Lower purple trendline;

→ Line Q, which divides the upper half of the channel into two quarters;

→ The 0.65 psychological level – previously defended strongly by bulls, as evidenced by the wide bullish candle on 12 August, when price surged easily (a sign of buying imbalance).

These supports collectively form a key demand zone (shaded in purple). Bears will need significant momentum to break through this area and extend the prevailing downtrend in AUD/USD through August 2025.

Credit rating agency S&P Global upgraded India's long-term unsolicited sovereign credit ratings to "BBB" from "BBB-" on Thursday, citing economic resilience and sustained fiscal consolidation.

The agency had revised the outlook on India's rating in May last year to positive from stable on robust growth and improved quality of government expenditure.

"The upgrade of India reflects its buoyant economic growth, against the backdrop of an enhanced monetary policy environment that anchors inflationary expectations," the rating agency said in a statement.

"Together with the government's commitment to fiscal consolidation and efforts to improve spending quality, we believe these factors have coalesced to benefit credit metrics," it added.

The Indian rupee strengthened to 87.58 against the dollar from 87.66, while the benchmark 10-year bond yield fell 7 basis points to 6.38% soon after the announcement.

The rating agency also revised its transfer and convertibility assessment to 'A-' from 'BBB+', it said.

S&P may lower the country's ratings if it sees an erosion of political commitment to consolidate public finances, while downward pressure could also come from economic growth slowing materially on a structural basis such that it undermines fiscal sustainability, it said.

Ratings could be further raised if fiscal deficits narrow meaningfully such that the net change in general government debt falls below 6% of GDP on a structural basis, it added.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up