Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Just as he warned yesterday, President Trump signed an executive order imposing an additional 25% tariff on India over its purchase of Russian energy, the White House said Wednesday hours after talks between the US and Russia over the war in Ukraine failed to yield a breakthrough.

Just as he warned yesterday, President Trump signed an executive order imposing an additional 25% tariff on India over its purchase of Russian energy, the White House said Wednesday hours after talks between the US and Russia over the war in Ukraine failed to yield a breakthrough.

The accelerated tariffs - which will stack on top of 25% country-specific tariffs set to be implemented overnight - will go into effect within 21 days, according to the executive order signed by Trump.

“They’re fueling the war machine. And if they’re going to do that, then I’m not going to be happy,” Trump said Tuesday in an interview with CNBC.

The reaction was immediate extended selling pressure in India ETF...

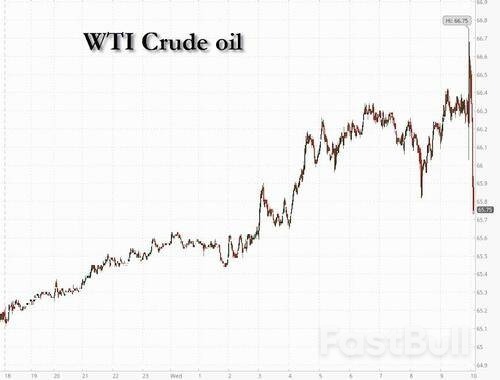

Oil's price action was more volatile...

The US 500 index has entered a short-term downtrend. The US 500 forecast for today is negative.

US 500 forecast: key trading points

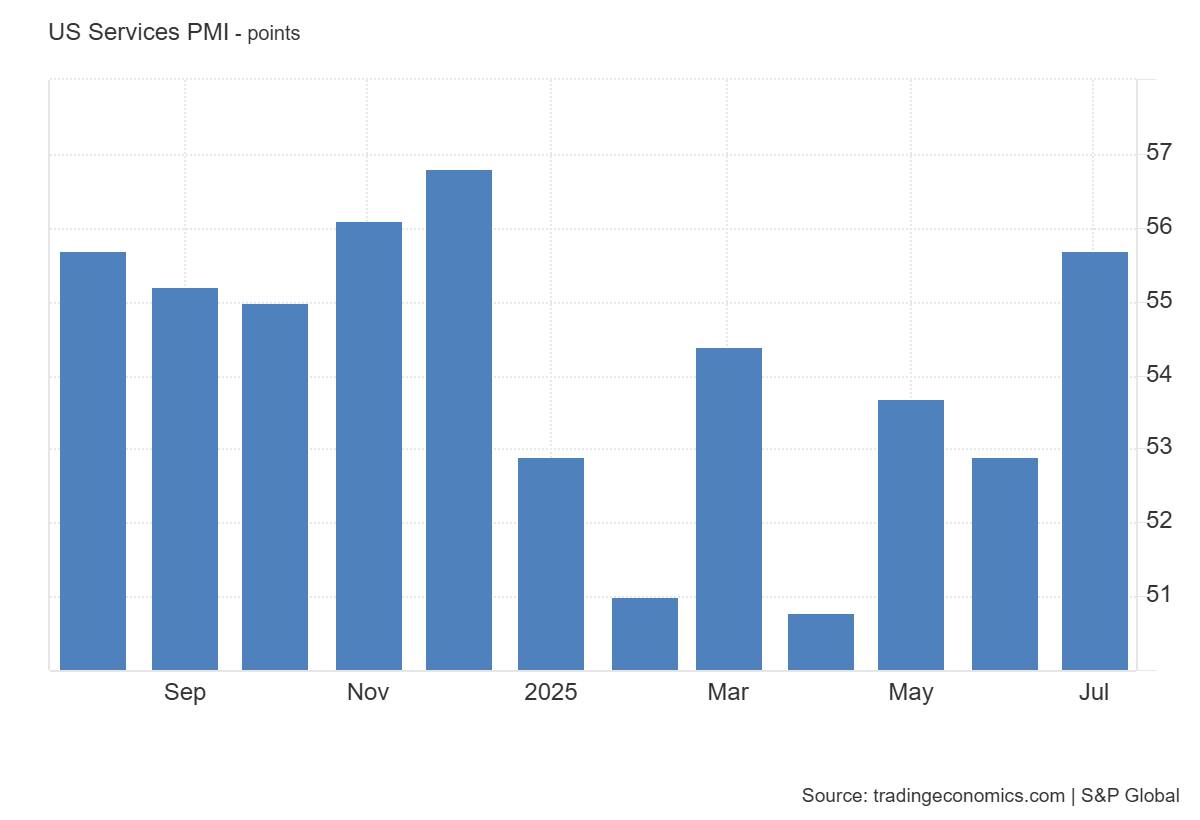

The services PMI in the US rose to 55.7 in July 2025, exceeding both the forecast of 55.2 and the previous figure of 52.9. This indicates that the services sector continues to expand at an accelerating pace, which is a positive signal for the US economy. Stronger-than-expected PMI growth reflects healthy demand and robust activity in the services sector, which strengthens business confidence and corporate profit outlook. This typically supports the stock market, including the broad US 500 index.

Positive effects are expected for sectors tied to services, such as finance, healthcare, consumer services, information technology, and communications, as they directly benefit from rising activity in services. However, Q3 results will play a decisive role, especially given the current weakness in the labour market.

After hitting an all-time high, the US 500 began a correction. A downtrend is now in place, although it is unlikely to persist for long. The support level lies at 6,205.0, while resistance stands at 6,410.0. The most probable scenario points to a continued decline towards the 6,075.0 level.

The following scenarios are considered for the US 500 price forecast:

The PMI release serves as a positive signal for the US stock market and particularly supports the services sector, boosting the US 500 index in the short to medium term. However, investor optimism remains capped due to labour market weakness and upcoming inflation data, which may rise as a result of newly imposed tariffs. From a technical perspective, the US 500 index is likely to continue its decline towards the 6,075.0 level.

New Zealand’s job market loses steam, with unemployment rising to a 15-year high of 5.2% in Q2. That is the strongest reading since the first full quarter of recovery following COVID in Q3 2020.In the second quarter, the jobless rate was 5.2%, slightly higher than 5.1% during the first three months of the year. Although the increase was below market expectations (economists predicted 5.3%), it further fuels worry about a wider economic slowdown.

Employment also shrank by 0.1% during the quarter, matching analyst expectations. The drop may seem modest, but in context, it marks the latest sign that economic momentum is fading.Abhijit Surya, senior economist at Capital Economics, said the Reserve Bank was unlikely to take comfort in the slight rise in the unemployment rate, noting that a closer look at the data revealed significant slack in the labour market.The weakening labour market is emerging alongside sluggish consumer spending, contracting manufacturing and services sectors, and a languishing housing market — all of which point to a slowing economy.

As previously pointed out, more people were jobless, and fewer people were even looking for work. The labour force participation rate — the working-age population either with a job or actively seeking employment — declined to 70.5%, down from Q1’s 70.7%. That marked the lowest level since early 2021.

However, the hit has been even harder on mid-teenagers and young workers when we dig deeper into the data. Whether it was an artificial boom in the few months when workers were hard to come by during the post-pandemic hiring spike, many went into the labour market. Nonetheless, when the economy takes a hit and employers engage in less than whiplash hiring activity, these groups are often the first out of the door.

Teenagers, in particular, were leaving the job market, many opting to return to school or study rather than being classed as jobless, said Michael Gordon, senior economist at Westpac in Auckland.Year-on-year, total employment fell by 0.9%, confirming that the slowdown is not just a seasonal blip, but part of a broader cooling in the economy.

Adding to the unease is a continued slowdown in wage growth. According to today’s report, annual wage inflation slowed for the ninth consecutive quarter.Ordinary time wages for non-government workers rose just 2.2% compared to a year earlier — down from 2.5% in the previous quarter. That signals a diminishing bargaining power for workers, even as the cost of living remains high for many households.

Despite the year-on-year slowdown, quarterly wage growth grew slightly, rising 0.6%, above economists’ expectations of 0.5%.Meanwhile, average ordinary time hourly earnings for non-government workers jumped 1.9% from the previous quarter — the strongest quarterly rise since Q3 2020.Although the rise in pay growth looked encouraging, some analysts dismissed it as potentially short-lived or a function of different types of workers making up a larger share of employment rather than broad wage inflation. Businesses may be dishing out higher wages to keep on skilled workers while pulling back elsewhere in terms of headcount.

That said, real wage growth underperforms for many employees, while inflation remains elevated and still tightens household budgets.The labour market data has added weight to expectations that the Reserve Bank of New Zealand (RBNZ) will soon resume cutting interest rates.The RBNZ had forecast a 5.2% unemployment rate in May, but it also predicted employment growth of 0.2%, a clearly missed target.With inflation showing signs of easing and economic growth stalling, pressure is mounting on the central bank to support the economy.Most analysts now expect the RBNZ to cut the Official Cash Rate (OCR) by 25 basis points to 3% at its next meeting on August 20, especially after pausing in July.

The effective tariff rate on U.S. imports will settle near 22% and duties on sensitive sectors critical to national security are unlikely to be lifted, JPMorgan Chase's Center for Geopolitics wrote in a report on Wednesday.

Tariffs are being viewed across party lines as vital to enhancing the U.S. industrial base in strategic sectors such as semiconductors and defense, making a rollback unlikely even after President Donald Trump's term, the report said.

While much of the market optimism has stemmed from the belief that tariffs are primarily a political bargaining tool, the report hints at a more nuanced trade landscape.

Recent trade deals have fueled hopes that the White House may eventually soften its stance, but the report said expectations of a return to pre-Trump policies may be misplaced.

"It would be a mistake to assume that the United States returns to an era of low tariffs and the pursuit of comprehensive free trade agreements," the report said.

"Even if the next U.S. president supports a pre-2017 approach to trade policy, they would face a number of challenges to unwinding the Trump administration's tariff structure."

As more times passes, companies might also recalibrate their investments accordingly, reducing the chances of going back to the previous trade regime.

JPMorgan launched the Center for Geopolitics in May to help businesses navigate disruptions from global instability and other economic challenges. It is led by Derek Chollet, who has served in the Pentagon, the State Department, the White House and Congress.

A report last month by the JPMorganChase Institute estimated that the implementation of full universal tariffs announced on April 2 could add up to $187.7 billion in direct import costs for midsize companies, more than six times the cost of earlier tariffs in place at the start of 2025.

U.S. envoy Steve Witkoff held talks with Russian President Vladimir Putin in the Kremlin on Wednesday, two days before the expiry of a deadline set by President Donald Trump for Russia to agree to peace in Ukraine or face new sanctions.

Witkoff flew to Moscow on a last-minute mission to seek a breakthrough in the 3-1/2-year war that began with Russia's full-scale invasion. Russian state TV showed a brief clip of him shaking hands with Putin at the start of their meeting.

Russian news agencies said the talks ended after about three hours, and Witkoff's motor convoy was seen leaving the Kremlin.

Russian investment envoy Kirill Dmitriev, who earlier greeted Witkoff on arrival and strolled with him in a park near the Kremlin, posted on social media: "Dialogue will prevail."

There was no immediate statement from either side on the substance of the talks.

Trump, increasingly frustrated with Putin over the lack of progress towards peace, has threatened to impose heavy tariffs on countries that buy Russian exports.

He is exerting particular pressure on India, which along with China is a huge buyer of Russian oil. The Kremlin says threats to penalise countries that trade with Russia are illegal.

It was not clear what Russia might offer to Witkoff in order to stave off Trump's threat.

Bloomberg and independent Russian news outlet The Bell reported that the Kremlin might propose a moratorium on air strikes by Russia and Ukraine - an idea that was mentioned last week by Belarusian President Alexander Lukashenko during a meeting with Putin.

Such a move, if agreed, would fall well short of the full and immediate ceasefire that Ukraine and the U.S. have been seeking for months. But it would offer some relief to both sides.

Since the two sides resumed direct peace talks in May, Russia has carried out its heaviest air attacks of the war, killing at least 72 people in the capital Kyiv alone. Trump last week called the Russian attacks "disgusting".

Ukraine continues to strike Russian refineries and oil depots, which it has hit many times.

Ukrainian President Volodymyr Zelenskiy said on Wednesday that Russia had attacked a gas pumping station in southern Ukraine in what he called a deliberate and cynical blow to preparations for the winter heating season. Russia said it had hit gas infrastructure supplying the Ukrainian military.

Andriy Yermak, chief of staff to Ukrainian President Volodymyr Zelenskiy, said on Wednesday that a full ceasefire and a leaders' summit were required. "The war must stop and for now this is on Russia," he posted on Telegram.

Putin is unlikely to bow to Trump's sanctions ultimatum because he believes he is winning the war and his military goals take precedence over his desire to improve relations with the U.S., three sources close to the Kremlin told Reuters.

"The visit of Witkoff is a last-ditch effort to find a face-saving solution for both sides. I don’t think, however, that there will be anything of a compromise between the two," said Gerhard Mangott, an Austrian analyst and member of a group of Western academics and journalists who have met regularly with Putin over the years.

"Russia will insist it is prepared to have a ceasefire, but (only) under the conditions that it has formulated for the last two or three years already," he said in a telephone interview.

"Trump will be under pressure to do what he has announced - to raise tariffs for all the countries buying oil and gas, and uranium probably as well, from Russia."

The Russian sources told Reuters that Putin was sceptical that yet more U.S. sanctions would have much of an impact after successive waves of economic penalties during 3-1/2 years of war.

The Russian leader does not want to anger Trump, and he realises that he may be spurning a chance to improve relations with Washington and the West, but his war goals are more important to him, two of the sources said.

Putin's conditions for peace include a legally binding pledge NATO will not expand eastwards, Ukrainian neutrality, protection for Russian speakers and acceptance of Russia's territorial gains in the war, Russian sources have said.

Zelenskiy has said Ukraine would never recognise Russia's sovereignty over its conquered regions and that Kyiv retains the sovereign right to decide whether it wants to join NATO.

Witkoff, a real estate billionaire, had no diplomatic experience before joining Trump's team in January, but has been simultaneously tasked with seeking ceasefires in the Ukraine and Gaza wars, as well as negotiating in the crisis over Iran's nuclear programme.

Critics have portrayed him as out of his depth when pitched into a head-to-head negotiation with Putin, Russia's paramount leader for the past 25 years, and at times accused him of echoing the Kremlin's narrative. In an interview with journalist Tucker Carlson in March, for example, Witkoff said there was no reason why Russia would want to absorb Ukraine or bite off more of its territory, and it was "preposterous" to think that Putin would want to send his army marching across Europe.

Ukraine and many of its European allies say the opposite. Putin denies any designs on NATO territory, and Moscow has repeatedly cast such charges as evidence of European hostility and "Russophobia".

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up