Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US President Donald Trump floated an 80% tariff on China ahead of negotiations due to begin Saturday as he urged Beijing to do more to open their markets to US goods.

US President Donald Trump floated an 80% tariff on China ahead of negotiations due to begin Saturday as he urged Beijing to do more to open their markets to US goods.

“80% Tariff on China seems right! Up to Scott B,” Trump said in a social-media post Friday morning, referring to Treasury Secretary Scott Bessent.

“CHINA SHOULD OPEN UP ITS MARKET TO USA — WOULD BE SO GOOD FOR THEM!!! CLOSED MARKETS DON’T WORK ANYMORE!!!,” he said in a separate post.

Bessent and US Trade Representative Jamieson Greer are set to begin talks with Chinese Vice Premier He Lifeng in Switzerland this weekend, the first public discussions between the world’s two largest economies on defusing a trade war that has seen Trump impose 145% levies on China and Beijing retaliate with 125% duties on many American goods.

Trump’s comments provided a stark dose of reality to investors who have been anticipating the start of negotiations between the two countries and eager for any sign that the US president will seek an off-ramp to ease a trade war that has roiled equity and bond markets and raised risks of a global downturn.

S&P 500 futures briefly turned negative and, while positive again, are well off session highs. European stocks trimmed gains and the Mexican peso reversed gains. Two-year US yields fell.

Trump levied high tariffs on dozens of nations in April only to quickly pause those import taxes to allow trading partners a 90-day window to negotiate deals with his administration. On Thursday, Trump touted the first of those agreements with the United Kingdom, though that deal appeared to fall well short of the “full and comprehensive” compact he had promised with many of the critical details being left to further negotiations.

Talks with China offer to be even more complicated. Trump earlier this week ruled out preemptively lowering taxes on China in order to help juice the negotiations.

While Trump has said in that he is willing to lower the tariffs on China at some point, the president and his advisers have said US consumers are willing to bear disruptions from the trade war in the form of higher prices and fewer choices to allow his bid to bring more manufacturing jobs to the country to succeed.

Daily Light Crude Oil Futures

Daily Light Crude Oil FuturesFederal Reserve Governor Adriana Kugler spoke on Friday, indicating that the U.S. economy and job market are displaying signs of resilience. However, Kugler also pointed out that there could be a potential decrease in consumer spending later in the year.

Despite recent figures suggesting a shrink in U.S. gross domestic product in the first quarter, Kugler stated that the underlying indicators of private sector consumption and investment have remained strong. This was stated in response to a question at an event hosted by the Central Bank of Iceland. Kugler interpreted these signals as evidence of the economy’s continuing resilience.

In response to a question about consumer sentiment towards President Donald Trump’s tariff policies, Kugler indicated that some measures of spending, such as retail sales, have shown signs of "front loading" in anticipation of expected price increases due to the tariffs. This trend could potentially reverse later. "You may see some fallback moving forward," Kugler said, hinting at a potential decrease in consumer spending in the future.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

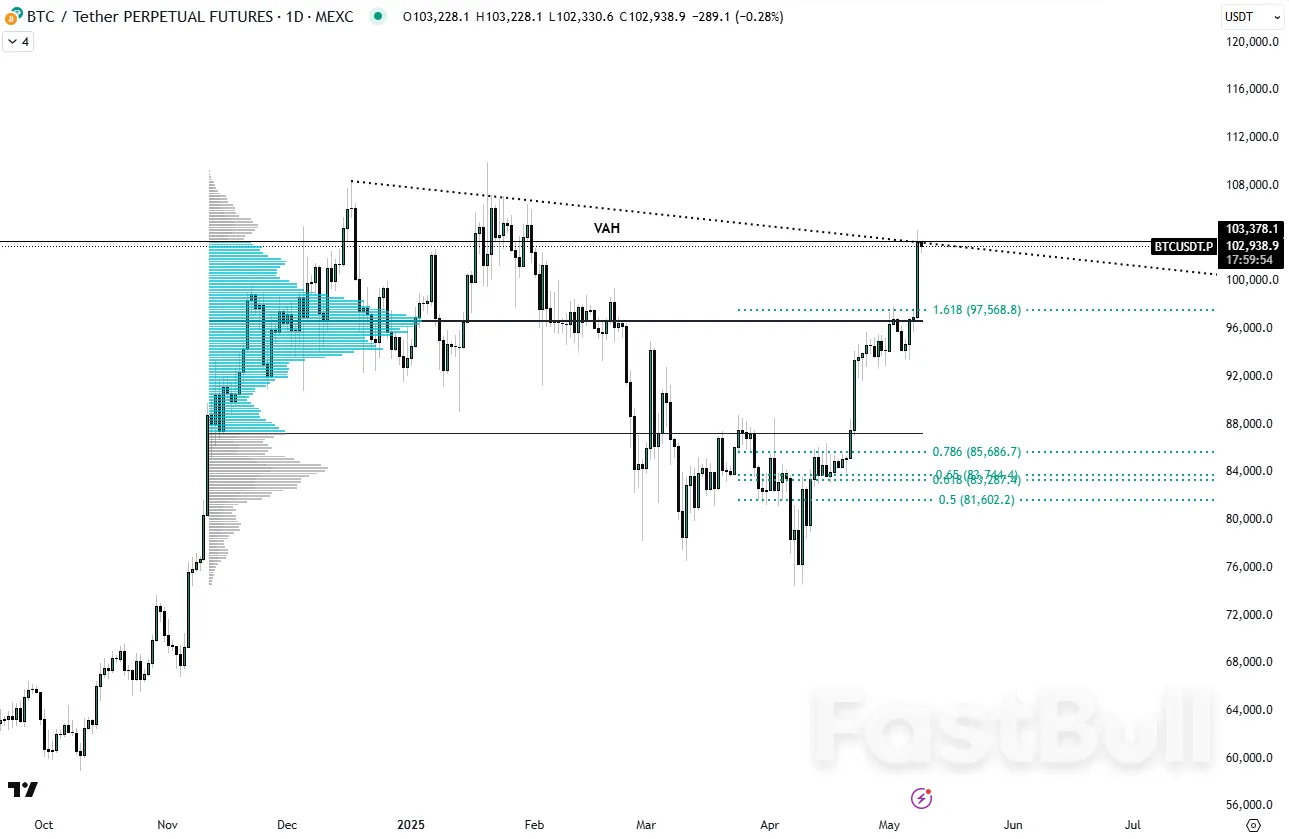

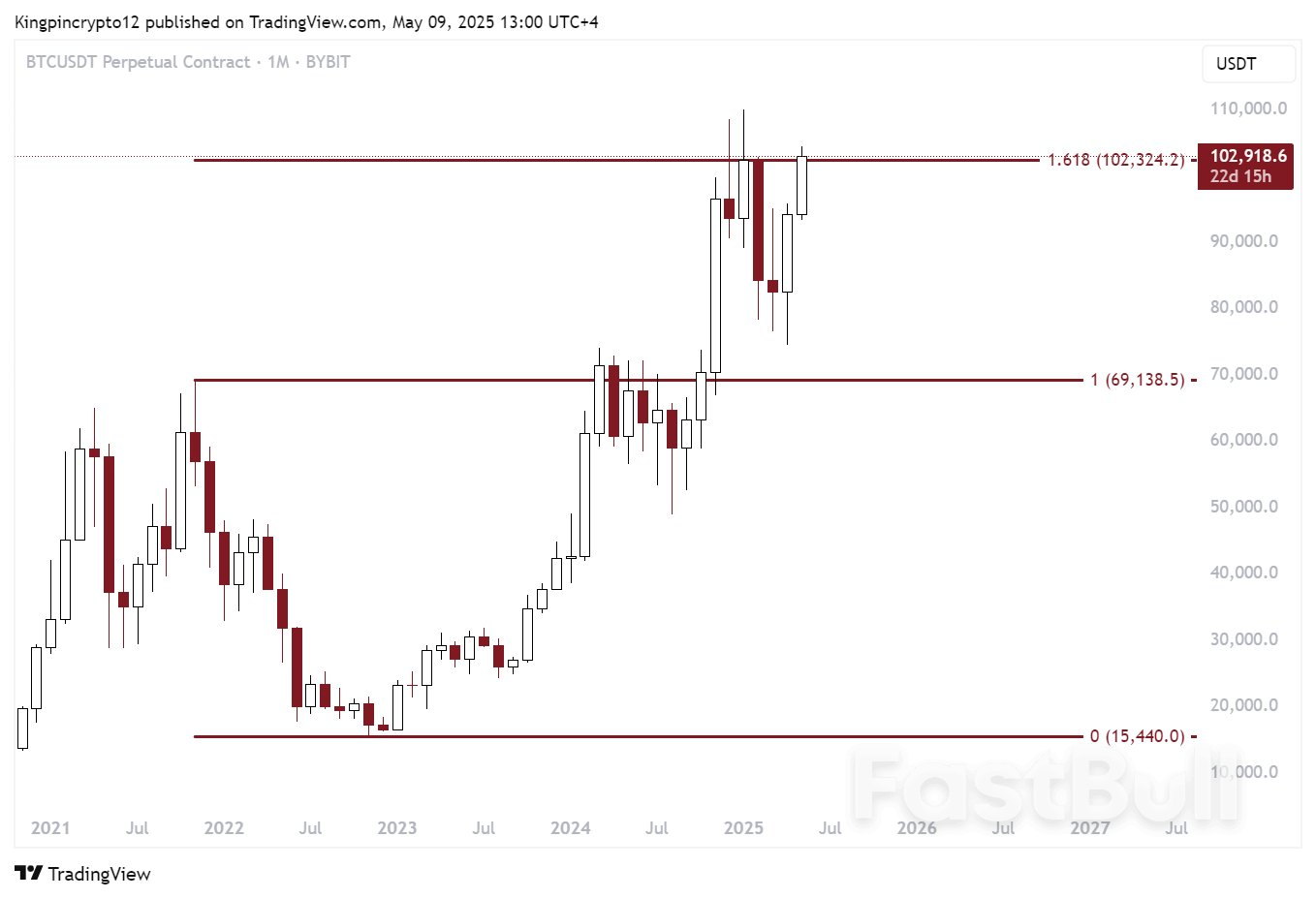

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView BTC/USDT 1-day chart with Fibonacci levels. Source: Patric H./X

BTC/USDT 1-day chart with Fibonacci levels. Source: Patric H./X

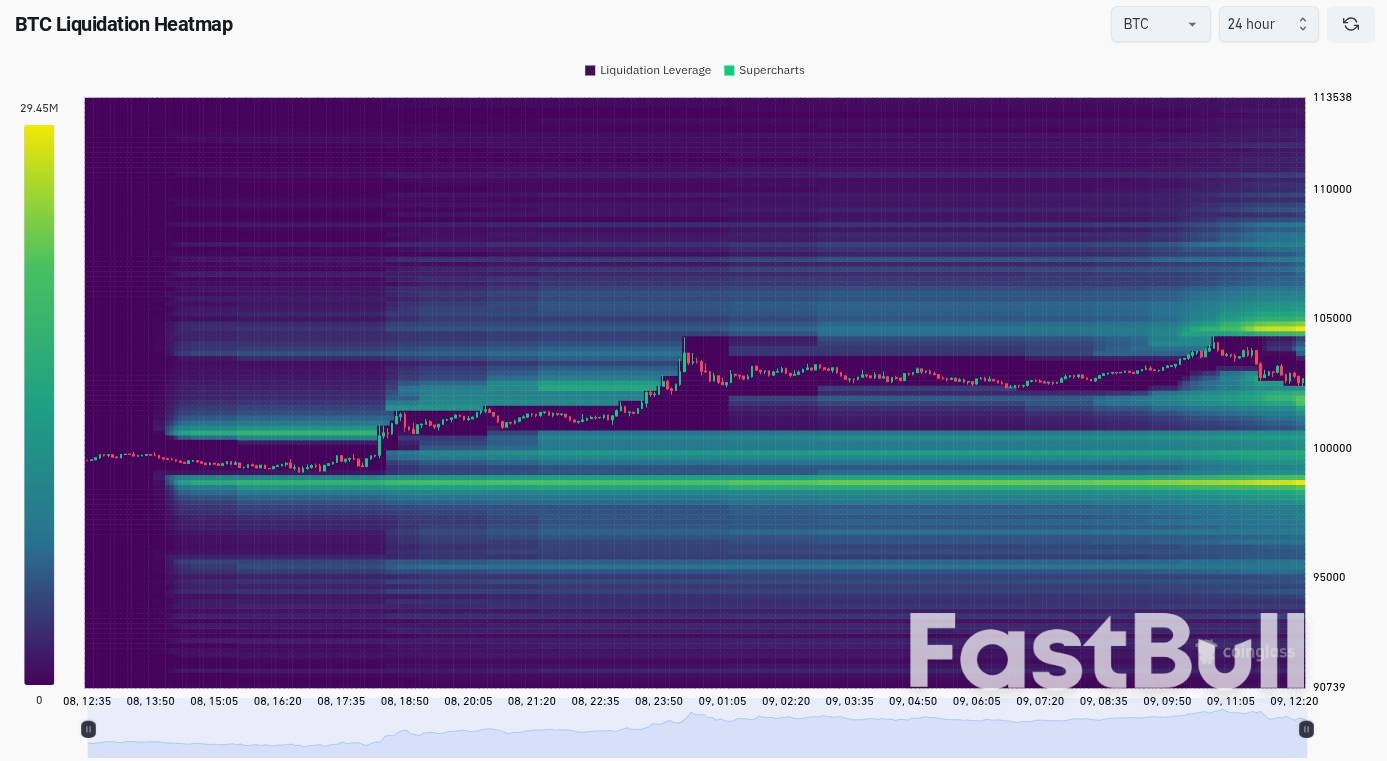

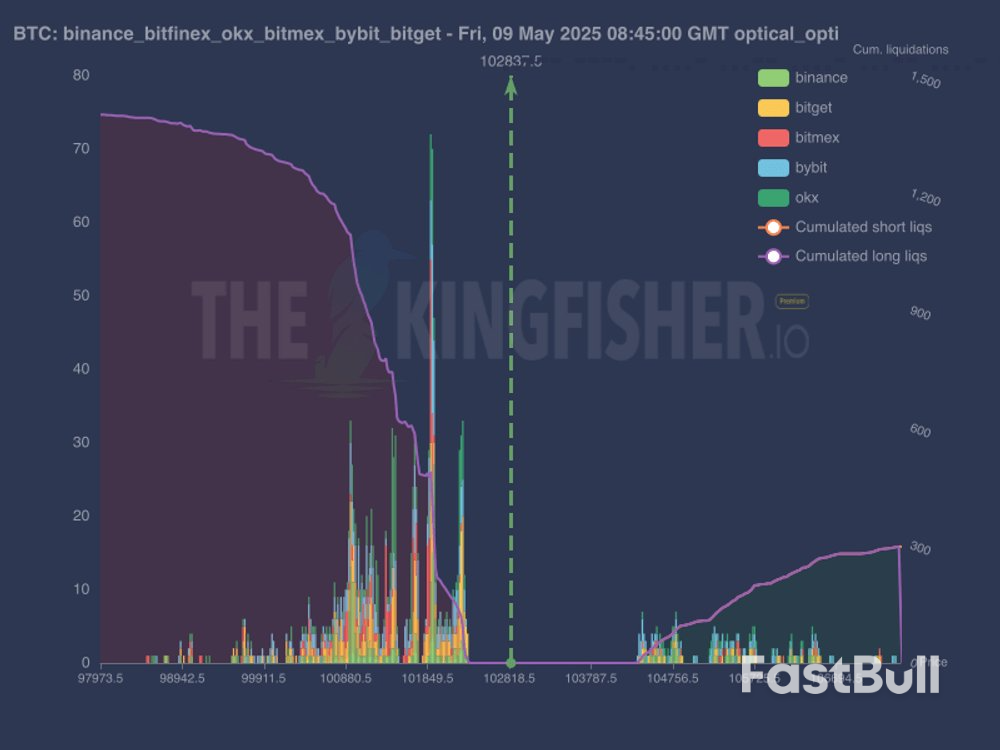

Bitcoin exchange order book liquidity data. Source: TheKingfisher/X

Bitcoin exchange order book liquidity data. Source: TheKingfisher/XThe dollar index edged lower from one month high on Friday, but remains constructive, as the latest bullish acceleration broke and establishes above psychological 100 level, which repeatedly capped attacks in past three weeks.

The dollar is also on track for the third consecutive weekly gain that contributes to signals of possible stronger recovery.

Profit-taking from sharp fall in past three months lifted the dollar’s price, with brightening outlook after the US reached trade deals with a number of large economies and signals of talks with China, adding to supportive factors, along with the latest remarks from US policymakers that persisting uncertainty would continue to offset expectations for rate cuts in coming months.

The recovery is supported by formation of bear trap pattern (under 98.92 Fibo support) on weekly chart, with improving technical picture on daily chart (strengthening positive momentum / 10/20 DMA turned to bullish setup and formed a bull-cross) although more work at the upside will be required to verify positive signals.

Weekly close above 100 level (psychological / near Fibo 38.2% of 104.30/97.65 bear-leg) will be the minimum requirement to keep alive optimisms for further recovery, with lift above 100.97 (50% retracement) to validate bullish signal.

Res: 100.69; 100.97; 101.76; 102.00.

Sup: 100.19; 100.00; 99.22; 98.85.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up