Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US Treasury finalised a US$20 billion (RM84.45 billion) currency swap framework with Argentina and bought pesos in the open market on Thursday.

The US Treasury finalised a US$20 billion (RM84.45 billion) currency swap framework with Argentina and bought pesos in the open market on Thursday, making good on US President Donald Trump's pledge to prop up the wobbling country and sending the peso and Argentine dollar bonds sharply higher."The US Treasury is prepared, immediately, to take whatever exceptional measures are warranted to provide stability to markets," US Treasury Secretary Scott Bessent said in announcing the actions on X.

Argentina's 2035 bond rose 4.5 cents to trade at 60.5 cents on the dollar, while the peso closed at 1,418 per dollar, up 0.8% on the day after falling 3% earlier.Local stocks rose 5.3% Thursday. Last month they touched a 2025 low, days before Bessent's initial support pledge. Argentine stocks traded in US exchanges rallied 13%.Bessent issued his statement at the end of four days of meetings with Argentine Finance Minister Luis Caputo that also involved officials from the International Monetary Fund (IMF), which has a US$20 billion loan programme with Argentina.

IMF managing director Kristalina Georgieva applauded the US' move in a post on X, saying the IMF was "fully aligned in support of the country's strong economic programme, anchored on fiscal discipline and a robust FX regime to facilitate reserve accumulation".A US Treasury spokesperson declined to provide any further details, including on the amount of pesos purchased and how the US$20 billion currency swap line would be structured.

Bessent had previously pledged support for Argentina from the Treasury's US$221 billion Exchange Stabilization Fund (ESF), and its majority holdings of IMF reserve assets known as Special Drawing Rights.Speaking later on Fox News Channel, Bessent insisted that the action was not a bailout, saying that no money was transferred to Buenos Aires and the ESF "has never lost money, it's not going to lose money here".

He added that the assistance provided strategic US benefits, including pledges by Argentina's right-wing president, Javier Milei, of "getting China out of Argentina" and its openness to allow US companies to develop its rare earths and uranium resources.Democratic lawmakers in the US Senate complained that Trump was moving to provide financing to bail out a foreign government and global investors, even as the US government has been shut down.

The backstop is partly aimed at giving Milei's party a boost in Argentina's Oct 26 mid-term legislative elections. His party wants to strengthen its minority position to solidify his agenda to cut government spending and boost private-sector investment.Argentine lawmakers are working to limit what the president can do via decrees, raising the stakes for Milei's party in the midterms.Although the effect on financial markets was immediate, there was no guarantee the US backstop will improve Milei's party's election prospects as public dissent over his austerity measures has grown.

UBS's Shamaila Khan, head of fixed income for emerging markets and Asia-Pacific, said the announcement was likely to bolster prospects for Milei's party. Kathryn Exum, co-head of sovereign research at Gramercy, said the midterms remain the major event, as are a policy and FX adjustment after the vote.Bessent called the success of Milei's reforms of "systemic importance" to the US by helping to anchor a prosperous Western Hemisphere.

Milei, who is due to meet Trump next week during the IMF and World Bank annual meetings in Washington, thanked Bessent and Trump in a message on X."Together, as the closest of allies, we will make a hemisphere of economic freedom and prosperity. We will work hard every day to provide opportunity for our people," Milei wrote.

Eduardo Ordonez Bueso, emerging markets debt portfolio manager at BankInvest, said markets had been hungry for details of Bessent's support pledge and had been challenging peso valuations."If they hadn't come through with a promise they made...we would be talking about a complete collapse of Argentina," he said.Several US Senate Democrats introduced legislation that would prohibit the use of the ESF to bail out Argentina and global investors. The measure is largely symbolic, as Democrats remain the minority in both chambers of Congress.

"It is inexplicable that President Trump is propping up a foreign government, while he shuts down our own," said Senator Elizabeth Warren, referring to the partial government shutdown due to lack of funding.

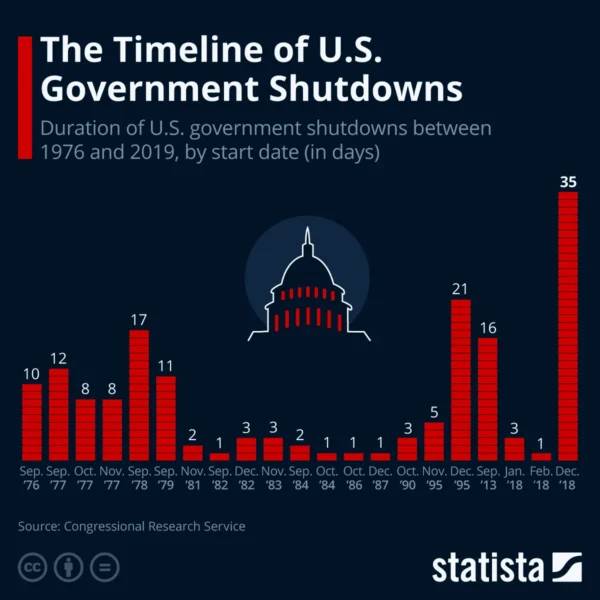

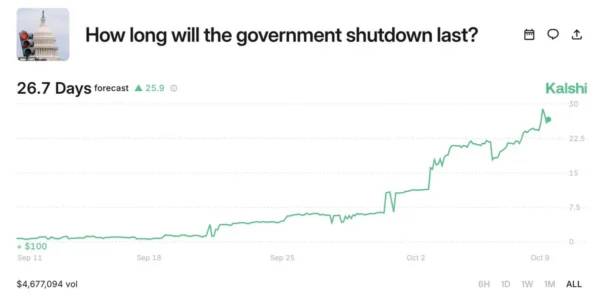

The US government shutdown, which began at midnight on October 6, shows no sign of ending soon — and many now expect it could at least become the second-longest in US history.

Despite six Democratic attempts to pass a funding bill, the Senate has repeatedly rejected proposals to reopen the government.

The current shutdown has been ongoing for nine days already – The length of it already surpasses 14 of the previous ones, with some lasting only one day, like during the 1980s.There are, however, faint hopes for a resolution, with growing pressure from agencies, unions, and private-sector partners potentially pushing lawmakers to reach a deal in the coming weeks.Because of the ongoing shutdown, even Marco Rubio, one of the US top diplomats, will not be able to attend the Paris meeting about the future for Gaza, as peace in the Middle East comes closer.

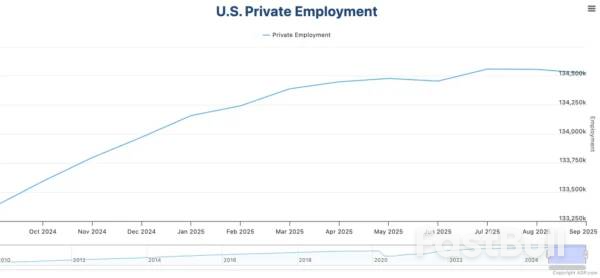

For now, the impact on economic visibility is clear. With most “non-essential” government functions halted, the Bureau of Labor Statistics (BLS) — responsible for the Non-Farm Payrolls (NFP) and Weekly Jobless Claims — is temporarily closed.This leaves traders and analysts without two of the most critical labor market indicators.So, where can investors look to fill the data gap and gauge the health of US employment while the shutdown persists? Let’s discover this just below.

Private surveys provide valuable insight into the US labor market.While they typically move markets less than official BLS data, they’re now attracting increased attention amid the government shutdown.

The most widely followed — and most market-moving — is the ADP Private Employment Report, which recently showed a decline of 32,000 jobs. It is getting more attention, particularly as it provides a seemingly more precise picture (when looking at the huge revisions from BLS data in 2025).

Other indicators help to fill the gap: the Challenger Job-Cut Report offers a monthly look at layoffs, while the Gallup Job Creation Index (released quarterly, so not very timely) gives a sentiment-based measure of hiring conditions.The ISM Manufacturing and Services PMIs also include employment sub-indexes, offering additional clues about job trends across sectors.Even private institutions have stepped up their data releases — for instance, a Bank of America survey showed slower job growth and rising claims despite steady wage gains, and Carlyle Group estimated that the US added just 17,000 jobs in September.

While the ADP report remains the benchmark among these alternatives, this period could see new private datasets gain prominence — especially those that prove more consistent or predictive of official labor trends once BLS operations resume.

Public data isn’t totally absent when assessing the US labor market — a few key Federal Reserve surveys continue operating even during the shutdown.These surveys offer timely snapshots of employment trends across various districts, providing indirect but valuable clues about hiring and job stability.The New York Fed’s Empire State Manufacturing Survey (the most market-moving) and the Philadelphia Fed’s Manufacturing Business Outlook Survey ask firms whether employment and work hours are rising or falling, giving an early read on hiring momentum in the Eastern US.

The Richmond Fed runs manufacturing and service sector surveys, where companies report payroll changes and labor availability.Further west, the Kansas City Fed’s Tenth District surveys and the Dallas Fed’s Texas Manufacturing and Service Outlooks measure shifts in employment and wages through monthly questionnaires sent to local businesses.Though these regional reports vary in scope, their employment sub-indices tend to move consistently with national labor data, making them valid proxies until the Bureau of Labor Statistics resumes regular publication.

Individual Fed regional presidents tend to mention these studies when they appear, which helps them assess their own decision-making during FOMC meetings.

Too Long, Didn’t read – What data releases should I focus on as a trader

Private Surveys:

Public Surveys, mostly from the Federal Reserve

Markets don’t seem to care too much about the shutdown, at least for now

The US Dollar is up 2% since October 1st, not showing the slightest care.

Even legendary traders and Hedge Fund managers like Citadel’s Ken Griffin repeat that the shutdown will have no material impact for Markets.

Still, Markets start to react when nobody seems to care anymore, so keep your eyes open.

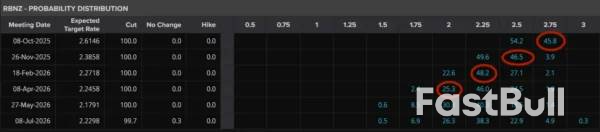

The New Zealand Dollar has been under heavy pressure in recent weeks, weighed down by a string of disappointing economic data, including a sharp GDP contraction that surprised markets and pushed the RBNZ toward a more dovish stance.

But markets often move in unexpected ways.

Despite the policy decision being split between a 25 bps and 50 bps cut, and the RBNZ ultimately choosing the larger move, NZD/USD didn’t tumble as far as expected.In fact, buyers stepped in, bringing the pair back to nearly unchanged levels by the close of yesterday’s session.

So, what explains this counterintuitive reaction?

Markets are forward-looking — a larger cut today reduces the need for aggressive easing later, prompting traders to reassess what might have been peak dovishness.In other words, Participants assess that the RBNZ will have less to do from here.

A 25 bps cut would have led to a longer rate cut path: A 2% Neutral Rate would have been reached in April 2026, taking the New Zealand economy longer to recover.

The red circles follow a 25 bps, slower rate cut path.

The new pricing shows that the cut cycle is priced to end in February 2026 – Hence, faster recovery for the New Zealand economy.Sellers now aim to test yesterday’s lows to see if the yearly bottom has been found after failing yesterday.We’ll now look at NZD/USD key levels to see where is the current bottom and if a new one could then emerge.

Amid a US Dollar rebound, sellers have found a place to sell the pair after re-testing the 4H 50-period Moving Average.Will the pair reach new lows, or has a bottom been found after the Jumbo rate cut?

This marks key breakout points to follow for the pair:

A break above the daily highs (0.58070) should confirm the intermediate bottom.A downside break would imply further weakness in the NZD is expected.

Levels to keep on your NZD/USD charts:

Support Levels:

Resistance Levels:

U.S. President Donald Trump and Finnish President Alexander Stubb announced a joint deal to build icebreaker ships during a White House meeting for talks related to trade and security on Oct. 9.“We have a big order coming up ... and we negotiated a pretty tough price,” Trump said during the Oval Office gathering.“We’re buying the finest icebreakers in the world.”Icebreaking ships are specially designed and constructed with reinforced hulls, oversized engines to drive through obstructions, and custom shapes to crush ice and create pathways.

The deal includes 11 ships valued at approximately $6.1 billion, four to be built in Finland and seven in the United States, according to the president.Available details are limited, and more information is coming soon, a White House spokesperson told The Epoch Times.Known as the “Land of a Thousand Lakes” because of its vast watery landscape, the Nordic nation’s ports freeze every winter, so Finland developed superior icebreaking technology over the past 100 years out of necessity.

Approximately 60 percent of all icebreaking ships are built in Finland, and the nation’s engineers are responsible for designing 80 percent of the world’s fleet, according to Stubb.Leaders from the country helped found the Icebreaker Collaboration Effort—also known as the ICE Pact—a joint agreement from July 2024 between Finland, the United States, and Canada to further the advancement of Arctic shipbuilding.“You’re going to be teaching us about the icebreaker business,” Trump told the Finnish leader.

The United States has one ship controlled by the Coast Guard with icebreaking capabilities, while Russia has approximately 40, Trump noted.

Finland can help close the gap, according to Stubb.

“You need to start ramping it up, and this is an indication that we’re going to do it, and we’re going to do it together,” he said.“I think we’re the country that can provide them at half the price and half the time.”Elected in 2024, the 57-year-old Finnish president—who previously served as prime minister, foreign minister, and as a member of the European Parliament—said the partnership will help the two countries more closely align their foreign policy strategies.

“It’s a huge strategic decision by the president as well, because we all know that the Arctic is important strategically ... and in terms of the economy as well,” Stubb said.“I know I come from a small country, but for us to be able to work together with you is extremely important from a strategic perspective, as well.”Trump first met Stubb in France last year. The two played golf—prompting Trump to praise the Finn, who played college golf, for his skill on the course—after an impromptu March get-together in Florida at the president’s Mar-a-Lago home.

As the open press event was winding down, Trump told reporters that discussions with Finland’s delegation would continue in the Cabinet Room.Stubb mentioned potential topics of interest, including quantum computing and the development of 6G networks for communication.Also present for the visit were Finland’s prime minister, Petteri Orpo, and its ambassador to the U.S., Leena-Kaisa Mikkola.The prime minister applauded the agreement as a symbol of optimism for the Finnish people.

“This deal is very important to Finland and our economy because our economy is suffering a lot because of the Russian aggression in Ukraine,” Orpo said.“And this deal ... means investments, it means jobs, and jobs mean hope. That’s why this is so important.”

In Australia, the only update of note this week was October’s Westpac-MI Consumer Sentiment Survey, which ultimately disappointed with a –3.5% decline to 92.1. Combined with last month’s fall, all gains over May to August have been erased and sentiment is now back into outright pessimistic territory. The most recent fall appears to be largely a consequence of renewed fears over the cost-of-living following the latest stronger-than-expected inflation update.

This looks to have fed through to households’ opinions on family finances. Both sub-indexes tracking current views and expectations deteriorating sharply back below long-run averages (–4.8% and –9.9% respectively). This coincided with the lift in expectations around mortgage interest rates. That said, while some consumers appeared to be ‘bracing for the worst’ as far as last week’s RBA’s decision was concerned, the Board’s non-committal and cautious language accompanying the decision went some way towards calming these fears. On the economy, consumers have become more downbeat on the year-ahead outlook (–2.5%) but remain fairly agnostic on the medium-to-longer term outlook (+1.4%).

Against this backdrop, consumers’ spending intentions remain a clear laggard in the survey detail. At 97.2, the ‘time to buy a major household item’ sub-index is some 21% below long-run average levels. This strikes a similar tone to official household spending data which is pointing to a more modest recovery following a solid showing in Q2 (which was buoyed by temporary factors including insurance payouts, abnormal seasonality, and EOFY sales). Going forward while a recovery is clearly underway, households’ ‘value-conscious’ attitude suggests that underlying momentum is still subdued. As a result, spending growth may remain patchy over the coming months and quarters.

This implies that the projected recovery in household spending is unlikely to be a decisive factor in the RBA’s near-term policy decision. Instead, as Chief Economist Luci Ellis highlights in this week’s essay, attention will be focused on upcoming labour market and inflation data ahead of the RBA’s November decision – the RBA has almost certainly not yet decided whether or not to cut the cash rate in November with these updates set to be the big deciding factor.

Offshore, the US government failed to reach an agreement on spending extending the shutdown and continuing to disrupt the release of official data. Consequently, attention was focused on the minutes of the FOMC’s September meeting.

The minutes struck a balanced tone with members highlighting both upside risks to inflation and growing downside risks to employment. The decision to cut rates by 25bps was motivated by weaker labour market conditions which also led them to “no longer characterize labor market conditions as solid”. Though downside risks were emphasised, the FOMC also affirmed they did not see a sharp deterioration in labour market conditions and that softer job gains were a function of both labour demand and supply, the latter reflecting the impact of fewer migrants. The view on inflation was more encouraging with the minutes noting that “excluding the effects of this year’s tariff increases, inflation would be close to target” and that they “perceived less upside risk to their outlooks for inflation than earlier in the year”. While concerns around inflation had subsided, the committee continues to expect an increase in inflation in the near-term and are attuned to how this is being transmitted into inflation expectations. We anticipate the FOMC will cut the federal funds rate once more this year, consistent with their view that ” it likely would be appropriate to ease policy further over the remainder of this year”.

Closer to home, the Reserve Bank of New Zealand cut its OCR by 50bps, a move that was out of consensus with the market but anticipated by our New Zealand colleagues. The Committee’s concern around excess capacity motivated the larger move though a 25bp cut was also considered. Forward guidance provided in the Media Release suggests further reductions are likely, we expect a 25bp cut in November.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up