Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. Treasury yields edged lower on Monday as investors adopted a cautious stance ahead of a packed week featuring long-delayed jobs data, November’s inflation report...

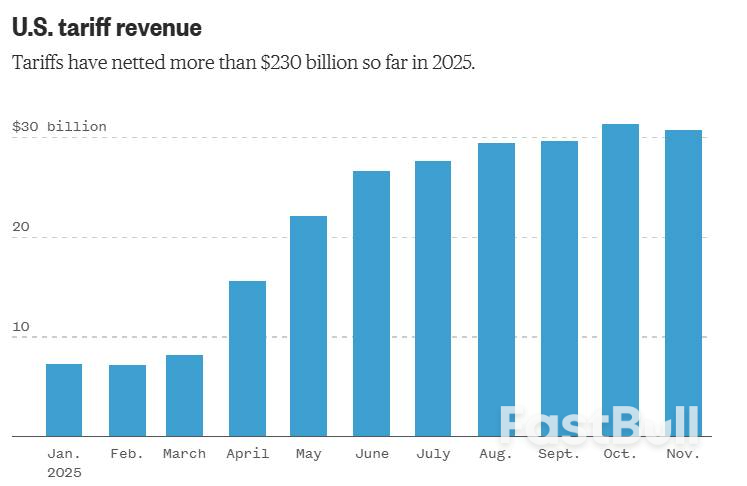

Tariffs have re‑emerged as a central pillar of U.S. trade policy. While the policy aims to reshape global trade and support domestic industries, early signs indicate falling revenue, rising costs, and growing legal risks. Economic and financial indicators now suggest mounting pressure across multiple sectors. This article presents the analysis of recent U.S. tariff actions, refund risks, and trade policy shifts, including the implications of the Trump-era trade measures.

At a recent rally in Pennsylvania, President Trump expressed strong support for the use of tariffs. However, after lifting tariffs on items such as coffee, oranges, and cocoa, monthly tariff revenue declined from $31.35 billion in October to $30.76 billion in November. This marked the first monthly drop since the reimplementation of broad-based duties.

Since the start of his tariff policy, multiple proposals have been discussed regarding how the revenue could be used. These range from issuing direct payments to households to offsetting recent tax adjustments. However, these plans remain unconfirmed and have not been implemented.

Moreover, looming over the tariff debate is a Supreme Court case that could strike down most of the tariffs introduced under the Trump administration. If the court rules against them, the government may owe businesses up to $100 billion in refunds.

Several companies, including major retailers like Costco, have already filed lawsuits seeking repayment. They argue that the use of emergency powers under the IEEPA law may be found unlawful.

If the court agrees, it could challenge the legal basis of the tariffs and potentially increase the federal government's debt burden.

On the other hand, tariffs had a significant impact on U.S. farmers. During the early phase of the trade conflict, China halted purchases of American soybeans, causing prices to collapse and exports to slow.

In response, the administration announced a $12 billion bailout for the agricultural sector, stating that tariff revenue would fund the program. While farmers accepted the aid, many noted it fell short of addressing long-term challenges related to lost market access and profitability.

In recent months, policymakers introduced additional carveouts, including tariff reductions on beef, coffee, and bananas. These changes suggest increasing pressure on the tariff policy, highlighting how certain industries and consumers have been negatively affected.

Recent statements acknowledge that tariffs impose costs on domestic consumers. Independent estimates suggest that the average U.S. household has paid around $1,200 more as a result of these duties, adding pressure during a period of elevated inflation.

In practice, tariffs increase import costs for U.S. companies, which are often passed on to consumers through higher prices. This dynamic can reduce demand, strain household budgets, and weigh on overall economic activity.

Trade risks now extend beyond China. The U.S.-Indonesia trade deal faces uncertainty, with reports citing Jakarta's failure to meet certain commitments. If the agreement collapses, it could weaken broader trade objectives.

At the same time, U.S. officials approved chipmaker Nvidia to sell high-performance H200 chips to China. This move reflects a shift toward a more flexible and adaptive trade policy. In my view, it represents a pragmatic adjustment that strikes a balance between economic priorities and broader strategic interests.

The policy direction eases earlier restrictions. It also creates uncertainty over how national security concerns are balanced against the benefits of trade. This evolving approach underscores the complexity of modern trade policy, where economic competitiveness and security considerations must often be reconciled.

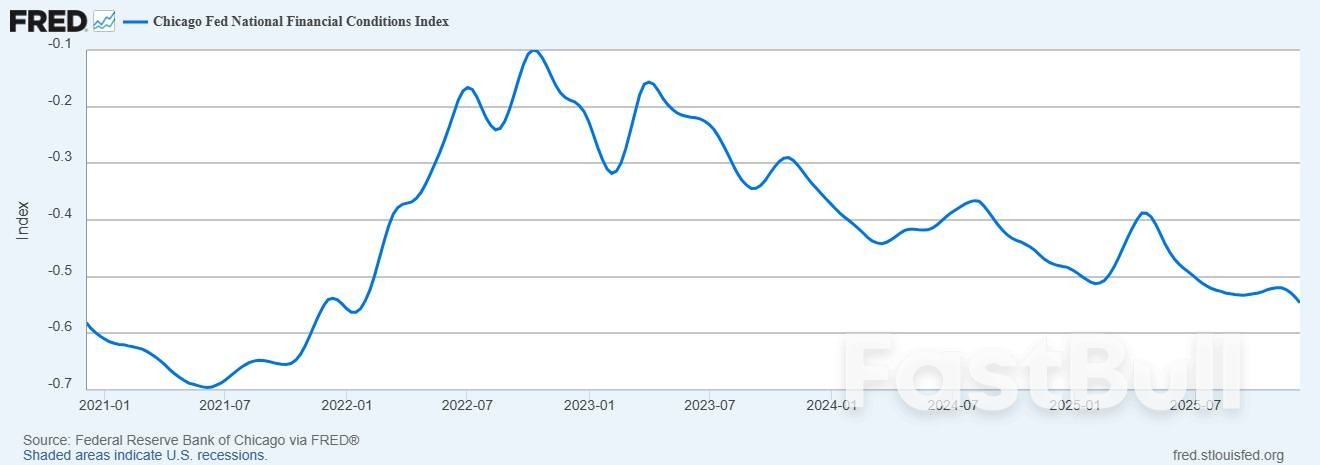

Beyond tariffs, broader financial indicators show warning signs. Unemployment claims dropped sharply. However, this decline might be due to seasonal distortions rather than genuine improvement.

The Chicago Fed National Financial Conditions Index fell to -0.546, indicating loose monetary conditions. While easy money supports elevated stock prices, it also increases the risk of asset bubbles.

The Trump trade war represents a high-stakes shift in U.S. trade strategy with broad economic consequences. Tariff revenue is declining, legal refund risks are increasing, and key industries, such as agriculture, continue to face pressure. Households are paying more, and financial markets are showing signs of stress. As trade relationships evolve and new policy adjustments emerge, the future direction of U.S. trade strategy remains uncertain and increasingly complex.

Switzerland lifted the growth outlook for next year on the back of its trade deal with the US, while lowering expectations on inflation after the central bank refrained from further easing.

The State Secretariat for Economic Affairs sees gross domestic product adjusted for large sports events expanding 1.1% in 2026, up from its September projection of 0.9%. That almost matches the growth seen before outsized American tariffs took effect. In its first estimate for the year after, the agency known as SECO penciled in 1.7%.

"Despite some easing of tensions, uncertainty remains high regarding international economic and trade policy and its macroeconomic impact," SECO said in a statement on Monday, citing tariffs, financial and real estate markets, sovereign debt and geopolitics. "Should any of these risks materialize, further upward pressure on the Swiss franc would be expected."

The authority, which is in charge of drawing up economic forecasts for the Swiss government, now expects consumer prices to rise by just 0.2% next year, down from 0.5% previously predicted, before accelerating to 0.5% in 2027.

The inflation outlook is even weaker than projections given by the Swiss National Bank after it decided to keep interest rates at zero on Thursday — the second meeting in a row to see officials hold off on changing policy. A rate cut would mean the reintroduction of negative borrowing costs, a move that policymakers have said faces a higher bar than a conventional reduction. Most analysts think rates won't go any lower in this cycle.

The resolution of its tariff spat with the US is widely expected to return Switzerland to a path of stable growth, after the economy suffered its first quarterly contraction since 2023 in the July-September period. Donald Trump's administration imposed a shock 39% levy on many Swiss exports in August, but both nations reached a preliminary trade agreement reducing surcharges to 15% in November.

Trading on 12 December was overshadowed by a sharp decline in the S&P 500 (US SPX 500 mini on FXOpen), with the session low approaching December's previous trough.

Among the key fundamental drivers behind Friday's drop was the market reaction to Broadcom's quarterly report. Shares (AVGO) plunged more than 10%, possibly as investors aggressively took profits in tech stocks, concerned that the AI hype may be overheated.

A review of the 4-hour chart of the S&P 500 (US SPX 500 mini on FXOpen) suggests that Friday's negative sentiment may have begun to ease, as the index is now recovering. Overall, this presents an interesting picture from a price-action perspective.

Five days ago, we noted that an ascending channel had formed in early December, which could be interpreted as cautious optimism ahead of key news.

However, Fed-related announcements triggered a surge in volatility (as we described, "the calm before the storm"), pushing prices beyond both boundaries of the blue channel:

→ The failure to hold above the upper boundary can be seen as bulls lacking confidence to challenge the all-time high. The false break around 6929 looks like a trader trap.

→ Conversely, bears may have been unable to suppress buying near Friday's low, as indicated by the long lower wicks on the candles (highlighted by the arrow).

The chart now shows a complex Megaphone pattern (marked A–F).

It is possible that the coming week will be characterised by consolidation following Wednesday–Friday's swings, with market sentiment increasingly influenced by the approaching holiday period.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up