Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Rachel Reeves may have to find up to £30bn in tax rises or spending cuts if forecaster revisits expectations

U.S. consumer spending increased slightly more than expected in August, keeping the economy on solid ground as the third quarter progressed, while inflation continued to rise at a measured pace.

Consumer spending, which accounts for more than two-thirds of economic activity, rose 0.6% last month after an unrevised 0.5% advance in July, the Commerce Department's Bureau of Economic Analysis said on Friday.

Economists polled by Reuters had forecast consumer spending increasing 0.5% after a previously reported 0.5% gain in July.

Spending has marched ahead despite a significant labor market slowdown, marked by stall-speed job growth in the last three months. It is being driven by high-income households as a robust stock market and still-elevated home prices boost their wealth. Federal Reserve data this month showed household wealth jumped to a record $176.3 trillion in the second quarter.

But lower-income households are struggling, and bearing a large share of the burden from higher prices on goods from import tariffs. More pain lies ahead when cuts to the federal government's supplemental nutrition assistance program, commonly known as food stamps, take effect.

"With spending concentrated among high-income households the risk to the consumption growth forecast is more concentrated in the drivers of household wealth – the stock market and house prices," said Ryan Sweet, chief U.S. economist at Oxford Economics. "Wealth effects have become more potent for consumer spending, a positive when stock and house prices are rising, but a risk if, and when, they sputter."

Strong consumer spending contributed to gross domestic product growing at a 3.8% annualized rate in the second quarter, the fastest in nearly two years. Growth estimates for the third quarter are converging around a 2.5% pace.

Economists expect spending to slow considerably by the end of the year, undercut by higher prices. Inflation has been slow to rise in response to President Donald Trump's sweeping tariffs as businesses sold inventory accumulated before the duties kicked in and even absorbed some of the duties.

The Personal Consumption Expenditures (PCE) Price Index increased 0.3% in August after gaining 0.2% in July, the BEA said. In the 12 months through August, the PCE Price Index advanced 2.7% after climbing 2.6% in July.

Excluding the volatile food and energy components, the PCE Price Index rose 0.2% last month after increasing 0.2% in July. In the 12 months through August, the so-called core inflation increased 2.9% after rising 2.9% in July.

The Fed tracks the PCE price measures for its 2% inflation target. The U.S. central bank last week resumed policy easing, cutting its benchmark overnight interest rate by 25 basis points to the 4.00%-4.25% range.

Fed Chair Jerome Powell said this week that "near-term risks to inflation are tilted to the upside and risks to employment to the downside - a challenging situation."

Russian aircraft have been violating countries’ airspace more frequently in recent weeks.

Two Russian platforms have been spotted in the airspace above Alaska. According to the North American Aerospace Defense Command (NORAD), two Su-35s and two Tu-95s were detected operating in the Alaskan Air Defense Identification Zone (ADIZ). In response to the situation, nine American aircraft, including F-16 Fighting Falcons, E-3 Sentrys, and KC-135 tankers, were scrambled to identify and intercept the Russian jets. This incident comes just one day after US president Donald Trump wrote on Truth Social that he believed Ukraine was capable of re-capturing all the territory it had lost to Russia over the last three-plus years of war. This announcement from Trump was surprising, as the president previously called on Kyiv to make concessions to Russia in order to achieve a more imminent ceasefire.

Moscow has violated international airspace more frequently in recent weeks. Earlier in September, European nations were put on high alert after Russian unmanned aerial vehicles were shot down by Polish and NATO allied warplanes after crossing into Poland’s airspace. Shortly after this incident, Estonia reported that Russian fighter jets had crossed into its own airspace.

The Su-35

The Sukhoi Su-35 remains one of Russia’s workhorses in its aerial fleet. Designated by NATO as the Flanker-E/M, the twin-engine, 4.5-generation platform was originally conceptualized during the Cold War as the definitive production iteration of the Su-27 “Flanker.” The Russian jet is powered by a pair of turn/UFA AL-31F 117S turbofan engines that enable the fighter to fly at speeds reaching roughly Mach 2.25 (times the speed of sound). In addition to its top speed, the Flanker-E is loaded with ordnance power. The Russian fighter can carry an array of air-to-surface and air-to-air missiles, including the long-range Kh-48 UshE. As explained by Air Force Technology, “The Su-35 can be armed with a range of guided bombs, including the KAB-500Kr TV-guided bomb, KAB-500S-E satellite-guided bomb, LGB-250 laser-guided bomb, Kab-1500Kr TV-guided bomb and KAB-1500LG laser-guided bomb. The aircraft can also be armed with 80mm, 122mm, 266mm, and 420mm rockets.”

The Tu-95

Like the Su-35, the Tu-95 Bear Bomber was conceptualized in the Soviet era. After the United States introduced its own strategic bombers during World War II, the USSR prioritized developing its own counter. Soviet officials issued a request for a bomber series capable of flying long ranges in order to strike targets across the continental United States. The resulting Bear bomber, designed by the design bureau led by Andrei Tupolev, was sufficient. Four Kuznetsov NK-12 engines with rotating propellers power the platform, making it one of the loudest bombers in service across the globe today. Over the years, the Tu-95 has undergone several overhauls in order to remain relevant in modern times. Notably, the Soviet Tsar Bomba nuclear bomb was released from a modified Bear variant specially equipped with redesigned engines, suspensions, and release mechanisms in order to successfully release the large nuclear weapon.

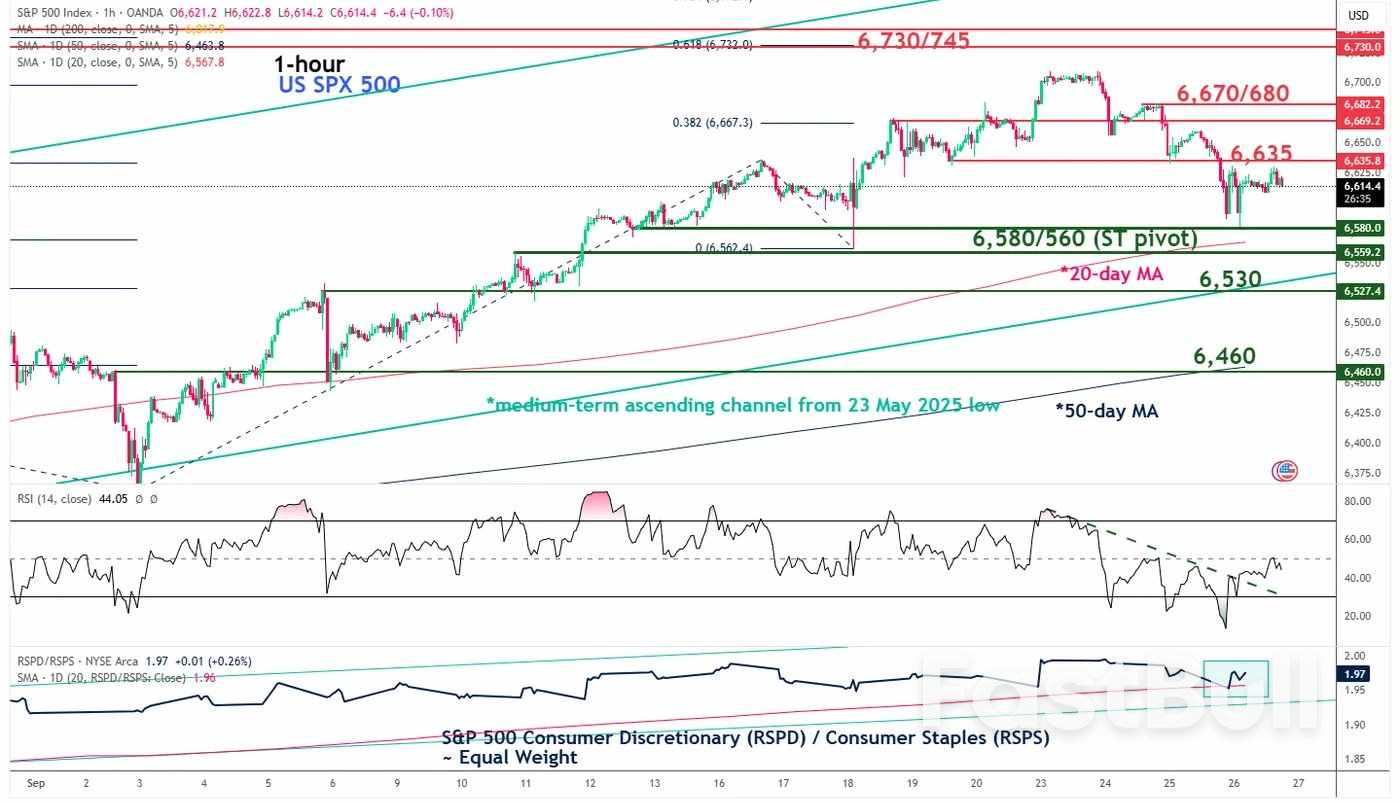

Fig. 1: US SPX 500 CFD Index minor trend as of 26 Sep 2025

Fig. 1: US SPX 500 CFD Index minor trend as of 26 Sep 2025Underlying U.S. inflation in August matched the prior month’s pace as anticipated, in a sign of sticky price pressures that Federal Reserve officials have flagged as a key influence on the trajectory for interest rates over the rest of the year.

The so-called "core" personal consumption expenditures price index, which strips out volatile items like food and fuel, rose by 2.9% in the twelve months through August, the same as in July and in line with economists’ estimates, according to data from the Commerce Department’s Bureau of Economic Analysis on Friday.

Month-on-month, the measure came in at 0.2%, also equalling both July’s figure and Wall Street projections.

On a headline basis, PCE stood at 2.7% year-over-year and 0.3% month-over-month. The gauges accelerated slightly from July and were the same as forecasts had predicted.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up