Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

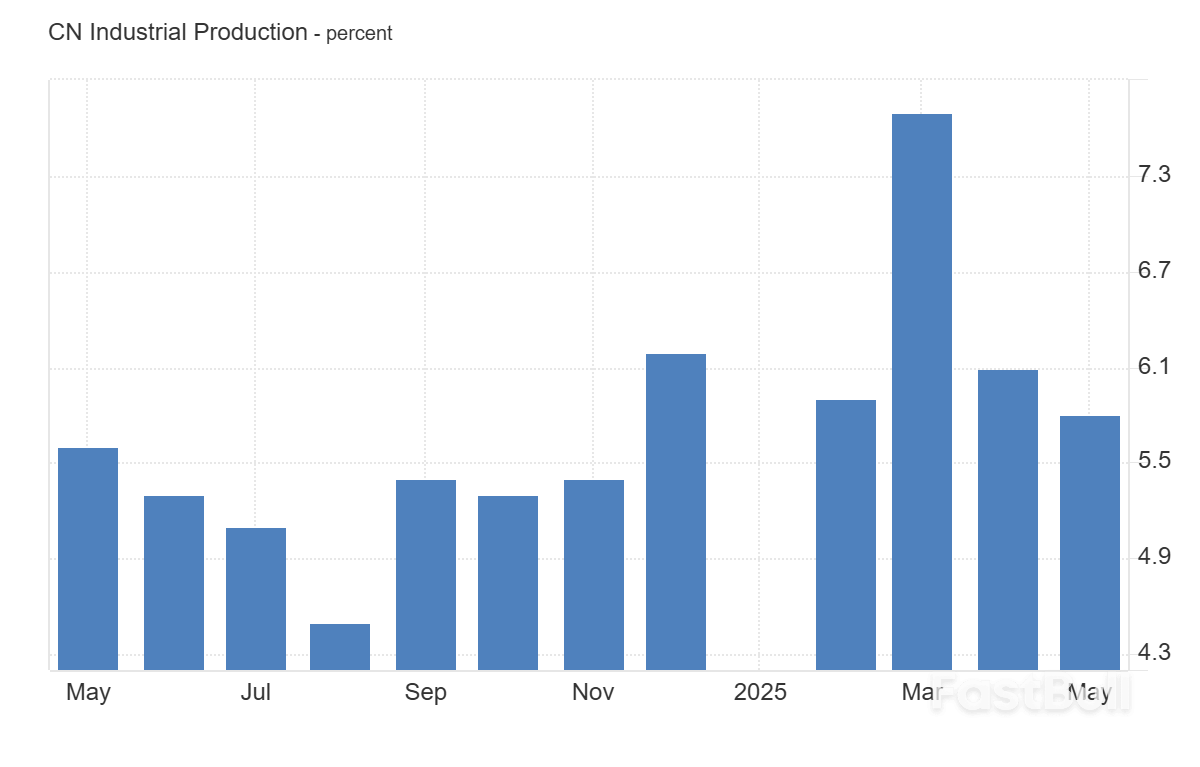

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Markets remain cautious amid escalating Iran-Israel tensions, but oil prices stay moderate due to OPEC+ supply. Focus shifts to the G7 meeting, Fed and BOE decisions, and key inflation data.

CONFIRMED: The USS Nimitz aircraft carrier strike group is on its way to the Middle East from the South China Sea, a U.S. official tells Fox News. The Nimitz was previously scheduled to replace the USS Carl Vinson carrier strike group which has been deployed for several months, but is now heading to the Middle East ahead of schedule. The two will now be in the Middle East at the same time. The USS Nimitz is the oldest active aircraft carrier in the U.S. Navy, commissioned on May 3, 1975. Scheduled to be decommissioned in 2026, this is possibly its final sea voyage. This is a very significant symbolic deployment because it was deployed in 1980 and its helicopters that were part of the failed US effort known as Operation Eagle Claw to rescue the American hostages being held at the US Embassy in Tehran. The US has been in a shadow war against Iran ever since.

This comes on the heels of reports that the US Embassy in Tel Aviv suffered "minor damage" from a nearby Iranian ballistic missile impact.

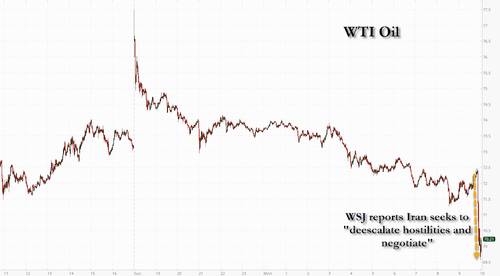

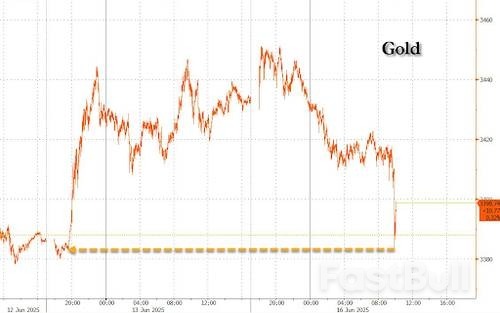

Update(1008ET): Everything is suddenly exploding higher - also with gold and oil dropping - especially on the following WSJ breaking report which suggests (dubiously, we should add...) that the Iranians are 'open' to returning to the negotiating table with Trump officials, even as ballistic missiles rain down on Israel, and as much of the Islamic Republic - particularly oil depots - burn...

"In the midst of a ferocious Israeli air campaign, Tehran has told Arab officials they would be open to return to the negotiating table as long as the U.S. doesn’t join the attack, the officials said. They also passed messages to Israel saying it is in the interest of both sides to keep the violence contained," per WSJ on Monday.

Oil prices tumbling on the breaking report...

S&P 2% from ATH...

Gold has been falling since before the missile war started late on Thursday...

WSJ continues, "Iran has been urgently signaling that it seeks an end to hostilities and resumption of talks over its nuclear programs, sending messages to Israel and the U.S. via Arab intermediaries, Middle Eastern and European officials said."

This comes also amid reports that dozens of US Air Force tankers have in the last hours taken off from the United States and headed towards Europe, as also confirmed in Flightradar24 and Air Live. Is Trump ready to join the Israeli side militarily? The Iranians fear so, it appears.

Iran's message is that "it is in the interest of both sides to keep the violence contained" - according to an urgeng diplomatic message passed along. But at this point it seems clear that Israel is going for full regime decapitation, given also that reports say the Israel Air Force has total aerial dominance over Western Iran and skies above Tehran at this point. If these reports of an Iranian olive branch are accurate, is it too-little-too-late?

After another day on the receiving end of an Israeli war of aggression that began Friday, Iran delivered a major counterpunch overnight, further demonstrating that Israel's highly-touted Iron Dome defense system is vulnerable to Iran's hypersonic missiles. Upon completing a deadly barrage aimed at targets in Tel Aviv, Haifa and elsewhere, Iran claimed it had employed a "new method" that put Israel's multi-layered defense system in disarray to the point its various systems targeted each other.

As fire and rescue teams scrambled to respond to the damage, Times of Israel reported at least eight people had been killed and more than 90 injured in the early-Monday attack, bringing Israel's running death toll to at least 24 with hundreds wounded. “The arrogant dictator of Tehran has become a scared murderer who fires at Israel’s civilian home front in order to deter the IDF from continuing to carry out attacks that are destroying his capabilities,” said Defense Minister Israel Katz, only to then promise that "residents of Tehran will pay the price, and soon."

Iran claimed it struck targets that included a power plant in Haifa that "was seen engulfed in flames," an oil refinery complex in Bazan, a facility of the military technology company Rafael Advanced Defense Systems facility, as well as Ben Gurion Airport. The Cradle reports that other targets included Nevatim Air Base, an army camp in Galilee, and hits on power grid facilities that caused "widespread blackouts." Projectiles also hit a residential high-rise building and at least another residential area. An Iranian defense official said the attack included missiles with 1.5-ton warheads, but noted Iran has even heavier warheads in its inventory.

Citing a statement from the Islamic Revolution Guards Corps, state media outlet PressTV reported that "the operation specifically targeted the Zionist regime’s command and control systems using advanced tactics and enhanced intelligence-tech capabilities."

“As a result,” the IRGC said, “the enemy’s multilayered defense systems were thrown into disarray, to the point where their own air defense units began firing on each other.” One video making the rounds on social media appears to show an IDF missile interceptor blowing itself up, though the careful observer must contemplate the possibility that an unforced IDF error captured on video may have been opportunistically exploited to make an exaggerated claim:

Dampening Israeli hopes that Iran may run out of missiles soon, Israeli National Security Advisor Tzachi Hanegbi told Army Radio that Iran has "thousands of ballistic missiles" in its inventory, which the Times of Israel called "a higher figure than previously estimated."

Iran has similarly made repeated claims that it hasn't used its full resources yet. “We are still exercising restraint and have not deployed all our capabilities to avoid global chaos," IRGC chief Major General Mohsen Rezaei told Iranian state media. "However, we may reach a point where we use new weapons." While reiterating Iran's claim that it doesn't seek to acquire a nuclear weapon -- a claim re-certified as valid by the US intelligence community as recently as March of this year -- he hinted that Iran's stance on nuclear weapon development could change, saying "the future cannot be predicted with precision."

A question is starting to loom large: How long can this Israeli society -- which has for years gone almost entirely unscathed as its military unleashes utter devastation on lesser forces and civilian populations -- withstand prolonged destruction from a well-equipped foe like Iran?

OPEC said on Monday it expected the global economy to remain resilient in the second half of this year despite concerns about trade conflicts and trimmed its forecast for growth in oil supply from producers outside the wider OPEC+ group in 2026.

In a monthly report, the Organization of the Petroleum Exporting Countries left its forecasts for global oil demand growth unchanged in 2025 and 2026, after reductions in April, saying the economic outlook was robust despite trade concerns."The global economy has outperformed expectations so far in the first half of 2025," OPEC said in the report.

"This strong base from the first half of 2025 is anticipated to provide support and sufficient momentum into a sound second half of 2025. However, the growth trend is expected to moderate slightly on a quarterly basis."

OPEC also said supply from countries outside the Declaration of Cooperation - the formal name for OPEC+ - will rise by about 730,000 barrels per day in 2026, down 70,000 bpd from last month's forecast.

Lower supply growth from outside OPEC+, which groups the Organization of the Petroleum Exporting Countries plus Russia and other allies, would make it easier for the wider group to balance the market. Rapid growth from U.S. shale and from other countries has weighed on prices in recent years.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up