Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

This year has been the worst for layoffs since the start of the pandemic, a new report shows — and those newly unemployed workers are entering a tough job market.

This year has been the worst for layoffs since the start of the pandemic, a new report shows — and those newly unemployed workers are entering a tough job market.

While a job loss can leave workers scrambling to keep up with bills like their mortgage or children's college tuition, there is one thing it's important to do before you reassess your expenses or talk to lenders, experts say: Apply for unemployment benefits.

It can take weeks for the benefits to reach you, and minimizing that wait can help you shore up your financial situation.

"After a layoff, workers should apply for unemployment benefits immediately to help cover essential expenses and preserve their savings for true emergencies," said certified financial planner Douglas Boneparth, president of Bone Fide Wealth in New York. Boneparth is also a member of the CNBC Financial Advisor Council.

U.S. employers have cut 1.17 million jobs through November of this year, with corporate restructuring, artificial intelligence and tariffs to blame, consulting firm Challenger, Gray & Christmas reported Thursday. That number is the highest level since 2020, during the Covid pandemic.

Payroll processing firm ADP also found this week that the labor market slowdown intensified in November, with private companies cutting 32,000 workers.

If you live in one state and work in another, you'll want to apply for the aid in the state where you worked, experts say.

On a DOL-sponsored website, you can find the contact information for state unemployment agencies.

State agencies should pay benefits within three weeks of your application, but delays have become more common since the pandemic, Evermore said.

"It's probably going to get worse as layoffs increase," she added.

Maximum benefits vary by state

Maximum unemployment benefit amounts vary by state. For example, California's maximum weekly benefit is $450; in Florida, the cap is $275, Evermore said. Recently, the maximum weekly benefit in New York rose to $869.

Standard benefit timeline is 26 weeks, but not always

In most states, claimants can get unemployment benefits for 26 weeks, Evermore said — although it's less in some states. In Florida, for example, the benefits last for just 12 weeks.

Unemployment benefits are subject to taxes

Unemployment benefits are subject to federal taxes, and many states tax them, too. When you start to receive the payments, your state will typically give you the option to have taxes withheld, Evermore said.

It's a good idea to take that option to avoid a potentially hefty tax bill later, she said.

U.S. Treasury yields rose on Thursday, snapping a three-day decline, as investors stepped back from bond purchases and consolidated positions ahead of next week's Federal Reserve meeting, where the central bank is widely expected to deliver a third consecutive rate cut.

In the bond market, yields rise when prices fall.

In late morning trading, the benchmark 10-year yield rose 3.4 basis points to 4.092%, while the 30-year yield climbed 2.7 bps to 4.752% (US30YT=RR).

On the front end of the curve, the two-year yield, which reflects interest rate moves by the Fed, advanced 3.3 bps at 3.519% (US2YT=RR).

"We've had a little bit of a streak of lower yields since Monday and with the focus on monetary policy, it feels like rate cuts just kept getting more and more momentum," said Jim Barnes, director of fixed income at Bryn Mawr Trust in Berwyn, Pennsylvania.

"Today you just have a little bit of a giveback. The jobless claims data probably helped with that a little bit. But the market was already trading off earlier, even before the claims data even came out."

ECONOMY LOST 9,000 JOBS IN NOVEMBER: REPORT

U.S. yields, however, pared their increase after data from Revelio Labs, which develops monthly employment estimates from online employment profiles and other information, showed that the economy lost 9,000 jobs in November, a second month of decline after a drop of 9,100 estimated for October.

The report overshadowed weekly U.S. jobless claims numbers that fell to their lowest in more than three years, although analysts said the data could have been skewed lower by the Thanksgiving holiday.

Initial claims for state unemployment benefits fell 27,000 to a seasonally adjusted 191,000 for the week ended November 29, the lowest level since September 2022. Economists polled by Reuters had forecast 220,000 claims for the latest week.

The initial claims number was also consistent with a report showing fewer job cuts in the first 11 months of 2025.

Global outplacement firm Challenger, Gray & Christmas said planned job cuts declined 53% to 71,321 last month from October. They were, however, 24% higher compared to the same period last year, and November's tally was the largest for the month since 2022.

"Initial jobless claims look better than the alternate data sources on layoffs ... (but) the latest week for claims data included the Thanksgiving holiday, and holidays often distort claims data, so this release should be taken with a big grain of salt," wrote Bill Adams, chief economist at Comerica Bank in Dallas.

"Even so, the recent trend looks good, with initial claims averaging a low 215,000 in the last four weeks."

On Thursday, U.S. rate futures have priced in an 87% chance of a 25-bps cut next week, down from 90% on Wednesday, CME FedWatch showed.

Fed funds futures have factored in more than 90 bps of easing next year, with two rate declines in the first half amid expectations the new Fed chair will push steeper rate cuts in line with what President Donald Trump wants.

Global shares edged up on Thursday, powered by expectations that a U.S. rate cut will support the world's largest economy after data showed employment is slowing, while the dollar was lower and poised for its 10th straight day of losses against a basket of major currencies.

U.S. stocks were losing ground in early trade after two consecutive sessions of gains, with the benchmark S&P 500 (.SPX), flat. Healthcare, consumer discretionary and materials stocks were suffering the most losses, while real estate, financials and utilities were advancing.

The Dow Jones Industrial Average (.DJI), fell 0.09%, the S&P 500 (.SPX), edged down 0.06% and the Nasdaq Composite (.IXIC), lost 0.14%.

In Europe, the STOXX 600 (.STOXX), was up 0.42% and still headed for a modest weekly gain. London's FTSE 100 index (.FTSE), was up 0.16% while Germany's DAX (DAX.O), gained 0.45%. MSCI's gauge of stocks across the globe (.MIWD00000PUS), rose 0.18%.

Japanese stocks rallied sharply after an auction of government bonds drew strong demand from investors, which helped set the tone for the broader equity market. The Nikkei (.N225), rose 2.33%.

"After a 5% pullback in late November, stocks have rebounded and are now trading at the pre-pullback levels and near all-time highs," Michael Farr, chief executive of investment advisory firm Farr, Miller & Washington in Washington.

The gains came after U.S. private payrolls data posted their biggest drop in more than two-and-a-half years, and following a survey of the services sector that showed activity held steady in November while hiring slowed.

"If they cut rates by a quarter of a point and then take a pause - which every Fed speaker has indicated, markets might be disappointed in the messaging. If they don't cut and say we're going to wait until the next meeting, markets will be disappointed there too," Farr said.

Fed funds futures are pricing a near 90% chance of a quarter-point cut at the end of the Fed's next meeting on December 10, compared with an 83.4% chance a week ago, according to the CME Group's FedWatch tool.

The dollar index , which tracks the U.S. currency's performance against six others, was last down 0.08% on the day, heading for a 10th straight daily decline, making this its longest stretch of losses since at least 1971, according to LSEG data.

The yield on the U.S. 10-year Treasury bond was last up 3.4 basis points at 4.092%. The Financial Times reported on Wednesday that bond investors had expressed concerns to the U.S. Treasury that Kevin Hassett, a candidate to replace Jerome Powell as Fed chair next year, could aggressively cut interest rates to align with President Donald Trump's preferences.

"I think there's purposeful timing by the Trump administration to announce the president's selection of a new Fed chairman that will be seen - correctly or not - as being more dovish around this meeting to appear as an antidote to the messaging," Farr said.

In Japan, the government's debt sale drew the strongest demand in more than six years, which helped soothe investor nerves about the country's long-term finances that have stoked similar worries about other economies.

The dollar was last down 0.28% at 154.8 against the yen , which is heading for its largest weekly gain against the U.S. currency in over two months.

The yen got another boost from a Reuters report that the Bank of Japan (BOJ) is likely to raise interest rates in December with the government expected to tolerate such a decision, citing three government sources familiar with the deliberations.

Meanwhile, the yuan softened a touch, leaving the dollar up 0.18% at 7.070 yuan in offshore trading in Hong Kong . The Chinese currency hit its strongest level against the dollar in more than a year on Wednesday.

Precious metals cooled after a recent hot streak. Gold was last down 0.28% at $4,195 an ounce, while silver fell 2.4% to $57.03 an ounce, after hitting a record high of $58.98 on Tuesday.

Brent crude was last up 0.06% at $62.71 a barrel.

Reporting by Chibuike Oguh in New York and Gregor Stuart Hunter; Editing by Lincoln Feast, Sonali Paul, Andrew Heavens, Chizu Nomiyama and Ed Osmond

The Trump administration is signaling that it could withdraw entirely and renegotiate large parts of an existing trade accord with the Canada and Mexico next year, underscoring its volatile approach even among trusted trade partners.

In an interview with Politico, U.S. Trade Ambassador Jamieson Greer floated the possibility of the U.S. exiting the U.S.-Canada-Mexico trade agreement that Trump negotiated in his first term. The three countries are set to enter fresh talks in July to update the agreement, if necessary.

Trump, though, might take a wrecking ball to the entire trade deal in pursuit of something he perceives as fairer.

"The president's view is he only wants deals that are a good deal," Greer said. "The reason why we built a review period into USMCA was in case we needed to revise it, review it or exit it."

Greer added that the Trump administration might simply split the agreement in two and negotiate with Mexico and Canada separately.

Trump blew up trade talks with Canada in October over a Canadian TV ad that borrowed from President Ronald Reagan to criticize his signature tariffs. Those discussions have been paused ever since, and Canadian Prime Minister Mark Carney has expressed no rush on his end to revive the talks.

"Our relationship with the Canadian economy is totally different than our relationship with the Mexican economy," Greer told Politico. "I mean, the labor situation is different. The stuff that's being made is different. The export and import profile is different. It actually doesn't make a ton of economic sense why we would marry those three together."

The USMCA represents the biggest trade achievement for Trump in his first term. In 2020, it replaced the North American Free Trade Agreement that he relentlessly attacked first as a 2016 presidential candidate and later on as president.

It enabled $1.8 trillion in cross-border, tariff-free trade from the U.S. to Mexico and Canada in 2022, according to government data. Much of U.S. exports to both countries consisted of services exports including professional and financial services.

The U.S. has kept 50% tariffs on Canadian steel and aluminum in tandem with a 25% tariff on Canadian imports. By comparison, Mexico has largely been spared from Trump's tariffs, with the bulk of its goods still entering the U.S. duty-free since they comply with U.S. origin rules under the USMCA agreement.

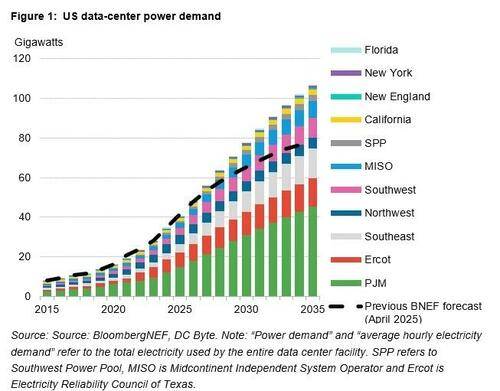

BNEF's report comes as some energy industry analysts and executives warn that an artificial intelligence bubble or speculative data center proposals could be fueling excessive load growth projections.

A report from Grid Strategies released last month said utility forecasts of 90 GW additional data center load by 2030 were likely overstated; market analysis indicates load growth in that time frame is likely closer to 65 GW, it said.

A July report from the Department of Energy estimated an additional 100 GW of new peak capacity is needed by 2030, of which 50 GW is attributable to data centers. Those facilities could account for as much as 12% of peak demand by 2028, according to Lawrence Berkeley National Laboratory.

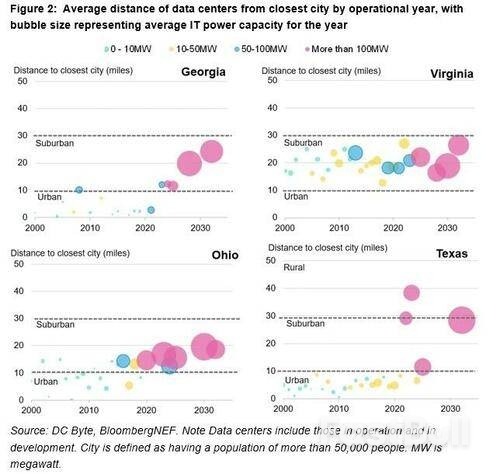

BNEF's data center project tracker shows the industry diversifying beyond traditional data center hubs like Northern Virginia, metro Atlanta and central Ohio into exurban and rural regions served by existing fiber-optic trunk lines for data traffic.

A map of under-construction, committed and early-stage projects shows gigawatts of planned data center capacity spreading south through Virginia and the Carolinas, up through eastern Pennsylvania and outward from Chicago along the Lake Michigan shore. More data centers are also planned for Texas and the Gulf Coast states.

Much of the capacity is poised to materialize on grids overseen by the PJM Interconnection, the Midcontinent Independent System Operator and the Electric Reliability Council of Texas. BNEF predicts PJM alone could add 31 GW of data center load over the next five years, about 3 GW more than expected capacity additions from new generation.

With the expected surge, the North American Electric Reliability Corp. warned late last year of "elevated risk" of summer electricity shortfalls this year, in 2026 and onward in all three regions.

Some experts disputed NERC's methodology, however. MISO's independent market monitor said in June that the group's analysis was flawed and that MISO was in a better position than grid regions not expected to see exponential data center growth, like ISO New England and the New York Independent System Operator.

Other technology and energy system analysts expect a significant amount of proposed data center capacity to dissipate in the coming years due to chip shortages, duplicative permit requests and other factors.

In July, London Economics International said in a report prepared for the Southern Environmental Law Center that meeting projections for U.S. data center load in 2030 would require 90% of global chip supply — a scenario it called "unrealistic."

Patricia Taylor, director of policy and research at the American Public Power Association, told Utility Dive earlier this year that it's common for data center developers to "shop around" the same project across neighboring jurisdictions.

Still, U.S. grid operators face an "inflection moment" as they balance the desire to accommodate large-scale data centers with the obligation to ensure reliable service for all customers, BNEF said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up