Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

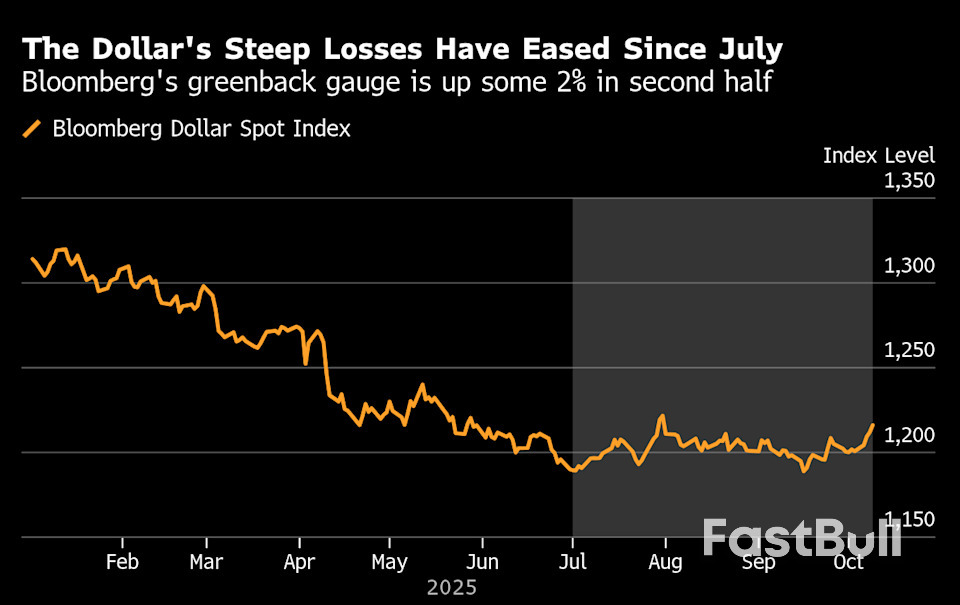

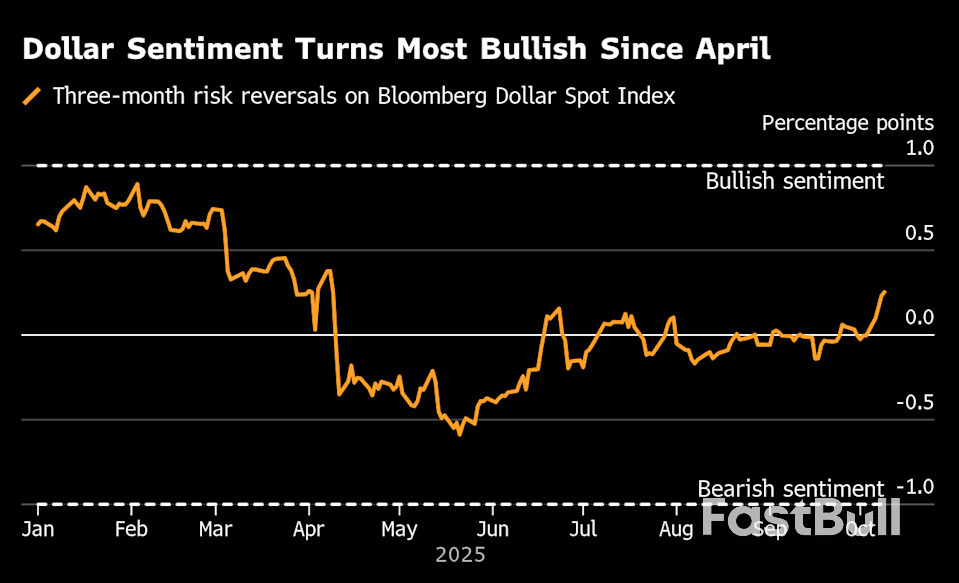

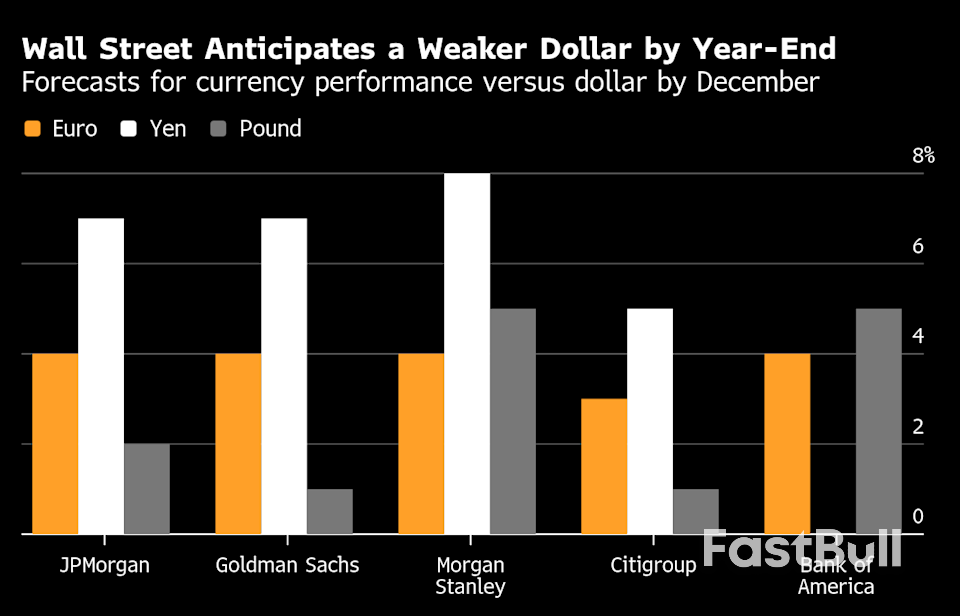

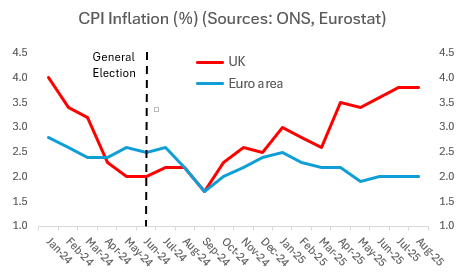

The dollar’s rebound is squeezing bearish investors as it hits a two-month high despite the U.S. shutdown. Weak yen and euro, steady U.S. economy, and cautious Fed signals are fueling renewed dollar strength.

The yen stabilised on Friday but was still headed for its steepest weekly drop in a year on Friday, as the chances of a near-term rate hike faded, while the euro was rooted near two-month lows by political crisis in France.

The yen edged up 0.2% to 152.7 per U.S. dollar, still close to its weakest since mid-February and heading for a 3.5% drop in the week, its biggest decline since last October.Its drastic drop has been spurred by concerns that the Bank of Japan may not hike interest rates again this year after fiscal dove Sanae Takaichi's surprise victory to lead the ruling party, stoking worries of Japanese authorities needing to step in to support the yen.Japanese Finance Minister Katsunobu Kato said on Friday that the government was concerned about excessive volatility in the foreign exchange market. Takaichi said on Thursday she did not want to trigger excessive declines in the yen.

"The Ministry of Finance is very sophisticated, they're very experienced, and I think they would use verbal intervention beforehand. And in a way, I think they have," Rabobank chief strategist Jane Foley said.

Takaichi said on Thursday that the BOJ is responsible for setting monetary policy but that any decision it makes must align with the government's goal.

She looked set to become Japan's first female prime minister in a parliament vote that was expected on October 15. But the date will be likely pushed back after the Liberal Democratic Party's junior coalition partner Komeito pulled its support, breaking their 26-year-old alliance.Traders are currently pricing an about 45% chance of a rate hike from the BOJ in the December meeting and are only fully pricing in a 25-basis-point hike in March.

The euro headed for its biggest weekly decline in 11 months, but managed to hold steady at $1.1564, near its lowest for two months. Political turmoil in France has weighed heavily on the single currency in the last week.

President Emmanuel Macron is searching for yet another prime minister, hoping his next pick - the sixth in under two years - can steer a budget through a legislature riven by crisis.

The political paralysis has made it deeply challenging to pass a belt-tightening budget and has made investors increasingly worried about France's yawning deficit, on top of evidence of slowing momentum in other key economic engines such as Germany.

"The data from Germany's not good, and therefore I think that makes the euro a little bit more susceptible to wobbles on the French news," Rabobank's Foley said.

As a result, the dollar index , which measures the U.S. currency against six others, neared two-month highs around 99.39 and headed for a weekly rise of 1.7%, its biggest in a year.

"The recent dollar rally has gone against market positioning and prompted a partial covering of USD shorts," said Chris Weston, head of research at Pepperstone.

"There remains a high degree of scepticism that the USD can materially push through 100, a level in the dollar index that was quickly reversed in May," he said in a note.

With the U.S. government shutdown continuing and little to no economic data for investors to parse through for clues on the path the Federal Reserve is likely to take, markets are keeping an eye on comments from policymakers.

The influential New York Federal Reserve President John Williams signalled on Thursday he would be comfortable with cutting interest rates again, despite some policymakers' qualms about rising inflation that suggest such a decision would not be easily made.

Traders are pricing in a 95% chance that the Federal Reserve cuts rates by 25 bps at its October meeting, while the odds of an additional cut in December have dropped to 80%, from 90%, in the past week, according to the CME Group's FedWatch Tool.

Germany said China’s increasing restrictions of exports on minerals critical to the technology industry are of “great concern” and the country must reduce its dependence on supplies from outside of the European economic area.

While it’s too soon to assess the impact of China’s latest curbs, “the issue is now being discussed intensively at both national and EU level,” a spokeswoman for the Economy Ministry said in an emailed response to Bloomberg’s questions.

Europe is caught in the middle of tense trade negotiations between the US and China ahead of a high-stakes meeting this month between Donald Trump and Xi Jinping. Beijing on Thursday unveiled sweeping new restrictions on rare earths, requiring exports of products with even trace amounts of the materials to have a license. China’s move is seen as a reaction to Washington’s export regime, which bans Chinese companies from accessing much of the cutting-edge technology made by the US and its allies.

The German economy ministry is in close contact with the companies affected, and is speaking to the European Commission and other European partners, it said. “The aim is to achieve a coordinated European approach,” the spokeswoman said in the statement. The German government’s goal is to increasingly relocate steps in raw material extraction and processing back to the European economic area, she said.

Singapore's central bank has a unique method of managing monetary policy, tweaking the exchange rate of its dollar instead of changing domestic interest rates like most other economies.The Monetary Authority of Singapore (MAS) sets the path of what it calls the policy band of the Singapore dollar nominal effective exchange rate (S$NEER), thus strengthening or weakening the local currency against those of its main trading partners.

Singapore is a small and trade-reliant economy. Gross exports and imports of goods and services in the city-state are more than three times its gross domestic product (GDP). Meanwhile, almost 40 cents of every Singapore dollar spent domestically is on imports.Given such a setting, the exchange rate has a much stronger influence on inflation than domestic interest rates.For example, if the Singapore dollar appreciates against currencies of major trading partners, it will reduce prices of imported goods and services. This dampens the prices that households have to pay.

The S$NEER is an index made up of bilateral exchange rates between Singapore and its major trading partners.The index is a trade-weighted exchange rate, where weights are assigned to the various currencies of Singapore's major trading partners based on the importance of the trade relationships.The central bank says this allows the Singapore dollar to perform collectively in relation to its major trading partners, which is what matters for general price levels in Singapore.

MAS does not set the precise level of the exchange rate or control it in real time. Instead, the S$NEER is allowed to move up and down within a policy band, the exact levels of which are not disclosed. If it goes out of this band, the MAS steps in by buying or selling Singapore dollars.The policy band has three parameters that the MAS can adjust. Until 2024, these parameters were reviewed at least twice a year, typically in April and October.Additional reviews can be held if conditions demand an immediate change in settings, such as in 2022 when high inflation triggered two off-cycle moves.

From 2024, the central bank started making monetary policy announcements every quarter instead of semiannually, saying it allowed policymakers to provide their assessment of the economic outlook in a timelier fashion.

The three policy levers are the slope, the level and the width of the band.

Adjusting the slope will influence the pace at which the Singapore dollar strengthens or weakens.Adjusting the level, or mid-point, of the policy band allows for an immediate strengthening or weakening of the S$NEER, making this a tool for drastic situations such as a recession.

By widening the policy band, the MAS can allow for more volatility of the S$NEER.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up