Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Thailand is considering eliminating tariffs on additional U.S. imports and preparing $6.1 billion in soft loans to cushion its economy, as it seeks to avert a looming 36% U.S. tariff set to take effect August 1....

Japan's central bank may face political pressure to keep interest rates low for longer than it wants, as opposition parties favouring tax cuts and loose monetary policy are expected to gain influence after a July 20 election.

Opinion surveys suggest Prime Minister Shigeru Ishiba's coalition may lose its majority in the upper house of parliament, forcing it to court an array of smaller parties pushing for easier fiscal and monetary policy.

The governing bloc led by Ishiba's Liberal Democratic Party is already a minority in the more powerful lower house, so a stalemate in both chambers could give opposition parties outsized influence in policy decisions.

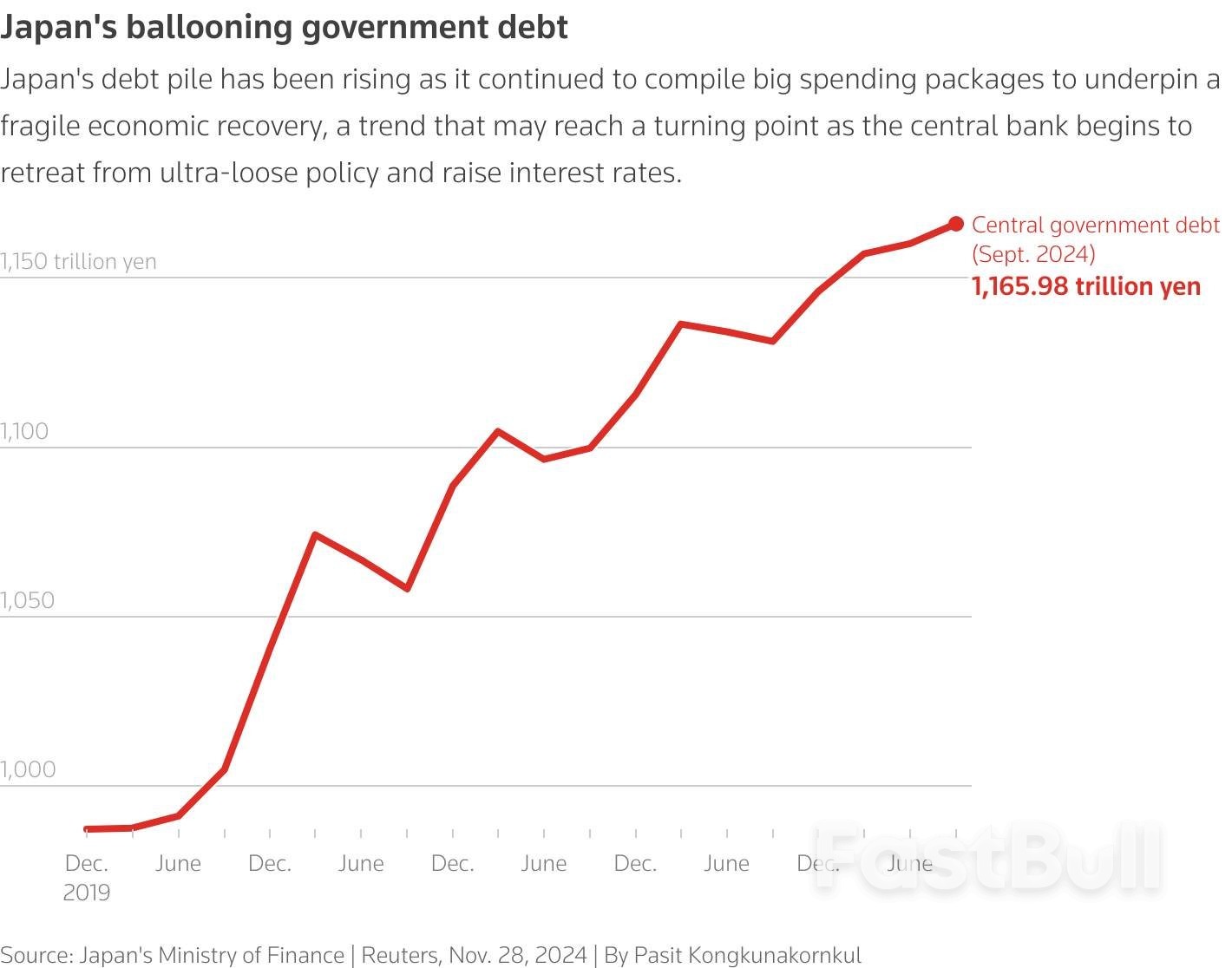

Ishiba has supported the Bank of Japan's policy of gradually lifting interest rates from near zero as inflation picks up in the world's fourth-biggest economy, while trying to curb the biggest government debt burden in the industrial world.

But if opposition groups gain traction with their pressure on the BOJ to avoid rate hikes and for the government to cut the sales tax, that could boost bond yields and complicate the bank's efforts to normalise monetary policy, some analysts say.

The BOJ declined to comment on the potential impact of the election on monetary policy.

"There's a 50% chance the ruling coalition could lose its majority in the upper house, which could lead to increased debate about cutting Japan's consumption tax rate," said Daiju Aoki, chief Japan economist at UBS SuMi Trust Wealth Management.

"That would push up Japan's long-term interest rates by stoking concern over the country's finances," he said.

Sohei Kamiya, head of the upstart right-wing party Sanseito, has criticised the BOJ for slowing its bond buying when the economy remains weak.

"The Ministry of Finance and BOJ should work hand in hand in taking aggressive steps for a few years to boost domestic demand," Kamiya told a press conference this month.

Another small group, the Japan Innovation Party, wants the BOJ to go slow in raising rates to restrain the cost of interest on the government's debt.

Yuichiro Tamaki, head of the Democratic Party for the People, a party seen as a strong candidate to join Ishiba's coalition, has urged the BOJ to loosen, not tighten, monetary policy to keep the yen from rising and hurting the export-reliant economy.

Even if the coalition keeps its majority, Ishiba may need to ditch his hawkish fiscal tilt and boost spending to cushion the economic blow from threatened U.S. tariffs and rising costs of living.

"There's a good chance the government will compile an extra budget to fund another spending package to the tune of 5 to 10 trillion yen ($35 billion-$70 billion). That would push up bond yields further," said former BOJ board member Makoto Sakurai, who expects the central bank to avoid raising rates at least until March.

Japan's public debt is equal to 250% of gross domestic product, far above that of Greece at 165%. The government spends nearly a quarter of its budget to finance a 1,164-trillion-yen ($7.9-trillion) debt pile, with the cost expected to rise steadily as the BOJ exits zero-interest rates.

To be sure, inflation - above the BOJ's 2% target for three years - boosts nominal tax revenues, which can help the government avoid ramping up bond issuance to fund further spending.

But cutting the sales tax rate, an idea Ishiba has ruled out for now, would leave a bigger hole in Japan's finances. Once a fringe idea, cutting the 10% sales tax is now among Japan's most popular economic policy proposals.

In a recent poll by the Asahi newspaper 68% of voters thought a sales tax cut was the best way to cushion the blow from rising living costs, compared with 18% who preferred cash payouts.

If the sales tax is on the chopping block after the election, it is the kind of vital issue that could prod Ishiba to dissolve the lower house and call a snap election - a move that would prolong political uncertainty.

If Ishiba were to step down, an LDP race to replace him could revive market attention to candidates like Sanae Takaichi, an advocate of aggressive monetary easing whom Ishiba narrowly beat in the party's leadership race last year.

Unlike Ishiba, who gave a quiet nod to BOJ policy normalisation, Takaichi has said it would be "stupid" for the central bank to raise rates.

All this would mean the BOJ's rate hikes, already on pause due to uncertainty over U.S. tariffs, could be put on hold even longer.

"We may need to brace for a long period of political uncertainty and market volatility," said Naomi Muguruma, chief bond strategist at Mitsubishi UFJ Morgan Stanley Securities.

"That would just give the BOJ another reason to sit on the sidelines and wait for the dust to settle."

New Zealand retail card spending fell in the second quarter, adding to signs that an initial spurt of economic growth early this year has all but disappeared.

Purchases on debit and credit cards at retail stores fell 0.7% from the first quarter, when it was unchanged, Statistics New Zealand said Monday in Wellington. The value of spending is lower than in the year-earlier quarter when the economy was entering a deep depression.

Sluggish consumer spending mirrors recent data showing the services and manufacturing industries remained in contraction in the month of June. The slowdown in domestic demand suggests gross domestic product barely expanded in the second quarter after 0.8% growth in the three months through March.

Sentiment is being challenged by a soft housing market, rising unemployment and a high cost of living. While home-loan interest rates are falling, many borrowers on fixed-terms are yet to get the full benefit until their mortgages roll over later this year, and are watching their budgets closely.

Today’s report showed spending on discretionary items such as hospitality, apparel, motor vehicles and durable goods such as appliances fell in the quarter. Purchases of consumable items such as groceries gained.

Household confidence may also be dented by the Reserve Bank’s decision last week to keep the Official Cash Rate unchanged at 3.25%, although policymakers did signal further cuts are expected.

At the same time, business confidence has been buffeted by uncertainty over US tariff policies and their impact on global economic growth.

Earlier Monday, Business New Zealand and Bank of New Zealand reported that the services industry contracted for a fifth straight month while the organizations last week said manufacturing had shrunk for a second consecutive month.

“The time line for New Zealand’s long-awaited economic recovery just keeps getting pushed further and further out,” said Doug Steel, senior economist at BNZ in Wellington. He expects GDP contracted in the second quarter.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up