Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Discover key insights from the ten year gold price chart (2015–2025). Explore long-term trends, major economic drivers, and smart investment strategies.

The Ten Year Gold Price Chart reveals how global events, inflation, and interest rates shaped gold’s value from 2015 to 2025. By studying decade-long price movements, investors can identify key trends, understand market cycles, and make more informed decisions about long-term portfolio diversification.

Gold has experienced dramatic swings over the past decade, shaped by global economic cycles, inflation fears, and shifting interest rates. The gold price chart last 10 years highlights how major geopolitical events — from trade wars and the pandemic to rising central bank demand — have influenced investor sentiment and market direction.

The decade-long pattern shows that gold remains a reliable store of value during crises and a portfolio diversifier when equity markets face turbulence. Studying the gold price chart last 10 years helps investors understand how macroeconomic shifts, monetary policy, and global sentiment align to drive long-term performance.

Key takeaways:

Understanding the Ten-Year Gold Price Chart requires more than just tracking numbers — it means interpreting the economic, political, and financial forces that shape gold’s long-term trajectory. Below are the key factors driving gold prices and the practical steps to analyze the trend over the past decade.

Several macroeconomic and market dynamics determine how gold performs over time. When reading the gold price chart last 10 years, investors should pay attention to the following factors:

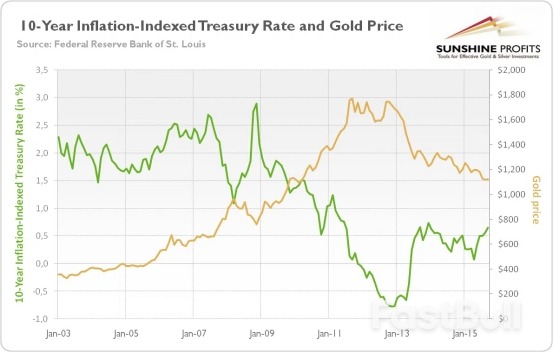

Gold typically moves in the opposite direction of interest rates. When rates fall or remain low, the opportunity cost of holding gold decreases — boosting demand and prices. Conversely, higher rates strengthen bonds and currencies, often pressuring gold.

Interest Rate vs Gold Price Chart (2015–2025)

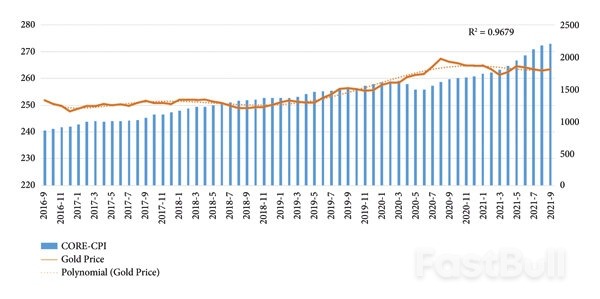

Gold is a classic hedge against inflation. During periods of rising consumer prices, investors turn to gold to preserve value. The inflation vs gold price chart over the past decade shows that gold tends to rally when inflation expectations surge. Overlay chart comparing CPI (Consumer Price Index) with gold price trends

A strong dollar often suppresses gold prices since the metal is priced in USD. When the dollar weakens, foreign investors can buy gold more cheaply, fueling demand.

Events such as wars, trade disputes, and financial crises trigger “safe-haven” buying. Each major global shock — from Brexit to the 2020 pandemic — has left visible spikes on the chart for gold prices for 10 years.

Central banks diversifying away from the dollar, along with ETF inflows, have supported long-term demand. A sustained increase in global gold reserves is often a bullish indicator.

To interpret the Ten-Year Gold Price Chart (2015–2025) effectively, follow these analytical steps:

Mark the key cycles:

Look at whether each successive high and low is rising or falling.

Compare gold’s movement with interest rates, inflation, and USD strength.

Mark price zones where gold repeatedly bounces (support) or struggles to break higher (resistance) — such as $1,200, $1,800, and $2,050. Breakouts beyond these levels often signal major market shifts.

Use moving averages (50-day, 200-day) and RSI or MACD to confirm trend strength. A crossover of short-term averages above long-term lines often indicates renewed bullish sentiment.

Monitoring the gold price chart in real time is crucial for investors who want to link short-term price action with long-term performance. By combining a live feed with the 10 year gold price chart, traders gain both context and precision — understanding whether today’s movement fits within a decade-long trend or signals a potential reversal.

Gold prices respond instantly to shifts in global interest rates, inflation expectations, and geopolitical risk. A real-time view complements the 10 year chart of gold prices, revealing how intraday fluctuations fit into broader market cycles.

Real-time tracking helps investors:

Modern tools make following both real-time data and long-term charts effortless:

When viewing live gold charts, integrate them with the 10 year gold price chart to separate noise from trend:

Short-term data shows momentum; long-term charts show conviction. By merging real-time monitoring with the 10 year gold price chart, investors can distinguish temporary volatility from structural shifts — the key to smarter portfolio timing and diversification.

Gold prices have risen roughly 60–70% over the last decade, reflecting strong demand during periods of inflation and global uncertainty.

The average annual return has been around 5–6%, depending on inflation and interest rate trends.

Yes — analysts view gold as a long-term hedge against inflation, currency risk, and market volatility. However, returns may vary with global economic cycles.

The Ten Year Gold Price Chart reveals how gold has evolved through changing interest rates, inflation cycles, and global events. By understanding long-term trends and tracking real-time data, investors can make informed, resilient portfolio decisions for the decade ahead.

The U.K. economy returned to modest growth in August, after flatlining the prior month, in what could be seen as a helpful boost for Chancellor Rachel Reeves as she prepares to deliver the autumn budget.

Data released earlier Thursday by the Office for National Statistics showed that U.K. gross domestic product grew by 0.1% in August on a monthly basis, following no growth in July.

On an annual basis, the U.K. economy expanded by 1.3% in August, a small downward adjustment from the 1.5% growth seen the previous month, which has been revised higher from the original 1.4% growth seen.

The ONS also reported that GDP grew by 0.3% in the three months to August 2025 compared with the three months to May 2025, a slight increase following growth of 0.2% in the three months to July 2025.

British finance minister Rachel Reeves is set to announce her latest decisions on taxation next month, and, despite raising taxes by about £40 billion in her first budget last year, faces having to find around £22 billion to meet her rule that day-to-day spending is in balance with tax revenues by the end of the decade, according to estimates by the Institute for Fiscal Studies.

Her options on November 26 are complicated by her promise to voters in the 2024 election that she would not raise the main rates of taxation on them.

Increases in taxation threaten cutting off any meager growth the country has to offer, and could complicate the Bank of England’s monetary policy decisions at its meeting early next month.

This meeting will include a decision on the base rate, with the previous meeting on September 18, resulting in the rate being held at 4.00%.

“Issues remain in the U.K.. Inflation remains high, as do interest rates, as the Bank of England awaits assurance that inflation is under control before cutting further,” said Michael Field, chief equity strategist at Morningstar.

The European Central Bank should hold interest rates steady unless new shocks hit, Slovenia’s acting central bank chief said, pushing back on arguments that inflation could fall too low without further easing.

The ECB has cut interest rates by 2 percentage points in the year to June but has been keeping them steady since, debating whether tariffs, Germany’s fiscal splurge or a strong euro would pull prices away from its 2% target.

"Inflation risks are balanced around the baseline scenario," Primoz Dolenc told Reuters in an interview.

"If there are no new economic shocks, I think that leaving the monetary policy stance as is would be the right thing to do going forward," he argued. "It’s a stance that neither fuels inflationary pressures nor restricts economic growth."

Markets see close to no chance of another rate cut this year and see just a one in two chance of a cut by June, a sharp contrast with the U.S. Federal Reserve, which is expected to cut rates at both of its remaining meetings this year.

Dolenc also cautioned against putting too much emphasis on ECB projections far into the future, including the initial 2028 forecast due in December, as they are prone to revisions over time.

"However, if such estimates over time prove to be robust, then this might be justification for monetary policy action," said Dolenc, who has been heading the central bank all year as political gridlock is preventing the appointment of a permanent governor.

Advocates of further policy easing argue that inflation could undershoot the target as political turmoil in France will weigh on growth, the strong euro curbs imported inflation and Chinese firms, facing sharply higher tariffs in the U.S., could dump surplus goods in Europe.

But Dolenc pushed back on each of these points, arguing that growth and inflation were both on a good track, even if uncertainty was unusually high.

He acknowledged that French turmoil could push up interest rates and spreads in case of escalation but there has been nothing disorderly or unwarranted in market movements so far. In any case, the ECB has all the tools it needs to fight turmoil, if it threatened its mandate, Dolenc said.

France has been in political turmoil for weeks as a shaky government is trying to consolidate public finances via unpopular tax hikes and spending cuts, reining in a budget that has been on an unsustainable course for years.

Chinese dumping has not been a problem either and the euro’s course has not significantly deviated from the long-term equilibrium in the exchange rate, Dolenc said.

"So far there has been no evidence of major shifts in Chinese exports to Europe, but we need to stay vigilant because this could potentially have an effect on inflation," Dolenc said.

Japan told its G7 counterparts that policymakers must be vigilant against excessively volatile and disorderly moves in the currency market, Finance Minister Katsunobu Kato said on Wednesday.

Kato also said he confirmed with US Treasury Secretary Scott Bessent an agreement made last month on exchange-rate policy during bilateral talks, held on the sidelines of the G7 and G20 finance leaders' gathering in Washington.

"We've seen some rapid yen falls since last week. It's desirable for exchange rates to move stably. We are vigilant to any excessive volatility in the currency market," Kato told reporters.

The yen has whipsawed in recent days due in part to Japan's political uncertainty, as new ruling party leader Sanae Takaichi's bid to become the country's first female prime minister was thrown into doubt when her ruling party's junior coalition partner quit.

Kato said he would not comment on what was driving recent exchange-rate moves when asked how Japan's political turmoil was affecting yen moves, but said in general that political stability was desirable for the economy.

In a joint statement issued last month, Japan and the US reaffirmed their commitment to "market determined" currency rates, while agreeing that foreign exchange interventions should be reserved for combating excess volatility.

A weak yen has become a political pain point for Japanese policymakers, as it inflates the cost of living for households by boosting import prices for raw material and fuel.

The Bank of Japan's (BOJ) exit from a decade-long, massive stimulus last year and past two interest rate hikes came in the wake of political calls for measures to combat sharp yen falls.

While sticky food inflation has led some hawkish board members to call for a near-term rate hike, the BOJ has kept rates steady since raising them to 0.5% in January, as it focuses on scrutinising downside risks to the economy from US tariffs.

"It's something the BOJ ought to decide," Kato said when asked how the central bank should respond to rising living costs from a weak yen.

While the weak yen and rising crude oil prices likely played a part in driving up prices in the past few years, it was hard to judge how yen falls were affecting prices recently, he added.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up