Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Those searching for evidence of the Trump administration’s tariffs on imported goods in the economic data have been left wanting.

Those searching for evidence of the Trump administration’s tariffs on imported goods in the economic data have been left wanting.

Inflation in April as measured by the Consumer Price Index was under control, rising 0.22% overall and 0.24% when excluding food and inflation. Both were in line with economists’ estimates and roughly consistent with the Federal Reserve’s targets. On a three-month annualized basis, inflation was 1.6% overall and 2.1% for the core rate.

The White House and defenders of its trade strategy celebrated the results as evidence there will be little to no economic hardships from tariffs. To be sure, it’s way too early to declare victory. Let’s give the economy a few more months before we pop the champagne.

Even before the temporary trade détente earlier this month with China, I was slightly less pessimistic of the effect of tariffs on the economy than many observers who were calling for a recession to start this year while also staying sober about the risks. That said, it may take several months to see the fuller impact of tariffs in the data, which is often reported with a lag.

Not since the 1930s has the effective tariff rate been as high as it is now at 18% implied by current policy, so the US has little recent experience to draw on when it comes to high overall tariffs. We do know, however, based on experience over the last decade with tariffs on individual products that it can take months for the effect to show up in economic data. In January 2018, the first Trump administration announced levies on imported washing machines ranging from 20% to 50%. Spending on such goods immediately surged 3.6%, as consumers tried to beat the tariffs, but it wasn’t until April that the CPI for laundry equipment rose substantially, more than two months after the tariff was announced.

There is reason to believe that might happen again. Especially with durable goods, retailers will often burn through pre-tariff inventory first before turning to higher-cost, post-tariff inventory. Consumers try to front-run tariffs, increasing purchases before they go in effect and reducing them just after tariffs hit. New orders made after the tariff may take weeks due to shipping times. All these factors lead to delays to the levies being reflected in new data.

Another is because tariffs often don’t typically ramp up to full strength immediately, due to delays in the collection of levies or pauses tied to pending trade talks. This is currently the case. Based on actual federal tariff revenue, the average effective rate in April was about 4.5% and preliminary data for May suggests it was around 6.5%. Current tariff policy, even after the China “pause,” suggests an average rate of 16% to 18% (and 21% to 22% if President Donald Trump follows through on his threat of 50% tariffs on the European Union). In other words, tariffs weren’t biting at full strength in April or May, which means it will likely still be hard to see signs of the effect of tariffs in the May economic data.

Nevertheless, we have seen some signs in the data consistent with tariffs, if not dispositive yet.

First, the CPI was more of a mixed bag with regards to tariffs rather than a solid rebuttal. Apparel prices fell by 0.2% in April, which is telling given how much apparel the US imports, from China in particular. But electronics and furniture prices — goods also highly exposed to tariffs — rose 0.75% and 1.5%, which are unusually big increases for those categories.

Tariffs are likely also showing up in more high frequency price data. Findings scraped from large US online retailers and compiled by economists Alberto Cavallo, Paola Llamas, and Franco Vazquez suggest that domestic-origin goods prices are up roughly half a percent since early March, while foreign-origin goods prices are up more than two percent. The timing of these price increases lines up almost exactly with White House tariff announcements in March and April.

The potential presence of tariffs in the economic data is not limited to prices. Inflation-adjusted retail sales jumped 1.9% in March but fell 0.1% in April. Industrial production meanwhile has been weak, falling 0.25% in March and then coming in essentially flat for April. New orders for manufactured durable goods plunged 6.3% in April, their biggest slide since January 2024, after spiking 7.6% in March.

Monthly data are volatile so neither of these are dispositive. The first estimate of real gross domestic product growth for the first quarter was weak at negative 0.3%, though this was mainly due to timing shifts of consumers and businesses around tariffs rather than any direct effects.

It's tempting to draw sweeping conclusions from the first few months of data, but history and economics both call for patience. Tariffs have a way of creeping into the numbers with a lag, and we haven’t seen policy like this in almost 100 years. For now, the prudent approach is to watch the data unfold, remain humble about what we know, and resist the urge to draw conclusions.

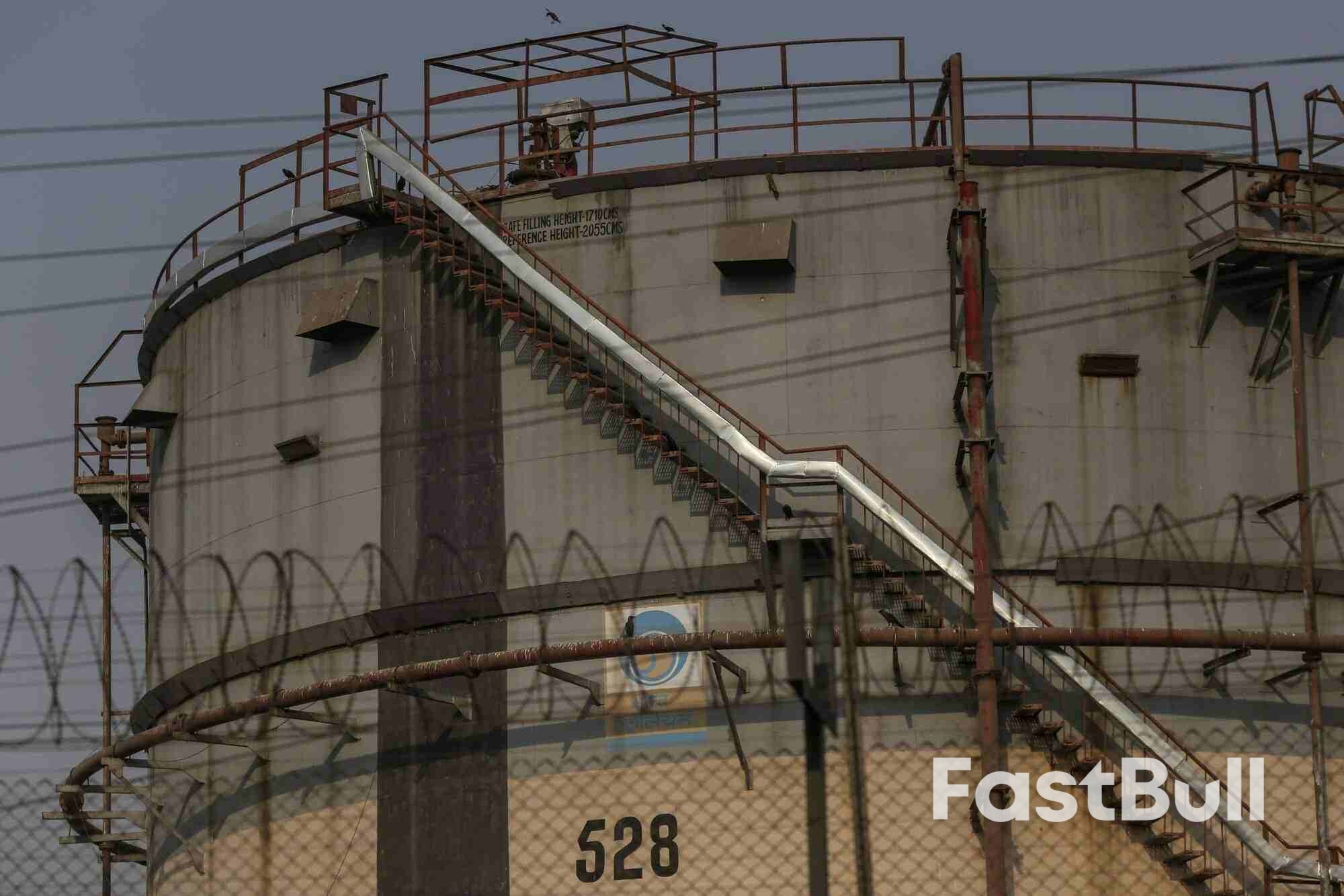

Oil edged higher in a choppy session as the market juggled the outlook for more OPEC+ supply and the risk of additional US sanctions on Russia.

Brent traded above $64 after closing 1% lower on Tuesday. OPEC+ will gather online on Wednesday to review production quotas for this year and next, before eight key members decide at the weekend whether to bolster output again in July.

Members held preliminary talks last week on making a large production hike for a third consecutive month, according to delegates.

President Donald Trump, meanwhile, warned in a social media post on Tuesday that Russian leader Vladimir Putin was “playing with fire” as the US weighed whether to target Moscow with additional sanctions.

The ramp up of idled production by OPEC and its allies has stoked fears about oversupply and added to the pressure on prices. Parts of the futures curve for Brent are in contango — a bearish structure that signals ample supply.

“From a macro perspective, it is a wait and see game in terms of risk appetite, with oil hesitant to follow higher equities even as long-dated US and Japanese yields came down,” said Harry Tchilinguirian, group head of research at Onyx Capital Group. “Right now there are downside fundamentals to the flat price, with the possibility of another voluntary cut unwind from OPEC.

Oil has trended lower since mid-January, with sweeping tariffs from the Trump administration and retaliatory measures from targeted countries adding to bearish headwinds, raising concerns over an economic slowdown. However, there has been some signs recently of easing trade tensions.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up