Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Tech stocks lifted the S&P 500 and Nasdaq, with Nvidia leading gains, but weak ADP job data dampened sentiment and raised pressure on the Fed. Traders now eye Friday’s key payroll report.

Daily Hewlett Packard Enterprise Company

Daily Hewlett Packard Enterprise CompanyHaving surged overnight and extended gains on a big crude draw (and trade-talk progress with the Europeans), oil prices are tanking now as Bloomberg reports that, according to people familiar with the matter, Saudi Arabia wants OPEC+ to continue with accelerated oil supply hikes in the coming months as it puts greater importance on regaining lost market share.

The kingdom, which holds an increasingly dominant position within OPEC+, wants the group to add at least 411,000 barrels a day in August and potentially September, the people said, asking not to be named because the information was private.

Riyadh is keen to unwind its cuts as quickly as possible to take advantage of peak demand during the northern hemisphere summer, one person said.

The reaction was instant, slamming WTI down 2%...

We would imagine Russia will not be pleased at this outburst (or the US shale producers or the Kazakhs), but Trump might be happy with what his old friends in The Kingdom are saying (and doing).

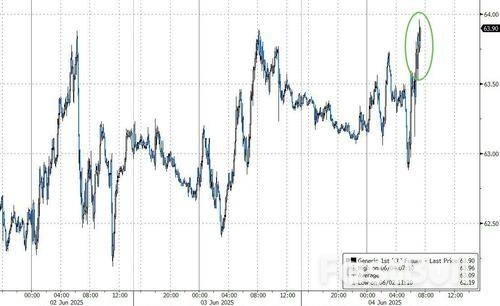

Crude prices are higher this morning on signs of progress in trade talks between the US and EU and the API report of a major drawdown in American crude inventories (despite product builds).

Geopolitical tensions continue to drive prices more aggressively as the possibility of a Putin-Zelensky meeting came and went and Iranian peace deal talks stumble.

The big question for traders is - will the official data confirm API's drawdown?

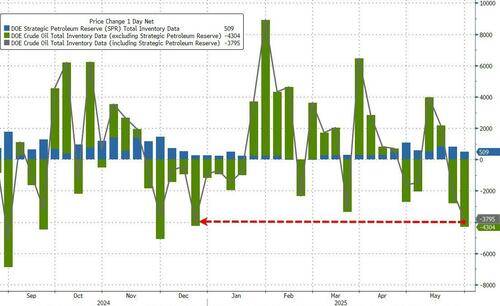

Crude -3.28mm

Cushing +952k

Gasoline +4.73mm

Distillates +761k

Crude -4.30mm

Cushing +576k

Gasoline +5.22mm

Distillates +4.23mm

The official data confirmed API's report with a large crude draw offset by big draws in products...

Even including the 509k barrel addition to the SPR, total crude stocks fell by the most since December...

The rig count continues to slide (now at its lowest since Dec 2021), and despite Trump's 'Drill, Baby, Drill' push, US crude production remains well of its highs...

WTI extended gains after the official data confirmed API's...

Oil rose at the start of the week after a decision by OPEC+ to increase production in July was in line with expectations, easing concerns over a bigger hike.

However, prices are still down about 11% this year on fears around a looming supply glut, while traders continue to monitor US trade tariffs as President Donald Trump said his Chinese counterpart is “extremely hard” to make a deal with.

Saudi Arabia led increases in OPEC oil production last month as the group began its series of accelerated supply additions, according to a Bloomberg survey.

Nevertheless, the hike fell short of the full amount the kingdom could have added under the agreements.

The nonpartisan Congressional Budget Office on Wednesday lowered its estimate of how much President Donald Trump's tax-cut and spending bill will add to the national debt, saying it would add about $2.4 trillion to the $36.2 trillion pile.

Its assessment comes a day after key Trump ally Elon Musk blasted the bill as a "disgusting abomination," giving fresh support to Republican deficit hawks who have been pushing back against the measure.

An earlier CBO estimate predicted the Republican bill, which passed on May 22 with no Democratic support, would add around $3.8 trillion to Washington's debt over the next decade.

The House-passed bill would reduce the federal government's revenues by $3.67 trillion over a decade, the CBO forecasted, while reducing spending by $1.25 trillion.

The number of people in the United States without health insurance would increase by 10.9 million by 2034 due to policy changes in the House bill, the CBO said. Of that number, an estimated 1.4 million people would be undocumented immigrants who no longer would be covered in programs funded by the states.

The CBO update does not include a forecast on the potential macroeconomic effects of the legislation, which will be forthcoming. Republicans argue that extending existing tax cuts and adding new breaks, which are included in the House bill, would further stimulate the economy.

They made similar arguments in 2017 that the tax cuts would pay for themselves by stimulating economic growth, but the CBO estimates the changes increased the federal deficit by just under $1.9 trillion over a decade, even when including positive economic effects.

The 1,100-page bill would extend corporate and individual tax cuts passed in 2017 during Trump's first term in office, cancel many green-energy incentives passed by Democratic former President Joe Biden and tighten eligibility for health and food programs for the poor. It also would fund Trump's crackdown on immigration, adding tens of thousands of border guards and creating the capacity to deport up to 1 million people each year. Regulations on firearm silencers would be loosened.

Democrats blast the bill as disproportionately benefiting the wealthy while cutting benefits for working Americans. The measure is now awaiting action in the Senate.

The new CBO estimate takes into account late changes that were made to the bill as Republican leaders steered it to passage.

The White House and top congressional Republicans tried to play down the objections of Musk, who joined Trump's team with brash promises of cutting $2 trillion in spending from the federal budget, but left last week having accomplished a small fraction of that.

Republican Senate Majority Leader John Thune, speaking to reporters, tried to minimize the damage, saying, "We obviously respect everything that Elon did with DOGE. On this particular issue, we have a difference of opinion."

The updated analysis is expected to help guide the Republican-controlled Senate, which is now grappling with putting together its own version of the legislation in coming weeks.

With Republicans holding a narrow 53-47 Senate majority, warring camps within the party are vying for changes to the House-passed bill. Some have been pushing to scale back the more than $700 billion in savings to Medicaid or to remove costly Trump-backed tax cuts for those earning overtime pay and tipped wages or income from Social Security retirement payments.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up