Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

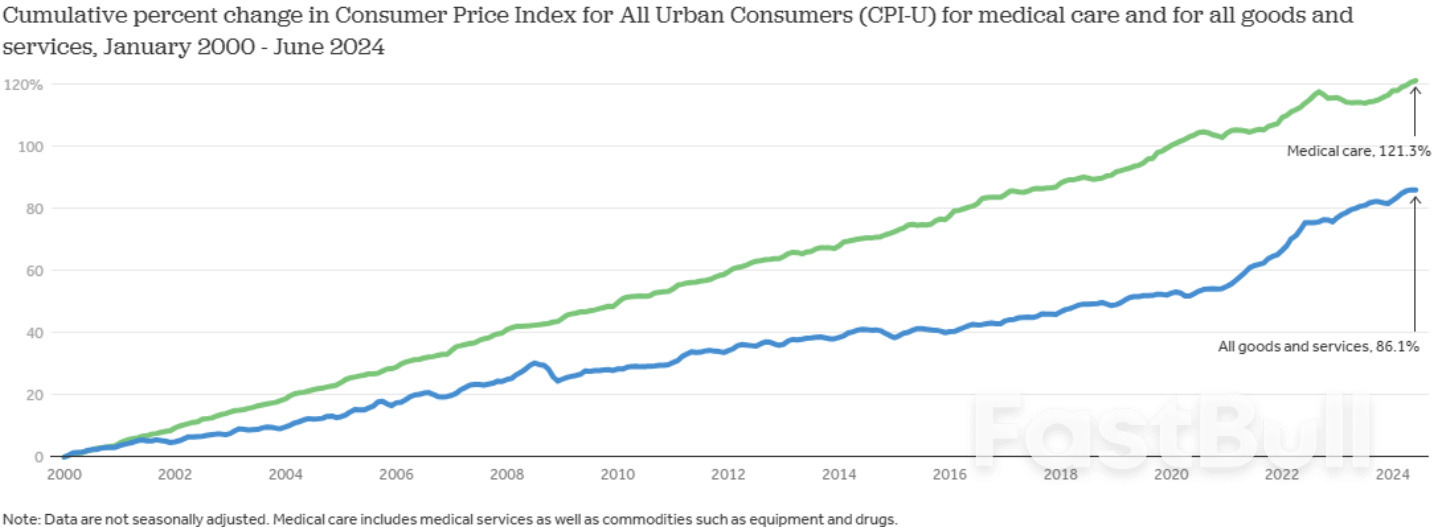

South Korea’s GDP contracted by 0.246% in Q1 2025—the steepest decline among 19 major economies—primarily due to weakened domestic consumption driven by high prices and household debt....

U.S. President Donald Trump signed a wide-reaching executive order on Monday directing drugmakers to lower the prices of their medicines to align with what other countries pay that analysts and legal experts said would be difficult to implement.

The order gives drugmakers price targets in the next 30 days, and will take further action to lower prices if those companies do not make "significant progress" towards those goals within six months of the order being signed.

Trump told a press conference that the government would impose tariffs on companies if the prices in the U.S. did not match those in other countries and said he was seeking cuts of between 59% and 90%.

"Everybody should equalize. Everybody should pay the same price," Trump said.

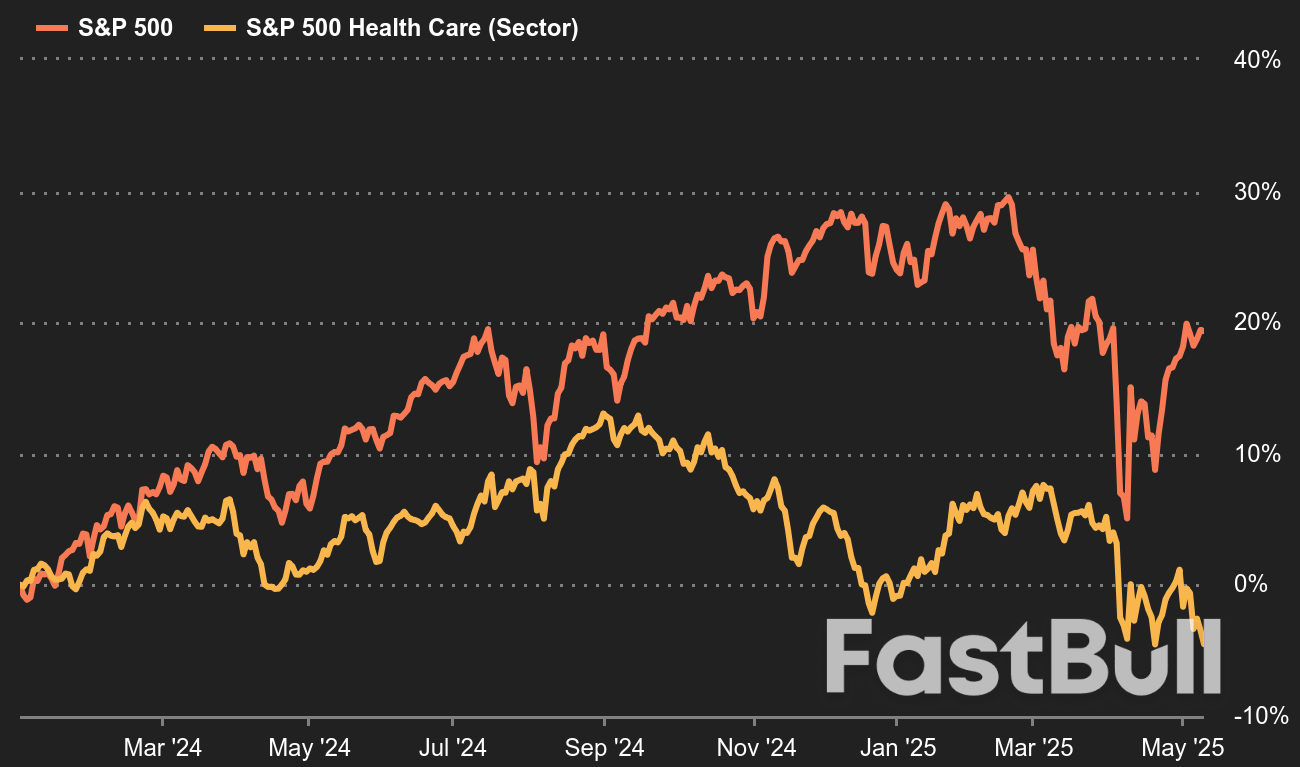

Investors were skeptical about the order's implementation, and shares, which had been down overnight on the threat of "most favored nation" pricing, recovered and rose in early morning trade on Monday.

The United States pays the highest prices for prescription drugs, often nearly three times more than other developed nations. Trump tried in his first term to bring the United States in line with other countries but was blocked by the courts.

Trump's drug pricing proposal comes as the president has sought to fulfill a campaign promise of tackling inflation and lowering prices for a host of everyday items for Americans, from eggs to the gas pump.

Trump said his order on drug prices was partly a result of a conversation with an unnamed friend who told the president he got a weight loss injection for $88 in London and that the same injection in the U.S. cost $1,300.

If drugmakers do not meet the government’s expectations, it will use rulemaking to bring drug prices to international levels and consider a range of other measures, including importing medicines from other developed nations and implementing export restrictions, a copy of the order showed.

Trade groups representing biotech and pharmaceutical decried the move.

"Importing foreign prices from socialist countries would be a bad deal for American patients and workers. It would mean less treatments and cures and would jeopardize the hundreds of billions our member companies are planning to invest in America," PhRMA CEO Stephen Ubl said in a statement.

Ubl said the real reasons for high drug prices are "foreign countries not paying their fair share and middlemen driving up prices for U.S. patients."

The order also directs the U.S. Federal Trade Commission to consider aggressive enforcement against what the government calls anti-competitive practices by drugmakers.

"We're all familiar with some of the places where pharmaceutical companies push the limits to prevent competition that would lower their prices," one White House official said, pointing to patent protections and deals drugmakers make with generic companies to hold off on cheaper copies.

The executive order is likely to face legal challenges, particularly for exceeding limits set by U.S. law, including on imports of drugs from abroad, said health policy lawyer Paul Kim. "The order's suggestion of broader or direct-to-consumer importation stretches well beyond what the statute allows," Kim said.

The FTC has a long history of antitrust enforcement actions against pharmaceutical and other healthcare companies. Trump last month ordered the FTC to coordinate with other federal agencies to hold listening sessions on anticompetitive practices in the drug industry. On Monday, he was expected to ask the FTC to consider taking enforcement action, sources said.

"President Donald Trump campaigned on lowering drug costs and today he’s doing just that. Americans are tired of getting ripped off. The Federal Trade Commission will be a proud partner in this new effort," said FTC spokesperson Joe Simonson.

Shares of major drugmakers, after initially falling during premarket trading, rallied on Monday, despite the wide-ranging order. Shares of Merck (MRK.N), opens new tab rose 5.2%, while Pfizer (PFE.N), opens new tab gained 3.2% and Gilead Sciences (GILD.O), opens new tab was up 6.7%. Eli Lilly (LLY.N), opens new tab, the world's largest drugmaker by market value, rose 2.4%.

The executive order differed from what drugmakers had been expecting. Four lobbyist sources told Reuters they were expecting an executive order that called for "most favored nation" pricing on a subset of Medicare drugs.

"Implementing something like this is pretty challenging. He tried to do this before and it was stopped by the courts," said Evan Seigerman, analyst at BMO Capital Markets.

The White House officials did not specify any targets.

Trump's order also directs the government to consider facilitating direct-to-consumer purchasing programs that would sell drugs at the prices other countries pay.

It also orders the Secretary of Commerce and other agency heads to review and consider actions regarding the export of pharmaceutical drugs or ingredients that may contribute to price differences. The Commerce Department did not immediately respond to a request for comment.

The European Central Bank is tipped to slash borrowing costs three more times this year, bringing its key deposit rate down to 1.5% by the end of 2025, according to analysts at Deutsche Bank.

But in a note to clients, the brokerage warned that there are "two-sided risks" to this estimate.

In one scenario, the implementation of partially-delayed U.S. tariffs leads to a "growth shock" in the eurozone, persuading the ECB to bring policy rates below the 1.5% level.

Another outcome revolves around broader economic "resilience" stopping an ongoing ECB rate easing cycle before borrowing costs dip to 1.5%.

"Our baseline continues to have the ECB cutting rates by 25 basis points in June, September and December," the analysts wrote.

They added that, due to ructions in stock and bond markets after Trump first announced his punishing tariffs in early April and the possibility that the tariffs could be "disinflationary" in the eurozone, the ECB recent easing cycle may continue and the 1.50% terminal rate might be reached in September.

Last month, the ECB cut interest rates as widely expected in an attempt to boost a eurozone economy that had been struggling even before the unveiling of U.S. President Donald Trump’s sweeping "reciprocal" tariffs.

Policymakers have also noted that both headline and core inflation declined in March, while services sector price gains have also cooled markedly over recent months -- potentially suggested that inflation could settle at around the ECB’s 2% medium-term target on a sustained basis.

The central bank slashed its benchmark deposit rate by 25 basis points to 2.25%, the seventh reduction in a year, while the interest rate on its main refinancing operations fell to 2.40% and its marginal lending facility dropped to 2.65%.

The eurozone economy has been building up some resilience against global shocks, the central bank said, but the outlook for growth has deteriorated owing to rising trade tensions.

Although Trump has postponed his elevated tariffs on the European Union, which includes many eurozone countries, other levies remain in place, such as universal 10% duties and tariffs on items like steel, aluminum and autos.

"Increased uncertainty is likely to reduce confidence among households and firms, and the adverse and volatile market response to the trade tensions is likely to have a tightening impact on financing conditions," the ECB said. "These factors may further weigh on the economic outlook for the euro area."

ECB officials have estimated that growth across the 20 countries that share the euro currency could fall by half a percentage point this year if the tariffs are eventually imposed.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up