Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

During a high-level economic forum in Seoul, South Korean Prime Minister Kim Min Seok committed to strengthening comprehensive cooperation with Vietnam, drawing parallels between South Korea’s own “Miracle on the Han River” and Vietnam’s development ambitions...

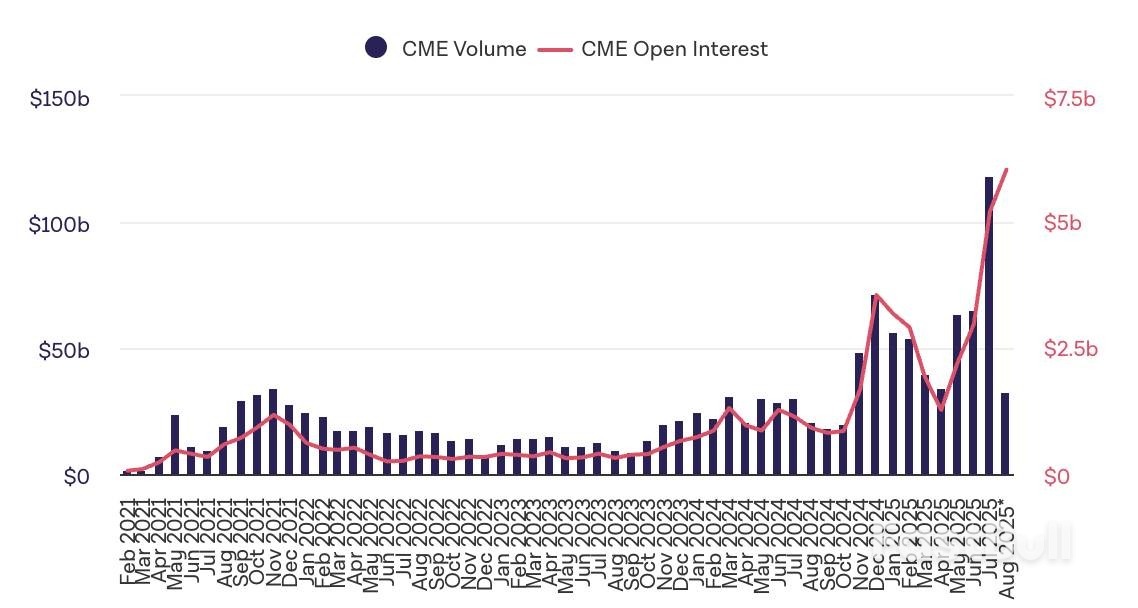

In July, Ethereum’s futures monthly trading volume at CME reached an unprecedented level of $118 billion, marking an 82% increase from the previous month. Data from CoinGlass highlights a dramatic 75% surge in open interest, rising from $2.97 billion in June to $5.21 billion, boosting ETH coin’s price to over $4,300 by the weekend.

The record-breaking trends at CME are mirrored globally as Ethereum futures trading volume across all exchanges hit $2.12 trillion in July. This reflects a 38% monthly increase, surpassing the previous May 2021 record of $1.87 trillion by 13%. By August 9, the total open interest was nearing an all-time high of $36.3 billion.

CoinGlass CME Ethereum

CoinGlass CME EthereumEthereum’s price exceeded $4,300 on a Saturday for the first time since December 2021. By Monday, it climbed to $4,350 but pulled back slightly later that day. Despite the fluctuation, current levels are only 14% below the all-time high of $4,878 set in November 2021.

Another significant factor in the markets is that funding rates are not at the extreme levels seen in December 2024, indicating that despite increased trading volumes, there’s no excessive leverage usage. Additionally, Google search data shows rising interest in Ethereum. By mid-month, “Ethereum” search volumes reached their peak since June 2022.

Data from CryptoAppsy reveals that ETH coin was trading at $4,303, up by 0.78% within the last 24 hours. The data shows significant growth, with prices rising 18.64% in the last week and 45.5% over the past 30 days.

The global financial landscape is abuzz with anticipation as the United States gears up for a pivotal inflation data release. For cryptocurrency enthusiasts and traditional investors alike, the ripple effects of this announcement could be profound. The Dollar has recently experienced a slight dip, reflecting market jitters and strategic positioning ahead of what promises to be a defining moment for economic policy. Meanwhile, the British Sterling has shown surprising strength, adding another layer of intrigue to the unfolding currency drama. Understanding these movements is crucial for anyone navigating the interconnected world of finance.

The US Dollar, often considered the bedrock of global finance, finds itself in a precarious position. Its recent softening is largely a pre-emptive reaction by traders and investors bracing for the Consumer Price Index (CPI) report. This key inflation metric is more than just a number; it’s a critical barometer that influences the Federal Reserve’s monetary policy decisions, particularly regarding interest rates. When inflation is high, central banks typically consider raising interest rates to cool down the economy, which can strengthen the dollar by making dollar-denominated assets more attractive. Conversely, signs of easing inflation might prompt expectations of rate cuts, potentially weakening the currency.

Several factors contribute to the dollar’s current sensitivity:

The upcoming US inflation report, specifically the CPI, provides a detailed look at the cost of goods and services. It’s a comprehensive measure that reflects the purchasing power of the dollar and directly impacts everyday consumers and large corporations. For investors, understanding the nuances of this report is paramount, as it dictates the future trajectory of monetary policy.

Here’s how different CPI outcomes could play out:

| CPI Outcome | Potential Dollar Reaction | Likely Fed Response | Broader Market Impact |

|---|---|---|---|

| Higher than Expected (Hot Inflation) | Dollar strengthens (initial reaction) | Increased likelihood of rate hikes or prolonged high rates | Bond yields rise, stock market volatility, potential pressure on risk assets like crypto |

| Lower than Expected (Cooling Inflation) | Dollar weakens | Increased likelihood of rate cuts or earlier cuts | Bond yields fall, potential stock market rally, positive for risk assets (crypto) due to cheaper borrowing |

| In Line with Expectations | Modest dollar movement, consolidation | Fed maintains current policy, reinforces data-dependent stance | Market largely priced in, less volatility, focus shifts to next data points |

The “core” CPI, which excludes volatile food and energy prices, is often scrutinized even more closely by central bankers as it provides a clearer picture of underlying inflationary trends. A persistent rise in core inflation would be a significant concern for the Fed.

While the dollar faces headwinds, the British Sterling (GBP) has been enjoying a period of relative strength. This surge isn’t merely a byproduct of dollar weakness; it reflects specific dynamics within the UK economy and the Bank of England’s (BoE) policy outlook. The BoE has maintained a relatively hawkish stance compared to some other major central banks, indicating a willingness to keep interest rates higher for longer to combat stubborn inflation in the UK.

Key drivers behind Sterling’s recent gains include:

However, it’s important to note that the UK economy still faces significant structural challenges, and the sustainability of Sterling’s gains will depend on continued positive economic indicators and the BoE’s ability to navigate inflation without stifling growth.

The forex market, or foreign exchange market, is the largest and most liquid financial market in the world, with trillions of dollars exchanged daily. Its immense size means that even slight shifts in economic data or central bank rhetoric can trigger significant currency movements. For investors, especially those with exposure to international assets or cryptocurrencies, understanding forex dynamics is not just academic; it’s a necessity for managing risk and identifying opportunities.

Here are some actionable insights for navigating this volatility:

The interconnectedness of the global financial system means that shifts in the dollar or sterling can indirectly influence the liquidity and sentiment within the cryptocurrency market. A stronger dollar, for instance, can sometimes make Bitcoin and other cryptocurrencies less attractive as investors seek safer, yield-bearing assets, though this correlation is not always consistent.

At the heart of currency valuation lies the concept of interest rates. Central banks use interest rates as their primary tool to manage inflation and stimulate or cool economic activity. When a central bank raises its benchmark interest rate, it makes borrowing more expensive and saving more attractive. This tends to draw foreign capital into the country, as investors seek higher returns on their investments, thereby increasing demand for the local currency and strengthening it.

Conversely, when interest rates are lowered, it makes borrowing cheaper, which can stimulate economic growth but also makes the currency less attractive to foreign investors, potentially leading to depreciation. The “carry trade” strategy, where investors borrow in a low-interest-rate currency and invest in a high-interest-rate currency, is a prime example of how interest rate differentials drive currency flows.

The current global economic climate is characterized by central banks grappling with persistent inflation while trying to avoid recession. The differing paces and magnitudes of rate hikes (or potential cuts) among major central banks are creating significant divergences in currency performance. The Federal Reserve’s path for US rates, the Bank of England’s response to UK inflation, and the European Central Bank’s evolving policy all contribute to the complex tapestry of the forex market.Understanding these underlying monetary policy frameworks is crucial for predicting currency movements beyond just the immediate reaction to economic data releases. It’s about recognizing the long game central banks are playing to achieve price stability and sustainable growth.

Challenges and Opportunities: The inherent unpredictability of economic data and geopolitical events remains a significant challenge. Unexpected inflation spikes or geopolitical tensions can quickly reverse market trends. However, these periods of volatility also present opportunities for informed investors who can anticipate and react to shifts. For instance, a clear dovish pivot by the Fed could signal a more favorable environment for risk assets, including cryptocurrencies, while a hawkish stance might suggest caution.

Actionable Insights for the Future: As we await the crucial US inflation figures, remember that the market is a dynamic entity. Don’t base decisions solely on single data points. Instead, look for trends, understand the broader economic narrative, and consider the implications for your overall investment strategy. The interplay between the dollar, inflation, sterling, and interest rates will continue to shape the global financial landscape, offering both challenges and compelling opportunities for those who stay vigilant and informed.

In conclusion, the slight dip in the Dollar ahead of the key US inflation release, juxtaposed with the gains of Sterling, highlights the delicate balance within the global forex market. The path of interest rates, guided by central bank responses to inflation, will ultimately dictate the trajectory of these major currencies. For investors, particularly those engaged with the volatile world of cryptocurrencies, monitoring these macro-economic indicators is not just prudent but essential for making informed decisions and navigating the ever-evolving financial currents.

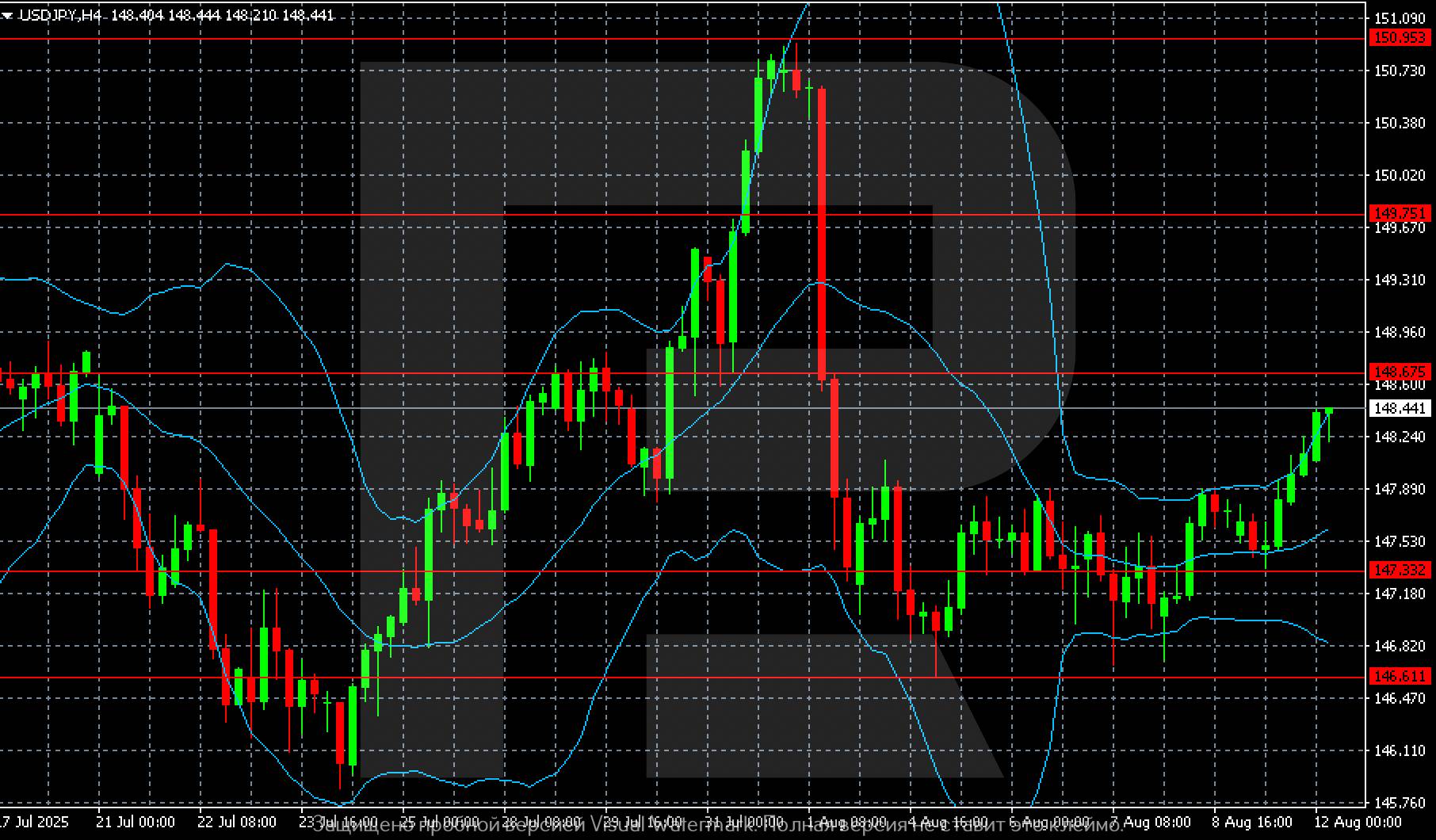

The USDJPY pair strengthened to 148.44 as safe-haven assets are out of favour with the market.

USDJPY forecast: key trading points

The USDJPY rate rose to 148.44 on Tuesday, marking the third consecutive session of gains amid improved global trade prospects, which reduced demand for safe-haven currencies. The US dollar gained support from news of a 90-day extension to the truce in US-China trade negotiations. This eased tensions and gave both sides more time to reach an agreement.

Domestically, market participants are focused on the Bank of Japan’s policy outlook. Board members remain divided over the timing and pace of future rate hikes. Some advocate maintaining a loose policy stance due to uncertainty surrounding the regulator’s economic forecasts.In the coming days, investors await the release of key Japanese macroeconomic indicators, including Q2 GDP, the Reuters Tankan survey, producer price data, and machine tool orders.

The USDJPY forecast is positive.

On the H4 chart, USDJPY has paused near 148.44. The pair continues to recover after its late-July drop. The rally, which began on 25 July, led to a test of the 150.95 high, followed by a sharp pullback.The support level has formed at 147.33 and 146.61. In early August, the price consolidated in the 146.60-148.00 range, and since 9 August, a gradual upward move has resumed. The pair is now approaching the key resistance level at 148.67.

A breakout above this mark would open the way towards 149.75 and then 150.95, while a failed attempt to consolidate above it could return the price to the 147.33 area. The widening of Bollinger Bands indicates rising volatility and the potential for a strong move in the near term.

The USDJPY pair is pushing higher and has strong prospects to extend this move. The USDJPY forecast for today, 12 August 2025, does not rule out a possible rise to 148.67.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up