Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

ECB Monetary Policy Statement

ECB Monetary Policy Statement Canada Average Weekly Earnings YoY (Oct)

Canada Average Weekly Earnings YoY (Oct)A:--

F: --

U.S. Core CPI YoY (Not SA) (Nov)

U.S. Core CPI YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. CPI YoY (Not SA) (Nov)

U.S. CPI YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. Core CPI (SA) (Nov)

U.S. Core CPI (SA) (Nov)A:--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Dec)

U.S. Kansas Fed Manufacturing Production Index (Dec)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Nov)

U.S. Cleveland Fed CPI MoM (Nov)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Nov)

U.S. Cleveland Fed CPI MoM (SA) (Nov)A:--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Dec)

U.S. Kansas Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

Argentina Trade Balance (Nov)

Argentina Trade Balance (Nov)A:--

F: --

P: --

Argentina Unemployment Rate (Q3)

Argentina Unemployment Rate (Q3)A:--

F: --

P: --

South Korea PPI MoM (Nov)

South Korea PPI MoM (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan National CPI MoM (Not SA) (Nov)

Japan National CPI MoM (Not SA) (Nov)A:--

F: --

P: --

Japan CPI MoM (Nov)

Japan CPI MoM (Nov)A:--

F: --

P: --

Japan National Core CPI YoY (Nov)

Japan National Core CPI YoY (Nov)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Nov)

Japan National CPI MoM (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Nov)

Japan National CPI YoY (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Nov)

Japan National CPI YoY (Nov)A:--

F: --

P: --

Japan National CPI MoM (Nov)

Japan National CPI MoM (Nov)A:--

F: --

P: --

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest Rate--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoY--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)--

F: --

P: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)--

F: --

P: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)--

F: --

P: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)--

F: --

P: --

Russia Key Rate

Russia Key Rate--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)--

F: --

P: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Silver holds above key support near $60 as traders await CPI and potential Fed cuts. Weak labor data and easing yields support bullish momentum, with pullbacks seen as buying opportunities if support holds.

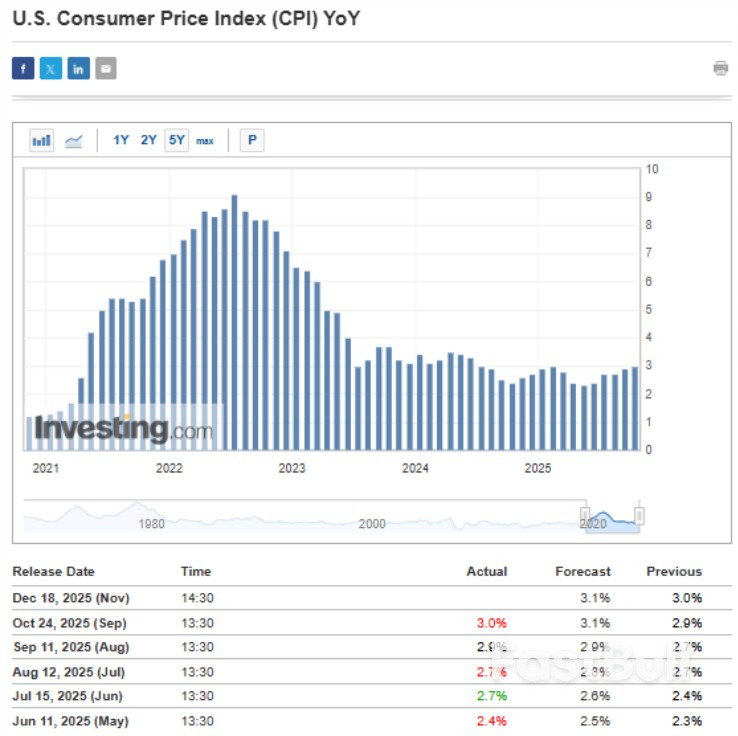

Underlying US inflation rose in November from a year earlier at the slowest pace since early 2021, marking a respite from months of stubborn price pressures, according to a report complicated by the federal government shutdown.

The core consumer price index (CPI), which excludes the often-volatile food and energy categories, increased 2.6% in November, according to Bureau of Labor Statistics (BLS) data out Thursday. That compares with a 3% annual advance two months earlier. The overall CPI climbed 2.7% in November from a year ago.

The BLS was unable to collect much of the October price data due to the government shutdown, limiting the agency's ability to determine month-over-month changes for the broader measures of inflation and many key categories in November.

The BLS said the core CPI rose 0.2% over the two months ended in November, restrained by declines in costs of hotel stays, recreation and apparel. Prices of household furnishings and personal care products rose.

Despite numerous caveats, the report offers hope that inflationary pressures are easing after remaining stuck in a narrow range since early this year.

Stock-index futures extended gains, while Treasury yields and the dollar fell after the report.

It's not clear whether the CPI report will sway Federal Reserve policymakers, who remain divided on the course of interest rates next year. Last week, the Fed lowered interest rates for a third straight meeting to guard against a more concerning deterioration in the labour market.

Fed chair Jerome Powell said last week the CPI data "may be distorted" because of the record-long government shutdown that ended on Nov 12.

Daily Light Crude Oil Futures

Daily Light Crude Oil FuturesPresident Donald Trump announced plans to award 1.45 million service members $1,776 payments as he sought to reassure Americans concerned about his stewardship of the US economy.

"Military service members will receive a special — we call Warrior Dividend — before Christmas, in honor of our nation's founding in 1776," Trump said.

Trump announced the plan Wednesday during a prime-time address from the White House meant to extol his accomplishments this year and assuage Americans increasingly worried about their cost of living.

The planned payments — pegged to the year the US declared its independence from Great Britain — are broadly in keeping with the administration's efforts to steer financial rewards to certain constituencies.

Administration officials cast the address as an opportunity to highlight the president's accomplishments in his first year back in the White House and preview new policies for 2026, but the remarks come at a critical moment with Trump confronting mounting public anxiety about his economic agenda and his advisers struggling to hone their messaging.

Voters returned Trump to office in part to address the persistent inflation that plagued former President Joe Biden. And Trump spent much of his remarks looking to lay the blame at the foot of his predecessor, detailing price increases during the prior administration.

"11 months ago, I inherited a mess, and I'm fixing it," Trump said. "When I took office, inflation was the worst in 48 years, and some would say in the history of our country, which caused prices to be higher than ever before, making life unaffordable for millions and millions of Americans."

Trump now finds himself facing the same economic headwinds. Surveys show Americans are worried about the cost of living and inflation, fears that powered rival Democrats to key electoral wins in November and pose a major threat to Trump and Republicans in 2026 elections that will decide control of Congress and the future of his legislative agenda.

A Reuters/Ipsos poll released Tuesday showed Trump's approval rating had slipped to nearly its lowest level of his second term in office, with just 39% of US adults approving of his job performance.

Trump's own inconsistent messaging on the economy has made his task harder. The president has vacillated between deriding voter anger over affordability as a Democratic "hoax" and at times emphasizing lower prices for gasoline and eggs as positive bellwethers.

Trump graded his record on the economy as an "A-plus-plus-plus-plus-plus," while insisting that his administration needs more time to remedy what he says was a mess left by Biden. The president also is in the final stages of a search for a new Federal Reserve chair.

"I'll soon announce our next chairman of the Federal Reserve, someone who believes in lower interest rates, by a lot, and mortgage payments will be coming down even further. Early in the new year, and you will see this in the new year, I will announce some of the most aggressive housing reform plans in American history," Trump said.

Trump sought to rally viewers by touting his work on other issues, saying he had stopped the flow of undocumented migrants and drugs while bolstering the military and brokering a ceasefire in Gaza.

"Boy, are we making progress. Nobody can believe what's going on," Trump said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up