Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Global shares inched higher as oil prices dipped slightly, despite rising tensions between Israel and Iran. Investors await key central bank meetings, economic data, and remain cautious amid geopolitical and inflation risks.

The conflict roiling Iran poses rewards and peril for fellow members of the OPEC+ oil cartel.

The price rally triggered by Israel’s offensive reversed the slump that the Organization of the Petroleum Exporting Countries and its allies caused in recent months by ramping up production. That should shore up revenues for the coalition.

Now there’s the question of what OPEC+ should do next.

So far, the Israeli onslaught has left Iran’s crude production and export facilities unchanged. OPEC Secretary General Haitham Al-Ghais has said there’s no immediate need for the group to respond.

Nonetheless, group leader Saudi Arabia is intent on swiftly reviving halted production and regaining the market share the alliance ceded to rivals during the past few years.

Riyadh pushed through three monthly group increases of 411,000 barrels a day — triple the initially scheduled amount — in quick succession. During the next few weeks, OPEC+ members will decide whether to approve another hike for August.

Frothy prices have the potential to assuage some of the resistance the Saudis have encountered from partners such as Russia, thus easing approval of another boost. The market upturn may even embolden the kingdom to press for a bigger increase.

But there are, of course, also hazards for OPEC+.

Given the lack of any supply disruption, a decision to expedite production increases the risk of swelling the global oil surplus that Wall Street analysts see on the horizon.

Current hostilities could expand and hit energy infrastructure across the Middle East.

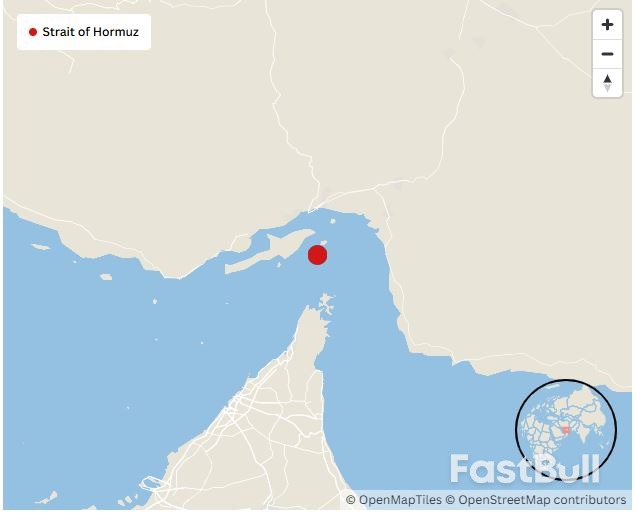

Also, Iran could retaliate against Israel by encouraging proxies such as the Houthis in Yemen to harass tankers in the region or impede the critical Strait of Hormuz waterway.

If Iranian oil flows are disrupted, the Saudis and other Gulf states will likely come under pressure from US President Donald Trump to compensate for those losses by tapping their spare capacities.

That possibly may put the Gulf nations’ energy assets in the crosshairs. When the Saudis backed the crackdown on Tehran during Trump’s first term, their critical Abqaiq processing plant suffered a paralyzing bombardment claimed by the Houthis.

China churned out less steel in May compared with the previous year as mills responded to the government’s pledge to cut production. Output declined 6.9% to 86.55 million tons, pushing the total 1.7% lower for the first five months. It’s the first year-on-year contraction in the monthly figure since Beijing vowed to address the industry’s glut during its annual policy meeting in March, according to the statistics bureau.

Oil erased another large increase, with traders monitoring attacks between Iran and Israel that have spared critical infrastructure for now. Brent traded down as much as 1.3% after leaping higher at the open.

The United Nations atomic watchdog convened an emergency meeting to assess Israel’s attacks on Iranian nuclear facilities and to discuss the disruptions to its oversight of the Islamic Republic’s stockpile of near-bomb grade uranium.

Some oil tanker owners and managers have paused offering their vessels for Middle Eastern routes since Friday as they assess the risks from the Israel-Iran conflict, fueling concerns over export flows from the region.

Abu Dhabi National Oil Co. made an $18.7 billion offer for Australian fossil fuel producer Santos Ltd., an audacious overseas move by the Middle Eastern company as it seeks to expand production of liquefied natural gas.

Nippon Steel Corp. shareholders are weighing the benefits of the $14.1 billion acquisition of United States Steel Corp., with a key short-term concern being how to finance the all-cash deal and promised investments.

Monday: OPEC monthly oil market report; Energy Asia conference, Kuala Lumpur (through Wednesday); China industrial output for May; Asia Pacific Precious Metals Conference, Singapore (through Tuesday); USDA export inspections for corn, soybeans, wheat

Tuesday: International Energy Agency’s monthly oil market report and Oil 2025 medium-term outlook; American Petroleum Institute’s weekly report on US oil inventories

Wednesday: US Energy Information Administration’s weekly reports on oil, natural gas and ethanol inventories; Japan Energy Summit and Exhibition, Tokyo (through Friday); Australian Energy Week, Melbourne (through Friday)

Thursday: AGM for Helleniq Energy Holdings SA

Friday: Baker Hughes Co. weekly rig count report; USDA total milk production

Opec has kept its global oil demand growth forecasts for this year and next unchanged.

The group sees oil consumption growing by 1.29mn b/d to 105.13mn b/d in 2025 and by 1.28mn b/d to 106.42mn b/d in 2026, according to its latest Oil Market Report (OMR) released today.

These projections remain markedly higher than the IEA's forecasts.

Opec upgraded its first quarter demand estimate, based on actual data, but said this increase was offset by lower expectations of oil demand in key consuming countries China and India in the second quarter and later in the year, mostly driven by US trade policies.

In terms of supply, Opec downgraded its 2026 non-Opec+ liquids supply growth forecasts for a third month in a row, mainly driven by the effects of lower oil prices on US shale producers. Opec now sees non-Opec+ liquids supply growth growing by 730,000 b/d in 2026, compared with 800,000 b/d in last month's OMR. Opec expects US liquids output growth of 210,000 b/d, down from 460,000 b/d in March.

But the group kept its 2025 non-Opec+ liquids supply growth forecast unchanged at 810,000 b/d.

Opec made no reference to the ongoing conflict between Israel and Iran in its report, suggesting the hostilities have not affected its supply and demand balances. The Opec secretariat last week criticised the IEA for saying it was ready to release emergency oil stocks if necessary. Opec said there were currently "no developments in supply or market dynamics that warrant unnecessary actions" and that such statements raise "false alarms" and project "market fear."

Opec+ crude production — including Mexico — rose by 180,000 b/d to 41.23mn b/d in May, according to an average of secondary sources that includes Argus. Opec puts the call on Opec+ crude at 42.7mn b/d in 2025 and 43.2mn b/d in 2026.

Whatever their differences, the US and Israel share one overriding priority when it comes to Iran: to prevent the regime from acquiring a nuclear weapon. Devastating Israeli airstrikes have both delayed that possibility and, over the longer term, made an Iranian attempt to “break out” more likely. The US must focus on what it can do to lower those odds.

Israel’s initial surprise attack killed several high-ranking generals and nuclear scientists and knocked out many of Iran’s air defenses. Israeli forces have targeted the country’s three main nuclear sites at Natanz, Isfahan and Fordow, apparently crippling its only uranium-conversion facility. The strikes widened over the weekend to include gas fields and other energy-related targets, even as Iranian missiles hit Tel Aviv and Haifa.

How much further Israel can degrade Iran’s nuclear infrastructure without US bunker-busters — needed to penetrate the most deeply buried sites — remains unclear. The program has likely been set back months, perhaps more.

But, assuming the fighting doesn’t lead to the regime’s collapse, the assassinated generals and physicists will be replaced, probably by even more hawkish successors. Those officials will have every incentive to accelerate efforts to develop a bomb secretly, just as Saddam Hussein initially did after Israeli F-16s destroyed Iraq’s Osirak nuclear reactor in 1981.

Even if Iran returns to the negotiating table, it will thus be even harder to trust any pledges the regime makes. To be credible, any new nuclear agreement would require inspections that are more intrusive and persistent than ever before. Any enrichment capability, even the low levels required for civilian use, will almost certainly have to be eliminated.

Why would Iran agree to such conditions now, after refusing for years? Much depends on how long the fighting continues and how much more damage it suffers. But the extent to which Israeli intelligence has penetrated the country’s security establishment is obvious. If the regime attempts to race for the bomb in the future, it can’t be sure it won’t be exposed — in which case the US can lend its B-2 bombers to the effort to destroy underground enrichment sites.

Nor can Iranian leaders be sure they will themselves survive a new round of strikes. Their air defenses will be difficult to restore. Meanwhile, Israel has defanged most of their proxies across the region. Erstwhile allies such as Russia and China have offered only symbolic support. The regime remains deeply unpopular with its own citizens, and the country’s economy is a shambles.

The billions in oil revenue the regime sacrificed to sanctions to pursue its nuclear ambitions clearly failed to buy it security. US officials should underscore that further attempts will be equally unsuccessful.

As the US waits for Iranian leaders to accept this reality, it should be working with its Group of Seven and Gulf allies, possibly even Russia and China, to unify around a set of demands to verifiably eliminate the possibility of an Iranian bomb. It should continue helping defend Israel against retaliation while striving to prevent the conflict from widening.

The uncomfortable fact remains that diplomacy — however unlikely it may seem at the moment — is the only path to security and a sustainable peace in the region. If a strong nuclear deal was desirable before this conflict, it’s vital now.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up