Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Russia has used long-range fleet to fire missiles at Ukraine; Nuclear-capable planes form part of strategic arsenal; Like-for-like replacement unlikely due to their age; Test of next-generation bomber expected next year.

Russia will take years to replace nuclear-capable bomber planes that were hit in Ukrainian drone strikes last weekend, according to Western military aviation experts, straining a modernisation programme that is already delayed.

Satellite photos of airfields in Siberia and Russia's far north show extensive damage from the attacks, with several aircraft completely burnt out, although there are conflicting versions of the total number destroyed or damaged.

The United States assesses that up to 20 warplanes were hit - around half the number estimated by Ukrainian President Volodymyr Zelenskiy - and around 10 were destroyed, two U.S. officials told Reuters.

The Russian government on Thursday denied that any planes were destroyed and said the damage would be repaired, but Russian military bloggers have spoken of loss or serious damage to about a dozen planes, accusing commanders of negligence.

Thestrikes- prepared over 18 months in a Ukrainian intelligence operation dubbed "Spider's Web", and conducted by drones that were smuggled close to the bases in trucks - dealt a powerful symbolic blow to a country that, throughout the Ukraine war, has frequently reminded the world of its nuclear might.

In practice, experts said, they will not seriously affect Russia's nuclear strike capability which is largely comprised of ground- and submarine-based missiles.

However, the Tu-95MS Bear-H and Tu-22M3 Backfire bombers that were hit were part of a long-range aviation fleet that Russia has used throughout the war to fire conventional missiles at Ukrainian cities, defence plants, military bases, power infrastructure and other targets, said Justin Bronk, an aviation expert at the RUSI think tank in London.

The same fleet had also been carrying out periodic patrol flights into the Arctic, North Atlantic and northern Pacific as a show of strength to deter Russia's Western adversaries.

Bronk said that at the outset of its 2022 invasion of Ukraine, Russia was operating a fleet of 50-60 Bear-Hs and around 60 Backfires, alongside around 20 Tu-160M nuclear-capable Blackjack heavy bombers.

He estimated that Russia has now lost more than 10% of the combined Bear-H and Backfire fleet, taking into account last weekend's attacks and the loss of several planes earlier in the war - one shot down and the others struck while on the ground.

These losses "will put major pressure on a key Russian force that was already operating at maximum capacity," Bronk told Reuters.

Russia's defence ministry did not immediately reply to a request for comment.

Replacing the planes will be challenging. Both the Bear H and the Backfire are aircraft that were designed in the Soviet era and have been out of production for decades, said Douglas Barrie, aerospace expert at the International Institute for Strategic Studies in London, although existing planes have been upgraded over the years.

Barrie said that building new ones like-for-like was therefore very unlikely, and it was unclear whether Russia had any useable spare airframes of either type.

Western sanctions against Russia have aimed to restrict the import of components such as microprocessors that are vital to avionics systems, although Moscow has so far been comparatively successful at finding alternative sources, Barrie added.

Russia has been modernising its Blackjack bomber fleet, and Putin sent a pointed signal to the West last year by taking a 30-minute flight in one such aircraft and pronouncing it ready for service.

But production of new Blackjacks is slow - one Russian military blogger this week put it at four per year - and Western experts say progress in developing Russia's next-generation PAK DA bomber has also been moving at a crawl.

The Federation of American Scientists (FAS) said in a report last month that Russia had signed a contract with manufacturer Tupolev in 2013 to build the PAK DA, but cited Russian media reports as saying state test flights are not scheduled until next year, with initial production to begin in 2027.

While it would be logical for Russia to try to speed up its PAK DA plans, it may not have the capacity, said Hans Kristensen, director of the Nuclear Information Project at the FAS. He said in a telephone interview that Russia is facing delays with a range of other big defence projects including its new Sarmat intercontinental ballistic missile.

RUSI's Bronk was also sceptical of Moscow's chances of accelerating the timeline for the next-generation bomber.

"Russia will struggle to deliver the PAK DA programme at all in the coming five years, let alone accelerate it, due to budgetary shortfalls and materials and technology constraints on industry due to sanctions," he said.

Oil prices remained steadfastly glued to $65 a barrel, as they have been for more than three weeks, with easing trade tensions helping offset concerns about a brewing supply glut later this year.

Brent inched lower, but held on to most of its gains from Thursday and was on track for its first weekly increase since mid-May. President Donald Trump and his Chinese counterpart, Xi Jinping, agreed to further trade talks over tariffs and supplies of rare earth minerals.

The positive signals come against the backdrop of an oil market that has been increasingly rangebound over recent weeks. Prices have traded in a $4 band since the middle of May and a gauge of volatility for US crude futures is at the lowest level since early April.

Oil has been buffeted in Trump’s second term, as trade tensions between the world’s two largest economies menace demand. At the same time, the OPEC+ alliance has been adding barrels back to the market at a faster-than-expected rate, further clouding an already weak outlook for the second half of the year.

“The market looks balanced in 2Q/3Q on our estimates as oil demand rises in summer and peaks in July-August, matching supply increases from OPEC+,” HSBC analysts including Kim Fustier wrote. “Deteriorating fundamentals after summer raise downside risks to oil prices.”

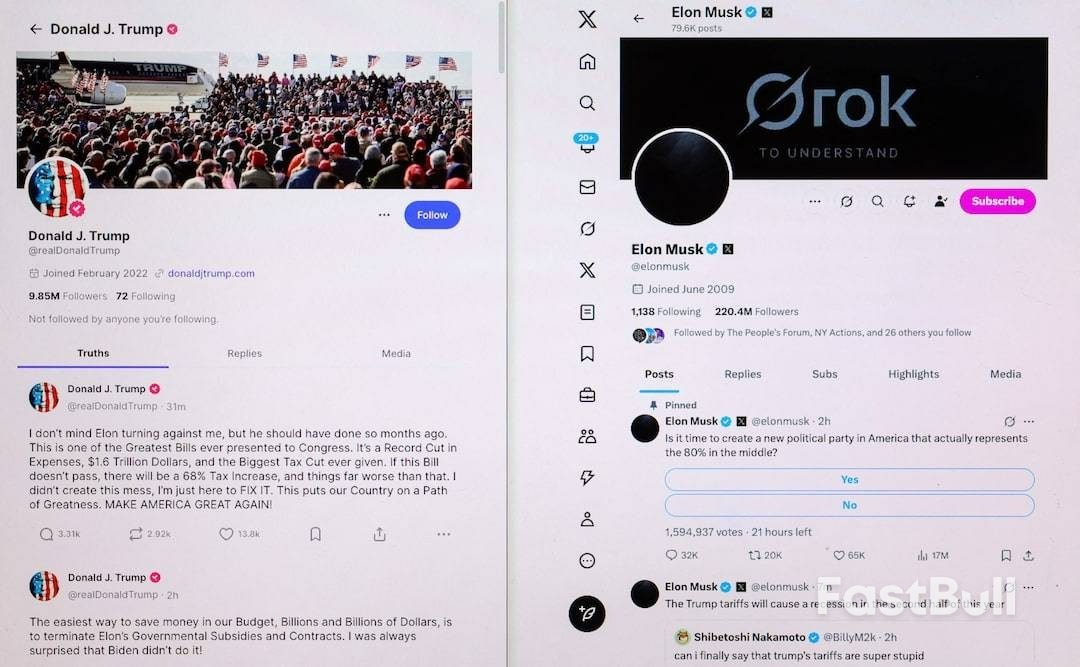

White House aides scheduled a call between Donald Trump and Elon Musk for Friday, Politico reported, after a huge public spat that saw threats fly over government contracts and ended with the world's richest man suggesting the U.S. president should be impeached.

The reported call could ease the feuding after an extraordinary day of hostilities - largely conducted over social media - that marked a stark end to a close alliance.

Shares in Musk's Tesla (TSLA.O), opens new tab closed down over 14% on Thursday, losing about $150 billion in market value in the largest single-day decline in value in its history. In pre-market European trading on Friday they pared some of those losses, rising 5% after the Politico report that the two men were scheduled to speak.

Musk had bankrolled a large part of Trump's presidential campaign and was then brought as one of the president's most visible advisers, heading up a sweeping and controversial effort to downsize the federal workforce and slash spending.

The verbal punches erupted on Thursday after Trump criticized Musk in the Oval Office and the pair then traded barbs on their social media platforms: Trump's Truth Social and Musk's X.

The falling-out had begun brewing days ago when Musk, who left his role as head of the Department of Government Efficiency a week ago, denounced Trump's sweeping tax-cut and spending bill.

The president initially stayed quiet while Musk campaigned to torpedo the bill, saying it would add too much to the nation's $36.2 trillion in debt.

Trump broke his silence on Thursday, telling reporters he was "very disappointed" in Musk.

"Look, Elon and I had a great relationship. I don't know if we will anymore," Trump said.

As Trump spoke, Musk responded on X.

"Without me, Trump would have lost the election," wrote Musk, who spent nearly $300 million backing Trump and other Republicans in last year's election.

In another post, Musk asserted that Trump's signature import tariffs would push the U.S. into a recession later this year.

"The easiest way to save money in our Budget, Billions and Billions of Dollars, is to terminate Elon's Governmental Subsidies and Contracts," Trump posted.

Minutes after the closing bell, Musk replied, "Yes," to a post on X saying Trump should be impeached, something that would be highly unlikely given Trump's Republicans hold majorities in both chambers of Congress.

Musk's businesses also include rocket company and government contractor SpaceX and its satellite unit Starlink.

Musk, whose space business plays a critical role in the U.S. government's space program, said that as a result of Trump's threats he would begin decommissioning SpaceX's Dragon spacecraft. Dragon is the only U.S. spacecraft capable of sending astronauts to the International Space Station.

Late on Thursday, Musk backed off the threat.

In another sign of a possible detente to come, Musk subsequently wrote: "You're not wrong," in response to billionaire investor Bill Ackman saying Trump and Musk should make peace.

Trump and Musk are both political fighters with a penchant for using social media to attack their perceived enemies, and many observers had predicted a falling-out.

Musk hit at the heart of Trump's agenda earlier this week when he targeted what Trump has named his "big, beautiful bill", calling it a "disgusting abomination" that would deepen the federal deficit.

His attacks amplified a rift within the Republican Party that could threaten the bill's prospects in the Senate.

Nonpartisan analysts say Trump's bill could add $2.4 trillion to $5 trillion to the nation's $36.2 trillion in debt.

A prolonged feud between the pair could make it harder for Republicans to keep control of Congress in next year's midterm elections if it leads to a loss of Musk's campaign spending or erodes support for Trump in Silicon Valley.

"Elon really was a significant portion of the ground game this last cycle," said a Republican strategist with ties to Musk and the Trump administration who spoke to Reuters on condition of anonymity.

"If he sits out the midterms, that worries me."

On Tuesday, Musk posted that "in November next year, we fire all politicians who betrayed the American people."

Musk had already said he planned to curtail his political spending in the future. Musk's increasing focus on politics provoked widespread protests at Tesla sites, driving down sales while investors fretted that Musk's attention was too divided.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up