Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Rheinmetall's newly-opened factory in Northern Germany — set to become Europe's biggest ammunition production facility — is another step in the region's race to catch up with Russian output, according to the company's chief executive.

Rheinmetall's newly-opened factory in Northern Germany — set to become Europe's biggest ammunition production facility — is another step in the region's race to catch up with Russian output, according to the company's chief executive.CEO Armin Papperger on Wednesday told CNBC that Russia had the capacity to put out 4 to 5 million artillery ammunition rounds a year. Comparatively, he said Europe has a yearly output of around 2 million, more than half of which is produced by Rheinmetall.

The European Union has been supporting Ukraine in its military effort to combat Russia's invasion, amid uncertainty over the U.S.' long-term plans to back Kyiv.Europe's "biggest need is artillery ammunition and missiles," Papperger said, stressing the new plant in Unterluess will focus on both items. The plant's output is expected to reach 350,000 artillery shells a year by 2027."We do our utmost, we do whatever we can do to be fast. I had a chat before with [German Defense Minister Boris] Boris Pistorius about that, he said, hurry up. We have to do more," Papperger told CNBC's Annette Weisbach.

Along with other European countries and NATO members, Germany has pledged to ramp up defense spending and expand its military in the coming decade — in Berlin's case, enabled by reforms earlier this year to its debt rules. It has specifically committed to more than double its defense spending to 153 billion euros ($178 billion) by 2029. Some analysts say Germany has more fiscal headroom to deliver on those promises than do the governments of France, Italy and the U.K.Papperger told CNBC he expected new contracts to come in over the fourth quarter this year and throughout the first quarter of 2026, and that it had received down payments from the government enabling it to make new investments.

"The German government is very fair to us," he said.

Speaking at the plant's opening on Wednesday, NATO Secretary General Mark Rutte said the factory was set up by Rheinmetall in a "staggering" timeframe of 14 months."This is exactly what we need to ensure the prosperity and security of our economies and societies across Europe and North America, especially at a time when we are aggressively being challenged," Rutte said.The NATO chief added that Russia and China were "producing weapons and heavy military equipment at an incredible rate" and with "little transparency.""Now we need to see similar efforts to increase the production of more complex capabilities, like tanks and air defense systems and missiles," Rutte said.

Britain, France and Germany will begin the process of reimposing U.N. sanctions on Iran at the U.N. Security Council on Thursday, two European diplomats said.

The trio, known as the E3, met Iran on Tuesday to try to revive diplomacy over the nuclear programme before they lose the ability in mid-October to restore sanctions on Tehran that were lifted under a 2015 nuclear accord with world powers.

Those talks did not yield sufficiently tangible commitments from Iran. The E3 have now decided to trigger the so-called snapback of U.N. sanctions over accusations that Iran has violated the 2015 deal that aimed to prevent Tehran from developing a nuclear weapon, the diplomats said.

The E3, whose ministers informed U.S. Secretary of State Marco Rubio of their decision on Wednesday, will transfer a letter to the U.N. Security Council later on Thursday.

They hope the move will push Tehran to provide commitments over its nuclear programme within 30 days that will convince them to defer concrete action.

Iran has previously warned of a "harsh response" if sanctions are reinstated. Talks between the E3 and Iran are tense as Tehran is furious at the bombing in June of its nuclear facilities by the U.S. and Israel.

The U.N process takes 30 days before sanctions that would cover Iran's financial, banking, hydrocarbons and defence sectors are restored.

The E3 had offered to delay the snapback for as much as six months to enable serious negotiations if Iran resumes full U.N. inspections - which would also seek to account for Iran's large stock of enriched uranium that has not been verified since the June strikes - and engages in talks with the United States.

Iran's Deputy Foreign Minister Kazem Gharibabadi told state television on Wednesday night that if snapback was triggered, interaction with the International Atomic Energy Agency would be "completely affected and halted."

"We have told the E3 that if this happens, Europe will, in effect, remove itself from the diplomatic arena and dialogue with Iran," he said, adding that Iran would then only hold discussions within a U.N. Security Council framework.

Iran has been enriching uranium to up to 60% fissile purity, a short step from the roughly 90% of weapons-grade, and had enough material enriched to that level, if refined further, for six nuclear weapons, before the strikes by Israel started on June 13, according to the IAEA.

Actually producing a weapon would take more time, however, and the IAEA has said that while it cannot guarantee Tehran's nuclear programme is entirely peaceful, it has no credible indication of a coordinated weapons project.

The West says the advancement of Iran's nuclear programme goes beyond civilian needs, while Tehran denies it is seeking nuclear weapons.

Russia pounded Ukraine with missiles and drones early on Thursday, killing at least 15 people including four children in the capital in a sweeping attack President Volodymyr Zelenskiy said was Moscow's answer to diplomatic efforts to end its war.As the sun rose, rescuers were digging through a partly destroyed apartment building on Kyiv's left bank, where a Reuters correspondent saw workers pulling two bodies from the rubble.

At least 38 people were wounded in the hours-long assault on the city which damaged buildings in seven districts including the headquarters of the European Union mission to Ukraine and the British Council, officials said.Across the country, Ukraine's military said Russian attacks struck 13 locations. National grid operator Ukrenergo said energy facilities were hit."Russia chooses ballistics instead of the negotiating table," Zelenskiy said on X, calling for new sanctions on Russia. "It chooses to continue killing instead of ending the war."

Russia's Defence Ministry said its attack hit military industrial facilities and military air bases. Moscow has regularly denied targeting civilians but dozens have died in recent months during strikes on densely populated areas.During the attack on Kyiv, explosions rang out as clouds of smoke rose into the night sky. Drones could be heard whirring overhead.Mayor Vitali Klitschko described it as one of the biggest attacks on the city in recent months.

A push by Kyiv and its allies to end the invasion that Moscow launched in February 2022 has yielded little despite high-level meetings between U.S. President Donald Trump and his Ukrainian and Russian counterparts.Russia has stepped up air strikes on Ukrainian towns and cities far behind the front line and pushed a grinding offensive across much of the east in a bid to pressure Ukraine into giving up territory.

"Horrified by yet another night of deadly Russian missile attacks on Ukraine," European Council President Antonio Costa wrote on social media."My thoughts are with the Ukrainian victims and also with the staff of @EUDelegationUA whose building was damaged in this deliberate Russian strike. The EU will not be intimidated," he added.British Prime Minister Keir Starmer also condemned the assault, writing on X: "My thoughts are with all those affected by the senseless Russian strikes on Kyiv which have damaged the British Council building. Putin is killing children and civilians, and sabotaging hopes of peace."

Ukraine's military said air defences had downed 563 of nearly 600 drones and 26 of 31 missiles launched by Russia across the country.One attack damaged a railway hub in central Ukraine's Vinnytsia region, where officials said a strike on critical infrastructure had left 60,000 residents without power.Ukrainian officials have warned recently that Russia would step up strikes on the country's energy grid as winter approaches.

Moscow's Defence Ministry said Russian air defences destroyed 102 Ukrainian drones overnight in at least seven regions.Ukraine's drone force said it had struck the Afipsky and Kuybyshevskyi oil refineries as part of that attack.

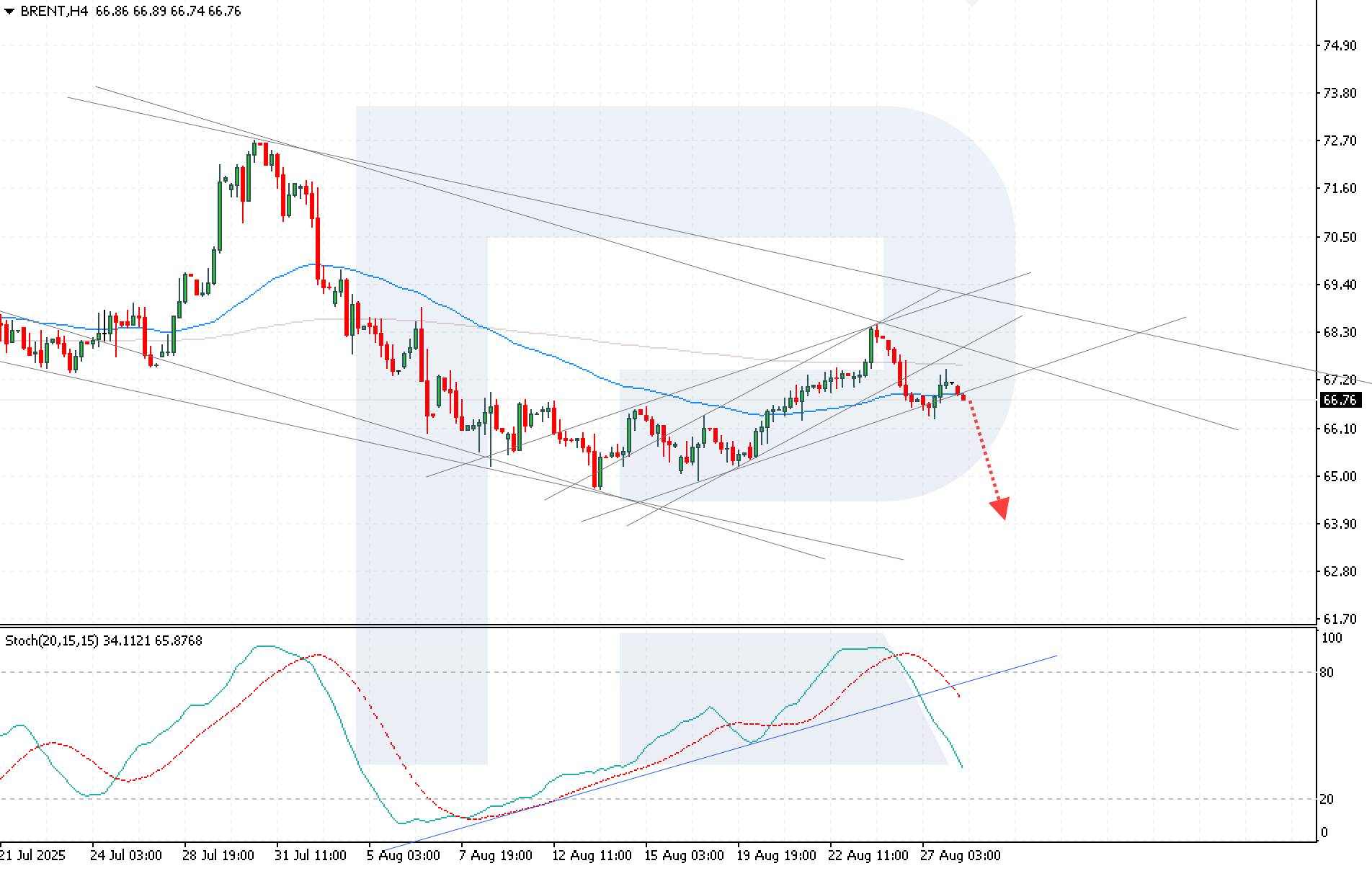

The oil market remains under pressure, with Brent quotes edging lower amid expectations of weaker demand and geopolitical factors, currently standing at 66.76 USD.

Brent forecast: key trading points

Brent prices are falling after rebounding from the key resistance level at 68.50 USD. Investors factor in the anticipated drop in US fuel demand as the summer season ends, while also assessing potential supply shifts amid US high tariffs on India. Analysts note that consumption has peaked, projecting a gradual demand slowdown. According to the Brent price forecast, such expectations point to growing bearish sentiment in the market.

US commercial crude inventories dropped by 2.39 million barrels last week to 418.3 million, according to the Energy Department’s weekly report. Analysts had forecast a decline of 2 million barrels.

Traders are also watching India’s stance in response to US pressure aimed at curbing Russian oil imports after the tariff hikes. However, analysts expect India to continue to buy in the near term, limiting this factor’s impact on the global market.

Brent quotes are retreating after rebounding from the 68.50 resistance level, remaining within a descending channel. The current dynamics suggest a strong likelihood of a bearish impulse towards 63.90 USD.

Today’s Brent outlook points to further downside after breaking below the short-term support level at 66.00 USD and consolidating below the EMA-65. The Stochastic Oscillator gives a bearish signal: its lines have turned downwards, confirming the probability of continued decline.

Another factor adding to pressure is the potential breakout below the lower boundary of the corrective channel, which would reinforce the bearish trend.

Brent quotes continue to face pressure, with expectations of declining US demand and uncertainty over India’s oil imports increasing the risk of bearish dynamics. Today’s Brent analysis signals that the downward impulse remains intact with a target at 63.90 USD.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up