Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

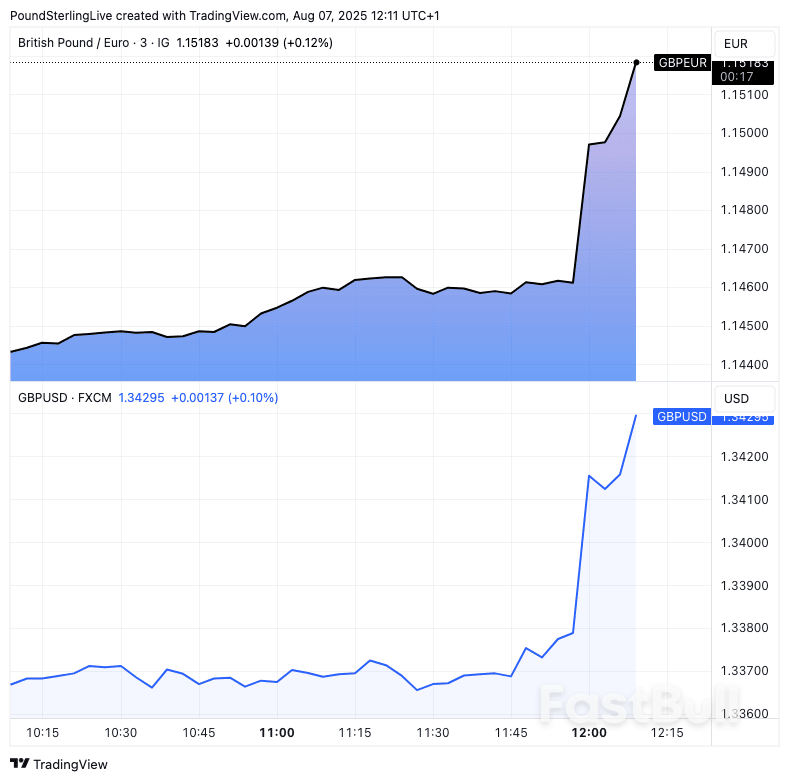

The British Pound rises against the Euro and Dollar as an initial response to the August policy decision.

President Donald Trump’s move to penalize India for buying oil from Russia will increase economic risks for the South Asian nation and test its longstanding ties with Moscow.

Indian exports to the US have already been hit with a 25% duty as part of Trump’s broader “reciprocal tariffs.” He’s now followed through on a threat to impose so-called secondary tariffs to punish India’s purchases of Russian crude, signing an executive order to apply an additional 25% levy on Indian goods from Aug. 27.

The US and its partners see India’s imports of Russian oil as a form of tacit support for Russia’s ongoing war in Ukraine, weakening the impact of sanctions on the Russian economy. The Indian government has called the extra tariffs “unfair, unjustified and unreasonable,” and defended its consumption of Russian oil as necessary for energy security.

India has had a strong and stable relationship with Russia over the last seven decades. India’s External Affairs Minister Subrahmanyam Jaishankar has referred to it as the one constant in global politics over the last half century.

Their ties have roots in the Cold War era, when India maintained cordial relations with Russia as the US moved closer to India’s arch-rival Pakistan. Despite New Delhi’s avowed non-alignment with either of the era’s two superpowers, US backing of Pakistan in its 1971 civil war that led to the independence of Bangladesh drew New Delhi closer to Moscow.

The ties between India and Russia deepened over the next three decades as they collaborated in critical areas such as space, nuclear energy and defense. As India’s relations with the US began to improve in recent decades, it has reduced its overwhelming reliance on Russian weapons by acquiring more arms from the US and European nations.

Indian Prime Minister Narendra Modi has maintained his country’s longstanding ties to Moscow, while pursuing deeper links with the US, which it sees as a partner in standing up to a more assertive China.

After Russian forces invaded Ukraine in 2022 and Western nations tightened sanctions on Moscow, India began buying large volumes of Russian oil. India has stood out among major democracies for its reluctance to criticize Russian President Vladimir Putin, and has abstained from United Nations votes condemning his war in Ukraine. It has also refused to participate in punitive measures against Russia.

Modi has sustained close ties with the Russian leader — he visited Russia in October and Putin is scheduled to go to India later this year.

Trade between India and Russia reached a record-high $68.7 billion in the year to March 31. India’s exports to Russia totaled $4.9 billion, while its imports from Russia amounted to $63.8 billion.

Russia’s biggest investments in India are in oil and gas, petrochemicals, banking, railways and steel. Indian investments in Russia focus mainly on oil, gas and pharmaceuticals.

India is the world’s third-largest consumer of oil. It buys about 37% of its crude from Russia, according to data analytics firm Kpler, up from a negligible percentage before the full-scale invasion of Ukraine.

The South Asian nation overtook China as the largest buyer of Russian seaborne crude oil. It became hooked on these cheaper barrels as Western sanctions and a price cap pushed them to a discount to market rates.

India traditionally relied on suppliers from the Middle East, such as Saudi Arabia, to meet its oil requirements. Shifting away from Russian barrels would push India back to those Middle Eastern producers and likely lead to an increase in the cost of imports.

However, the discounts on Russian oil have narrowed. In May, Indian buyers paid $4.50 a barrel less for their Russian crude imports than they did for Saudi purchases. In 2023, the gap was more than $23 a barrel.

India saved a modest $3.8 billion in the year to March 2025 on its oil purchases as the discount on Russian crude shrank, according to credit ratings agency ICRA. But it exported roughly $87 billion worth of goods to the US, its largest trading partner, last year.

“If you look at the size of India’s trade with the US, and look at how much savings India gets from buying Russia crude, it’s pretty clear what India would do,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. “Are you going to risk up to $87 billion worth of exports to the US in order to save a few billion from oil discounts?”

Russia is the largest supplier of weapons to India, according to a March report from the Stockholm International Peace Research Institute, an independent think tank that studies global weapon sales. India has purchased fighter jets, battle tanks and missiles from Russia, and the two countries also formed a joint venture to produce Kalashnikov assault rifles for India’s armed forces.

However, India — the world’s second-biggest arms importer — has slowly been reducing its dependence on Russian weapons in recent years. There have been no new major arms deals between the two countries for the last few years, and India’s push to diversify looks set to continue after delays in the delivery of Russian S-400 air defense systems.

Many of India’s weapons now come from the US. India has contracted at least $24 billion worth of US-origin defense articles, according to a 2025 report from the US Congressional Research Service. Major purchases include attack helicopters, transport aircraft and howitzers, according to the report, and more weapons sales are being considered, such as of anti-submarine warfare, communication and land-attack equipment.

“Since 2008, defense trade has emerged as a major pillar of the US-India security partnership, and bilateral military exercises across all services are now routine,” the report said.

Modi must now walk a geopolitical tightrope. If he allows India’s refiners to keep buying Russian oil, he risks a direct blow to the economy and damage to the ties with his country’s top trade partner. On the other hand, yielding to US pressure could undermine India’s long-standing relationship with Moscow.

If India continues to trade with Russia, a 50% duty on its goods shipped to the US — the combined hit of the reciprocal and secondary tariffs — could reduce its exports to America by 60% and lower its gross domestic product by 0.9%, according to Bloomberg Economics.

But economists also calculate that shifting away from Russia to other oil suppliers would have implications for India’s inflation and economic growth. Standard Chartered Plc estimates that a 100% pivot from Russian oil could increase India’s annual import bill by $4 billion to $6.5 billion. If India stops buying Russian crude and higher fuel prices are passed on fully to consumers, inflation would be 3-5 basis points higher, Standard Chartered’s economist Anubhuti Sahay wrote in a report.

The governor of India’s central bank, Sanjay Malhotra, has a different view. He doesn’t see a major impact on inflation for now, as India also sources crude from other countries.

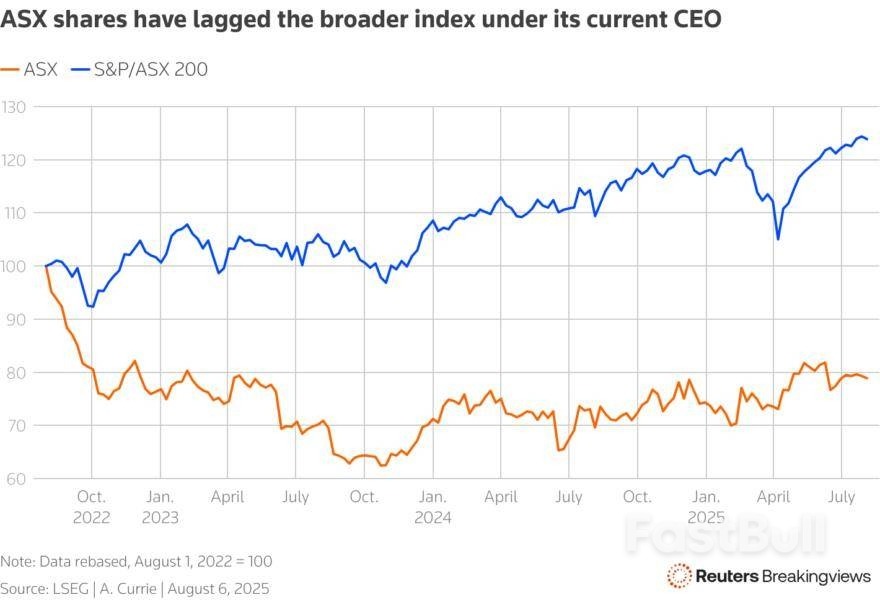

Everyone gets names wrong sometimes. That's little consolation to the poor souls at the Australian Stock Exchange who on Wednesday mistook TPG Telecom, the country's third-largest phone company, for U.S. private equity firm TPG Capital as the buyer in an M&A deal. The resulting A$520 million ($338 million) hit to the erroneously identified suitor's market value rings some alarming bells.

It was a simple case of human error, the bourse admitted, when staff at the ASX published the official statement about TPG Capital's A$621 million buyout of automotive software outfit Infomediaunder TPG Telecom's ticker. Shares of the company formerly known as Vodafone Hutchison Australia fell 4% before trading was halted - two hours later - so that the ASX could fess up and nix the trades; even so they closed down 5%.

Granted, the loss pales in comparison to past so-called fat-fingered financial blunders. In 2018, a Samsung Securitiesemployee mistakenly sent 1000 shares instead of 1000 won as dividends to employees, resulting in an $81 billion error, using current exchange rates. Deutsche Bankmistakenly sent a hedge fund $6 billion a decade ago - though got it back. Citigrouptopped that last year, wiring a customer $81 trillion instead of a mere $280, before it was reversed at the last minute.

Trouble is, ASX's goof is not an anomaly for the company. It is already under fire for repeated problems trying to replace its ageing clearing and settlement systems, including an outage in December. The Australian Securities and Investment Commission in June launched an investigation into governance and risk management, following its decision last year to sue the exchange alleging it made misleading statements about the project's progress.

Wall Street banks usually pay for their errors with lower earnings, fines or reputational hits - or all of them. The ASX's latest gaffe could have more significant consequences. CEO Helen Lofthouse's position looks insecure - ASX's stock has fallen 20% in her three years in charge. The bourse's monopolistic grip on the domestic stock market also appears fragile. Australian Securities and Investments Commission is in the final stages of considering Chicago-based Cboe Global Markets'application to list, rather than just trade, Australian stocks. The fat finger at the ASX makes an approval look even more likely.

Shares in TPG Telecom fell more than 4% in early trading on August 6 after a market announcement from the Australian Stock Exchange wrongly identified the company as the buyer of another ASX-listed firm, Infomedia, for A$651 million ($423 million). The actual purchaser of the automotive software outfit is U.S. private equity firm TPG Capital.The bourse cancelled the trades after taking some two hours before explaining the mistake. TPG Telecom's stock initially recovered most of the losses but then closed down more than 5%.

Recurring applications for unemployment benefits surged to the highest since November 2021, adding to recent signs that the labor market is weakening.

Continuing claims, a proxy for the number of people receiving benefits, rose by 38,000 to 1.97 million in the week ended July 26, according to Labor Department data released Thursday. An elevated level of recurring filings indicates unemployed workers have more difficulty in finding a new job.

Initial claims also rose, to 226,000, last week, slightly higher than economists expected. Weekly data tends to be volatile, and the four-week moving average was little changed.

Investors and economists are on high alert for any indication that the labor market is further deteriorating after the government’s July employment report showed a more significant cooldown in job creation than originally thought.

That report, which included outsized downwards revisions to May and June numbers, prompted President Donald Trump to fire the Bureau of Labor Statistics commissioner and raised expectations that the Federal Reserve would cut interest rates at their next policy meeting in September.

Job growth has slowed over the last few months as businesses have grown more cautious about staffing decisions in reaction to Trump’s economic policies and uncertainty around them, particularly tariffs.

Overall, layoffs have remained subdued this year. However, some large companies have recently announced staff cuts, including Merck & Co. and Intel Corp. Stanford University also plans to reduce its workforce by more than 300 people, adding to the list of schools that have announced headcount reductions due to federal funding cuts.

Gold price rose on Thursday morning as new packages of increased US import tariffs took effect, adding to high global uncertainty and prompting investors into safety.

Fresh rise cracked strong resistances at $3400 zone (Fibo 76.4% of $3438/$3268 / psychological /upper triangle boundary) but failed to break higher on first attempt.

As expected, bulls faced headwinds and metal’s price eased to the mid-point of congestion that extends into third straight day.

Technical picture on daily chart has improved, but flat momentum (slightly above the centreline) and overbought stochastic warning, after gold faced a double false break below and above triangle recently.

However, triangle is narrowing, and eventual clear break is likely to be seen in coming sessions that would generate fresh direction signal.

Current favorable fundamentals contribute to bullish scenario, with sustained break above $3400 zone to signal bullish continuation and expose targets at $3438 and $3452 (tops of July 23 / June 16) guarding key barrier at $3500 (new record high, posted on Apr 22).

Conversely, violation of triangle support line ($3347) would weaken near-term structure, but extension below daily cloud top ($3335) will be required to verify fresh negative signal and shift focus towards key supports at $3300 / $3286 / $3268 (psychological /daily cloud base / July 30 multi-week low).

Res: 3400; 3405; 3414; 3438.Sup: 3365; 3353; 3347; 3335.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up