Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Poland's central bank is likely to deliver its sixth interest-rate cut this year after inflation slowed more than expected, slipping below policymakers' target.

Poland should prioritize cheaper land wind energy over offshore projects to stay competitive in the global economy, according to the head of the country's power grid operator.

The European Union's most coal-reliant state would be better off putting its ambitious offshore plans on the backburner until the potential of onshore turbines is fully unlocked, Grzegorz Onichimowski, chief executive officer of state power grid PSE, said in an interview.

His comments align Poland with a cooling sentiment in the European offshore industry, following failed auctions in Germany and Denmark within the past year due to rising costs.

"Why hurry? First we need to unlock the onshore wind energy, which will show us how much offshore wind we really need," he said.

The stark warning comes as Poland is gearing up for a December 17 tender to grant contracts for another 3 gigawatts of offshore capacity. Maximum prices are set between 486 zloty ($134) to 512 zloty a megawatt hour, significantly higher than current exchange levels with taxpayers poised to cover the gap.

"Even if the final prices are below the maximum limits, they will still be much above the market," he said. "This is not a contract for difference, this is a mechanism of stable subsidies."

Onichimowski suggested the auction should ideally be postponed, though he acknowledged projects are already at advanced stages.

Across Europe, offshore wind is seen as a crucial part of the continent's transition away from fossil fuels, but steep price increases for materials like steel as well as higher borrowing costs in recent years have forced governments to ramp up subsidies to ensure the projects are delivered.

Poland's preliminary strategy targets 18 gigawatts of Baltic Sea wind power and 35 gigawatts of onshore wind by 2040 as the nation phases out coal plants that now produce more than half of its electricity. Wind generation accounts for roughly 15% of the total power mix.

However, expansion on land has stalled since 2017 due to restrictive distance regulations. While Prime Minister Donald Tusk has promised to speed up onshore development, necessary regulatory changes are still pending. Tusk came to power two years ago with a pledge to accelerate transition into green energy sources, arguing that affordable power could fuel Poland's future economic growth.

First movers in the country's offshore sector, including Orsted AS and Northland Power Inc, are already constructing farms with a total capacity exceeding 4 gigawatts, with operations slated to begin next year.

For Polish industry, the stakes are high. Producers have long appealed for relief from soaring energy prices driven by coal dependency and distribution costs.

PSE's Onichimowski warned that inefficient spending on grid or generation assets that remain idle will double the financial blow, putting Poland at a disadvantage against developing economies.

"Every zloty we spend unnecessarily, every stranded cost we create by excessive investments, will hit us twice as hard," the CEO said. "The global competition will be lethal and it's already visible today."

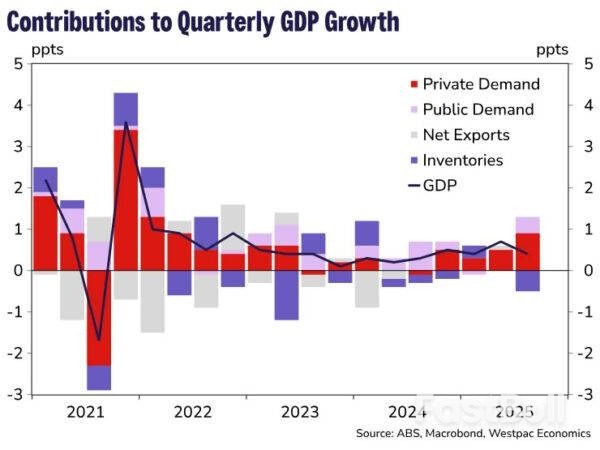

The September quarter National Accounts show growth slowed to 0.4% over the quarter while upward revisions to previous activity saw the year-ended outcome accelerate to 2.1%yr – a touch above the RBA's updated trend estimate of +2.0%yr but slightly below Westpac Economics' estimate of trend.

Domestic demand (spending by consumers, businesses, and governments) grew a solid 1.2%qtr over the September quarter and 2.6% in year-ended terms – the strongest quarterly growth since the June quarter 2012 (outside the pandemic). There was no need for a 'handover' with both the private and public sectors contributing to the pickup in domestic demand.

New private demand grew a strong 1.2%qtr and 3.1% in year-ended terms – also the fastest quarterly pace since the March quarter 2012 (outside the pandemic). While the consumer contributed, the standout was new business investment which grew 3.4%qtr and 3.8%yr. Despite this lift, the outcome was a touch softer than our 5.8%qtr forecast as engineering construction disappointed on the downside (-0.7%qtr v forecast of 2.0%qtr). Victoria recorded an outsized sharp 8.0% fall in engineering construction activity. Timing difference with the construction work done partial is one possible explanation of this discrepancy.

The positive news was that we saw investment increases across most of the asset classes, including machinery (7.5%qtr and 6.2%yr); and new building (2.0%qtr and 2.1%yr). And while data centre fit outs and the purchase of civil aircrafts were the main contributors to the boost in machinery, capex data showed that the lift was broader to also include consumer facing industries (such as accommodation and food services) and some business facing industries (such as administrative and support services).

Housing construction activity grew 1.8%qtr and 6.5%yr. Here too the quarterly outcome was softer than we expected based on the partial data (+1.8%qtr v +3.2%qtr). However, the year ended outcome was in line with our forecasts as activity in previous quarters was revised higher. The quarterly outcome was driven by both the construction of new dwellings (2.6%qtr) and renovation activity (0.5%qtr). There remains a healthy pipeline of projects to work through, which should support housing construction activity going forward.

Firmer consumer spending extended into Q3, with household spending growing 0.5%qtr and 2.5%yr. This follows the bumper June quarter outcome of 0.9%qtr, which was partly driven by one-offs including the roll-off of state electricity rebates, larger than usual EOFY discounting, and holiday spend around Easter and ANZAC Day.

With population growth projections running at 1.7%yr, this implies consumption per capita has started to post sizable increases. The Aussie consumer continues to be supported by rising real incomes which grew 0.9%qtr and 3.8%yr. A key uncertainty is whether this income boost will fade if interest rates were to remain on hold for longer and as the Stage 3 tax cuts are chewed away by bracket creep (we saw personal income tax increase as a share of household income this quarter). Without this boost, consumption could slow which would have implications for the labour market.

On the flip side, the upswing is likely to gain greater momentum the longer it runs, which increases the likelihood it will become self-sustaining, boosting incomes and supporting consumption going forward. The Westpac–DataX Card Tracker Index shows spending picked up in October, suggesting momentum is extending to the December quarter.

Net exports and inventories were broadly in line with expectations. A rundown in mining, public sector, and consumer goods inventories has detracted around 0.5ppts from Q3 growth, while net exports added a further 0.1ppt drag.

Note, the statistical discrepancy detracted 0.1ppt from growth over the quarter, compared to a 0.2ppt contribution last quarter.

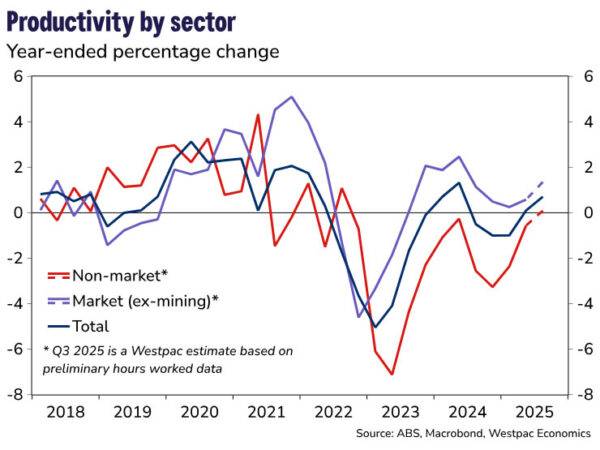

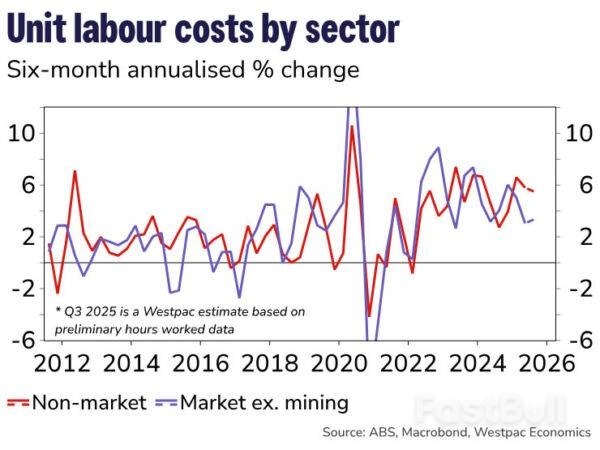

Labour productivity bounced to grow 0.8%yr. Digging a little deeper, we estimate that productivity in the market (ex-mining) sector grew at around 1.4%yr in Q3 (estimates will be finalised after Friday's Labour Accounts).

As well as moderating growth in the sector's unit labour costs to around 3.3% in six-month annualised terms, this supports the view that whole-economy productivity growth will recover as the sector-specific factors in mining and the care economy wash out.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up