Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Platinum prices surged to $1,390.98 per ounce, the highest since 2014, as supply constraints and rising investor demand—especially from China—combined with substitution effects from palladium...

Ethereum (ETH) staking has hit a new all-time high, with over 33.9 million ETH locked as of June 24, 2025. This surge comes as Ethereum simultaneously posted a 9% weekly gain, closing at $2,428.41 amid $3.3 billion in net inflows.

The momentum across Ethereum is currently bullish, fueled by rising participation in staking and increasing demand-side flows. This growth is visible in the uninterrupted staking curve that began in December 2020, gaining strength particularly after the 12 million mark was crossed in mid-2022.

According to CryptoBullet, staked ETH began under 5 million in January 2021 but climbed steadily despite market volatility and macro headwinds. From Epoch 6843 to Epoch 362559, staked ETH advanced through every phase, pushing above 33.9 million in June 2025.

The current staking growth appears independent of an Ethereum staking ETF, which could further escalate locked volume. Notably, no prolonged downtrend has occurred over the years, signaling persistent validator confidence in Ethereum's Proof-of-Stake framework.

Recent movements in the sector have reshaped priorities, with Ethereum gaining 9.01% on the week and closing firmly above $2,400. The move followed a rebound off the $1,600 zone earlier this month, which has historically acted as a strong technical support.

Source: TradingView

Source: TradingViewEthereum's weekly chart shows a low of $2,188.00 and a high of $2,482.04, reflecting strong buying from intraday dips. The latest price action indicates ETH is forming a higher low on the weekly chart, with a potential path toward $2,800 resistance.

Volume hit 1.64 million ETH on Binance this week, confirming faith in the rally. This volume pop is in line with growing staking, further supporting the thesis that ETH holders are deploying capital into long positions instead of exiting the market.

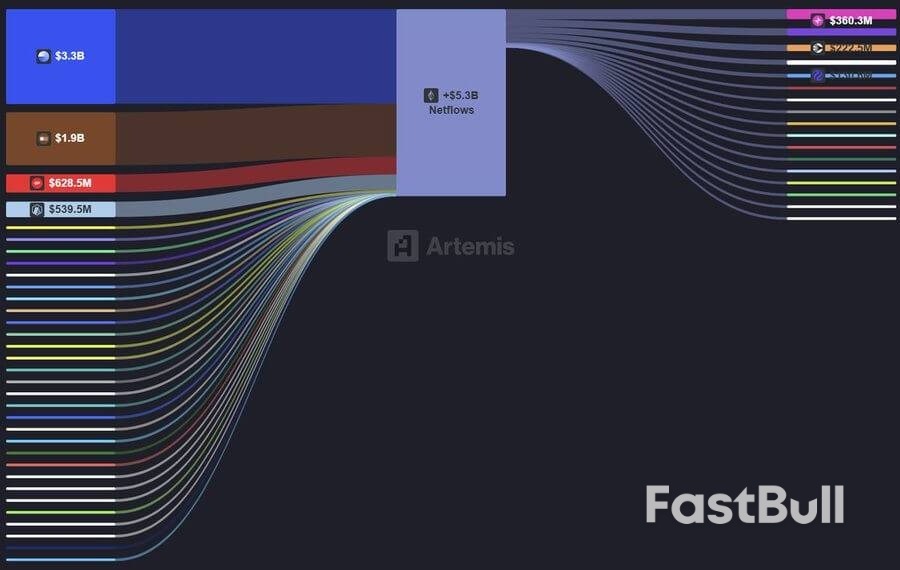

Simultaneously, other market indicators suggest a different trend beneath the surface-Ethereum led all assets with $3.3 billion in net inflows. According to data from Artemis, Ethereum captured the largest share of $5.3 billion in net flows across the crypto sector.

Source: Artemis

Source: ArtemisBitcoin was in second place at $1.9 billion, with Solana and Arbitrum coming third and fourth, with $628.5 million and $539.5 million, respectively. The other $360.3 million of ETH inflows was deployed into Ethereum-based protocols for use in DeFi, staking platforms, and stablecoin liquidity pools.

Ethereum’s sustained capital magnetism underscores its current dominance. When staking grows and price rises in tandem, the market takes notice. And when Ethereum absorbs over 60% of crypto inflows, the ecosystem speaks for itself.

Bitcoin surged to $108.2K after news of a ceasefire between Israel and Iran sent widespread optimism in the market, fueling the price rally as traders emotionally responded to macro triggers in a switch from fear to instant euphoria.

The market's general sentiment is still firmly bullish, with BTC breaking above $108K after a week of consolidation. Speculative gossip soon reversed from collapse chatter to manic targets for the upside, reflective of extreme emotional responses to global news. This move is one of the most volatile reversals in trader sentiment this month.

According to data shared by Santiment, low-end Bitcoin price mentions ($30K–$70K) spiked heavily on June 22. This reaction reflected traders' anxiety as war tensions escalated, prompting talk of deep price retracements. The sharp rise in bearish sentiment dominated conversations and dragged social dominance down.

The panic was short-lived. By June 25, conversations had flipped entirely toward bullish targets ranging between $120K and $160K. In a post by Santiment, the data showed massive engagement around high-end price calls, indicating a dramatic change in trader outlook.

As ceasefire reports circulated globally, the Bitcoin market rallied sharply. Traders responded by ditching bearish targets and fueling speculation of a run toward $120K. The crowd's mindset, previously defensive, turned aggressively bullish with remarkable speed.

The shift wasn’t just in price targets-it showed up in the dominance line too. When bearish calls peaked, social dominance dipped. But when optimism returned, that line climbed again, mirroring a sudden surge in speculative confidence.

June 25 recorded the most significant spike in $120K+ call volume since early June. According to a report by Santiment, traders weren’t just betting on a recovery-they were anticipating new highs. This dramatic switch revealed how external events can instantly alter crypto investor psychology.

Social volumes across both bearish and bullish spectrums mirrored intense emotional cycles among market participants. Traders reacted instantly to war-related news, swinging between fear of collapse and dreams of breakout highs.

As bearish sentiment dropped post-June 23, bullish calls began dominating social platforms. The reaction was not just speculative-it fueled trading behavior. The $108K level became the focal point of renewed conviction and crowd-driven speculation. Bitcoin remains hyper-sensitive to macro events, as seen in this recent sentiment whiplash. The data confirms that fear and greed continue to rule market behavior in high-stakes environments.

The post Bitcoin Hits $108.2K After $120K+ Price Speculation Dominates Social Buzz appears on Coin Futura. Visit our website to read more interesting articles about cryptocurrency, blockchain technology, and digital assets.

The People's Liberation Army "shows zero tolerance to Taiwan independence separatist activities", a Chinese defence ministry spokesperson said on Thursday when asked about recent speeches made by Taiwan's President Lai Ching-te.

The PLA will enhance combat readiness to firmly safeguard national sovereignty and territorial integrity, spokesperson Zhang Xiaogang told a regular press conference.

"The Lai authorities keep pushing Taiwan into a dangerous situation of war; they are the cause of harming the livelihood of the Taiwanese people," Zhang said, adding that Lai's comments showed his "ill intentions".

Lai on Sunday began a series of 10 speeches on "uniting the country", saying that democratically-ruled Taiwan was "of course a country" and that China had no legal or historical right to claim it.

Beijing and Taipei have clashed over their competing interpretations of history in an escalating war of words over what Beijing views as provocations from Taiwan's government, saying it was impossible to "invade" what was already Chinese land.

Beijing has never renounced the use of force to bring the island under its control and has a particular dislike for Lai, describing him as a "separatist". Taiwan strongly objects to China's sovereignty claims and says it is up to the island's people to decide their future.

Tensions between China and Taiwan, including several rounds of Chinese war games, have grown over the last five years and now include daily air and naval deployments near the island.

The last Chinese war games in April and October were widely seen by regional military attaches as a test of a possible blockade of Taiwan.

The U.S. and its regional allies are watching closely, with some officials saying that China's deployments and its military modernisation have raised the possibility Beijing may one day make good on its threats to take Taiwan by force.

Hungarian Prime Minister Viktor Orbán is leading an effort to ensure Ukraine, which is currently at war with Russia, does not join the European Union due to the high potential for a conflict that could spread to all of Europe.

In this regard, he is now confronting Ukrainian President Volodymyr Zelensky directly on X on the issue.

“President (Zelensky), with all due respect: the European Union was founded to bring peace and prosperity to its member states. Accepting a country that is at war with Russia would immediately drag the EU into a direct conflict. It is unfair to expect any member state to take this risk,” wrote Orbán.

Orbán had responded to a post from Zelensky, in which the Ukrainian leader thanked EU leadership after a meeting, stating that they discussed, among other things, Ukraine’s ascension into the EU.

Citing his meeting with EU commission President Ursula von der Leyen, NATO Secretary General Mark Rutte, and European Council President António Costa, Zelensky called out Hungary.

“It is important that the leaders of the member states reach a common decision to open the first negotiation cluster. It is unfair when a single party blocks the Union’s decision. We also discussed in detail additional sanctions against the Russian Federation and the preparation of the EU’s 18th sanctions package.

This package must significantly increase pressure on Russia’s energy and banking sectors, as well as on the shadow fleet.

The key element here must be a strong price cap on Russian oil, and we count on the appropriate decisions. I thank the leaders for their support. Every step of assistance means lives saved,” he wrote.

Zelensky desires an accelerated process to gain EU membership, despite his country being the most corrupt country in Europe — a finding noted even before the war.

The rebuilding of Ukraine is expected to cost hundreds of billions of euros.

Currently, the country has no democracy or free press, as all elections have been suspended during the war.

Perhaps of greatest concern is that even if Ukraine is admitted to the EU during a ceasefire, hostilities could start again, which could drag Europe further into a new war.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up