Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices remained steadfastly glued to $65 a barrel, as they have been for more than three weeks, with easing trade tensions helping offset concerns about a brewing supply glut later this year.

Oil prices remained steadfastly glued to $65 a barrel, as they have been for more than three weeks, with easing trade tensions helping offset concerns about a brewing supply glut later this year.

Brent inched lower, but held on to most of its gains from Thursday and was on track for its first weekly increase since mid-May. President Donald Trump and his Chinese counterpart, Xi Jinping, agreed to further trade talks over tariffs and supplies of rare earth minerals.

The positive signals come against the backdrop of an oil market that has been increasingly rangebound over recent weeks. Prices have traded in a $4 band since the middle of May and a gauge of volatility for US crude futures is at the lowest level since early April.

Oil has been buffeted in Trump’s second term, as trade tensions between the world’s two largest economies menace demand. At the same time, the OPEC+ alliance has been adding barrels back to the market at a faster-than-expected rate, further clouding an already weak outlook for the second half of the year.

“The market looks balanced in 2Q/3Q on our estimates as oil demand rises in summer and peaks in July-August, matching supply increases from OPEC+,” HSBC analysts including Kim Fustier wrote. “Deteriorating fundamentals after summer raise downside risks to oil prices.”

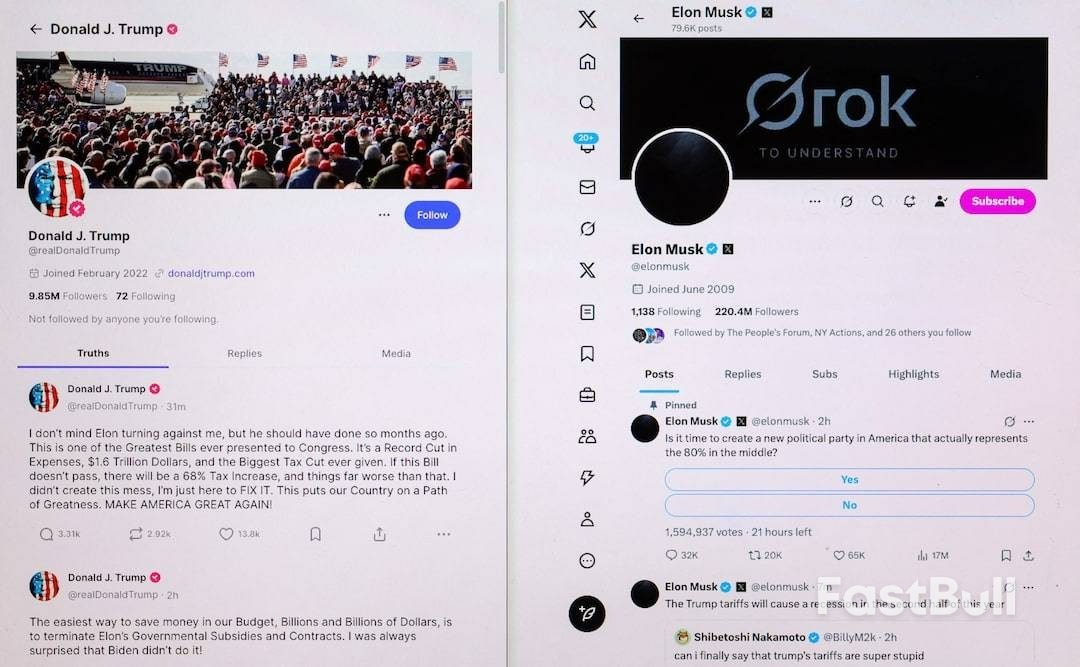

White House aides scheduled a call between Donald Trump and Elon Musk for Friday, Politico reported, after a huge public spat that saw threats fly over government contracts and ended with the world's richest man suggesting the U.S. president should be impeached.

The reported call could ease the feuding after an extraordinary day of hostilities - largely conducted over social media - that marked a stark end to a close alliance.

Shares in Musk's Tesla (TSLA.O), opens new tab closed down over 14% on Thursday, losing about $150 billion in market value in the largest single-day decline in value in its history. In pre-market European trading on Friday they pared some of those losses, rising 5% after the Politico report that the two men were scheduled to speak.

Musk had bankrolled a large part of Trump's presidential campaign and was then brought as one of the president's most visible advisers, heading up a sweeping and controversial effort to downsize the federal workforce and slash spending.

The verbal punches erupted on Thursday after Trump criticized Musk in the Oval Office and the pair then traded barbs on their social media platforms: Trump's Truth Social and Musk's X.

The falling-out had begun brewing days ago when Musk, who left his role as head of the Department of Government Efficiency a week ago, denounced Trump's sweeping tax-cut and spending bill.

The president initially stayed quiet while Musk campaigned to torpedo the bill, saying it would add too much to the nation's $36.2 trillion in debt.

Trump broke his silence on Thursday, telling reporters he was "very disappointed" in Musk.

"Look, Elon and I had a great relationship. I don't know if we will anymore," Trump said.

As Trump spoke, Musk responded on X.

"Without me, Trump would have lost the election," wrote Musk, who spent nearly $300 million backing Trump and other Republicans in last year's election.

In another post, Musk asserted that Trump's signature import tariffs would push the U.S. into a recession later this year.

"The easiest way to save money in our Budget, Billions and Billions of Dollars, is to terminate Elon's Governmental Subsidies and Contracts," Trump posted.

Minutes after the closing bell, Musk replied, "Yes," to a post on X saying Trump should be impeached, something that would be highly unlikely given Trump's Republicans hold majorities in both chambers of Congress.

Musk's businesses also include rocket company and government contractor SpaceX and its satellite unit Starlink.

Musk, whose space business plays a critical role in the U.S. government's space program, said that as a result of Trump's threats he would begin decommissioning SpaceX's Dragon spacecraft. Dragon is the only U.S. spacecraft capable of sending astronauts to the International Space Station.

Late on Thursday, Musk backed off the threat.

In another sign of a possible detente to come, Musk subsequently wrote: "You're not wrong," in response to billionaire investor Bill Ackman saying Trump and Musk should make peace.

Trump and Musk are both political fighters with a penchant for using social media to attack their perceived enemies, and many observers had predicted a falling-out.

Musk hit at the heart of Trump's agenda earlier this week when he targeted what Trump has named his "big, beautiful bill", calling it a "disgusting abomination" that would deepen the federal deficit.

His attacks amplified a rift within the Republican Party that could threaten the bill's prospects in the Senate.

Nonpartisan analysts say Trump's bill could add $2.4 trillion to $5 trillion to the nation's $36.2 trillion in debt.

A prolonged feud between the pair could make it harder for Republicans to keep control of Congress in next year's midterm elections if it leads to a loss of Musk's campaign spending or erodes support for Trump in Silicon Valley.

"Elon really was a significant portion of the ground game this last cycle," said a Republican strategist with ties to Musk and the Trump administration who spoke to Reuters on condition of anonymity.

"If he sits out the midterms, that worries me."

On Tuesday, Musk posted that "in November next year, we fire all politicians who betrayed the American people."

Musk had already said he planned to curtail his political spending in the future. Musk's increasing focus on politics provoked widespread protests at Tesla sites, driving down sales while investors fretted that Musk's attention was too divided.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up