Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. S&P/CS 10-City Home Price Index YoY (Oct)

U.S. S&P/CS 10-City Home Price Index YoY (Oct)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Oct)

U.S. FHFA House Price Index YoY (Oct)A:--

F: --

U.S. Chicago PMI (Dec)

U.S. Chicago PMI (Dec)A:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Nov)

Brazil CAGED Net Payroll Jobs (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

FOMC Meeting Minutes

FOMC Meeting Minutes U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

South Korea CPI YoY (Dec)

South Korea CPI YoY (Dec)A:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Dec)

China, Mainland NBS Manufacturing PMI (Dec)A:--

F: --

P: --

China, Mainland Composite PMI (Dec)

China, Mainland Composite PMI (Dec)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Dec)

China, Mainland NBS Non-manufacturing PMI (Dec)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Dec)

China, Mainland Caixin Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

Turkey Trade Balance (Nov)

Turkey Trade Balance (Nov)A:--

F: --

P: --

South Africa Trade Balance (Nov)

South Africa Trade Balance (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

South Korea Trade Balance Prelim (Dec)

South Korea Trade Balance Prelim (Dec)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Dec)

South Korea IHS Markit Manufacturing PMI (SA) (Dec)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Dec)

Indonesia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

India HSBC Manufacturing PMI Final (Dec)

India HSBC Manufacturing PMI Final (Dec)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Dec)

U.K. Nationwide House Price Index MoM (Dec)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Dec)

U.K. Nationwide House Price Index YoY (Dec)--

F: --

P: --

Turkey Manufacturing PMI (Dec)

Turkey Manufacturing PMI (Dec)--

F: --

P: --

Italy Manufacturing PMI (SA) (Dec)

Italy Manufacturing PMI (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Dec)

Euro Zone Manufacturing PMI Final (Dec)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Nov)

Euro Zone M3 Money Supply (SA) (Nov)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Nov)

Euro Zone 3-Month M3 Money Supply YoY (Nov)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Nov)

Euro Zone Private Sector Credit YoY (Nov)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Nov)

Euro Zone M3 Money Supply YoY (Nov)--

F: --

P: --

U.K. Manufacturing PMI Final (Dec)

U.K. Manufacturing PMI Final (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Dec)

Brazil IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Manufacturing PMI (SA) (Dec)

Canada Manufacturing PMI (SA) (Dec)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Dec)

U.S. IHS Markit Manufacturing PMI Final (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Dec)

Mexico Manufacturing PMI (Dec)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Japan Manufacturing PMI Final (Dec)

Japan Manufacturing PMI Final (Dec)--

F: --

P: --

China, Mainland Caixin Composite PMI (Dec)

China, Mainland Caixin Composite PMI (Dec)--

F: --

P: --

China, Mainland Caixin Services PMI (Dec)

China, Mainland Caixin Services PMI (Dec)--

F: --

P: --

Indonesia Trade Balance (Nov)

Indonesia Trade Balance (Nov)--

F: --

P: --

Indonesia Core Inflation YoY (Dec)

Indonesia Core Inflation YoY (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Dec)

Indonesia Inflation Rate YoY (Dec)--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Dec)

Saudi Arabia IHS Markit Composite PMI (Dec)--

F: --

P: --

Freddy94_

ID: 1815108

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

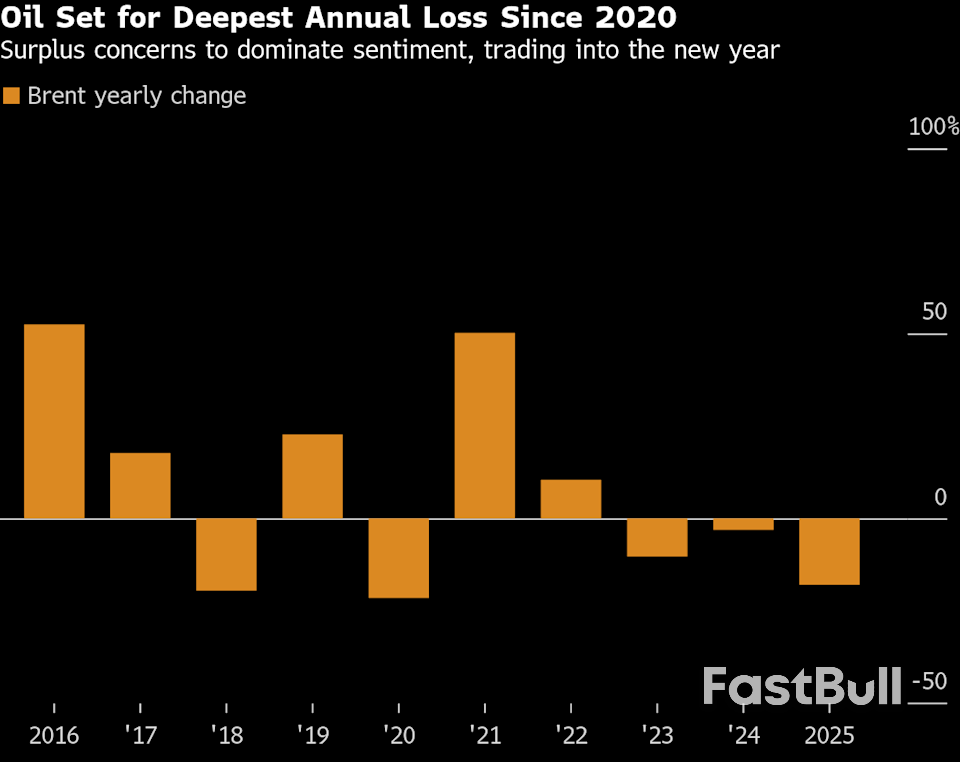

Oil is set for its biggest annual loss since 2020 as global oversupply deepens, OPEC+ raises output, and demand lags, leaving prices pressured despite ongoing geopolitical risks.

Applications for US unemployment benefits fell last week to one of the lowest levels this year, accentuating volatility in the data during the holiday season.

Initial claims decreased by 16,000 to 199,000 in the week ended Dec. 27, according to Labor Department data released Wednesday. That was lower than all estimates in a Bloomberg survey of economists and one of just a handful of readings below 200,000 since early 2024.

The figures have been volatile recently, as is typical at this time of year. The latest period included Christmas, as well as the newly declared federal holidays of Dec. 24 and 26.

Applications for unemployment benefits jumped at the beginning of the month after falling to a three-year low around Thanksgiving in the week prior. The four-week moving average of initial applications, a metric that helps smooth out volatility, ticked up to 218,750.

Continuing claims, a proxy for the number of people receiving benefits, decreased to 1.87 million in the previous week. That was also one of the lowest readings in recent months.

The US has seen sluggish hiring through much of this year, which has eroded Americans' views of their employment prospects. Meantime, the unemployment rate has climbed to a four-year high, even as layoffs remain relatively limited.

A report from the Conference Board last week showed more Americans think jobs are hard to get, and the share saying jobs are plentiful is decreasing. Economists expect the unemployment rate to remain elevated throughout 2026.

India is set to sustain high economic growth and authorities will take measures to shield it from potential shocks due to volatility in the global economy, the central bank said.

The economy remains "robust and resilient," supported by strong domestic demand growth, benign inflation and healthy corporate balance sheets, Reserve Bank of India Governor Sanjay Malhotra said in the central bank's bi-annual Financial Stability Report released on Wednesday.

"Nonetheless, we recognize the near-term challenges from external spillovers and continue to build strong guardrails to safeguard the economy and the financial system from potential shocks," he said

India's foreign exchange reserves, at nearly $695 billion, are the world's fourth largest and cover more than 11 months of imports. The central bank uses the reserves to smooth volatility in the exchange rate, which has intensified amid delays in a trade deal with the US, India's largest export market.

The RBI cut its policy rate to a more than three-year low earlier this month to support growth and offset the impact of punitive US tariffs on Indian shipments. It also signaled an intention to cut rates further if inflation remained soft even as it injected substantial liquidity into bond markets to ease borrowing costs.

Uncertainty over an agreement with Washington has pressured the rupee, which has tumbled nearly 5% this year. The economy grew a robust 8.2% in the July–September quarter but the outlook remains clouded by global factors.

Stress tests on Indian banks showed that asset quality may improve, as lenders have adequate capital to withstand potential stress, the report said.

Bad loans at 46 Indian banks are likely to drop to a multi decade low of 1.9% of total advances by March 2027 from 2.1% in September this year, according to the report. Even under adverse and severe stress scenarios, asset quality is expected to remain relatively healthy at 3.2% and 4.2%, respectively.

The capital adequacy ratio of banks, a key measure of financial strength, may decline to 16.8% by March 2027 from 17.1% in September 2025, the RBI said. While the ratios worsen under adverse scenarios, "none of the banks would fall short of the minimum Capital to Risk-Weighted Assets Ratio requirement of 9% even under the adverse scenarios."

Bitcoin (BTC) is nearing the end of a six-week consolidation phase. The asset has been moving within a tight symmetrical triangle, and traders are now watching for a breakout or breakdown. As of press time, it is trading at around $88,500, showing a slight rise over the last 24 hours.

For the past month and a half, Bitcoin has been forming a symmetrical triangle, which reflects a balance between buyers and sellers, with the range narrowing each week. The current setup indicates that the price is approaching a point where this balance will end, likely with a sharp movement in either direction.

Analyst The Swing Trader posted,

"Bitcoin has been forming a very tight pennant for the last 6 weeks… A breakout targets a 15% move into $100K resistance."

Based on the triangle's range, a breakout could send Bitcoin as high as $100,500. A breakdown, on the other hand, could lead to a 15% drop toward $75,000.

Meanwhile, Titan of Crypto shared a chart showing Bitcoin in a clear accumulation range between $80,000 and $94,000. The post explained that short-term direction may depend on which liquidity area is taken first, above or below the range.

"If the upper pool is taken first, odds of bearish continuation increase," the post said.

Some traders expect a move lower before any lasting recovery. Jason Pizzino offered a similar short-term view, pointing to a bear flag pattern following the recent decline. If this pattern breaks to the downside, it could send Bitcoin into the $70,000–$76,000 range.

Despite quiet retail interest, institutional activity has continued. Lark Davis reported that public companies now hold more than 1.09 million BTC, or around 5.1% of the supply. Strategy, which recently added 1,229 BTC, now holds 672,497 BTC in total. Metaplanet purchased another 4,279 BTC in December, bringing its total to 35,102.

Other firms, including Bitdeer Technologies, Anap Holdings, and Cango Inc., have also made purchases. These investments come as the market remains uncertain near the $88,000 mark, with no clear breakout yet.

Some market indicators are beginning to shift. Ash Crypto posted that the MACD is now at levels last seen during the 2022 low and is showing a bullish divergence. This may suggest that downward pressure is fading. Still, the price has struggled to stay above $90,000 in recent weeks.

A long-term forecast from Dragonfly's Haseeb Qureshi sees potential for Bitcoin to reach $150,000 by 2026. For now, BTC remains compressed within its triangle, and traders are watching for a move that could set the tone for early 2026.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up