Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Asian and European stocks rebounded on US rate cut hopes, despite weak US jobs data. Strong corporate earnings supported Wall Street, while oil slid on OPEC+ output hikes. Dollar gained modestly.

The Lebanese government is expected to discuss Hezbollah's disarmament on Tuesday, facing pressure from the United States to make progress as Israel presses attacks on the Iran-backed group.

While President Joseph Aoun and Prime Minister Nawaf Salam aim to establish a state monopoly on arms, seeing this as vital to stabilising Lebanon, Hezbollah has rejected demands for its disarmament, saying such calls serve Israel.

Iran's Revolutionary Guards founded Hezbollah in 1982 during Lebanon's 1975-90 civil war, part of Tehran's effort to export its 1979 Islamic Revolution and fight Israeli forces that had invaded Lebanon in 1982.

While other groups disarmed after Lebanon's civil war, Hezbollah kept its weapons to fight Israeli forces occupying the predominantly Shi'ite Muslim south. It kept its weapons after Israel withdrew in 2000.

In 2006, during a five-week war, it fired thousands of rockets into Israel. The war erupted after Hezbollah crossed into Israel, kidnapping two soldiers and killing others.

Hezbollah's arsenal grew after 2006. The U.S. Central Intelligence Agency's World Factbook said it was estimated to have as many as 150,000 rockets and missiles in 2020 and in 2022 was estimated to have 45,000 fighters.

Hezbollah's veteran leader Hassan Nasrallah, killed by Israel in 2024, said the group had 100,000 fighters.

After the 2006 war, Hezbollah became involved in conflicts outside Lebanon. It sent fighters to Syria to help Bashar al-Assad fight rebels, aided Iran-backed Shi'ite militias in Iraq, and supported the Houthis of Yemen, sending fighters to assist them in their war with a Saudi-led coalition, according to Riyadh, though Hezbollah has never confirmed this.

It also deepened ties with Palestinian militant group Hamas. Hezbollah became the spearhead of the Iran-backed "Axis of Resistance".

After Hamas attacked Israel on October 7, 2023, Hezbollah opened fire on Israeli positions in the frontier region, declaring solidarity with the Palestinians.

Hezbollah and Israel traded fire for almost a year until September 2024, when Israel detonated thousands of booby-trapped pagers used by Hezbollah members, and stepped up airstrikes, killing Nasrallah and other commanders.

Israel also sent troops into Lebanon's south.

In addition to killing much of Hezbollah's command, Israel killed thousands of fighters and destroyed much of its arsenal.

The toppling of Assad in Syria in December 2024, choked Hezbollah's main supply route from Iran and tilted the regional power balance against it.

A U.S.-backed ceasefire agreed in November 2024 required Hezbollah's disarmament beginning in areas south of the Litani River, the area adjacent to Israel.

Hezbollah says the deal only applies to that region and that it has handed over weapons to Lebanese troops in that area. Israeli forces continue to occupy five hilltops in the south and to carry out airstrikes on Hezbollah fighters and arms depots.

Hezbollah long had a decisive say over state affairs but was unable to get its way over the formation of the 2025 post-war government, which adopted a policy of establishing a monopoly on arms.

Lebanese have been at odds over Hezbollah's arms for decades - opponents accuse it of dragging Lebanon into wars, supporters see its weapons as key to defending the country.

In 2008, Hezbollah fighters took over parts of Beirut in an armed conflict sparked by the government's vow to take action against the group's military communications network.

A U.N.-backed court convicted three Hezbollah members in absentia over the assassination of former prime minister Rafik al-Hariri, a Sunni Muslim politician killed in 2005 by a truck bomb in Beirut, along with 21 other people. Hezbollah has denied any role.

Hezbollah has solid backing among Shi'ites. The group has been represented in governments, either by Hezbollah politicians serving as ministers or through its approval of candidates for cabinet portfolios reserved for Shi'ites.

It runs its own social services. Together with its ally, Amal, it dominated local elections in May in Shi'ite areas. The groups hold all seats reserved for Shi'ites in parliament.

The United States holds Hezbollah responsible for suicide bombings in 1983 that destroyed the U.S. Marine headquarters in Beirut, killing 241 service personnel, and a French barracks, killing 58 French paratroopers. It also blames Hezbollah for a suicide attack on the U.S. Embassy in Beirut in 1983.

Lebanese officials and Western intelligence agencies have said groups linked to Hezbollah kidnapped Westerners in Lebanon in the 1980s. Referring to those attacks and hostage-taking, Nasrallah said in a 2022 interview they were carried out by small groups not linked to Hezbollah.

Western governments, including the United States, and Gulf Arab states, including Saudi Arabia, deem Hezbollah a terrorist group. Some, notably the European Union, have designated its military wing a terrorist group, drawing what critics say is an artificial distinction with its political wing.

Argentina blames Hezbollah and Iran for the bombing of a Jewish community centre in Buenos Aires in which 85 people died in 1994 and for an attack on the Israeli Embassy in Buenos Aires in 1992 that killed 29 people. Hezbollah and Iran deny any responsibility.

The Bitcoin price traded above $114,537 on August 4, 2025, at just above its key support of 1.5% gain; this should keep it stable for a little longer. Technical analysis for the platform shows limited downside, with a very small chance of prices going below $114,446 before the month-end.

Nevertheless, should prevailing bullish momentum persist, a move north of $141,645 is on the cards. These projections reflect the current market sentiment and potential historical resistance patterns, a positive price outlook for Bitcoin in the short term.

| Scenario | Projection | Notes |

| Support zone | $112K–$113K | Base for bitcoin price support |

| Resistance zone | $114K–$120K | Key for upward break |

| Bull case | $140K+ | If resistance clears |

| Bear case | Below $112K | Potential decline toward $107K |

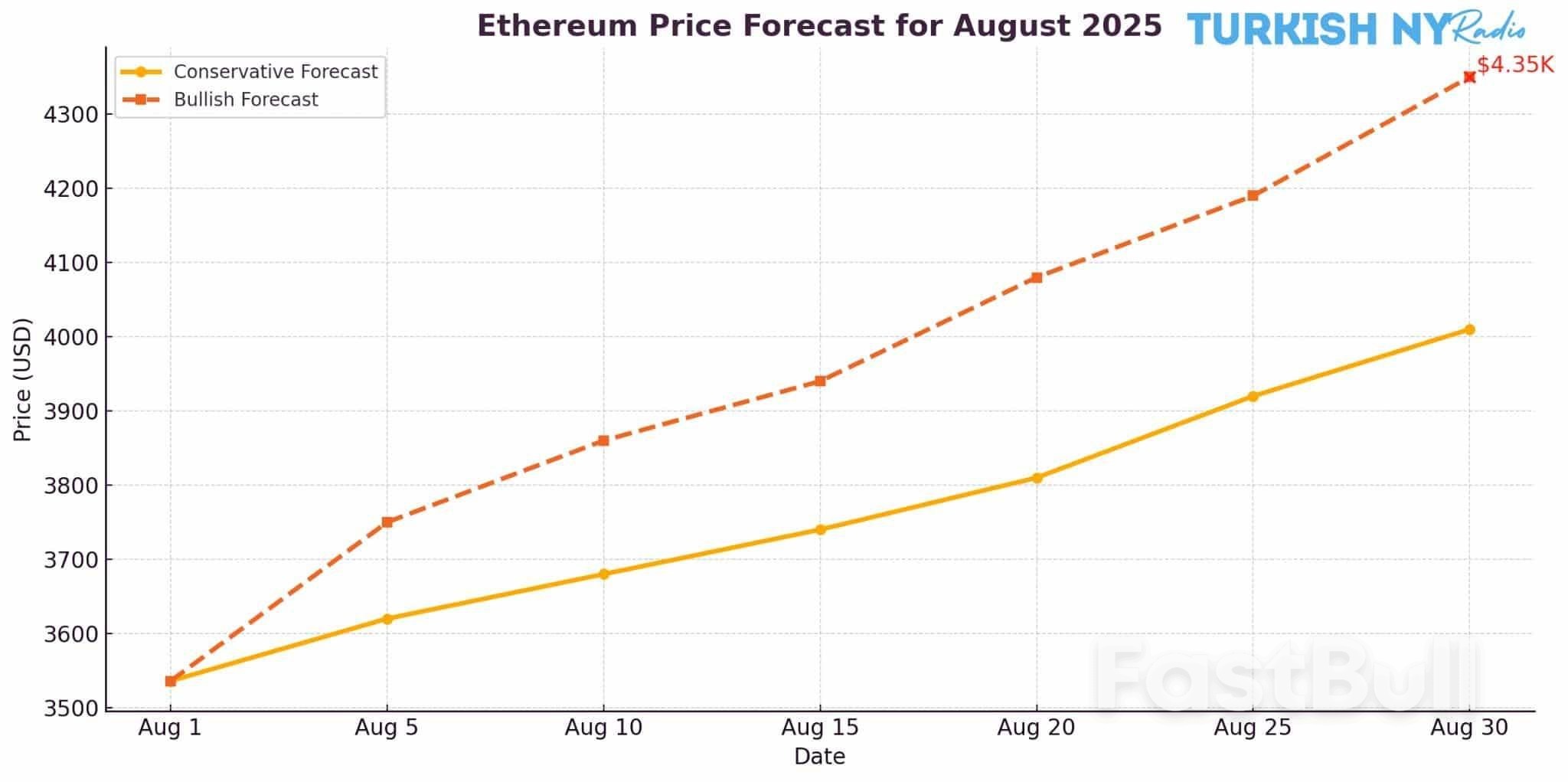

The Ethereum price has recently been updated to trade at $3,536 per coin, with a total market cap of less than $427 billion. US stablecoin frameworks and DeFi legislation post-project crypto provide a tailwind for growing Ethereum value. Top Analysts Believe $3,800–$4,100 Will Be Broken And Place ATH Near $4,865 In 2019.

Why the Ethereum Price Could Explode Past $4K This Month

Why the Ethereum Price Could Explode Past $4K This Month| Scenario | Projection | Conditions |

| Support | $3,500 | Must hold for bullish Ethereum price |

| Resistance | $3,800–$4,100 | Breakout zone |

| Bull case | Up to $4,800+ | If leg into tokenization, DeFi growth |

| Bear case | $3,200 | If macro or ETF flows reverse |

XRP Price Volatility: Correction in High Traffic

Currently, XRP is trading around $2.98, with a gain of 5 percent in the last 24 hours. The asset traded as low as $2.19 at the end of July but hit an intraday peak of $3.60, piquing investor fascination and drawing more interest in Friday’s action. But now, a trading volume means potential consolidation.

Conversion rate: 1 XRP 0.000844 ETH Strong resistance is evident in technical analysis at $3.25-$3.30 XRP/USD. Key Resistance—$3.40 Key Support—$2.70–$2.50 Signalling Possible Continued Bullish Momentum If XRP fails to close above $3.00, further downside might be expected towards the support levels of $2.70–$2.50. However, some of the models indicate that there may be a V-shaped recovery, which could push prices back to $3.60–$4.00.

Why the Ethereum Price Could Explode Past $4K This Month

Why the Ethereum Price Could Explode Past $4K This Month| Scenario | Projection | Conditions |

| Support | $2.70–$2.50 | If XRP price breaks $3.00 |

| Resistance | $3.25–$3.30 | Reclaim to target higher zone |

| Bull case | $3.60–$4.00 | If volume increases from bottom levels |

| Bear case | Below $2.60 | Downside risk if macro storms hit |

Stable macroeconomic conditions and institutional momentum continue to sustain the crypto markets, led by Bitcoin, with Ethereum and XRP tailing closely behind, owing in part to the newly minted U.S. Strategic Bitcoin Reserve, made up of that very same incarnate, alongside a measured camp comprising BTC-ETH-XRP-ADA-SOL.

Congress is adopting the legislative GENIUS Act and the Clarity Act to create more regulatory certainty around digital assets. According to Barron, these developments are bolstering confidence in long-term crypto forecast models. Price predictions by Cantor Fitzgerald put Bitcoin at $1 million and Ethereum at $7,000 in Q4 2025 under bullish macro (macroeconomic) and on-chain conditions.

More crypto news on Ethereum price, expert analysis, and price forecasts is available now on our crypto news platform

Bitcoin Price Breaks $114K—$115K, Aims for $140K—$141K; Else No Hope of Maintaining It & Likely to Retrace Down by $112K. Ethereum price requires support above $3,500, targeting over $4k if legislative sentiment remains bullish. If the $3.30 claim is rejected, the XRP price will be exposed to a decline toward $2.50–$2.60.

The August crypto forecast depends on macroeconomic variables, ETF dynamics, and regulatory developments. Some of these reasons could affect the price of Bitcoin and even Ethereum or XRP in the short to medium term.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up