Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Over 630 days of war later and much of Hamas' top command has been wiped out, and large swathes of the Gaza Strip obliterated.

Over 630 days of war later and much of Hamas' top command has been wiped out, and large swathes of the Gaza Strip obliterated. It's been no secret that the Netanyahu government is pursuing the complete annihilation of Hamas, ensuring that it can never again return to rule, but the reality is that the Israeli army is still taking on mass casualties.

This shows that the Hamas insurgency, using the Strip's hundreds of miles of tunnels, is still fierce and ongoing. "Five Israeli soldiers were killed in combat in the Gaza Strip, the Israeli army admitted on Tuesday, in one of the deadliest days for Israeli forces in the devastated Palestinian territory this year," regional media reports.

The five soldiers "fell during combat in the northern Gaza Strip," the IDF announced. In total 14 others were wounded. Included were two that were severely wounded and "evacuated to a hospital to receive medical treatment."

The five soldiers "fell during combat in the northern Gaza Strip," the IDF announced. In total 14 others were wounded. Included were two that were severely wounded and "evacuated to a hospital to receive medical treatment."They came under attack near Beit Hanoun in the north of Gaza,when improvised explosive devices were detonated, after which Israeli soldiers who sought to rescue the wounded came under fire again. Thus it's clear that either Hamas or Islamic Jihad militants set a trap and ambush for the soldiers.

The IDF and Israeli media have described that the infantry troops were operating on foot when the blast happened. One detail which highlights the ongoing extreme difficulty of uprooting the Palestinian insurgency is that the area where the attack occurred was subject of Israeli aerial raids just prior:

The military said the area where the attack took place was targeted from the air ahead of the troops’ operations.

The Netzah Yehuda soldiers were operating under the Gaza Division’s Northern Brigade as part of a fresh offensive with the 646th Reserve Paratroopers Brigade in Beit Hanoun, which began on Saturday, aimed at clearing the area of terror operatives who remain holed up there.

Israeli opposition leader Yair Lapid wrote on X in the wake of the large-scale casualties, "For the sake of the fighters, for the sake of their families, for the sake of the hostages, for the sake of the State of Israel: this war must be ended."

Israeli society has remained fiercely divided over Netanyahu policy, with hostage victims' family members outraged that efforts to negotiate a deal to release the remaining captives have completely stalled.

Meanwhile, there is some activity on this front, with Qatar’s foreign ministry on Tuesday saying that renewed indirect negotiations will "need time". The White House has been supportive of peace efforts, but has sided with Israeli actions in Gaza time and again in its public rhetoric.

"What is happening right now is that both delegations are in Doha. We are speaking with them separately on a framework for the talks. So talks have not begun, as of yet, but we are talking to both sides over that framework," he tells a Doha news conference.

Gold held a decline after President Donald Trump said the new August deadline for the start of so-called “reciprocal” tariffs won’t be delayed, with nations expected to use the extended window to continue negotiating with the US.

Bullion traded near $3,300 an ounce, after a 1% loss in the previous session. Trump’s move to postpone the imposition of all “Liberation Day” duties — which were first announced in April and then delayed to July 9 — to next month is partly an effort to clinch more agreements from nations still willing to deal with the US, denting haven demand for the precious metal.

While the delay has eased some concerns about the potential negative impact that Trump’s tariff agenda could have on the global economy, the president also indicated he could announce substantial new rates on imports of copper and pharmaceuticals. If those materialize, that could see renewed demand for havens.

Gold was also impacted on Tuesday as US Treasuries fell. Yields have been rising as investors pare bets on Federal Reserve interest-rate cuts by year-end, following a report last week that showed a surprisingly resilient US labor market. Higher borrowing costs tend to pose a headwind for non-yielding bullion.

The precious metal has rallied by more than a quarter this year, setting a record in April, as Trump’s efforts to overhaul trade policies stoked uncertainty, driving investors to seek safety in gold. The advance has been supported by central-bank accumulation, with China announcing an eighth straight month of purchases earlier this week.

Spot gold was little changed at $3,300.23 an ounce as of 7:40 a.m. in Singapore. The Bloomberg Dollar Spot Index was little changed. Silver, palladium and platinum edged lower.

U.S. President Donald Trump on Tuesday met for a second time in two days with Israeli Prime Minister Benjamin Netanyahu to discuss Gaza as Trump's Middle East envoy said Israel and Hamas were closing their differences on a ceasefire deal.

The Israeli leader departed the White House on Tuesday evening after just over an hour's meeting with Trump in the Oval Office, with no press access. The two men also met for several hours during a dinner at the White House on Monday during Netanyahu's third U.S. visit since the president began his second term on January 20.

Netanyahu met with Vice President JD Vance and then visited the U.S. Capitol on Tuesday, and is due back in Congress on Wednesday to meet with U.S. Senate leaders.

He told reporters after a meeting with the Republican House of Representatives Speaker Mike Johnson that while he did not think Israel's campaign in the Palestinian enclave was done, negotiators are "certainly working" on a ceasefire.

"We have still to finish the job in Gaza, release all our hostages, eliminate and destroy Hamas' military and government capabilities," Netanyahu said.

Shortly after Netanyahu spoke, Trump's special envoy to the Middle East, Steve Witkoff, said the issues keeping Israel and Hamas from agreeing had dropped to one from four and he hoped to reach a temporary ceasefire agreement this week.

"We are hopeful that by the end of this week, we'll have an agreement that will bring us into a 60-day ceasefire. Ten live hostages will be released. Nine deceased will be released," Witkoff told reporters at a meeting of Trump's Cabinet.

A delegation from Qatar, which has been hosting indirect talks between Israeli negotiators and the Hamas Palestinian militant group, met with senior White House officials for several hours before Netanyahu's arrival on Tuesday, Axios reported, citing a source familiar with the details.

The White House had no immediate comment on the report.

The Gaza war erupted when Hamas attacked southern Israel in October 2023, killing around 1,200 people and taking 251 hostages, according to Israeli figures. Some 50 hostages remain in Gaza, with 20 believed to be alive.

Israel's retaliatory war in Gaza has killed over 57,000 Palestinians, according to the enclave's health ministry. Most of Gaza's population has been displaced by the war and nearly half a million people are facing famine within months, according to United Nations estimates.

Trump had strongly supported Netanyahu, even wading into domestic Israeli politics by criticizing prosecutors over a corruption trial against the Israeli leader on bribery, fraud and breach-of-trust charges that Netanyahu denies.

In his remarks to reporters at the U.S. Congress, Netanyahu praised Trump, saying there has never been closer coordination between the U.S. and Israel in his country's history.

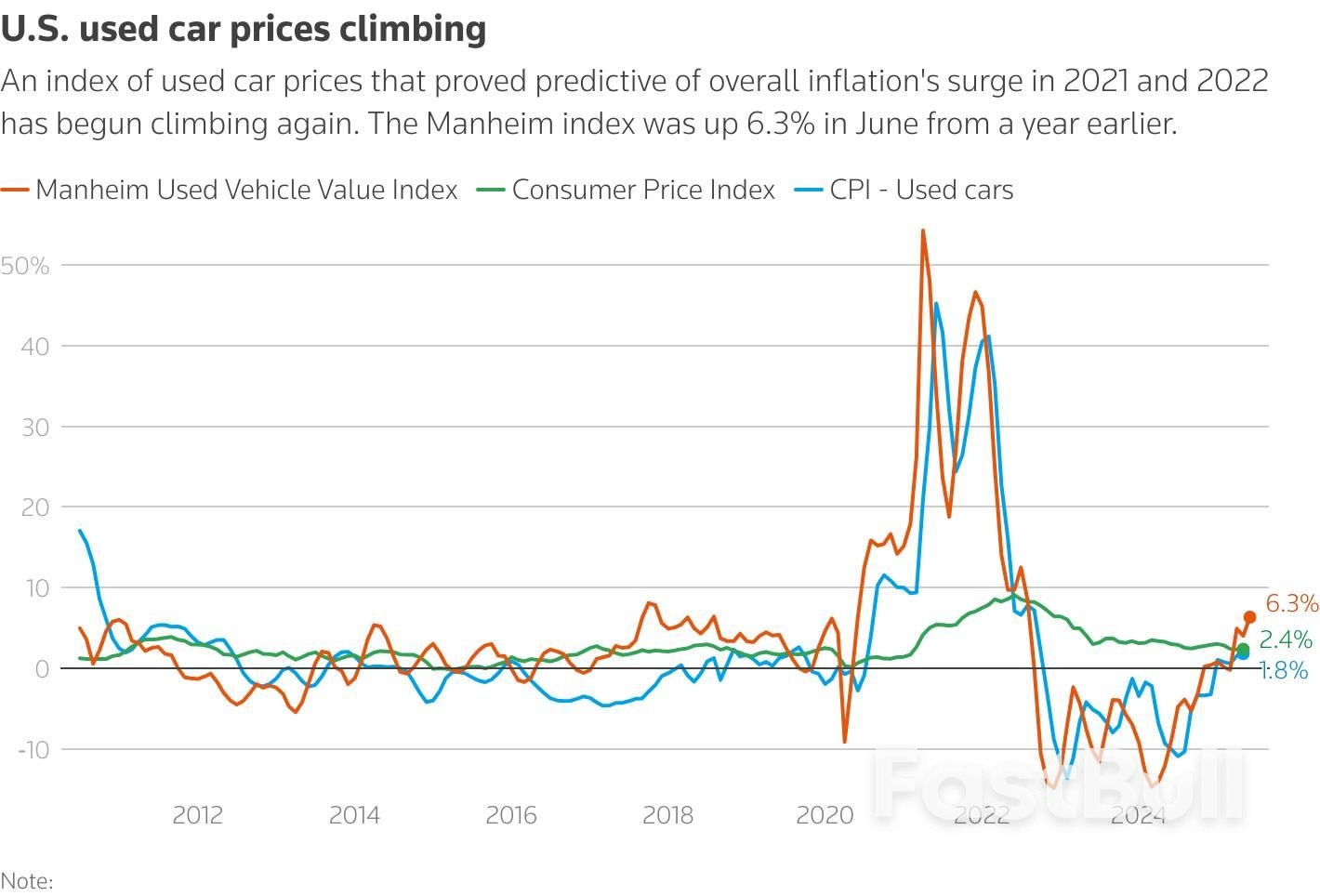

A gauge of U.S. used vehicle prices sold at wholesale auctions that proved predictive ahead of the inflation surge following the COVID pandemic is climbing again, last month notching its largest annual increase in nearly three years.

The rise comes amid ongoing vehicle price and sales volatility connected to auto tariffs imposed by President Donald Trump.

The Manheim Used Vehicle Value Index rose 1.6% in June from May on a seasonally adjusted basis and surged 6.3% from a year earlier, the largest year-over-year increase since August 2022, according to data released on Tuesday. At 208.5, the index has been trending upward for a year and is now at its highest since October 2023.

“Wholesale appreciation trends have been more volatile over Q2 as tariffs really impacted new sales and supply, which impacted the used marketplace as well,” said Jeremy Robb, senior director of economic and industry insights at Cox Automotive, which provides the index.

Price pressures typically ease in the second half of the year, but Robb said retail vehicle sales remain "a bit hotter than prior years" and the supply of vehicles coming off lease into the used-car market has been trending downward, "two factors which should be fairly supportive of higher values as we move onward.”

Trump's 25% tariff on imported autos prompted a surge in new vehicle-buying during the early spring as consumers sought to front-run anticipated price increases from the levies. Sales fell off substantially in May and dropped again in June.

Overall inflation has so far defied the predictions of most economists, but many Federal Reserve officials remain convinced some sort of price surge will follow and are hesitant to cut interest rates until satisfied that risk has passed.

Manheim's index in recent years has caught the eye of private economists and some Fed officials who saw it as among the early indicators auguring for a more substantial, and long-lasting, bout of inflation as the economy emerged from the pandemic in 2021 and 2022.

The index began a sharp climb in late 2020 that persisted for more than a year. By mid-2022, overall U.S. inflation as measured by the Consumer Price Index had topped 9% and was the highest since the 1980s.

Fed Governor Christopher Waller in the fall of 2021 warned against "selectively ignoring data series - be it used car prices, food and energy prices or household surveys of inflation expectations. All of these series convey important information about the evolution of inflation, and one should exhibit caution in dismissing data as outliers."

At the time, Waller was building the case for interest rate hikes to combat still-building inflation that some of his colleagues considered "transitory."

Now, though, Waller, who is viewed to be among those Trump is considering as a successor to Fed Chair Jerome Powell, appears more concerned the tariff increases will hurt demand rather than stoke another lasting bout of inflation. Waller said recently he was open to cutting rates as early as the Fed's meeting later in July.

Handing President Donald Trump another victory, the U.S. Supreme Court gave the go-ahead on Tuesday for his administration to pursue mass federal job cuts potentially numbering in the hundreds of thousands and the restructuring of numerous agencies.

Workforce reductions are being planned by the administration at the U.S. Departments of Agriculture, Commerce, Health and Human Services, State, Treasury, Veterans Affairs and more than a dozen other agencies.

The Supreme Court lifted San Francisco-based U.S. District Judge Susan Illston's May 22 order that blocked large-scale federal layoffs called "reductions in force" while litigation in the case proceeds.

White House spokesperson Harrison Fields welcomed the court's action, calling it "another definitive victory for the president and his administration" that reinforced Trump's authority to implement "efficiency across the federal government."

The Supreme Court in recent months has sided with Trump in several cases that were acted upon on an emergency basis since he returned to office in January including clearing the way for implementation of some of his hardline immigration policies. In addition, Trump last week also claimed the biggest legislative win of his second presidential term with congressional passage of a massive package of tax and spending cuts.

The court, in a brief unsigned order on Tuesday, said Trump's administration was "likely to succeed on its argument that the executive order" and a memorandum implementing his order were lawful. The court said it was not assessing the legality of any specific plans for layoffs at federal agencies.

Liberal Justice Ketanji Brown Jackson was the sole member of the nine-person court to publicly dissent from the decision. Jackson wrote that Illston's "temporary, practical, harm-reducing preservation of the status quo was no match for this court's demonstrated enthusiasm for greenlighting this president's legally dubious actions in an emergency posture."

Trump in February announced "a critical transformation of the federal bureaucracy" in an executive order directing agencies to prepare for a government overhaul aimed at significantly reducing the federal workforce and gutting offices and programs opposed by his administration.

A group of unions, non-profits and local governments that sued to block the administration's mass layoffs said Tuesday's Supreme Court ruling "dealt a serious blow to our democracy and puts services that the American people rely on in grave jeopardy."

"This decision does not change the simple and clear fact that reorganizing government functions and laying off federal workers en masse haphazardly without any congressional approval is not allowed by our Constitution," the plaintiffs said in a statement, adding that they would "continue to fight on behalf of the communities we represent."

Illston had ruled that Trump exceeded his authority in ordering the government downsizing.

"As history demonstrates, the president may broadly restructure federal agencies only when authorized by Congress," Illston wrote.

The judge's ruling was the broadest of its kind against the government overhaul being pursued by Trump and the Department of Government Efficiency, a key player in the Republican president's drive to slash the federal workforce.

Formerly spearheaded by billionaire Elon Musk, DOGE has sought to eliminate federal jobs, shrink and reshape the U.S. government and root out what they see as wasteful spending. Musk formally ended his government work on May 30 and subsequently had a public falling out with Trump.

The judge blocked the agencies from carrying out mass layoffs and limited their ability to cut or overhaul federal programs. Illston also ordered the reinstatement of workers who had lost their jobs, though she delayed implementing this portion of her ruling while the appeals process plays out.

Don Moynihan, a public policy professor at the University of Michigan, said the Supreme Court's decision allows Trump to move forward with mass firings of federal workers, without adjudicating the legality of those layoffs.

"These are not minor reductions in force," Moynihan said. "Trump has made clear he wants a major downsizing of the federal government. The court is willing to let him move forward and do severe and irreparable damage to public services."

Americans narrowly favor on Trump's campaign to downsize the federal government, with about 56% saying they supported the effort and 40% opposed, according to April Reuters/Ipsos polling. Their views broke down along party lines with 89% of Republicans, but just 26% of Democrats, supportive.

The San Francisco-based 9th U.S. Circuit Court of Appeals in a 2-1 ruling on May 30 denied the administration's request to halt the judge's ruling. That prompted the Justice Department's June 2 emergency request to the Supreme Court to halt Illston's order.

"The Constitution does not erect a presumption against presidential control of agency staffing, and the president does not need special permission from Congress to exercise core Article II powers," the Justice Department told the court, referring to the constitution's section delineating presidential authority.

Allowing the Trump administration to move forward with its "breakneck reorganization," the plaintiffs told the court, would mean that "programs, offices and functions across the federal government will be abolished, agencies will be radically downsized from what Congress authorized, critical government services will be lost and hundreds of thousands of federal employees will lose their jobs."

The Supreme Court in recent months has let Trump's administration resume deporting migrants to countries other than their own without offering them a chance to show the harms they could face and end temporary legal status previously granted on humanitarian grounds to hundreds of thousands of migrants.

In addition, it has allowed Trump to implement his ban on transgender people in the U.S. military, blocked a judge's order for the administration to rehire thousands of fired employees, twice sided with DOGE and curbed the power of federal judges to impose nationwide rulings impeding presidential policies.

President Donald Trump said he will announce a 50% tariff on copper on Tuesday, hoping to boost U.S. production of a metal critical to electric vehicles, military hardware, the power grid and many consumer goods.

U.S. Comex copper futures jumped more than 12% to a record high after Trump announced the planned tariffs, which came earlier than the industry had expected, and the rate was steeper.

Trump told reporters at a White House cabinet meeting that he planned to make the copper tariff announcement later in the day but he did not say when the tariff would take effect.

"I believe the tariff on copper, we're going to make 50%," Trump said.

After Trump spoke, U.S. Commerce Secretary Howard Lutnick said in an interview on CNBC that the copper tariffs would likely be put in place by the end of July or August 1. He said Trump would post details on his Truth Social media account sometime on Tuesday.

In February, the administration announced a so-called Section 232 investigation into U.S. imports of the red metal. The deadline for the investigation to conclude was November, but Lutnick said the review was already complete.

"The idea is to bring copper home, bring copper production home, bring the ability to make copper, which is key to the industrial sector, back home to America," Lutnick said.

The National Mining Association declined to comment, saying it preferred to wait until details were released. The American Critical Minerals Association did not immediately respond to requests for comment.

Copper is used in construction, transportation, electronics and many other industries. The U.S. imports roughly half of its copper needs each year.

Major copper mining projects across the U.S. have faced strong opposition in recent years due to a variety of reasons, including Rio Tinto,and BHP'sResolution Copper project in Arizona and Northern Dynasty Minerals'sPebble Mine project in Alaska.

Shares of the world's largest copper producer, Phoenix-based Freeport-McMoRan, shot up nearly 5% in Tuesday afternoon trading. The company, which produced 1.26 billion pounds of copper in the U.S. last year, did not immediately respond to a request for comment.

Freeport, which would benefit from U.S. copper tariffs but worries that the duties would hurt the global economy, has advised Trump to focus on boosting U.S. copper production.

Countries set to be most affected by any new U.S. copper tariff would be Chile, Canada and Mexico, which were the top suppliers to the U.S. of refined copper, copper alloys and copper products in 2024, according to U.S. Census Bureau data.

Chile, Canada and Peru - three of the largest copper suppliers to the U.S. - have told the administration that imports from their countries do not threaten U.S. interests and should not face tariffs. All three have free trade deals with the U.S.

Mexico's Economy Ministry, Chile's Foreign Ministry and Canada's Finance Ministry did not immediately respond to requests for comment. Chile's Mining Ministry and Codelco, that country's leading copper miner, declined to comment.

A 50% tariff on copper imports would hit U.S. companies that use the metal because the country is years away from meeting its needs, said Ole Hansen, head of commodity strategy at Saxo Bank.

"The U.S. has imported a whole year of demand over the past six months, so the local storage levels are ample," Hansen said. "I see a correction in copper prices following the initial jump."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up