Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

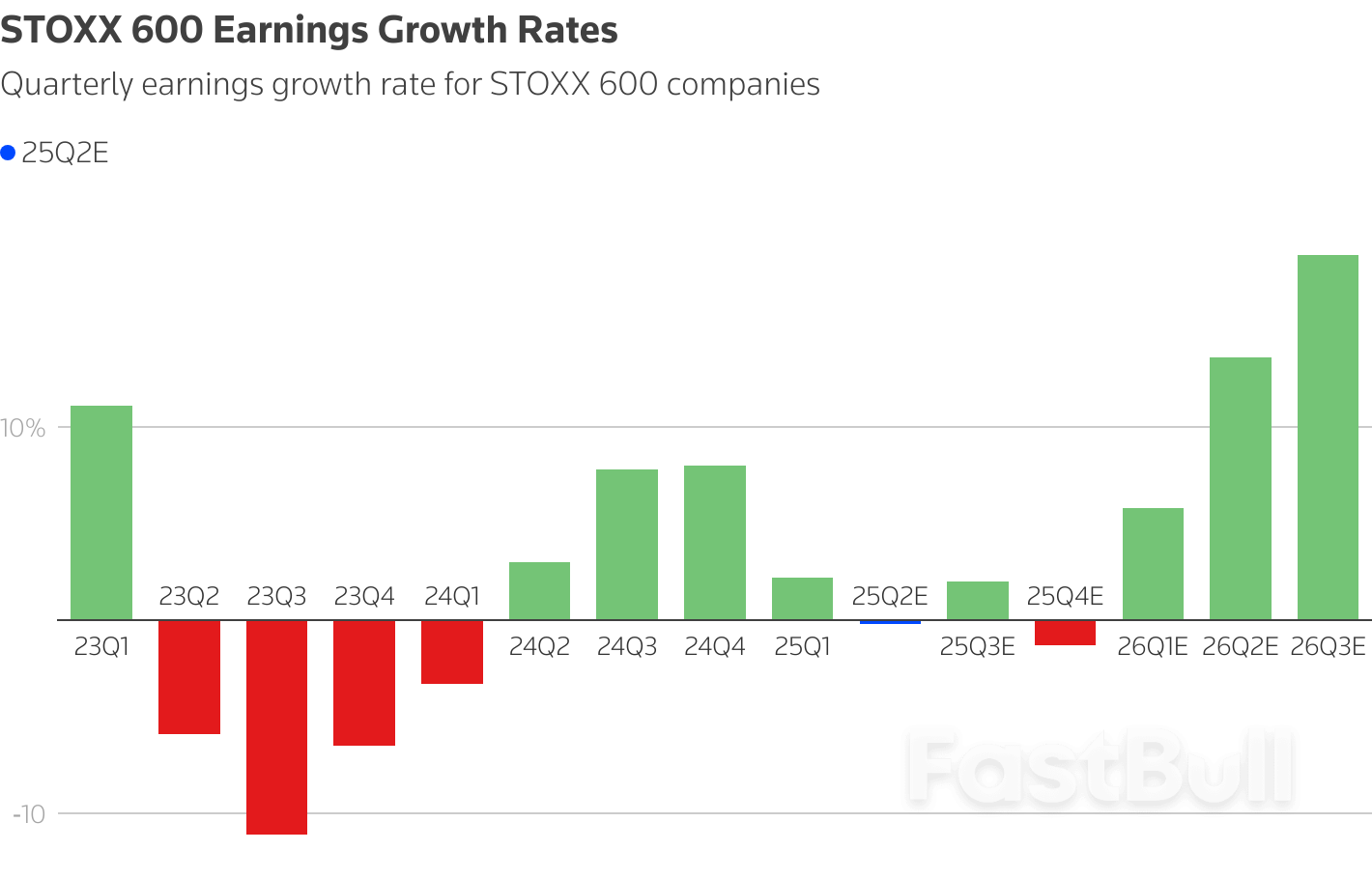

European investors eye Q2 earnings for clues on resilience amid tariff uncertainty. Despite strong stock gains, earnings are expected to contract slightly. Guidance and FX headwinds remain key concerns as trade risks persist.

Brazil scrambled to respond to U.S. President Donald Trump’s announcement of 50% tariffs on Brazilian exports, with President Luiz Inacio Lula da Silva convening an urgent cabinet meeting on Thursday as officials worked to de-escalate the crisis.

Brazilian diplomacy "has always been available to the American government to seek a solution of greater partnership and greater understanding, as we have always done," Finance Minister Fernando Haddad told reporters on Thursday.

"I don't believe this situation will continue," he said, calling the tariffs announced by Trump on Wednesday "unsustainable."

Two government sources told Reuters that Lula is calibrating Brazil's response and is unlikely to announce concrete measures on Thursday. His chief of staff said the government is forming a working group to decide how to react.

While Lula said on Wednesday that Brazil would respond to any tariffs with reciprocal measures, the sources said diplomatic efforts were gaining traction within the government on Thursday.

The U.S. tariffs, slated to take effect on August 1, were tied by Trump to Brazil’s treatment of former President Jair Bolsonaro, who is standing trial before the country's Supreme Court under charges of plotting a coup to stop Lula from assuming office in 2023.

Haddad criticized Bolsonaro and Brazil’s far-right opposition for perpetuating claims of legal persecution against the former president. "This blow against Brazil, against national sovereignty, was orchestrated by extremist forces within the country," Haddad said. "Even the far right will have to admit sooner or later that it shot itself in the foot."

The U.S. is Brazil's second largest trading partner after China and has a rare trade surplus with world's top economic power.

The tariffs could have a significant impact on food prices in the U.S., experts say, with the South American agricultural powerhouse being a major seller of coffee, orange juice, sugar, beef and ethanol to the U.S., among other products.

Brazil's real weakened as much as 2% against the U.S. dollar in spot trading on Thursday, before paring some losses to trade down 0.7%. Benchmark stock index Bovespa slipped 0.7%, with planemaker Embraer and meatpacker Minerva among the biggest fallers.

Vietnam has become the third country (after the UK and China) to reach an agreement with President Donald Trump over the ‘reciprocal tariffs’ he announced on 2 April. Trump had originally imposed a 46 per cent tariff on Vietnamese exports to the US – the fifth highest figure announced on his ‘Liberation Day’. All those tariffs were suspended within hours but were due to be reimposed within 90 days (a deadline that has now been pushed to August 1).

Announcing the deal with Vietnam last week, Trump said that the US will instead impose a 20 per cent tariff on Vietnamese goods. A higher rate of 40 per cent will apply on any goods from Vietnam it considers to have been ‘trans-shipped’ – i.e. simply moved through Vietnam rather than being manufactured or assembled there. The Trump administration has previously accused Vietnam of trans-shipping Chinese goods into the US market, in effect concealing part of China’s trade surplus with the US.

The Vietnamese government has worked hard to reach an agreement with Washington. It has conducted well-publicized raids on sellers of counterfeit products to try to assuage Washington’s concerns over protecting intellectual property. Ministers have held multiple rounds of talks online, sent trade delegations to the US and pledged to buy billions of dollars’ worth of American products. Some reports even suggest Vietnam is considering buying American F-16 fighter jets, which would have been unthinkable even a few months ago in line with Hanoi’s long-held aversion to becoming dependent on Washington for strategic defence systems.

That said, all these purchases add up to a tiny fraction of Vietnam’s overall trade surplus with the US, perhaps $10 billion compared to a surplus in 2024 of $123 billion. According to President Trump, Vietnam has also pledged to cut all tariffs on imports from the US. This prompted him to declare that American-made SUVs ‘will be a wonderful addition to the various product lines within Vietnam’. While this seems optimistic given that many Vietnamese streets are too small for American cars, it is quite possible that Vietnamese government ministries might be told to ‘buy American’ for their next vehicle purchase to reduce the trade surplus a little more.

Vietnam has moved so fast to reach an agreement with Washington primarily because its economy depends on exports to the American market, and the country’s leadership knows it will be judged on its economic performance. The Communist Party of Vietnam (CPV) will hold its five-yearly Congress within a few months and its General-Secretary, To Lam, wants to be selected for another term in office. Keeping the country’s exports flowing to the US is a big win for him and his recently unveiled development strategy, which is firmly aimed at increasing economic growth.

To Lam’s strategy involves the embrace of the private sector, which was endorsed by the new Politburo in May. He has also largely ended the anti-corruption campaign initiated by his hard-line predecessor, which had hobbled the economy. This approach is intended to help catapult Vietnam into the ranks of ‘high income countries’ by 2045, the centenary of the Vietnamese Declaration of Independence, and avoid falling into the ‘middle income trap’ like most of its Southeast Asian neighbours.

To achieve this ambitious goal, Vietnam needs to sustain annual economic growth of at least eight per cent for the next 20 years. This will depend on maintaining very high levels of exports, particularly to the US and Europe.

At the same time, Vietnam is becoming more connected to Chinese-controlled supply chains. Vietnam’s economic growth has been driven in part by foreign firms building factories in the country to assemble products using components made in China. Historically, these assembly lines were owned by Japanese, Korean or Taiwanese firms. Increasingly, however, Chinese-owned companies are also setting up production in Vietnam.

There are three reasons for this. Firstly, corporations are seeking to mitigate the risks of having all their production in one country; secondly, they need to reduce their exposure to US tariffs on China; and thirdly, because it is made possible by Vietnam and China both being part of the huge 15-country free trade area known as the Regional Comprehensive Economic Partnership (RCEP).

For now, Vietnam’s major economic role globally is as an assembly line between Chinese producers and Western markets. This has rankled the Trump administration, which says China has trans-shipped products via Vietnam to avoid US tariffs. The higher tariff rate on trans-shipped products in the deal announced by Trump is intended to counter this. But exactly where the boundary lies between Vietnamese goods and trans-shipped goods will occupy trade negotiators, diplomats and customs officials for many months to come.

While the deal will certainly contribute to improved US–Vietnam relations it is unlikely to signal a major change in Vietnam’s foreign policy orientation. Hanoi cannot afford to antagonize either of its major partners. It needs the US as a market, but also relies on trade with, and political support from, China.

While Vietnam has developed close economic ties with the US, the CPV has remained wary of Washington’s political agenda. President Trump’s apparent lack of interest in promoting democracy abroad will help alleviate some of those fears, though some suspicion will inevitably remain.

China has been damaging its relations with Vietnam recently with aggressive moves in the South China Sea and it is possible that Hanoi could reach out to Washington for some assistance in defending its position. This was certainly the case during the 2010s. However, Vietnam will not be part of any potential American military efforts that specifically target China.

China will have mixed feelings about the US–Vietnam deal. Some of its companies and factories may benefit from continuing to route their production networks through Vietnam, but others may lose out from having their trans-shipment practices curtailed. Officials in Beijing may also be concerned about whether Hanoi has privately agreed other issues with Washington, such as greater security cooperation in the future. Hanoi will have to make full use of its communist party-to-party connections to reassure Beijing that it has not been flipped into the US camp.

There is also a role here for third parties. Vietnam risks becoming a casualty of the power competition between China and the US. European countries and others with an interest in a multipolar world and a liberal trading order can offer stability to Vietnam. But perhaps they could also start to ask for things in exchange.

Rather than reducing carbon emissions, Vietnam has been increasing the use of coal and gas-fired power stations and European manufacturers of, for example, clean energy generation technology have been blocked from the Vietnamese market by various non-tariff barriers. Vietnam is also failing to curb illegal migration to Europe. These issues are included in the EU and UK free trade agreements with Vietnam, and in other agreements on partnership and migration, but Vietnam is not upholding its side of the bargain. Perhaps it is time for Europeans to get tough too.

An Israeli strike hit Palestinians near a medical centre in Gaza on Thursday, killing 16 including children and wounding more people, local health authorities said, as ceasefire talks dragged on with no result expected soon.

The strike in Deir al-Balah in the central Gaza Strip came as Israeli and Hamas negotiators hold talks with mediators in Qatar over a proposed 60-day ceasefire and hostage release deal aimed at building agreement on a lasting truce.

However, a senior Israeli official said on Wednesday that an agreement was not likely to be secured for another one or two weeks.

Khalil al-Deqran, spokesperson for the health ministry in Gaza's Hamas-run government, said Israel had targeted a medical centre and that six of the dead were children. Many of those injured had suffered severe wounds to the head and chest, he said.

Israel's military said it had struck a militant who took part in the Hamas-led October 7, 2023, attack that triggered the war. It said it was aware of reports regarding a number of injured individuals and that the incident was under review.

Videos on Thursday verified by Reuters showed a scene of carnage, with the bodies of dead and injured, mainly women and children, lying in blood amid a cloud of dust as people screamed all around, and of motionless children lying in blood on a donkey cart.

At Deir al-Balah's al-Aqsa Martyrs Hospital, where the dead and wounded were taken, Samah al-Nouri said her daughter had been killed in the morning's strike after attending the clinic to seek treatment for a throat ailment.

"They hit her with a shell. Her brother went to check and he said they all died. What did they do? What's their fault? She was only getting treatment in a medical facility. Why did they kill them?" she said.

Israeli attacks on Palestinian hospitals and health facilities, detentions of medics, and restrictions on the entry of medical supplies have drawn condemnation, opens new tab from the United Nations.

The United Nations humanitarian agency OCHA said in May that the U.N. had documented at least 686 attacks impacting healthcare in Gaza since the war began.

Dwindling fuel supplies risk further disruption in the remaining, semi-functioning hospitals, including to incubators at the neonatal unit of al-Shifa hospital in Gaza City, doctors there said.

"We are forced to place four, five or sometimes three premature babies in one incubator," said Dr Mohammed Abu Selmia, the hospital director, adding that premature babies were now in a critical condition.

U.S. President Donald Trump met Israeli Prime Minister Benjamin Netanyahu this week to discuss Gaza amid reports Israel and the Palestinian militant group Hamas were nearing agreement on a U.S.-brokered ceasefire proposal after 21 months of war.

The Israeli official who was in Washington with Netanyahu said that if the two sides agree to the ceasefire proposal, Israel would use that time to offer a permanent truce requiring Hamas to disarm.

If Hamas refuses, "we'll proceed" with military operations in Gaza, the official said on condition of anonymity.

A Palestinian official said the talks in Qatar were in crisis and that issues under dispute, including whether Israel would continue to occupy parts of Gaza after a ceasefire, had yet to be resolved.

The two sides previously agreed a ceasefire in January but it did not lead to a deal on a permanent truce and Israel resumed its military assault in March, stopping all aid supplies into Gaza and telling civilians to leave the north of the tiny territory.

Israel's military campaign in Gaza has now killed more than 57,000 people, according to Palestinian health authorities. It has destroyed swathes of the territory and driven most Gazans from their homes.

The Hamas attack on Israeli border communities that triggered the war killed around 1,200 people and the militant group seized around 250 hostages according to Israeli tallies.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up