Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Federal Reserve may cut interest rates later this year if rising unemployment signals economic weakness. Trump blames the Fed for inaction, while officials remain cautious amid inflation and recession fears.

Shares of Circle and Coinbase rallied on Wednesday, as Wall Street cheered the Senate's passage of the GENIUS Act, which would establish a federal framework for U.S. dollar-pegged stablecoins.

Circle, the issuer of the USDC stablecoin, rose 22% following the passing of the bill late Tuesday. It's the continuation of a remarkable run for Circle's stock since the company held its stock market debut on June 5. The shares are trading at about $180, up almost sixfold from their $31 IPO price.

Coinbase, which co-founded USDC and shares in 50% of its revenue with Circle, gained more than 10%. Stablecoins have become Coinbase's biggest revenue driver after trading, with stablecoin-related income surging 50% year-over-year in the first quarter.

The GENIUS Act, short for the Guiding and Establishing National Innovation for U.S. Stablecoins Act, allows private companies to issue stablecoins under strict guardrails, including full reserve backing and monthly audits.

It represents the crypto industry's first major legislative win, but still has to get signed into law. The bill now heads to the House, which has its own version of a stablecoin bill dubbed STABLE. Both prohibit yield-bearing consumer stablecoins, but diverge on who regulates what.

The Senate version centralizes oversight with Treasury, while the House splits authority between the Federal Reserve, the Comptroller of the Currency, and others. Reconciling the two could take a while, especially as House Republicans weigh attaching a broader market structure package, according to congressional aides.

If the GENIUS Act becomes law, it could pave the way for explosive growth in the nearly $260 billion stablecoin market, and drive more revenue to key infrastructure players like Circle and Coinbase.

Coinbase earns 100% of the interest on USDC held directly on its platform. CEO Brian Armstrong has said he wants USDC to overtake Tether as the world's top stablecoin.

"If you can get shared economics, I don't see why we wouldn't see more of these banks partnering with USDC," Armstrong said last month, calling stablecoins a major pillar of Coinbase's long-term growth.

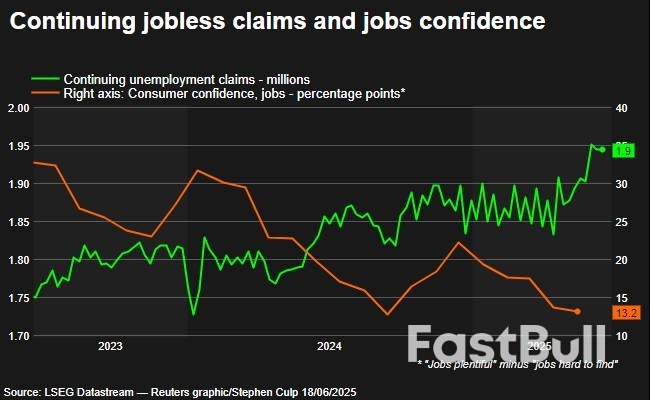

The number of Americans filing new applications for unemployment benefits fell last week, but stayed at levels consistent with a further loss of labor market momentum in June and softening economic activity.

The report from the Labor Department on Wednesday showed widespread layoffs in the prior week, which had boosted claims to an eight-month high. Though some technical factors accounted for the elevation in claims, layoffs have risen this year, with economists saying President Donald Trump's broad tariffs had created a challenging economic environment for businesses.

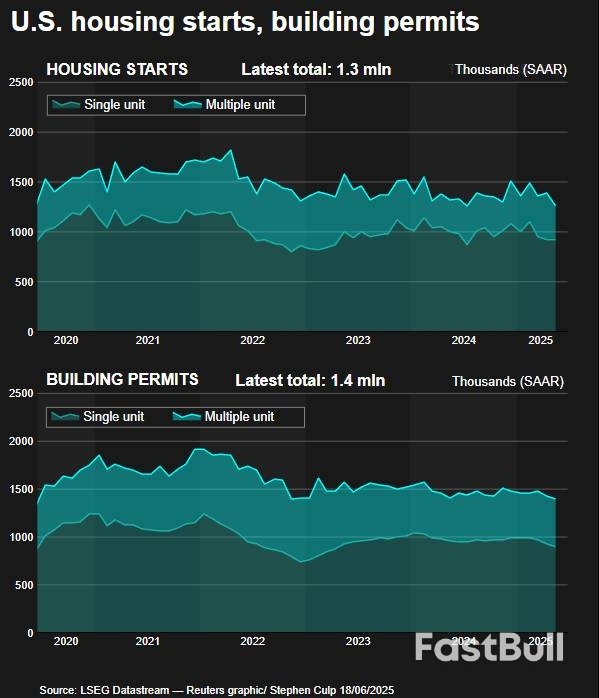

Those challenges were also evident in other data showing permits for future construction of single-family housing dropped to a two-year low in May as builders grappled with higher costs from duties on materials, including lumber, steel and aluminum.

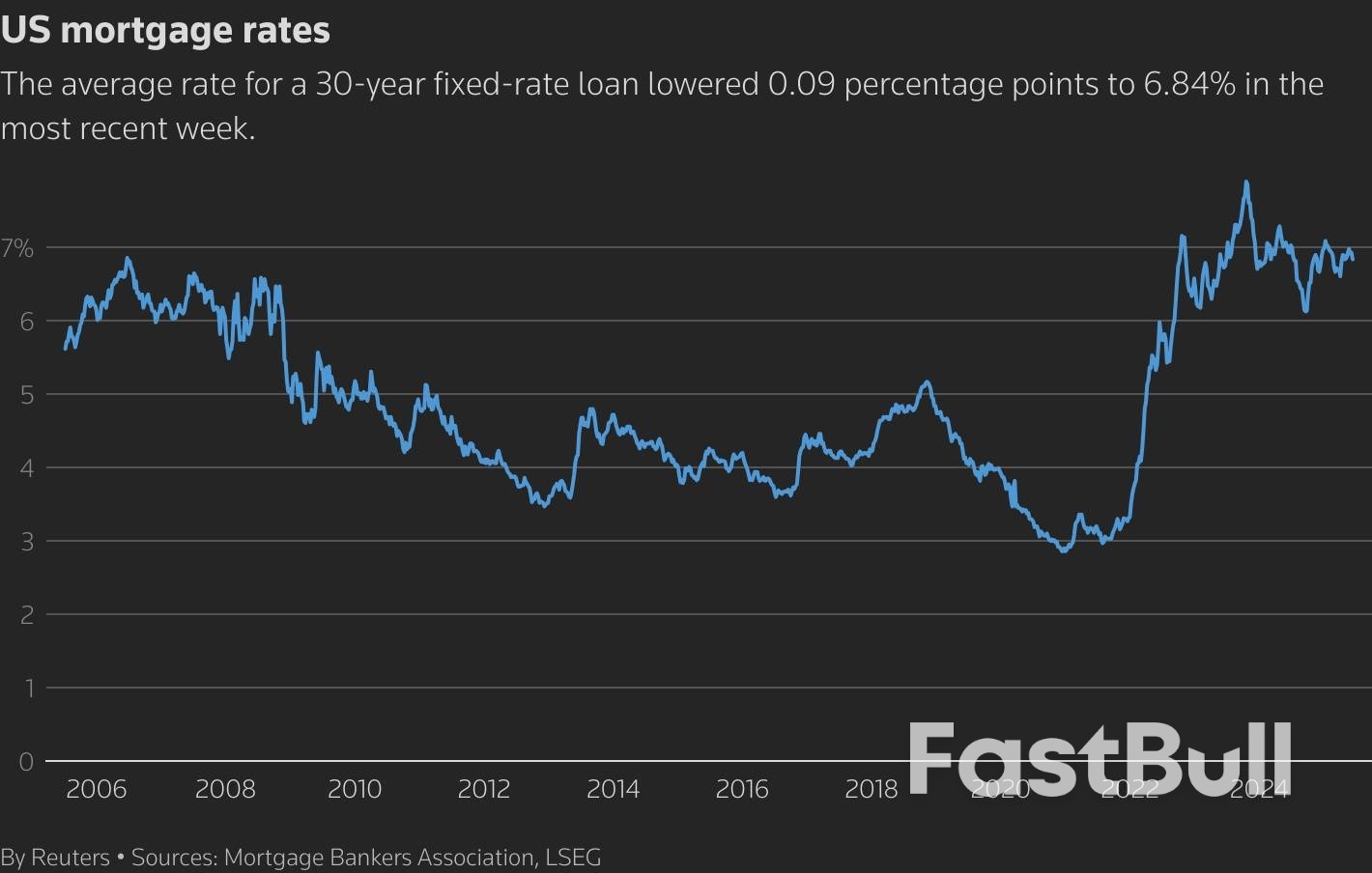

Higher borrowing costs as the Federal Reserve responded to the heightened economic uncertainty from tariffs by pausing its interest rate cutting cycle have weighed on demand for homes, resulting in excess inventory of unsold houses.

Fed officials were on Wednesday expected to leave the U.S. central bank's benchmark overnight interest rate in the 4.25%-4.50% range, where it has been since December as they also monitor the economic fallout from the conflict between Israel and Iran.

"Even though claims remain low by historical standards, we can no longer deny that there is some upward movement toward levels that would support our assessment of an economy slowing into a contraction," said Carl Weinberg, chief economist at High Frequency Economics. "It is time, now, to say that."

Initial claims for state unemployment benefits dropped 5,000 to a seasonally adjusted 245,000 for the week ended June 14. Data for the prior week was revised to show 2,000 more applications received than previously reported, lifting claims for that week to the highest since October.

Economists polled by Reuters had forecast 245,000 claims for the latest week. The report was released a day early because of the Juneteenth National Independence Day holiday on Thursday.

Layoffs were reported in the prior week across several states in a range of industries including transportation and warehousing, accommodation and food services, agriculture, construction and manufacturing.

The four-week moving average of claims, which strips out seasonal fluctuations from the data, increased 4,750 to 245,500 last week, the highest level since August 2023. But some economists do not view the labor market as having changed much.

"The increase could be a sign of a slight pickup in job separations," said Conrad DeQuadros, senior economic advisor at Brean Capital. "However, there appears to be a marked seasonal pattern in the last three years in the seasonally adjusted claims data where claims rise from mid-February through the summer and then retreat later in the year."

Stocks on Wall Street were trading higher. The dollar fell versus a basket of currencies. U.S. Treasury yields eased.

The claims data covered the period during which the government surveyed businesses for the nonfarm payrolls component of June's employment report. Claims increased between the May and June survey weeks.

Historically low layoffs have accounted for much of the labor market stability, with the hiring side of the equation tepid amid hesitancy by employers to boost headcount because of the unsettled economic environment. Nonfarm payrolls increased by 139,000 jobs in May, compared with a 193,000 gain a year ago.

Data next week on the number of people receiving benefits after an initial week of aid, a proxy for hiring, could shed more light on the state of the labor market in June.

The so-called continuing claims dropped 6,000 to a still-high seasonally adjusted 1.945 million during the week ending June 7. Recently laid-off workers are struggling to find work.

A separate report from the Commerce Department's Census Bureau showed permits for future construction of single-family housing dropped 2.7% to a seasonally adjusted annual rate of 898,000 units in May, the lowest level since April 2023.

Higher borrowing costs have sidelined potential buyers, boosting the supply of new single-family homes on the market to levels last seen in late 2007. That has left builders with little incentive to break ground on new housing projects.

An immigration crackdown that has seen raids at construction sites could lead to labor shortages, compounding problems for builders, economists said.

A line chart titled "US mortgage rates" that tracks the metric over time.

A National Association of Home Builders survey on Tuesday showed sentiment among single-family homebuilders plummeted to a 2-1/2-year low in June.

Permits for the volatile multi-family housing segment, buildings with five units or more, rose 1.4% to a rate of 444,000 units in May. Overall building permits fell 2.0% to a rate of 1.393 million units, the lowest level since June 2020.

Single-family housing starts, which account for the bulk of homebuilding, gained 0.4% to 924,000 units last month. Starts for multi-family housing units slumped 30.4% to a rate of 316,000 units. Overall housing starts plunged 9.8% to a rate of 1.256 million units, the lowest level in five years.

The completions rate for single-family houses surged 8.1% to 1.027 million units. The inventory of housing under construction decreased 1.3% to a rate of 623,000 units, the lowest level since February 2021.

"We don't expect an imminent collapse in the housing market," said Matthew Martin, a senior U.S. economist at Oxford Economics. "However, uncertainty will keep construction depressed the remainder of the year."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up