Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

HSBCsaid on Thursday it planned to privatise Hong Kong's Hang Seng Bankafter its majority-held subsidiary has come under fire for its performance and exposure to faltering property markets in the city and mainland China.

HSBCsaid on Thursday it planned to privatise Hong Kong's Hang Seng Bankafter its majority-held subsidiary has come under fire for its performance and exposure to faltering property markets in the city and mainland China.HSBC will offer HK$155 per share, valuing the deal at about HK$106.1 billion ($13.63 billion) for the purchase of the 36.5% of shares not already owned by HSBC.HSBC said the offer was made at a 30.3% premium to Hang Seng Bank's closing price of HK$119 on Wednesday.

The offer price could be adjusted for any dividends, except the 2025 third interim dividend, HSBC said in a statement to the Hong Kong Stock Exchange."The privatisation exercise represents a significant investment into Hong Kong," HSBC said in the announcement."It represents HSBC’s strong conviction in Hong Kong’s future as a leading global financial centre and super-connector between international markets and Mainland China."Hang Seng Bank has reported rising bad loans over the last few years due to its relatively high exposure to the Hong Kong and mainland Chinese property markets.

Impaired loans reached 6.1% of its gross loans as of end-2024, up sharply from 2.8% at the end of 2023.Reuters last year reported that due to worries about a potential rise in bad loans amid growing economic headwinds and the property sector crisis in China, HSBC in early 2024 started planning to tighten risk management at Hang Seng Bank.HSBC said on Thursday the deal would have a negative impact of about 125 basis points on its common equity tier 1 (CET1) ratio, which stood at 14.6% at June-end.

It said the bank expected to restore its CET1 ratio to its target operating range of 14.0% to 14.5% through organic capital generation and by not initiating any further buybacks for the next three quarters.Privatisation schemes are commonly used in Hong Kong to streamline corporate structures and reduce the costs associated with maintaining a public listing.The offer price is final, HSBC said, adding that it does not reserve the right to revise it.

Oil fell for the first time in five sessions, as traders focused on the prospect of cooling tensions in the Middle East and higher US inventories.

West Texas Intermediate fell below $62 a barrel, with Brent crude closing above $66. US President Donald Trump said both Israel and Hamas had agreed to terms for the release of all hostages still held by the militant group in Gaza in a breakthrough in the push to end the two-year war.

Elsewhere, US nationwide crude stockpiles expanded for a second week, although they remained near seasonal lows, according to official data released on Wednesday. Levels at the Cushing, Oklahoma, storage hub, however, declined, as did inventories of refined products.

Crude remains under pressure on expectations for higher supplies, both from the Organization of the Petroleum Exporting Countries and its allies, as well as from the Americas. Beyond the Middle East, geopolitical concerns remain pertinent, with Ukrainian attacks on Russian oil infrastructure affecting flows.

Key points:

The Bank of Japan can raise interest rates if prospects of durably meeting its 2% inflation target improve, but would struggle to justify doing so this year given weak signs in the economy, former deputy governor Masazumi Wakatabe told Reuters.Wakatabe, who is known as a fiscal and monetary dove, endorsed the central bank's cautious policy normalisation and said more rate hikes could come if the economy improves.He noted the economy was "at a historical turning point" with companies raising prices on a regular basis in a departure from their past caution over doing so.

"If the economy is improving steadily, and the likelihood of sustainably and durably achieving 2% inflation is heightening, an interest rate hike would obviously be on the table," he said in an interview on Wednesday.But Wakatabe warned of recent weak signs in the economy that suggest underlying inflation, which has been flat around 1.6%, may not accelerate much. Private economists also project Japan's economy to contract in the third quarter, Wakatabe added."Recent data shows Japan's labour market stagnating. If Japan's third-quarter GDP data prove weak, it would be hard to justify raising rates in December," he said.

The government will release third-quarter gross domestic product (GDP) data on November 17. After a meeting slated for October 29-30, the BOJ board holds its final policy-setting meeting for this year on December 18-19.

An advocate of expansionary fiscal and monetary policy, Wakatabe is among academics with ties to Sanae Takaichi, who is on course to become next premier after her victory in a weekend ruling party leadership race.Upon winning the race, Takaichi made clear the government will take the lead in setting fiscal and monetary policy - and that her priority would be to reflate domestic demand.Wakatabe said the BOJ must coordinate closely with the government, but does not necessarily need to keep interest rates low solely for the purpose of financing government spending.

"If inflation expectations rise and push up underlying inflation, the BOJ can raise interest rates. It needs to do so because otherwise, the economy will overheat," Wakatabe said."On the other hand, the BOJ needs to keep the economy on a firm footing. It's about finding the right balance, looking at data. I think the BOJ understands this point."The yen slumped to an eight-month low against the dollar this week as markets saw Takaichi's win as reducing the chance of a near-term rate hike.

"The BOJ hasn't committed to a set timing for raising rates and hasn't dropped any signals," Wakatabe said. "It's really dependent on data."Wakatabe served as deputy governor for five years through 2023, during which the BOJ maintained a massive stimulus deployed by former governor Haruhiko Kuroda in 2013. Under incumbent governor Kazuo Ueda, the BOJ exited Kuroda's stimulus last year and raised interest rates to 0.5% in January.Currently an economics professor at Japan's Waseda University, Wakatabe wrote a chapter on fiscal and monetary policy in a book Takaichi published last year.

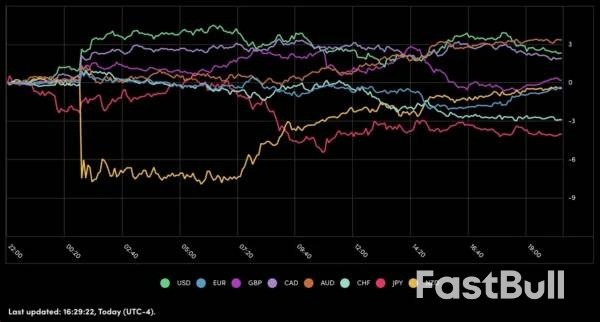

Today’s session saw the continuation of the weekly flows, with the US Dollar higher and Gold breaking new milestones. The US-Canada deal seems to be getting closer from the recent remarks made by Canada’s Carney.US Equities sparked a huge reversal higher with both the S&P 500 and Nasdaq closing at record highs, yet again.

Nothing really explained yesterday’s risk-off session, therefore dip buyers just came and bought things back.The Dow remains a lagger throughout this week after showing just a wick above the 47,000 threshold.In geopolitics, Trump mentioned in a roundtable talk that Middle East discussions are going towards the right direction and the US President should head to Egypt to finalize the Deal.

The Royal Bank of New Zealand also surprised Markets with a 50 bps Jumbo cut (which was 50% priced in ahead of the decision).The news got followed with a huge selloff for the Kiwi before markets started to price out cuts later in 2026. A larger cut tends to generate higher economic prospects and future expectation expectations.Hence, the NZD still recovered most of what it had lost. You can access more on the rate decision here.

When looking at this daily asset picture, one may ask himself: If everything is going up, then what is giving ?

The answer is in the Yen getting absolutely killed this week (take a look at USDJPY, catastrophic!). The CHF is also getting sold off quite aggressively with more dovish talks from the SNB – Carry trades are getting put back aggressively from what it seems.This makes even more sense when looking at the huge rallies in Crypto and Equities around the world.Kudos to the European Indices which are brushing off the usual French government mess ups and are rallying strongly nonetheless.

FX volatility is back strong!

Look at the huge recovery in the NZD, something to keep an eye on and remember.Apart from that, weekly flows are continuing with the AUD still gaining (very consitent performer of the past month) with the CAD and USD just following each other.As mentioned just before, both the CHF and JPY are getting sold off aggressively in what could be a return of the Carry Trade.

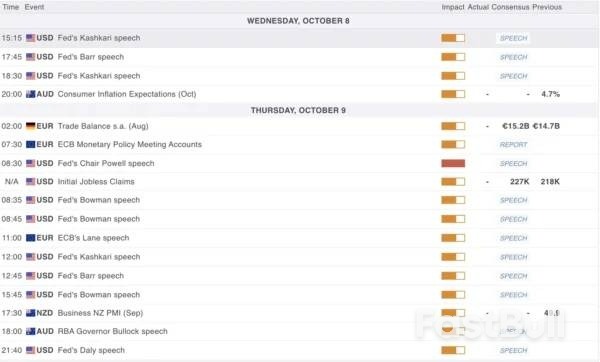

The next 24 hours in markets will be dominated by central bank chatter.

The daily session concludes with a trio of Fed speakers — Kashkari, Barr, and Kashkari again — followed by Australia’s Consumer Inflation Expectations (20:00 ET).Thursday should be busier, even with the absence of US/BLS data : the ECB’s Meeting Accounts (07:30 ET) open the European session, followed by Fed Chair Powell at 08:30 ET, the US Jobless Claims, and a long lineup of Fed officials including Bowman, Barr, and Daly.Across the Pacific, traders will also watch New Zealand’s Business NZ PMI and a key speech from RBA Governor Bullock (18:00 ET) for clues on regional policy direction.

Japan’s new ruling party leader, Sanae Takaichi, has yet to reach an agreement with the party’s long-time coalition partner Komeito about continuing their alliance, a delay that highlights the challenges she faces in building a stable administration.

Even with Komeito on board, the Liberal Democratic Party lacks a majority in both houses of parliament. That makes it imperative for Takaichi to get the longstanding ally to continue its support before she cuts deals with other parties to obtain the numbers needed to pass budgets and push ahead with policy.

While the most likely outcome is that the two parties will reach agreement in the coming days, the delay shows the level of reservations Komeito has over Takaichi’s right-wing views and her response to funding scandals within the LDP.

In a sign of that unease, Komeito head Tetsuo Saito indicated in comments that aired Wednesday that the party won’t vote for Takaichi in a parliamentary ballot to decide the prime minister if a coalition agreement isn’t in place.

A shock exit by Komeito from the coalition might force Takaichi to make more expensive concessions to opposition parties such as the Democratic Party for the People or the Japan Innovation Party to win their backing on a policy-by-policy basis or in a new coalition.

Discussions between Takaichi and Saito on Tuesday ended without a deal, in contrast to the previous two administrations, both of which signed agreements on the day new LDP party executives were formally appointed.

Without Komeito, Takaichi faces a shortfall of 37 seats to reach an LDP majority in the lower house. In the upper house the LDP is 25 seats short.

Komeito was founded in 1964 with the backing of the Buddhist group Soka Gakkai, an organization whose members can provide a pool of votes. Collaboration with Komeito since the late 1990s has enabled the LDP to project more of a reassuring image of consensus-building.

Komeito has typically reined in the LDP’s more hawkish leaders and efforts to remove restrictions on Japan’s Self-Defense Forces while putting forward policies favoring the vulnerable. Komeito ensured the sales tax was only raised to 8% on food in 2019 instead of 10%.

Takaichi’s past hawkish comments stand at odds with Komeito’s pacifist stance. Over the years, Takaichi has been a regular visitor to Yasukuni, a shrine that honors Japan’s war dead including war criminals. Visits by previous premiers have proven to be a flashpoint for China and South Korea.

Still, Saito said Tuesday that he had reached a shared understanding on many points after Takaichi gave a detailed explanation of her views on history, Yasukuni and foreigners. That likely leaves problems over the LDP’s slush fund scandal as the sticking point, with Komeito pushing for more restrictions on corporate donations.

Takaichi likely inflamed tensions over the funding issue when she appointed Koichi Hagiuda, to a senior LDP post on Tuesday. Hagiuda was one of the lawmakers implicated in the funding scandal.

Whether Komeito stays put or not, Takaichi will need opposition support to pass draft legislation.

She is likely only seeking cooperation from Ishin and the DPP at this stage given the complexity of expanding or changing the ruling coalition. She has little time to play with, given a hectic diplomatic schedule if she becomes premier, including a possible meeting with US President Donald Trump later this month.

Ishin holds 35 and 19 seats in the lower and upper chambers respectively, while the DPP holds 27 and 25. A one-on-one partnership with either Ishin or the DPP, but without Komeito, wouldn’t be enough for the LDP to secure control of both chambers — highlighting the importance of Komeito’s seats.

The LDP signed an agreement last year with the DPP to raise the income threshold in exchange for support on an extra budget, a move that is a basis for further cooperation. That deal is already set to trim tax revenue by ¥1.2 trillion, according to the LDP. The Finance Ministry has estimated the lost revenue of lifting the ceiling by the full amount demanded by the DPP at up to ¥8 trillion.

Takaichi has said she favors raising the tax threshold. Still, DPP leader Yuichiro Tamaki talked down the possibility of a coalition after meeting Takaichi on Wednesday, reiterating his view that he wanted to enact policies rather than get a cabinet position.

The DPP also calls for a blanket sales tax cut to 5%. The DPP says it can finance the resulting ¥10 trillion shortfall through bond issuance, the surplus from special accounts and unused government funds. Giving in to these demands would make the DPP an expensive partner.

Based in the western region of Kansai, the right-leaning Ishin has faced off in recent elections against Komeito, which is also based in the area, making them fierce rivals. That makes Komeito reluctant to see Ishin join the ruling coalition.

Still, on policy, the parties are not so far apart. Ishin backed the annual budget for the current fiscal year after securing commitments from the LDP on free high school education and reduced social insurance premiums.

Ishin supports a targeted sales tax cut that lowers the rate on food to 0% for two years, with the cost theoretically covered by tax revenue surpluses — a less expensive alternative compared with the DPP’s plan.

Takaichi has also endorsed Ishin’s “second capital” initiative, which aims to offer up a city, likely Osaka, as an alternative to Tokyo in case of natural disasters. That may help talks to proceed.

As for Komeito, there are risks if it bolts from the coalition. Komeito would need to fight for relevance against the more aggressive DPP or the far-right Sanseito, political forces that are more attuned to a younger generation. Recent opinion polls show Komeito trailing its new rivals.

US President Donald Trump speaks during a roundtable about "Antifa," an anti-fascist movement he designated a domestic "terrorist organization" in the State Dining Room of the White House in Washington, DC, on Oct. 8, 2025.

U.S. President Donald Trump announced Wednesday night stateside that Israel and Hamas had agreed on the first phase of a peace plan which could put an end to the two-year war and free hostages.

"ALL of the Hostages will be released very soon, and Israel will withdraw their Troops to an agreed upon line as the first steps toward a Strong, Durable, and Everlasting Peace. All Parties will be treated fairly!," Trump said in a post on Truth Social.

The preliminary agreement was confirmed by Israeli officials, Hamas and mediator Qatar.

Qatari Prime Minister's spokesperson Maged al Ansary said in a post on X that an agreement had been reached on "all terms and mechanisms for implementing the first phase of the Gaza ceasefire agreement, which will lead to stopping the war, releasing Israeli detainees and Palestinian prisoners and allowing aid to enter," according to CNBC's translation of his post in Arabic. More details will be announced later, he added.

Israeli Prime Minister Benjamin Netanyahu thanked Trump on X and said that "With the approval of the first phase of the plan, all our hostages will be brought home. This is a diplomatic success and a national and moral victory for the State of Israel." An Israeli government spokesperson said that release of hostages will start Saturday, according to Reuters.

Hamas confirmed the details in a separate statement. "We highly appreciate the efforts of our mediating brothers in Qatar, Egypt, and Turkey. We also value the efforts of U.S. President Donald Trump, who seek to bring about a definitive end to the war and a complete withdrawal of the occupation from the Gaza Strip," the group said.

It remained unclear whether the parties had made progress on more contentious issues, including whether Hamas would agree to demilitarize, as President Trump has demanded and how governance of the war-torn Gaza Strip would be handled.

Trump's 20-point proposal released last month to end the war in Gaza called for "a process of demilitarization of Gaza ... which will include placing weapons permanently beyond use through an agreed process of decommissioning."

The plan called for Gaza to be governed under "the temporary transitional governance of a technocratic, apolitical Palestinian committee, responsible for delivering the day-to-day running of public services and municipalities for the people in Gaza."

The Gaza war started in October 2023 when Hamas terrorists attacked Israel, killing about 1,200 people. Israel's retaliatory campaign has since killed more than 67,000 people, and laid waste to much of Gaza.

UK government plans to introduce a new Unemployment Insurance benefit could save as much as £3 billion ($4 billion) a year and increase weekly payments to jobseekers, according to the Institute for Fiscal Studies.Under the proposal, two out-of-work benefits would be replaced with a single time-limited allowance based on past contributions into the social-security system. Payments will be set at the higher rate of the two, currently reserved for people with health conditions.

The IFS says that limiting this benefit to six or 12 months will more than offset the increased payments to jobseekers by reducing the cost of long-term claimants, who currently make up 88% of spending on contribution-based unemployment support.The analysis provides a boost for the government in its battle to contain the spiraling welfare bill and put the public finances back on track. In July, it was forced to U-turn on plans to cut £5 billion from disability and health-related benefits after a rebellion by Labour lawmakers. The Office for Budget Responsibility projects working-age welfare spending to rise almost 20% in the next five years.

In a report published Thursday, the IFS said the level of savings from the reform will depend on the time limit imposed. A six-month limit to claiming Unemployment Insurance would save a projected £3 billion, with the figure falling to £2 billion if in place for a year. These savings come from long-term claimants with health conditions, most of whom currently receive support indefinitely.The UK is less generous than its OECD peers when it comes to supporting those who lose their jobs. The current Jobseeker’s Allowance is set at only 12% of mean wages – or £92.05 a week – when the OECD average is 55% and higher still elsewhere in Europe. Unemployment Insurance would see the proportion rise to 19%.

“Given the UK’s internationally low levels of support for the newly unemployed, there is a strong case for strengthening the level and duration of support offered to them through contributory benefits,” said Anvar Sarygulov, research grants and programs manager at the Nuffield Foundation, which funded the IFS study. “However, the government needs to avoid pulling the rug out from under existing long-term claimants with health conditions by thinking carefully about the delivery and design of any transitional support.”The unemployment insurance proposal came in a government paper earlier this year, alongside the now-scrapped changes to health benefits. The IFS analysis is contained in a pre-released chapter of its forthcoming Green Budget.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up