Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Hedge funds have made their most significant exit from tech stocks in a year, pivoting instead toward consumer staples as valuations soar and persistent rate volatility clouds the equity outlook, according to Goldman Sachs..

European companies were left wondering on Monday whether to cheer a hard-won US trade deal or lament a still sharp jump in tariffs versus those in place before President Donald Trump's second term.

A day earlier, European leaders heralded a framework trade deal with the United States that would impose a 15% import tariff on most EU goods, averting a spiralling battle between two allies which account for almost a third of global trade.

Although the deal is better than the 30% rate threatened by Trump and will bring clarity for European makers of cars, planes and chemicals, the 15% baseline tariff is well above initial hopes of a zero-for-zero agreement. It is also higher than the US import tariff rate last year of around 2.5%.

"Those who expect a hurricane are grateful for a storm," said Wolfgang Große Entrup, head of the German Chemical Industry Association VCI, calling for more talks to reduce tariffs that he said were "too high" for Europe's chemical industry.

"Further escalation has been avoided. Nevertheless, the price is high for both sides. European exports are losing competitiveness. US customers are paying the tariffs."

The deal, which also includes US$600 billion (RM2.5 trillion) of EU investments in the United States and US$750 billion of EU purchases of US energy over Trump's second term, includes some exemptions, even if details are still to be ironed out.

Carmakers Volkswagen and Stellantis, among others, will face the 15% tariff, down from 25% under the global levy imposed by Trump in April.

Stellantis shares rose 3.5% and car parts maker Valeo was up 4.7% in early trade. German pharma group Merck KGaA gained 2.9%.

Aircraft and aircraft parts will be exempt — good news for French planemaker Airbus — as will certain chemicals, some generic drugs, semiconductor equipment, some farm products, natural resources and critical raw materials.

Shares in the world's biggest chip maker ASML rose more than 4%, among the biggest gainers on the pan-European STOXX 600 index.

Dutch brewer Heineken cheered the deal, with CEO Dolf van den Brink welcoming the certainty it brought.

The world's number two brewer sends beer, especially its namesake lager, to the US from Europe and Mexico, and has also suffered from the indirect effect on consumer confidence in important markets like Brazil.

The rate on spirits that could impact firms such as Diageo, Pernod Ricard and LVMH, is still being negotiated though.

"It seems that in coming days there could be negotiations for certain agricultural products, zero for zero, which is what the European and US sectors have been calling for," said Jose Luis Benitez, director of the Spanish Wine Federation.

Benitez added that a 15% rate could put Europe at a disadvantage versus other wine exporting regions subject to 10% tariffs.

"If there are any exceptions, we hope that the (European) Commission understands that wine should be one of them."

Lamberto Frescobaldi, the president of Italian wine body UIV, said on Sunday that 15% tariffs on wine would result in a loss of €317 million over the next 12 months, though the group was waiting to see the final deal text.

Others said that the agreement — which followed on the heels of a similar one with Japan — helped bring greater clarity for company leaders, but still threatened to make European firms less competitive.

"While this agreement puts an end to uncertainty, it poses a significant threat to the competitiveness of the French cosmetics industry," said Emmanuel Guichard, secretary general of French cosmetics association Febea, which counts L'Oreal, LVMH and Clarins among its members.

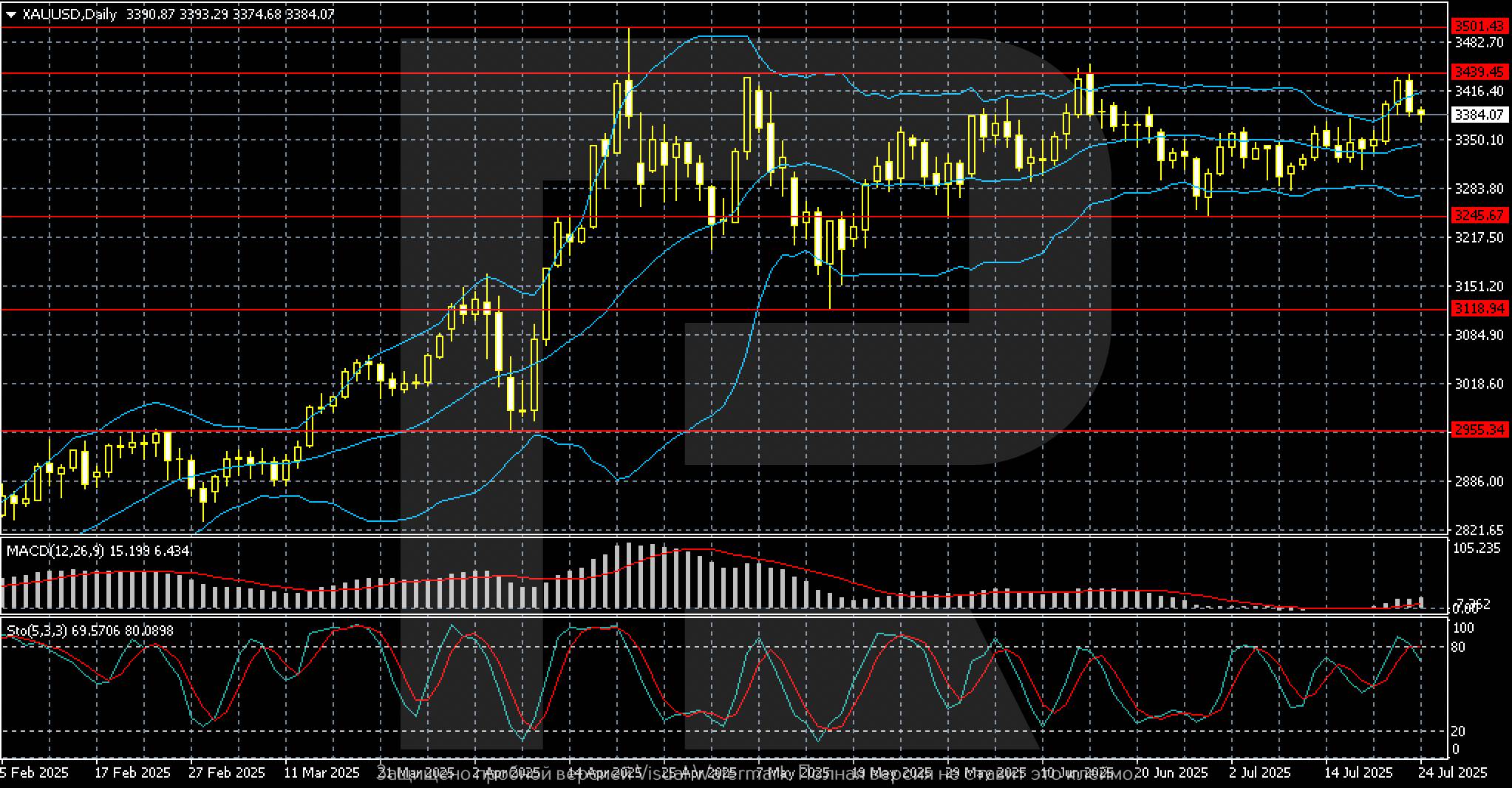

Interest in the precious metal remains subdued, but in the context of new tariff threats and potential disagreements between the Fed and the White House, demand could strengthen. Technically, holding above 3,350 preserves the potential for growth towards 3,440-3,450, with a possible upward breakout if the positive backdrop is confirmed.In the coming days, focus will be on the Federal Reserve meeting and the details of trade agreements with China and the EU, as they will likely set the direction for XAUUSD this week.

XAUUSD forecast for this week: quick overview

Gold ends the week in a sideways range between 3,350 and 3,435 USD per ounce. Pressure on the metal came from rising interest in risk assets due to optimism about US trade agreements with Japan and the EU. However, escalating tariff rhetoric towards India and South Korea and uncertainty in negotiations with China keep gold from a deeper correction. The weekly low is 3,351, while the high is 3,439.

3,350 is the nearest level closely watched by the market. A breakout below this level would open the way to 3,300 and then to the more significant support at 3,245. If pressure and yields rise further, a decline to 3,118 is possible.

The key resistance area lies between 3,435-3,440. A breakout in this area on the daily timeframe will confirm the market’s readiness to resume the uptrend with targets at 3,500-3,520.

Gold remains influenced by news on US trade talks and expectations regarding the Federal Reserve rate. The upcoming negotiations with China this week could affect demand for safe-haven assets. Another important factor is the prospect of policy easing: markets are pricing in a pause in July and a possible rate cut in October. This supports gold amid a moderately strengthening dollar.

Moderately bullish. The technical picture remains neutral to positive, as prices stay above 3,350. Indicators point to consolidation with upward potential. A breakout above 3,440 would signal growth towards the spring highs.

The baseline scenario suggests consolidation with a bullish bias, with targets at 3,440 and, if broken, at 3,500-3,520. The support level lies at 3,350, with further levels at 3,300 and 3,245 in case of a breakout. Federal Reserve decisions and trade news will act as key catalysts for movement.

Gold fundamental analysis

Gold trades below 3,390 per troy ounce and remains under local and rather emotional pressure. Optimism around potential US trade deals with key partners has reduced the metal’s appeal as a safe-haven asset.

The European Union is nearing a deal with Washington that would introduce a broad 15% tariff on EU goods, avoiding the harsher 30% rate scheduled to take effect on 1 August. The new structure may also include automobiles, mirroring the format already agreed upon in the deal between the US and Japan.However, caution remains as negotiations with South Korea and India are still ongoing, and the threat of tariffs ranging from 15% to 50% remains valid.

Investors are also awaiting progress in dialogue with China: US Treasury Secretary Scott Bessent is scheduled to meet with Chinese representatives in the final week of July.On the monetary policy front, focus is on this week’s Fed meeting. The market expects the rate to remain unchanged. However, a potential easing in October is already being priced in.

XAUUSD technical analysis

On the daily chart, Gold (XAUUSD) is consolidating within a range and trading near 3,384 per ounce. Prices have pulled back from the recent local high of 3,439 and remain below the key resistance level, showing no clear momentum.

The Bollinger Bands are gradually narrowing, indicating lower volatility and the possible approach of a directional move. The nearest resistance levels are at 3,439 and 3,501 – the local highs of the spring rally. The support level lies at 3,245 and then at 3,119.

The MACD oscillator maintains a weak bullish signal: the histogram remains positive, and the MACD line is slightly above the signal line, but without a clear impulse. The Stochastic is approaching overbought territory; a downward crossover could lead to a correction.

Overall, Gold is trading sideways between 3,350 and 3,440. A breakout of either boundary will signal a directional move. A rise above 3,439 will open the path to 3,500, while a fall below 3,245 will increase pressure on the metal.

Key drivers in the coming days will be news on international trade and the outcome of the Fed meeting.

XAUUSD trading scenarios

The fundamental backdrop remains mixed. On one hand, demand for gold as a safe-haven asset has declined amid optimism over US trade deals with key partners – Japan and the EU. On the other hand, persistent uncertainty in talks with China, threats of higher tariffs for several countries, and expectations of Fed policy easing in October continue to support demand for the metal. In this environment, gold consolidates below the 3,440 level, showing restrained dynamics.

Long positions can be considered if gold holds above the 3,350-3,360 area. This would confirm the resilience of the support level and market readiness to recover towards 3,435 and then 3,500. A consolidation above 3,440 on the daily chart would open the way to the spring highs near 3,500-3,520.

The optimal entry point remains a pullback to the 3,350 area with confirmation in the form of a candlestick pattern or a bounce from the Bollinger midline. This scenario is preferable in case of a weakening dollar, rising inflation expectations, and signs of cooling in the US economy.

Short positions become relevant if prices break below the 3,350 support level and consolidate below 3,320. This would signal weakening bullish momentum and the start of a downward exit from the range.Downside targets include the 3,245 and 3,120 levels. The correction could continue if US bond yields rise, the dollar strengthens, and the Fed signals a pause in its easing cycle.The market is balancing between technical consolidation and fundamental risk reassessment. As long as gold holds above 3,350, a neutral-positive bias remains.

Summary

Gold remains in a consolidation mode within the 3,350-3,435 range, staying sensitive to fundamental news. Investors assess the prospects of Fed policy easing, the progress of US trade agreements with key partners, and the general state of global demand for safe-haven assets. Despite local pressure from the dollar and rising Treasury yields, the metal finds support from geopolitical and trade uncertainty.

The current sideways corridor reflects the market’s wait-and-see stance. A consolidation below 3,350 or above 3,440 will serve as a technical signal for a new impulse. Until then, movement remains limited with moderate volatility.In an uncertain environment, short-term traders may focus on range-bound trading – rebounds from boundaries and confirmed reversal signals at key levels. It is worth paying increased attention to the Fed’s rhetoric and the course of negotiations with China.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up