Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

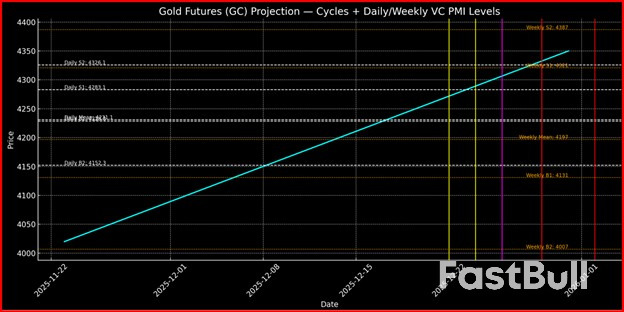

Gold prices rose to a six-week high on Monday, supported by growing expectations of U.S. interest rate cuts and a sliding dollar, while silver struck a record high ahead of key U.S. economic data.Spot gold was up 0.3% at $4,244.29 per ounce, as of 09:21 AM ET (1421 GMT), its highest since October 21. U.S. gold futures for February delivery gained 0.6% to $4,278.40.Silver was up 1.8% to $57.39 per ounce, after hitting an all-time high of $57.86 earlier.

Gold prices rose to a six-week high on Monday, supported by growing expectations of U.S. interest rate cuts and a sliding dollar, while silver struck a record high ahead of key U.S. economic data.

Spot gold was up 0.3% at $4,244.29 per ounce, as of 09:21 AM ET (1421 GMT), its highest since October 21. U.S. gold futures for February delivery gained 0.6% to $4,278.40.Silver was up 1.8% to $57.39 per ounce, after hitting an all-time high of $57.86 earlier.

The U.S. dollar slipped to a two-week low, making gold more affordable for holders of other currencies.

"The underlying environment of expectations of further rate cuts, along with inflationary pressure still above the Fed target... is still the underlying support in gold and silver," said David Meger, director of metals trading at High Ridge Futures.

Traders have increased December rate-cut bets to an 87% probability, following softer U.S. economic data and dovish remarks from Fed officials, including Governor Christopher Waller and New York Fed President John Williams.

Lower interest rates tend to favor non-yielding assets such as gold.

Investors are also focusing on key U.S. data this week, including November ADP employment figures on Wednesday and the delayed September Personal Consumption Expenditures (PCE) Index, the Fed's preferred inflation gauge, due Friday.

Fed Chair Jerome Powell's remarks later on Monday are also expected to offer further policy clues.

Meanwhile, the expectation that the next Fed Chair is going to be more dovish than previous ones is also supporting gold and silver, Meger said.

White House economic adviser Kevin Hassett said on Sunday that, if chosen, he would be happy to serve as the next Fed chairman. Treasury Secretary Scott Bessent indicated a new chair could be named before Christmas.

"We still view gold and silver in a strong sideways to higher uptrend," Meger said.

Among other precious metals, platinu rose 0.3% to $1,677.28, while palladium fell 0.5% to $1,443.75.

Oil prices rose $1 a barrel on Monday following drone attacks by Ukraine, the closure of Venezuelan airspace by the United States, and OPEC's decision to leave output levels unchanged in the first quarter of 2026.

Brent crude futures advanced $1, or 1.6%, to $63.38 a barrel by 9:14 a.m. CDT (1514 GMT). U.S. West Texas Intermediate crude gained 94 cents, or 1.61%, to $59.49 a barrel.

"Ukrainian drone attacks on Russian shadow fleet as well as a commitment by OPEC to maintain current production levels has the market in an optimistic state," wrote Phil Flynn, senior analyst for the Price Futures Group, in a note. "This comes as global oil demand continues to rise despite the negativity that we continue to hear on the demand side of the equation."

The Caspian Pipeline Consortium, which carries 1% of global oil, said on Saturday that one of the three mooring points at its Novorossiysk terminal had been damaged, halting operations. But Chevron, a CPC shareholder, said late on Sunday that loadings were continuing at Novorossiysk. Usually, two moorings are engaged in loadings, while one is used as a backup.

The attacks on the CPC export terminal drove oil prices higher, UBS analyst Giovanni Staunovo said.

They came as Ukraine stepped up its military operations in the Black Sea and hit two oil tankers, which were heading to Novorossiysk.

Meanwhile, the Organization of the Petroleum Exporting Countries and its allies initially agreed on a pause in early November, slowing a push to regain market share with looming fears of a supply glut.

LSEG senior analyst Anh Pham said the market was reacting positively to the news.

"For some time, the narrative has centred on an oil glut, so OPEC+'s decision to maintain its production target provided some relief and helped stabilise expectations for supply growth in the coming months."

Brent and WTI crude futures settled lower on Friday for the fourth straight month, their longest losing streak since 2023, as expectations for higher global supply weighed on prices.

On Saturday, U.S. President Donald Trump said "the airspace above and surrounding Venezuela" should be considered closed, sparking fresh uncertainty in the oil market, as the South American nation is a major producer.

Trump on Sunday said he had spoken to Venezuelan President Nicolas Maduro but did not give details.

Russian President Vladimir Putin declared on Tuesday that Russia is prepared for war with European powers if they seek conflict, while emphasizing that Moscow does not want such an outcome.

During his address, Putin stated that European nations have made "absolutely unacceptable" demands regarding a potential peace settlement for Ukraine.

"If Europe wants to fight war, we are ready now," Putin said, escalating his rhetoric against European nations.

The Russian leader claimed that Europeans have "detached themselves" from peace talks and are hindering the U.S. administration and President Trump's efforts to achieve peace through negotiations.

"Europeans do not have peaceful agenda, they are on the side of war," Putin asserted.

Putin highlighted the strategic importance of Pokrovsk in Ukraine, describing it as "a great base for fulfilling goals" and reiterating that it is now "fully in Russia's army control," a statement Ukrainian officials have rebuffed.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up