Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold climbed to a fresh record above $3,719 per ounce as traders positioned ahead of key U.S. inflation figures that could reinforce expectations for further Federal Reserve rate cuts....

Over the past week, gold briefly pulled back before resuming its upward momentum, surpassing Wednesday's intraday high of $3,707 to reach fresh all-time highs. The market's expectation of two additional rate cuts this year remains the core driver for gold's rally, while ongoing central bank purchases provide strong support. Although recent US-China talks temporarily eased trade concerns, the US short-term budget standoff and ongoing geopolitical developments continue to maintain a risk premium for gold.

This week, a series of Fed officials' speeches, along with Friday's US core PCE data release, may trigger short-term volatility for gold.

On the XAUUSD daily chart, gold briefly broke above the critical psychological level of $3,700 last week before entering a high-level consolidation phase. Early-week gains were offset by a midweek short-squeeze, with prices retreating fully from Wednesday to Thursday. However, the pullback did not extend, bottoming near $3,630. Bulls subsequently stepped in to cover positions, and gold has now reclaimed $3,700, testing new highs.

Technically, two key points stand out: First, the previous breakout failed to hold primarily due to news flow dynamics and short-term arbitrage (profit-taking and options hedging). Second, given the current liquidity and policy expectations, pullbacks are generally seen as buying opportunities rather than trend reversals - i.e., the market favors “buying the dip.”Currently, $3,700 is a critical short-term level. A stable close above this point would likely turn it into strong support, opening the door for a further move toward $3,750. Conversely, if selling pressure intensifies, the consolidation low since September 9 around $3,630 would become the key defensive level.

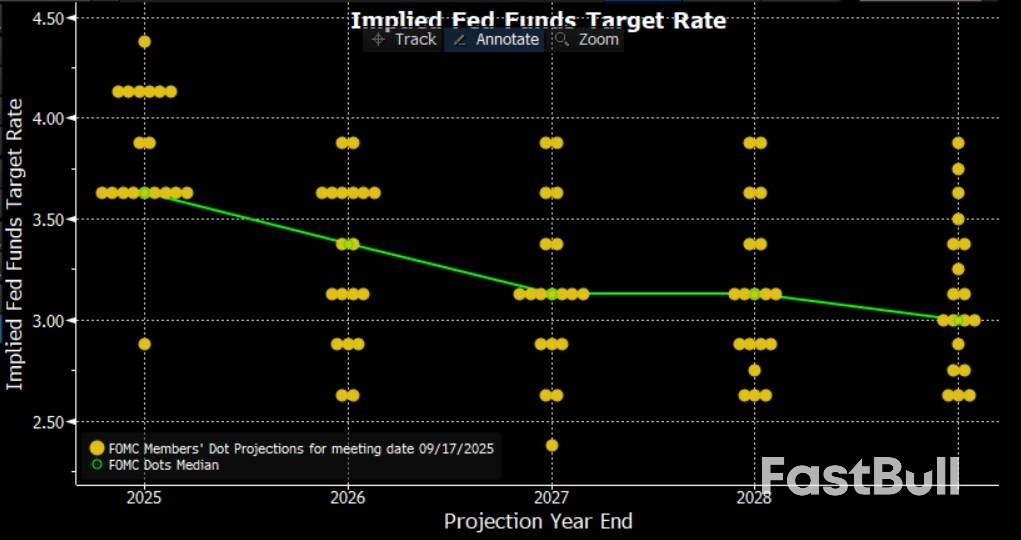

Gold's upside remains primarily driven by expectations around Fed monetary policy. According to the CME FedWatch Tool, the market currently prices in a roughly 90% probability of a 25bp rate cut in October, and nearly an 80% probability of another cut in December. This aligns with the Fed's updated dot plot, which signals roughly 50bp of additional easing priced in for the remainder of the year, supporting non-yielding assets such as gold.

Meanwhile, the extremely dovish stance of new Fed governor Miran, combined with concerns about the Fed's independence, adds to market uncertainty regarding policy credibility, providing additional support for gold.

Gold's buying momentum, however, is not solely reliant on Fed rate cut expectations. Physical demand and continued official purchases also provide strong long-term support. In China, for example, the central bank reported purchases of just 20.8 tons from January to July 2025, while UK customs data shows imports of roughly 137 tons during the same period, highlighting a significant gap between official statistics and actual flows. This indicates robust demand through London and other channels, with quotas posing no material constraint.

At the same time, India's gold premiums have risen to nearly a 10-month high, reflecting strong retail and seasonal demand.

On the investment side, SPDR Gold ETF added approximately 18.9 tons in a single day on September 19, pushing total holdings to 994.56 tons, the highest level this year. This reflects not only direct capital demand but also strong market confidence in gold's safe-haven appeal.

Geopolitical factors are more mixed. On one hand, last week's US-China leadership call eased short-term trade-related buying pressure. On the other hand, the US Senate's rejection of a short-term spending bill, rising government shutdown risks, and tensions in Ukraine, Gaza, Eastern Europe, and the Caribbean continue to inject uncertainty premiums into gold.Overall, Fed rate-cut expectations remain the primary driver of gold, while sustained global central bank purchases establish a strong longer-term floor. Together, these factors reinforce the bullish advantage in the current environment.

In the short term, while gold may face some profit-taking or temporary USD rebounds, the overall trend remains upward. Buying on dips remains the prevailing strategy, with traders advised to consider longer-term capital flows and physical demand as underlying support while monitoring short-term volatility for entry opportunities.

This week, 18 Fed officials are scheduled to speak. Chair Powell will appear on Tuesday, September 23, with markets expecting clearer policy signals. New governor Miran may reiterate an extremely dovish stance, emphasizing “150bp of cuts this year with limited recession risk,” potentially signaling future aspirations for the chairmanship. Any dovish indications could further support gold bulls.

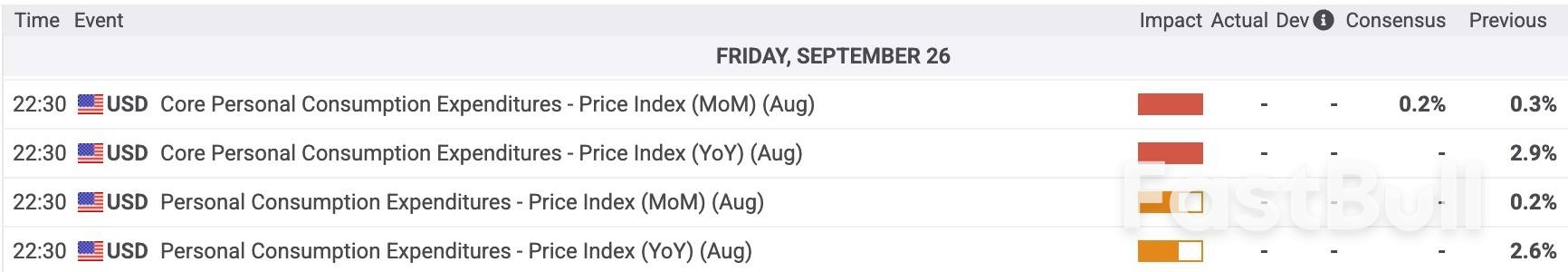

Friday, September 26, will bring the release of core PCE inflation, with market expectations at 0.3% MoM and 2.7% YoY, both slightly above prior readings.

With policy focus currently skewed toward employment, weakening labor data is likely to influence market expectations for rate cuts more than minor inflation fluctuations. Therefore, unless inflation surprises significantly, Fed decisions are unlikely to be materially affected, and gold may only see short-term volatility as a result.

AUD/USD failed to stay in a positive zone and declined below 0.6650. NZD/USD is also moving lower and might extend losses below 0.5845.

The pair even settled below 0.6620 and the 50-hour simple moving average. There was a clear move below 0.6600. A low was formed at 0.6581 and the pair is now consolidating losses below the 23.6% Fib retracement level of the downward move from the 0.6706 swing high to the 0.6581 low.On the upside, immediate resistance is near a connecting bearish trend line at 0.6610 and the 50-hour simple moving average. The next major hurdle for the bulls could be near 0.6645 and the 50% Fib retracement.

The main selling point could be 0.6660, above which the price could rise toward 0.6690. Any more gains might send the pair toward 0.6700. A close above 0.6700 could start another steady increase in the near term. In the stated case, the next key resistance on the AUD/USD chart could be 0.6750.On the downside, initial support is near 0.6580. The next area of interest might be 0.6550. If there is a downside break below 0.6550, the pair could extend its decline. The next target for the bears might be 0.6500. Any more losses might send the pair toward 0.6420.

The pair settled below 0.5920 and the 50-hour simple moving average. Finally, it tested 0.5845 and is currently consolidating losses. There was a minor increase above a connecting bearish trend line with resistance at 0.5860.If the pair recovers, it could face hurdles near the 23.6% Fib retracement level of the downward move from the 0.6007 swing high to the 0.5846 low at 0.5885 and the 50-hour simple moving average.

The next major barrier is at 0.5925 since it coincides with the 50% Fib retracement. If there is a move above 0.5925, the pair could rise toward 0.5945. Any more gains might open the doors for a move toward 0.5990 in the coming days.On the downside, immediate support on the NZD/USD chart is near the 0.5845 level. The next major stop for the bears might be 0.5800. If there is a downside break below 0.5800, the pair could extend its decline toward 0.5750. The main target for the bears could be 0.5720.

A phone call between US president Trump and his Chinese counterpart Xi Jinping supported the bulls on Friday. The sale of TikTok’s US operations to an American company was the main point but Trump said both made progress on a variety of issues including “Trade, Fentanyl, the need to bring the War between Russia and Ukraine to an end”. The US president added that he would meet Xi in person on the sidelines of the upcoming Asia-Pacific Economic Cooperation summit. The main indices on Wall Street all hit new records. The US dollar extended its post-Fed rebound into a third day. DXY rose to 97.64, EUR/USD drifted gradually but steadily towards the mid 1.17-1.18 area. The dollar’s (for now still) minor comeback comes along with some short-term bottoming out of the 2-year yield. Net daily changes in US rates on Friday varied between 0.8-2.2 bps. German bonds slightly underperformed. Intra-EMU spreads narrowed. France’s 10-yr yield (and therefore spread as well) finished the week the way it started: slightly higher than Italy. The remarkable swap has been years in the making. Italy’s rating upgrade (see below), along with southern peers including Portugal and Spain, are testament to the changing fiscal pecking order. Gilts were the laggards. The long end of the UK curve was particularly vulnerable (30-yr +5.2 bps). August budget deficit figures came in much higher than the Office of Budget Responsibility expected. This independent budget watchdog assesses the government performance against its self-imposed fiscal rules so Friday’s numbers are yet another blow for UK finance minister Reeves going into November’s Autumn Budget. Sterling was among the weaker performers with EUR/GBP closing north of 0.87 for the first time since early August. Cable (GBP/USD) forfeited the 1.35 handle.

The new trading weeks kicks off today with a series of central bank speeches, ranging from Bailey and chief economist Pill in the UK over ECB’s Lane and Nagel in the euro area to several Fed members (NY’s Williams, board member Miran) that are to address the economy and monetary policy. PMI’s are scheduled for release tomorrow along with Fed’s Powell offering his view on the economic outlook. PCE deflators, the Fed’s preferred inflation gauge, are printed on Friday. A slew of central bank meetings are scattered across the week with Hungary and Sweden on tap Tuesday, the Czech Republic Wednesday and Switzerland the day after.

Rating agency Fitch raised Italy’s credit rating from BBB to BBB+ with a stable outlook. The upgrade reflects increased confidence in Italy’s fiscal trajectory, a stable political environment, ongoing reform momentum and reduced external imbalances. Fitch expects a continued gradual deficit reduction in 2025-2027, supported by structural improvements on the revenue side and strict expenditure control. They expect a deficit ratio of 3.1% of GDP, below the official 3.3% target. The government’s aim is bring it down to 2.6% in 2027 and under 2% by 2029. The primary surplus is expected to rise from 0.7% of GDP this year to 2.4% in 2029, supported by reform implementation. Fitch forecasts the debt ratio to increase modestly from 135.3% of GDP to 137.5% in 2026, before falling back towards 134% by 2030. One of Italy’s weaker points remains its low growth potential. The rating agency estimates growth of 0.6% this year and an average of 0.8% in 2026-2027. Domestic demand, particularly investment, will be a key driver of short-term growth, offsetting weakness in the external sector. Italian BTP’s have been performing strongly this year with the 10y swapspread narrowing from a YtD top at 130 bps to 83 bps currently and trading more and more in line with semi-core peers.

RBA governor Bullock sounded slightly more hawkish this morning in a testimony to the House of Representatives Standing Committee on Economics. Inflation has fallen substantially since the peak of 7.8% in 2022 and is now within the 2-3% target range. Labour market conditions are close to full employment. Since the August meeting, domestic data have been broadly in line with the Australian central bank’s expectations or if anything slightly stronger. The Board will discuss this and other developments at their meeting next week. Markets expect a stable policy rate (3.6%), but slightly reduced bets on a final rate cut at the November meeting (75% from 95%). Australian bond yields add 3-4 bps across the curve this morning while AUD/USD treads water.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up