Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold retreated below $4,000 as risk sentiment shifted and global stocks weakened. Traders await U.S. sentiment data, French and Japanese political updates, and Q3 earnings, while silver outperforms amid market uncertainty.

Canada’s economy added a staggering 60k jobs in September (+0.3% month/month), 55k more than consensus expectations for a 5k gain. The details were similarly strong with full-time positions jumping 106k, and the private sector rising 22K.

The unemployment rate held steady at 7.1% in September, as the labour force more than made up for the past two months of losses, adding 72k workers.

Job gains were concentrated in manufacturing (+28k), health care and social assistance (+14k), and agriculture (+13k). The biggest losses were seen in wholesale and retail trade (-21k), construction (-8.2k), and transportation and warehousing (-7.4k).

Wage growth was steady in September with average hourly wages up 3.6% versus a year ago.

Well, that’s quite the surprise. Canada’s job market looks like it recovered all of August’s losses in September. Importantly, even for a noisy data series, this is a strong result. That said, it’s important to note that the unemployment rate remained unchanged as the labour force jumped by an even greater amount. Considering population growth slowed to 28k people, the biggest surprise was a large influx of new workers despite a weak job market.

The Bank of Canada’s next decision is due at the end of the month and this surprise from the labour market could change the calculus on the decision. However, underlying inflation continues to hover within the target range and the unemployment rate suggest that the labour market still has excess slack. The next inflation report is due on the 21st and the bar will be even higher for inflation to underperform and bring the BoC onside for another rate cut. Markets seems to agree as the pricing for a rate cut materially deteriorated this morning.

The RBA has almost certainly not yet decided whether or not to cut the cash rate in November. The data flow from here will determine the outcome, with hesitation now likely to result in more cuts later.

It’s almost certain that RBA has not yet decided whether or not to cut the cash rate at its November meeting. If the meeting were held today, they would keep rates on hold, awaiting further data. Several potentially decisive data releases are due before the actual meeting, though, including the September labour data and the full quarterly CPI. Until then, we need to hold two possible futures in mind: hold or cut.

The August CPI indicator did imply an ugly result for the September quarter. Our own nowcast for the trimmed mean measure is a ‘big’ 0.8%qtr that could easily round up to a 0.9%, a result that would surely stay the RBA’s hand. Looking at the detail, though, outside home-building costs it is not clear that the August data provided much signal of an ongoing higher rate of inflation than expected. As we noted at the time, the result in market services was mixed, with some personal services inflation below our forecasts while the cost of eating out was stronger. The latter suggests that, following a period of retrenchment in hospitality (evident in the labour account employment data), improving conditions have allowed for some margin repair. Some of the price gains may also indirectly relate to recent annual award wage increase; though this is a normal seasonal effect, its size will depend on how margins react. Neither of these influences on price growth are likely to be sustained if demand remains patchy.

We therefore think the economy could be in for something like a re-run of late 2023, when an upside surprise in September quarter inflation was followed by a downside surprise (to something more like our own near-cast) in the December quarter. The result was a hike in late 2023 followed by an ‘on-the-fly’ pivot following the February 2024 meeting – from flagging possible further hikes in the post-meeting statement to ‘not ruling anything in or out’ in the media conference. That message landed a lot better, and sure enough, the next move was, eventually, a cut.

We are also mindful of the two-sided risks around both the labour market and household spending data. We will know more about the labour market shortly when the September monthly labour force data is released next week, completing the picture for the quarter. So far, we see a gradual softening in employment growth as demand pivots away from the jobs-rich ‘care economy’. The unemployment and underemployment consequences of this are being masked by an unwind in the extra labour supply induced by earlier cost-of-living pressures. With demographic drivers still implying an upward trend in labour force participation, we see more latent labour market slack emerging over time and weighing on wages growth and inflation. There is precedent for this outcome in Australia’s experience in the late 2010s.

On household spending, the August Household Spending Indicator, released after the September RBA Monetary Policy Board (MPB) meeting, was notably below market expectations. This accords with our assessment that the expected recovery in consumer spending has been patchy and that the strength in national accounts consumption in Q2 partly reflected some one-off factors such as insurance payouts and the unwinding of some electricity rebates. Though we see two-sided risks around the consumption outlook, the more downbeat tone from consumer sentiment in recent months certainly suggests that underlying momentum is still subdued. Given how weak real household incomes have been for a number of years, this ongoing pessimistic tone does not surprise us.

Recall also that a recovery in household spending is necessary to counterbalance the slowdown in public sector demand growth that is already underway. Faster growth in household spending should only stay the MPB’s hand from further rate cuts if the pick-up is stronger than implied by the RBA’s August forecasts. These were constructed on an assumption of a couple more cash rate cuts, as the market was pricing at the time. Far too many observers are in the habit of seeing any pick-up in demand or housing prices as something for policy to react against, rather than as the expected and intended transmission of monetary policy. The Governor’s comments at the latest media conference show that the RBA, at least, does understand the difference.

The rates outlook boils down to the issue of how much signal to take from an upside surprise in one quarter in terms of what that means for subsequent quarters. RBA Governor Bullock has on several occasions insisted that ‘we will be guided by our forecasts’. However, that statement sits a bit uncomfortably with the flat profile for the RBA’s trimmed mean inflation forecasts and the unemployment rate. These give the impression of a set of forecasts being used as a communication device to explain and frame a policy decision rather than an independent input into that decision. This is understandable and perhaps inevitable given the judgement involved in synthesising the output of many different models and information sources. However, it does hold the risk that the policy view helps shape the forecast rather than the other way around.

What’s left in these circumstances is reactivity to incoming data – that is, to the recent past. As well as making policy less predictable – contrary to the MPB’s stated intentions – it is not a great way to run an economy policy setting that affects the economy with a lag, especially when inflation has been within the target range for a little while now at the same time as policy is likely still restrictive.

Bottom line: the odds that the RBA cuts in November are, at this point, below 50% but still a long way from zero. The data flow could change things again. Frankly, the prospect of flip-flopping a ‘call’ as the month goes on is unattractive, especially when it is quite obvious that the policymakers have not made up their mind yet. We must hold the two possibilities in mind at least until the labour market data come in. (A good-enough labour market result would make it unlikely that the RBA would cut, even if the September quarter CPI comes in a little more benign than we currently expect.)

The RBA communications schedule has half a dozen speeches between now and the November meeting that will be opportunities for it to provide guidance on some of its key forecast judgements, though they all pre-date the release of the September quarter CPI. If the RBA does hold in November, though, our conviction that they end up cutting in February rises, as does our expectation that the trough will be 2.85% rather than something higher. The more the MPB hesitates in the face of uncertainty, the more likely it is that domestic inflation pressures surprise it on the downside next year, and trimmed mean inflation turns out more like the Westpac Economics forecast than the August RBA one.

The yen stabilised on Friday but was still headed for its steepest weekly drop in a year on Friday, as the chances of a near-term rate hike faded, while the euro was rooted near two-month lows by political crisis in France.

The yen edged up 0.2% to 152.7 per U.S. dollar, still close to its weakest since mid-February and heading for a 3.5% drop in the week, its biggest decline since last October.Its drastic drop has been spurred by concerns that the Bank of Japan may not hike interest rates again this year after fiscal dove Sanae Takaichi's surprise victory to lead the ruling party, stoking worries of Japanese authorities needing to step in to support the yen.Japanese Finance Minister Katsunobu Kato said on Friday that the government was concerned about excessive volatility in the foreign exchange market. Takaichi said on Thursday she did not want to trigger excessive declines in the yen.

"The Ministry of Finance is very sophisticated, they're very experienced, and I think they would use verbal intervention beforehand. And in a way, I think they have," Rabobank chief strategist Jane Foley said.

Takaichi said on Thursday that the BOJ is responsible for setting monetary policy but that any decision it makes must align with the government's goal.

She looked set to become Japan's first female prime minister in a parliament vote that was expected on October 15. But the date will be likely pushed back after the Liberal Democratic Party's junior coalition partner Komeito pulled its support, breaking their 26-year-old alliance.Traders are currently pricing an about 45% chance of a rate hike from the BOJ in the December meeting and are only fully pricing in a 25-basis-point hike in March.

The euro headed for its biggest weekly decline in 11 months, but managed to hold steady at $1.1564, near its lowest for two months. Political turmoil in France has weighed heavily on the single currency in the last week.

President Emmanuel Macron is searching for yet another prime minister, hoping his next pick - the sixth in under two years - can steer a budget through a legislature riven by crisis.

The political paralysis has made it deeply challenging to pass a belt-tightening budget and has made investors increasingly worried about France's yawning deficit, on top of evidence of slowing momentum in other key economic engines such as Germany.

"The data from Germany's not good, and therefore I think that makes the euro a little bit more susceptible to wobbles on the French news," Rabobank's Foley said.

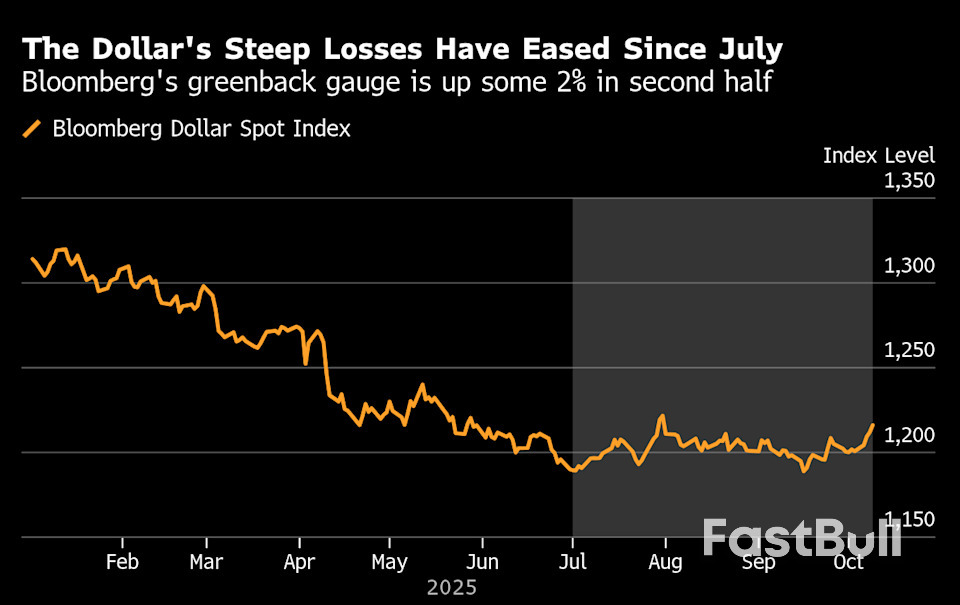

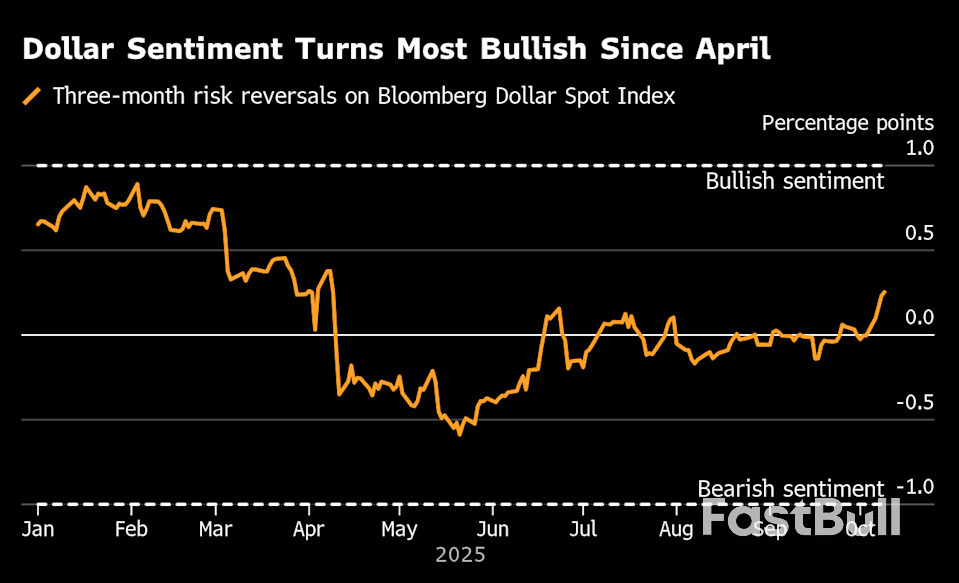

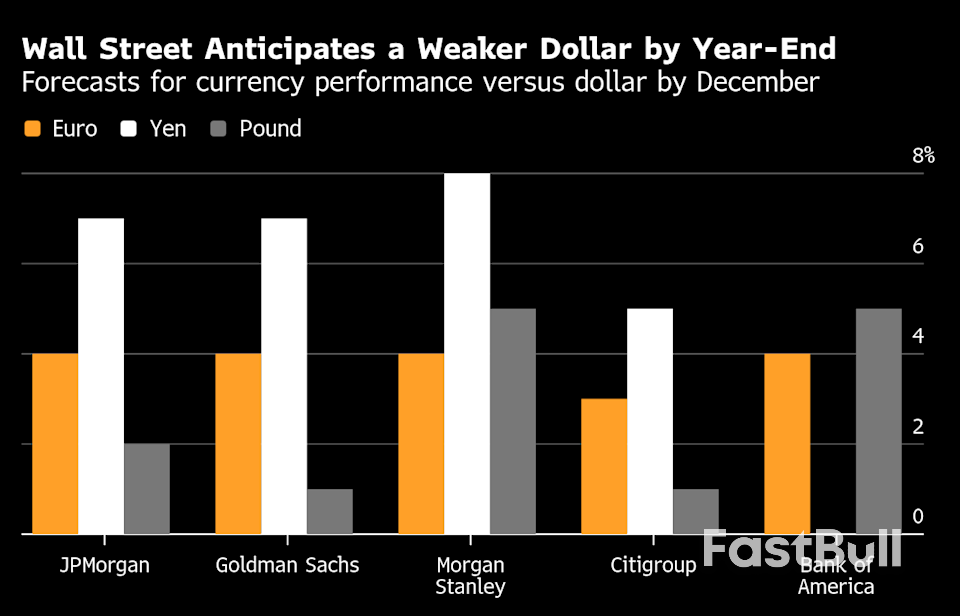

As a result, the dollar index , which measures the U.S. currency against six others, neared two-month highs around 99.39 and headed for a weekly rise of 1.7%, its biggest in a year.

"The recent dollar rally has gone against market positioning and prompted a partial covering of USD shorts," said Chris Weston, head of research at Pepperstone.

"There remains a high degree of scepticism that the USD can materially push through 100, a level in the dollar index that was quickly reversed in May," he said in a note.

With the U.S. government shutdown continuing and little to no economic data for investors to parse through for clues on the path the Federal Reserve is likely to take, markets are keeping an eye on comments from policymakers.

The influential New York Federal Reserve President John Williams signalled on Thursday he would be comfortable with cutting interest rates again, despite some policymakers' qualms about rising inflation that suggest such a decision would not be easily made.

Traders are pricing in a 95% chance that the Federal Reserve cuts rates by 25 bps at its October meeting, while the odds of an additional cut in December have dropped to 80%, from 90%, in the past week, according to the CME Group's FedWatch Tool.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up