Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold hovers at key technical levels as traders await a breakout or breakdown near the 50-day moving average. Fed’s dovish tone and rate cut expectations continue to underpin gold market sentiment despite a slightly firmer dollar. Soft U.S. CPI and anticipated weak PPI strengthen the gold price forecast ahead of Jackson Hole policy clues.

Key Points:

Daily Gold (XAU/USD)

Daily Gold (XAU/USD)Gold is trading slightly lower on Thursday as it hovers around two key technical levels — the short-term pivot at $3353.58 and the 50-day moving average at $3349.00. Price action at these thresholds will likely dictate near-term direction, with bulls eyeing a break above the August 8 minor high at $3409.43. A downside breach of $3349.00 could expose gold to deeper losses toward $3331.17, and possibly down to the long-term support at $3310.48.

At 12:26 GMT, XAU/USD is trading $3355.53, down $0.160 or -0.00%.

Daily US Dollar Index (DXY)

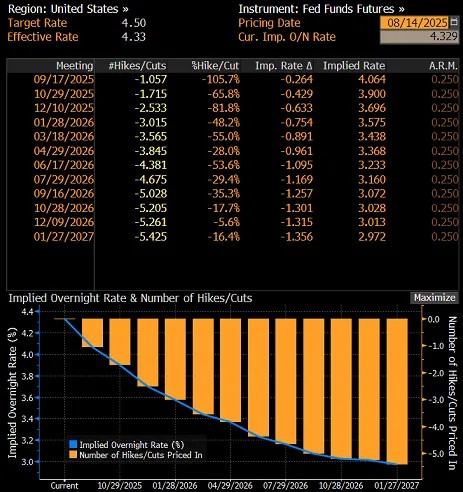

Daily US Dollar Index (DXY)The U.S. dollar index firmed modestly, pressuring gold, but remained near multi-week lows. Traders are largely positioning for an interest rate cut at the Fed’s next meeting. According to LSEG data, markets are fully pricing in a September rate cut, with roughly 7% odds of a 50 basis-point move. U.S. Treasury Secretary Scott Bessent stoked these expectations, stating that the Fed should consider a “series of rate cuts” and open the door to an aggressive start.

Non-yielding gold typically gains in a lower interest rate environment, and the market is increasingly betting that the Fed will ease policy further before year-end. Treasury yields continued to drift lower, with the 10-year at 4.208% and the 2-year at 3.662%, reflecting growing conviction around policy easing.

All eyes are now on Thursday’s U.S. Producer Price Index and weekly jobless claims for further confirmation that the Fed has room to cut. Earlier in the week, July’s CPI data came in softer than expected, easing concerns about tariff-driven inflation. Traders are betting that continued labor market softness and subdued inflation will justify the Fed’s dovish lean going into its Jackson Hole symposium next week.

Commodities strategist Nitesh Shah noted that despite Thursday’s marginal price dip, gold remains well-supported by the broader rate environment. The market will look to fresh data to reinforce this bullish bias.

Gold remains in consolidation, but the broader setup favors the bulls as dovish Fed rhetoric and falling yields provide fundamental support. A sustained move above $3353.58 will likely open the door toward $3409.43.

On the downside, failure to hold the 50-day MA at $3349.00 risks a drop to $3331.17, with $3310.48 as the next key support. Near-term, the gold prices forecast leans bullish, contingent on upcoming inflation data validating rate-cut bets.

Gold – Chart

Gold – Chart Silver – Chart

Silver – ChartAn extensive package of statistics on the United Kingdom published on Thursday morning showed mostly better-than-expected data, excluding foreign trade data. However, strong fundamental data failed to support the pound, which appears somewhat exhausted from its growth over the past couple of weeks.

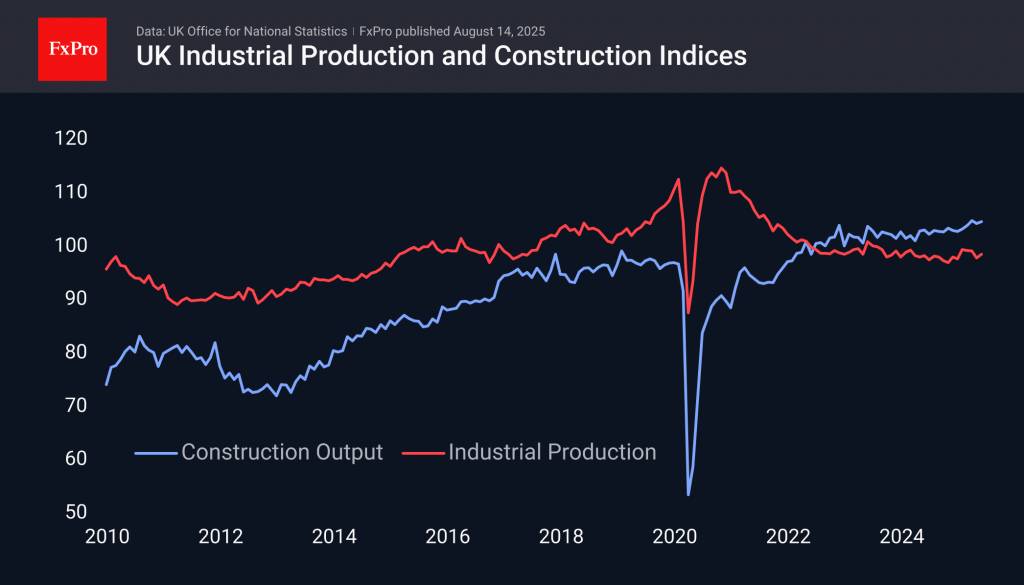

The economy grew by 0.4% in June, against expectations of 0.2%, and it also delivered growth of 0.4% quarter-on-quarter and 1.2% compared to the same quarter a year earlier. The services sector continues to make a positive contribution to the economy, with the index rising by 0.3% in June after 0.1% in May. The industrial production index added 0.7% in June, but this was after an accumulated decline of 1.5% over the previous three months. The UK industrial production index has been drifting around current levels for the past three years.

The construction industry continues to recover, probably supported by monetary policy easing. The corresponding industry activity index is almost entirely on the trajectory it entered after 2013, when the economy recovered from the mortgage crisis.

The pound began to rebound on 1 August after touching the Fibonacci support level of 61.8% of the growth from the January lows to the peak at the start of July. The latest rally of 3.5% from 1.3140 to almost 1.3600 looks like a resumption of growth after a corrective pullback. However, confirmation of this pattern will only come after exceeding 1.3800, the highs at the start of July.

For now, we are seeing a very strong wave of resistance at current levels, which has been stopping and reversing the pound’s growth against the dollar since the end of May, apart from a brief breakout at the end of June. If this year’s highs are updated, it will be a serious breakthrough, opening growth potential to 1.48–1.50 with intermediate stops at 1.4250.

On Thursday, the pound is struggling to rise against the dollar due to the latter’s strengthening and accumulated fatigue from growth since the beginning of the month. However, the pound feels quite confident against the euro, rolling back EURGBP to 0.8600 — lows since early July — confirming the strength of two-year resistance.

Iranian police arrested around 21,000 people on various charges during the 12-day war with Israel, Iran's national police force reported on Tuesday. According to local media, more than 7,850 public tips were received during the fighting, leading to the arrests.The spokesperson of the Iranian police, Saed Montazer al-Mahdi, noted that the Iranian Cyber Police (FATA) handled 5,700 cybercrime cases, including internet fraud, unauthorized withdrawals, and a cyber attack on the Nobitex exchange.

He said 2,774 “illegal citizens” were detained, with 261 people arrested on suspicion of espionage and 172 detained for unauthorized filming – some for filming “sensitive centers” around the country. Examinations of the suspects' mobile phones led to the opening of 30 special security cases.Speaking on the Evin Prison incident, Mahdi stated that police arrested 127 “security and political” inmates during an escape attempt, including two of whom were dressed in firefighter uniforms.Fars News Agency reported on July 25 that more than 700 people had been detained over the previous 12 days on charges of “security cooperation with Israel.”

Separately, judiciary spokesman Asghar Jahangir said on 22 July that 75 prisoners escaped during an Israeli missile strike on Evin Prison.According to Shargh Media Group, Iranian Minister of Intelligence Ismail Khatib said, “The intelligence and security organizations have the resources [personnel, assets, and operational capabilities] to mobilize them both internally and within the regime itself. During the imposed 12-day war, we witnessed seven million public reports.”He added, “We hope that as this unity has been the axis of destroying all influence, hostility, conspiracy, and sedition, we will all be able to protect this unity and cohesion.”

During the June war, Israel launched coordinated attacks inside Iran, killing senior military and intelligence officials, nuclear scientists, and striking key military sites and administrative infrastructure.Analysts speculate that the purpose of striking administrative buildings and infrastructure is to weaken the Iranian government's grip and control over its border provinces with the hope of seeding unrest and separatist movements.Both during and after the war, Iranian security forces seized large caches of explosives, drones, and weapons, along with workshops used for manufacturing unmanned systems from within the country itself.

Since then, the hunt for infiltrating agents has continued across the country, with leaders urging citizens to “maintain their vigilance, as they showed during the war.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up