Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Global gold demand climbed to 1,248.8 metric tons in the second quarter of 2025, up 3% year-on-year, driven primarily by a 78% surge in investment activity...

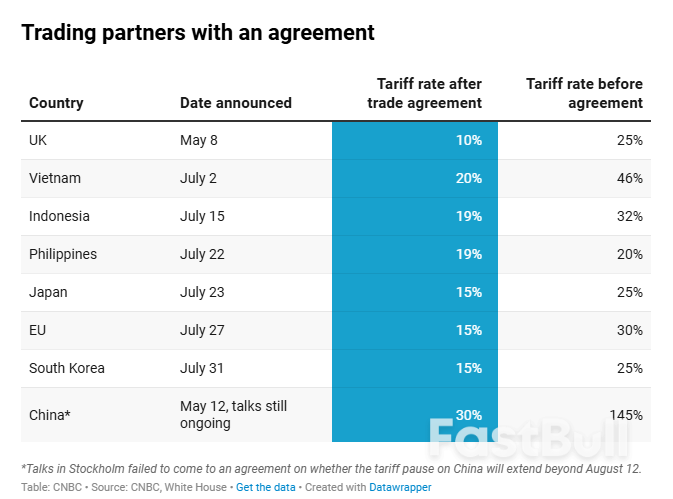

Come Friday, the world will have to contend with higher tariff rates from the Trump administration, raising the specter of even more economic uncertainty.For most countries, that can of worms has been kicked twice down the road, from "Liberation Day" on April 2, to July 9, and now to Aug. 1.Back in April, Trump had claimed to have done "over 200 deals" in an interview with Time Magazine, and trade advisor Peter Navarro had said that "90 deals in 90 days" was possible. The country has fallen far short of that, with only eight deals in 120 days, including one with the 27-member European Union.

UK first to a deal

The U.K. led the charge on trade agreements with the U.S., striking one as early as May. The framework includes a 10% baseline tariffs on U.K. goods, as well as various quotas and exemptions for products such as autos and aerospace goods.But even after U.S. President Donald Trump met with Prime Minister Keir Starmer in Scotland recently, some points in their trade agreement remain uncertain. That includes tariffs on U.K. steel and aluminum, which the U.S. agreed to slash. Talks about the U.K.'s digital services tax, which Trump wants scrapped, also seem to be continuing.

Vietnam: tariffs more than halved

Vietnam was the second to cross the line with the Trump administration, with Trump announcing a trade agreement on July 2 that saw the tariff imposed on Vietnam slashed from 46% to 20%.

One point with Vietnam was a 40% "transshipping" tariff on goods originating in another country and transferred to Vietnam for final shipment to the U.S, although it is not clear how this will be applied. Trump also claimed that there would be full market access to the country for U.S. goods.Chinese manufacturers have used transshipping to sidestep the hefty tariffs on its direct shipments to the United States, using Vietnam as a major transshipment hub.However, it seems that Vietnam was blindsided by the 20% rate imposed, according to a report by Politico. Politico said negotiators had expected a 11% levy, but Trump unilaterally announced the 20% rate.

Indonesia: bringing down barriers

Indonesia's tariff rate was cut to 19% from 32% in its agreement with Trump, announced on July 15.The White House said Indonesia will eliminate tariff barriers on over 99% of U.S. products exported to Indonesia across all sectors, including agricultural products and energy.The framework also says the countries will also address various "non-tariff barriers" and other obstacles that the U.S. faces in Indonesian markets.

Philippines: marginal decrease

Unlike its ASEAN counterparts above, which had sizable reductions to its tariff duties, the Philippines saw a decrease of a single percentage point to 19% from 20% on July 22.Manila will not impose tariffs on U.S. goods as part of the agreement, according to Trump, who praised the country for what he described as "going OPEN MARKET with the United States."In addition, Trump also said that the Philippines will work together "Militarily," without specifying any details. The two countries are already treaty allies, with Manila hosting U.S. troops and having a mutual defense treaty going back to 1951.

Japan: rice and autos

Japan was the second major Asian economy to come to an agreement with the U.S. after China, seeing its tariff rate cut to 15% from 25% on July 23, and being the first economy to see a lower preferential tariff rate for its key automobile sector.

Trump called the agreement "perhaps the largest Deal ever made," while adding that Japan would invest $550 billion in the United States and the U.S. would "receive 90% of the Profits."The path to this agreement was fraught with uncertainty, with Trump saying days before the agreement that he did not expect the two countries to reach a deal.He described Japan on separate occasions as "very tough" in trade talks and suggested the country was "spoiled" for not accepting U.S. rice despite facing a domestic rice shortage.

EU: some discontent remains

The European Union's agreement with the U.S. was struck just days ago, after long negotiations. EU goods are now facing a 15% baseline tariff rate, half the 30% Trump had previously threatened the bloc with. Existing duties on autos will be reduced to 15%, and levies on some products like aircraft and certain drug generics will go back to pre-January levels.But the deal has been met with criticism, including from some European leaders. French Prime Minister Francois Bayrou went as far as saying it was an act of "submission" and a "dark day." EU Trade Commissioner Maros Sefcovic, however, called it "the best deal we could get under very difficult circumstances."

South Korea: also at 15%

South Korea is the latest country to reach an agreement, on Thursday, with the terms being somewhat similar to the one Japan received.The country will see a blanket 15% tariff on its exports, while duties on its auto sector are also lowered to 15%. South Korea "will give to the United States $350 Billion Dollars for Investments owned and controlled by the United States, and selected by myself, as President," Trump said.

U.S. Commerce Secretary Howard Lutnick said "90% of the profits" from that $350 billion investment will be "going to the American people."However, South Korean President Lee Jae Myung said the $350 billion fund will play a role in facilitating the "active entry" of Korean companies into the U.S. market into industries such as shipbuilding and semiconductors.

China: talks still ongoing

The Trump administration's trade talks with China has taken a different tack than the rest of the world. The world's second largest economy was firmly in Trump's trade crosshairs from the moment he took office.Rather than a deal, China has reached a series of suspensions over its "reciprocal" tariff rate. It was initially hit with a 34% tariff from "Liberation Day," before a series of back-and-forth measures between the two sides saw the duties skyrocket to 145% duties for Chinese imports to the U.S. and 125% for U.S. imports to China.

However, both sides agreed to reduced tariffs in May, after their first trade meeting in Geneva, Switzerland. The truce was agreed to last till Aug. 12. China currently faces a 30% combined tariff rate, while the U.S. is looking at 10% duties.The countries' most recent meeting in Stockholm ended without a truce extension, but U.S. Treasury Secretary said that any truce extension will not be agreed to until Trump signs off on the plan.For countries without a deal, it appears that a higher global baseline tariff of about 15%-20% will be slapped on them, according to Trump, higher than the 10% baseline announced on "Liberation Day."Countries with a trade surplus with the U.S. will most likely see a higher "reciprocal" tariff rate.Here are some key trading partners that have not agreed to a deal with the U.S.

India: tariffs and a penalty

On Wednesday, Trump announced a 25% tariff on India, with an additional unspecified "penalty" for what he views as unfair trade policies and for India's purchase of military equipment and energy from Russia."While India is our friend, we have, over the years, done relatively little business with them because their Tariffs are far too high, among the highest in the World," Trump said in a post on Truth Social.The 25% tariff rate is modestly lower than what Trump imposed on India on "Liberation Day," when he announced a 26% rate on the key trading partner, but at the high end of the 20%-25% range that the U.S. president said he was considering.

Canada: an 'intense phase'

There has been frequent back-and-forth between Canada and the U.S. over tariffs in recent months, with the country being hit by duties even before Trump announced his so-called "reciprocal" tariffs.Canada is now facing 35% tariffs on various goods from Aug. 1, with Trump also threatening to increase that rate in case of retaliation. The rate is separate from any sectoral tariffs.Trump has repeatedly cited drugs flowing from Canada to the U.S. as a reason for his move to impose tariffs. Canadian Prime Minister Mark Carney said earlier this week that the partners were in an "intense phase" of talks, noting that it would be unlikely for an agreement not to include any tariffs, Reuters reported.

Mexico: no sign of progress

Like Canada, Mexico has also long been a U.S. tariff target, with Trump citing drugs and illegal migration as factors in his decision to announce levies on the U.S.' southern neighbor.The president has said that Mexico has not done enough to secure the border. Mexico is set to be hit with a 30% tariff, with any retaliation set to be met with an even higher rate from the U.S.The Mexican government has stressed that it is important for the trading partners to resolve their issues ahead of Aug. 1, but there have not been many signs of progress toward an agreement in recent weeks.

Australia: sticking to the baseline

Australia currently faces the baseline 10% as it runs a trade deficit with the United States. However, the country could be facing a higher tariff rate if Trump decides to raise his baseline rate to 15%-20%.Canberra has not been publicly known to be in trade talks with Washington, with Prime Minister Anthony Albanese reportedly arguing that Australia's deficit with the U.S. and its free trade agreement should mean there should be no tariff on Australian imports.Most recently, Australia relaxed restrictions on U.S. beef, a move which the office of the U.S. trade representative credited to Trump, but Albanese had reportedly said the move was not prompted by Trump.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up