Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

JAKARTA, May 28 (Reuters) - French President Emmanuel Macron will meet his Indonesian counterpart Prabowo Subianto in Jakarta on

French President Emmanuel Macron will meet his Indonesian counterpart Prabowo Subianto in Jakarta on Wednesday, and defence ties with Paris' biggest arms client in Southeast Asia are expected to be on the agenda.

Indonesia is the second leg of Macron's regional trip after Vietnam, where the two countries signed deals worth over $10 billion. He is scheduled to fly to Singapore on Thursday.

Indonesia's foreign ministry said the two sides would discuss "existing strategic partnerships," without giving specific details about the areas of discussion.

In 2022, the two countries signed an $8.1 billion defence deal that included an order for 42 Rafale fighter jets made by France's Dassault Aviation (AM.PA), opens new tab, as well as a series of agreements including submarine development and ammunition.

"Some commitments need follow-up and Indonesia has shown interest in some other military hardware, but there has been no progress yet," said Khairul Fahmi, a military expert at Indonesia-based Institute for Security and Strategic Studies.

No Rafale jets have been delivered to Indonesia yet. The chief of the Indonesian Air Force Mohamad Tonny Harjono said in February that six jets would arrive in Indonesia in early 2026, state news agency Antara reported.

Aside from the Rafale deal, Indonesia in 2024 struck an agreement with French state-owned shipyard Naval Group to buy two "Scorpene" submarines, and in 2023 announced the purchase of 13 long-range air surveillance radars from France's Thales.

Prabowo, who became president last year, was the defence minister when these deals were signed.

Macron's delegation to mineral-rich Indonesia includes French mining group Eramet's new CEO Paulo Castellari. Eramet (ERMT.PA), opens new tab chairwoman Christel Bories said they would look to discuss mining permits in relation to the Weda Bay nickel mine.

Indonesia is the world's largest producer of nickel, and also holds the biggest known reserves of the metal. Eramet and other companies have complained about reduced volume allowances.

The group also has been in talks with Indonesia's new sovereign wealth fund, Danantara, about battery supply-chain investments, with Eramet still wanting to get into nickel processing after dropping a plan to build a plant with BASF last year.

Reporting by Ananda Teresia and Stanley Widanto in Jakarta, and Gus Trompiz in Paris; Writing by Gibran Peshimam; Editing by John Mair

Key Points:

Bitcoin surpassed the $110,000 mark on May 26, 2025, amid strong trading activity and macroeconomic factors.

The event boosts Bitcoin's stance as a dominant cryptocurrency, while experts remain attentive to potential fluctuations due to global economic conditions.

Bitcoin's price movement to $110,000, a critical psychological level, occurred after it dipped to $106,000 on May 25. Strong institutional support led by key players, like Michael Saylor, who said, "Bitcoin is an unparalleled store of value that continues to gain traction among institutional investors," has been instrumental in this achievement, highlighting his fervent advocacy for Bitcoin as a store of value. The current US President's delay in implementing tariffs on the EU appears correlated with the price increase.

Financial markets witnessed a surge with digital asset inflows reaching $3.3 billion weekly, supporting Bitcoin's climb. Institutional investments fuel growth while market analysts project support for a move toward $115,000. The cryptocurrency market experienced over a 2% rise as a result of these factors, signaling continued confidence.

The situation's implications involve potential economic and financial shifts influencing prices. Bitcoin's upward trajectory may affect investor decisions globally. Long-term holder accumulation and Bitcoin ETFs were instrumental in this price increase, with predictions suggesting recently established support could push prices to higher targets.

Experts caution that if institutional inflows slow or regulatory pressures mount, a price correction below $110,000 may occur. Continued market interest and technical analyses suggest maintaining current levels could solidify future growth trends.

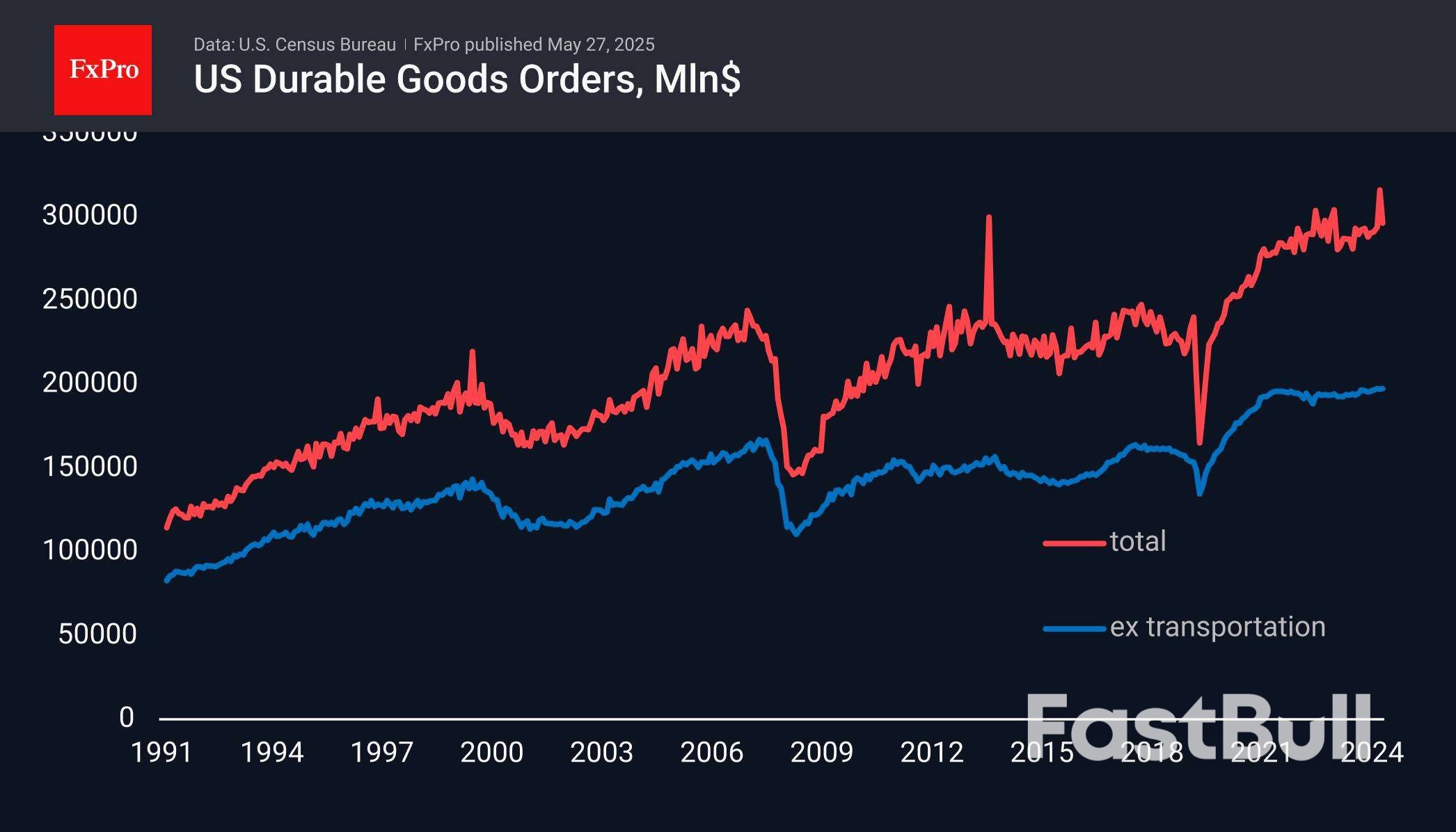

Preliminary estimates of durable goods orders in the US showed a less sharp than expected dip in April. The decline was 6.3% versus a 7.5% jump a month earlier and an expected 7.6% drop.

The volatility is almost entirely due to the transport sector, and without that component, there was a 0.2% gain for the month after a commensurate decline earlier. This indicator has been near a plateau for the past three years, adding only 1% in money over that time against a 12% rise in the Core CPI and a 9% rise in Core PPI. Simply put, America has been cutting investment in durable goods for about as long as the Fed has been shrinking its balance sheet.

In the short term, the current report is relatively positive for demand for US assets, including the dollar, coming in above expectations. However, in the medium term, it is worth paying attention to the decline in orders expressed in real prices. This may indicate a growing threat of stagnation, if not contraction, of the US economy, bringing the Fed rate cut closer.

The FxPro Analyst Team

U.S. President Donald Trump on Tuesday said Vladimir Putin was "playing with fire" by refusing to engage in ceasefire talks with Kyiv as Russian forces made gains in Ukraine's northeast.

With his frustration increasing, Trump has lashed out at the Russian president as Moscow has hit Ukraine with some of the three-year-old war's deadliest drone and missile attacks while not moving forward on ceasefire efforts.

"What Vladimir Putin doesn't realize is that if it weren't for me, lots of really bad things would have already happened in Russia, and I mean REALLY BAD. He's playing with fire," Trump said in a Truth Social post on Tuesday.

The president, who prides himself on having friendly relations with Putin, did not elaborate.

Trump in a post on Sunday said Putin had "gone absolutely CRAZY" by unleashing a massive aerial attack on Ukraine.

Putin said after a two-hour call with Trump last week that Russia was ready to work with Ukraine on a memorandum about a future peace accord.

The Russian leader said part of this work would be defining a possible ceasefire, including its timeframe. Ukraine, its European allies and the U.S. have all urged Putin to accept an immediate, unconditional ceasefire lasting at least 30 days.

The Kremlin has said it could not estimate how long drafting the memorandum would take, and it said on Tuesday it was still working on it. Kyiv and European governments have accused Moscow of stalling while it advances on the battlefield.

Trump's social media blast on Tuesday came as Kyiv suffered another battlefield setback with Russian forces capturing four villages in Ukraine's northeastern Sumy region.

Trump has so far held off on major new sanctions against Russia, though U.S. officials say a package of sanctions has been prepared should he decide to do so. Trump is also under pressure from Ukraine President Volodymyr Zelenskiy to increase military assistance to Ukraine.

The Russian advances follow some of the biggest drone and missile attacks on Ukraine since Russia began the full-scale war in early 2022, although the level dropped markedly overnight from Monday to Tuesday.

Ukraine has also fired dozens of long-range drones into Russia in recent days, forcing some Moscow airports to close temporarily.

Sumy Governor Oleh Hryhorov wrote on Facebook that the villages of Novenke, Basivka, Veselivka and Zhuravka had been occupied by Russia, although residents had long been evacuated.

Russia's Defence Ministry said on Monday it had taken the nearby village of Bilovody, implying a further advance in the more than three-year war.

Ukrainian officials have said for weeks that Russian troops are trying to make inroads into Sumy region, the main city of which lies less than 30 km (19 miles) from the border.

Russian forces, attacking in small groups on motorcycles and supported by drones, have been widening the area where they have been carrying out assaults, a spokesperson for Ukraine's border guard service said.

Ukrainian forces used Sumy region as a launch pad to seize a chunk of Russia's neighbouring Kursk region last year before being largely driven out by April. The area has been pounded for months by Russian guided bomb attacks and other strikes.

"The enemy is continuing attempts to advance with the aim of setting up a so-called 'buffer zone'," Hryhorov wrote on Facebook.

During a trip to the Kursk region in March, Putin repeated a call for his military to consider establishing a "buffer zone" along Russia's border.

Though Russia's offensive activity is concentrated in the eastern Donetsk region, Moscow's inroads into northeastern Ukraine show how it is stretching Kyiv's forces on multiple fronts.

Zelenskiy has repeatedly warned that Russia is preparing new offensives against Sumy as well as the northeastern Kharkiv and southeastern Zaporizhzhia regions.

"There is much evidence that they are preparing new offensive operations. Russia is counting on further war," he said on Monday, without elaborating.

The US government will have veto power over key decisions relating to US Steel, as part of a deal with Nippon Steel that would approve the Japanese firm’s bid for the well-known American steel company, a US lawmaker said on Tuesday.

The details are laid out in what is called a national security agreement the companies will sign with the US government, said Republican Senator David McCormick of Pennsylvania, where US Steel is headquartered.

“It’ll be a US CEO, a US majority board and then there will be a golden share, which will essentially require US government approval of a number of the board members, and that will allow the United States to ensure production levels aren’t cut and things like that,” he told CNBC in an interview after Nikkei reported that a golden share was under consideration.

It was not immediately clear if McCormick was announcing a new part of the deal beyond prior pledges made by the companies to the Committee on Foreign Investment in the US, which reviews foreign investments for national security risks and has reviewed Nippon Steel’s bid for US Steel twice.

But on Tuesday, investors appeared confident the deal would soon close, with US Steel shares trading up 1.6% to $52.84 a share, close to their highest point since the deal was announced.

US President Donald Trump was expected to address the deal in a rally at a US Steel plant in Pennsylvania this week.

In response to questions about the deal, White House spokesperson Kush Desai said, “The President looks forward to returning to Pittsburgh … on Friday to celebrate American Steel and American Jobs.”

Nippon Steel declined to comment and US Steel did not respond to a request for comment.

National security agreements get worked out in reviews led by the Committee on Foreign Investment in the US, which scrutinizes foreign investments for national security risks and has reviewed Nippon Steel’s proposed merger twice.

In an NSA term sheet proposed to CFIUS in September 2024, Nippon Steel pledged that a majority of US Steel’s board members will be American, and that three of them — known as the “independent US directors” will be approved by CFIUS.

“US Steel may reduce production capacity if and only if it is approved by a majority of the Independent US directors,” the term sheet states, adding that core US managers will be US citizens.

Japan’s top steelmaker has since December 2023 sought to seal a $14.9 billion bid to acquire US Steel at $55 a share.

Both President Donald Trump and former President Joe Biden expressed opposition to the tie-up, arguing US Steel should remain American-owned as they sought to woo voters in Pennsylvania ahead of the November presidential election.

Biden formally blocked it in January on national security grounds, prompting a lawsuit by the companies that alleged the review process had been unfair. The Biden White House disputed that view.

Trump launched a fresh CFIUS review of the deal in April. On Friday he appeared to finally give it his blessing in a social media post, noting that the “planned partnership” would create “at least 70,000 jobs, and add $14 billion dollars to the US economy.” The post sent US Steel’s share price up over 20%.

But on Sunday, Trump cast doubt over that interpretation, noting in remarks to reporters that “It’s an investment and it’s a partial ownership, but it will be controlled by the USA.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up