Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US President Donald Trump has been busy, announcing fresh tariff threats against the European Union (EU) of 30%. Trump also threatened 100% secondary tariffs on Russia if no ceasefire deal is reached within 50 days.

The U.S. is expected on Tuesday to report that rising costs for imported goods lifted overall consumer prices in June, kicking off what might be several months at least of such increases and giving Federal Reserve officials highly awaited data on whether the Trump administration's tariffs are boosting inflation.

Fed Chair Jerome Powell has pinpointed this summer as the time when the U.S. central bank will likely learn if inflation is responding to the tariffs applied by the Trump administration on trading partners and various industrial sectors.

So far the levies have had only a limited impact on inflation, a fact that President Donald Trump has used to excoriate Powell and demand that the Fed lower interest rates.

But that doesn't mean higher inflation isn't on the way as businesses run down inventory bought before the tariffs took effect or use up other tools at hand to avoid raising prices for their customers.

"We know there is a lag between implementation and the inflationary effect," said Gregory Daco, chief economist at EY-Parthenon. "Businesses manage imports using different processes ... We have not seen the full-blown effects of tariffs on CPI data ... I would expect to start to see more."

The U.S. Labor Department is scheduled to release the latest CPI data at 8:30 a.m. EDT (1230 GMT). The consensus forecast in a Reuters poll of economists has the index, excluding volatile food and energy prices, increasing at a 3% annual rate last month, slightly faster than in May.

That reading would likely leave the Personal Consumption Expenditures Price Index the Fed uses for its 2% inflation target far enough above that goal to keep the central bank's benchmark interest rate in the 4.25%-4.50% range at the end of its July 29-30 policy meeting.

Investors expect the Fed to resume cutting interest rates in September, though U.S. central bankers say any such move will hinge on how inflation and other aspects of the economy behave.

The final U.S. tariff levels are not even fixed, with levels of 30% or more now threatened by Trump on Mexico, Canada and the European Union, higher levies on autos and many industrial metals already in place, and more actions likely. For the Fed, the way the process is unfolding feeds into concerns that the extended debate, policy reversals and uncertainty, and the potential for Trump to settle on higher levels than currently expected all add up to more inflation risk.

The PCE index outside food and energy rose at a 2.7% annual rate in May; recent Fed policymaker projections see it hitting 3.1% by the end of 2025; and the most recent round of tariffs threatened by Trump for August 1 could push it even higher.

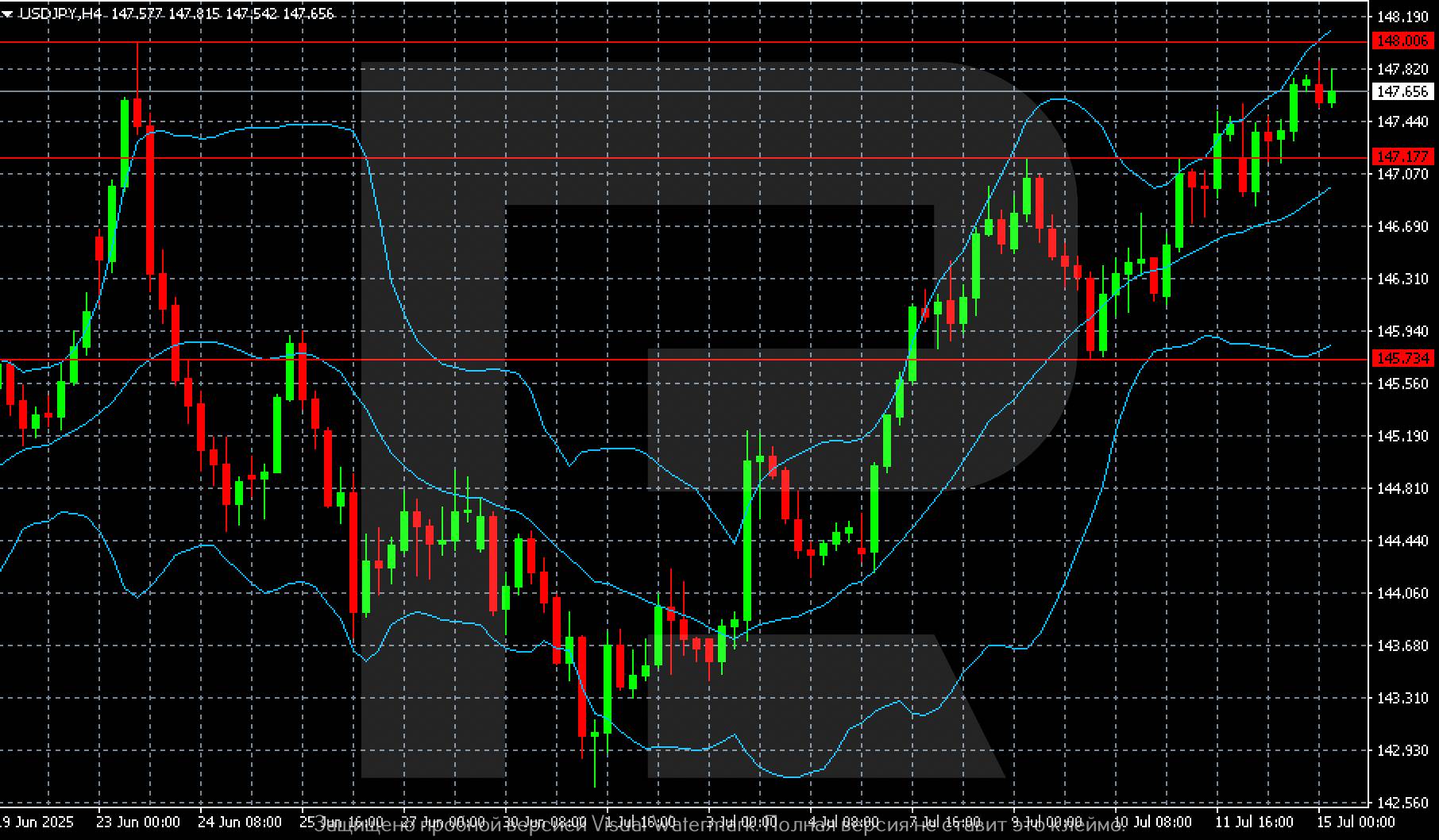

The USDJPY pair has risen significantly and retains the potential to climb further. The USDJPY forecast for today, 15 July 2025, suggests a possible test of the 148.00 level.

The USDJPY pair continues to climb as the market reacts to trade-related risks. Find more details in our analysis for 15 July 2025.

On Tuesday, the USDJPY rate rose to 147.65, marking a new two-month high, as trade risks from new US measures persist.

Washington plans to impose 25% tariffs on Japanese goods starting 1 August, while Tokyo has yet to announce any retaliatory action. Negotiations between the two parties have effectively stalled. One Japanese official warned of potential economic consequences if the tariffs are enforced.

Investors now await upcoming trade and inflation data from Japan, which will help assess the scale of pressure on the domestic economy. In addition, market focus also turns to the US inflation report, which could influence the Federal Reserve's future rate decisions.

The USDJPY forecast is positive.

On the H4 chart, the USDJPY pair is clearly in a strong uptrend since 3 July 2025. Following a period of consolidation between 144.00 and 146.00, with a local bottom formed near 144.00, the yen has lost ground rapidly. USD has strengthened to 147.65 and now approaches the key resistance level of 148.00.

The price confidently trades above the middle Bollinger Band, confirming upside momentum. The nearest support level lies at 147.18, followed by 145.73. If the price breaks above the 148.00 level, the upward wave will likely extend towards new highs.

From a technical standpoint, the outlook remains bullish. Each dip gets bought back, and the upper Bollinger Band is expanding. However, the 148.00 level may act as a short-term barrier to further gains.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up