but later you will

but later you will

Signal Accounts for Members

All Signal Accounts

All Contests

[Speaker Of The U.S. House Of Representatives: Confident Of Sufficient Votes To End Partial Government Shutdown By Tuesday] February 1st, According To Nbc News, U.S. House Speaker Johnson Said He Is Confident That There Will Be Enough Votes By At Least Tuesday To End The Partial Government Shutdown

Iranian Official Tells Reuters: Media Reports Of Plans For Revolutionary Guards To Hold Military Exercise In Strait Of Hormuz Are Wrong

Ukraine's Defence Minister Says Kyiv And Spacex Working On System To Ensure Only Authorized Starlink Terminals Work In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Europe Has Failed To Defeat Russia In Ukraine

Russian Security Committee's Vice Chairman Medvedev: We Never Found The Two Nuclear Submarines Trump Spoke Of Deploying Closer To Russia

Russian Security Committee's Vice Chairman Medvedev: Victory Will Come 'Soon' In Ukraine But Equally Important To Think Of How To Prevent New Conflicts

Russian Security Committee's Vice Chairman Medvedev: Trump Is An Effective Leader Who Seeks Peace

Russian Security Committee's Vice Chairman Medvedev: Behind The So Called 'Chaos' Of Trump, He Is An Effective And Original USA Leader

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

but later you will

but later you will

but later you will

but later you will

Envious of Trump, who can freely control gold prices.

Envious of Trump, who can freely control gold prices.

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Mary C. Daly, President of the San Francisco Fed, signals potential multiple rate cuts in 2025 during public remarks on August 4, reflecting on U.S. economic conditions.

Key Takeaways:

Mary C. Daly, President of the San Francisco Fed, signals potential multiple rate cuts in 2025 during public remarks on August 4, reflecting on U.S. economic conditions.

Daly's openness to rate cuts highlights potential shifts in U.S. monetary policy, impacting financial markets and cryptocurrencies, prompting immediate stock rallies and anticipated crypto market movements.

Mary Daly of the Federal Reserve Bank of San Francisco has signaled openness to rate cuts in 2025. She highlighted uncertainty regarding the timing and scale of these reductions, reflecting the continuing economic assessment by the Fed.

As a member of the Federal Open Market Committee, Daly's remarks suggest more than two U.S. interest rate cuts might be necessary in 2025. She noted the importance of responding to potential labor market constraints and inflation trends. "We may do fewer than two cuts. The more likely thing is we need to do more." - Mary C. Daly, President, Federal Reserve Bank of San Francisco.

Financial markets reacted positively to Daly's statements. Anticipation of potential rate reductions has spurred investor interest, with U.S. stock indices rallying on the news. Notably, major tech shares performed well due to these expectations.

Fed policy shifts traditionally impact various asset classes. Expectations of rate cuts tend to drive investments into risk assets, including cryptocurrencies. Mary Daly's comments have significant implications for financial strategies in the near term.

Rate cuts can stimulate capital flows into digital currencies. This trend was observed in past cycles, where similar reductions led to significant crypto investments. Mary Daly's insights could, therefore, herald promising market scenarios for digital assets.

Supreme Court Justice Alexandre de Moraes, the target of U.S. Treasury sanctions last week, issued the arrest order against Bolsonaro. His decision cited a failure to comply with restraining orders he had imposed on Bolsonaro for allegedly courting Trump's interference in the case.

Bolsonaro is on trial before the Supreme Court on charges he conspired with allies to violently overturn his 2022 electoral loss to leftist President Luiz Inacio Lula da Silva. Trump has referred to the case as a "witch hunt" and called it grounds for a 50% tariff on Brazilian goods taking effect on Wednesday.

The Monday order from Moraes also banned Bolsonaro from using a cell phone or receiving visits, except for his lawyers and people authorized by the court.A press representative for Bolsonaro confirmed he was placed under house arrest on Monday evening at his Brasilia residence by police who seized his cell phone.Bolsonaro's lawyers said in a statement they would appeal the decision, arguing the former president had not violated any court order.

In an interview with Reuters last month, Bolsonaro called Moraes a "dictator" and said the restraining orders against him were acts of "cowardice."Some Bolsonaro allies have worried that Trump's tactics may be backfiring in Brazil, compounding trouble for Bolsonaro and rallying public support behind Lula's leftist government.However, Sunday demonstrations by Bolsonaro supporters — the largest in months — show that Trump's tirades and sanctions against Moraes have also fired up the far-right former army captain's political base.

Bolsonaro appeared virtually at a protest in Rio de Janeiro via phone call to his son, Senator Flavio Bolsonaro, in what some saw as the latest test of his restraining orders.On Monday, Senator Bolsonaro told CNN Brasil that Monday's order from Moraes was "a clear display of vengeance" for the U.S. sanctions against the judge, adding: "I hope the Supreme Court can put the brakes on this person (Moraes) causing so much upheaval."

The judge's orders, including the restraining orders under penalty of arrest, have been upheld by the wider court.Those orders and the larger case before the Supreme Court came after two years of investigations into Bolsonaro's role in an election-denying movement that culminated in riots by his supporters that rocked Brasilia in January 2023. That unrest drew comparisons to the January 6, 2021 riots at the U.S. Capitol after Trump's 2020 electoral defeat.

In contrast with the tangle of criminal cases which mostly stalled against Trump, Brazilian courts moved swiftly against Bolsonaro, threatening to end his political career and fracture his right-wing movement. An electoral court has already banned Bolsonaro from running for public office until 2030.Another of Bolsonaro's sons, Eduardo Bolsonaro, a Brazilian congressman, moved to the U.S. around the same time the former president's criminal trial kicked off to drum up support for his father in Washington. The younger Bolsonaro said the move had influenced Trump's decision to impose new tariffs on Brazil.

In a statement after the arrest on Monday, Congressman Bolsonaro called Moraes "an out-of-control psychopath who never hesitates to double down."Trump last month shared a letter he had sent to Bolsonaro. "I have seen the terrible treatment you are receiving at the hands of an unjust system turned against you," he wrote. "This trial should end immediately!"

Washington based its sanctions against Moraes last week on accusations that the judge had authorized arbitrary pre-trial detentions and suppressed freedom of expression.The State Department did not immediately respond to a request for comment on Bolsonaro's house arrest.The arrest could give Trump a pretext to pile on additional measures against Brazil, said Graziella Testa, a political science professor at the Federal University of Paraná, adding that Bolsonaro seemed to be consciously provoking escalation."I think things could escalate because this will be seen as a reaction to the Magnitsky sanction" against Moraes, said Leonardo Barreto, a partner at the Think Policy political risk consultancy in Brasilia, referring to the asset freeze imposed on Moraes last week.

U.S. President Donald Trump's decision to fire a top labor official following weak jobs data obviously sends ominous signals about political interference in independent institutions, but it is also a major strategic own goal.

Trump has spent six months attacking the Federal Reserve, and Chair Jerome Powell in particular, for not cutting interest rates. The barbs culminated in Trump branding Powell a "stubborn MORON" in a social media post on Friday before the July jobs report was released.

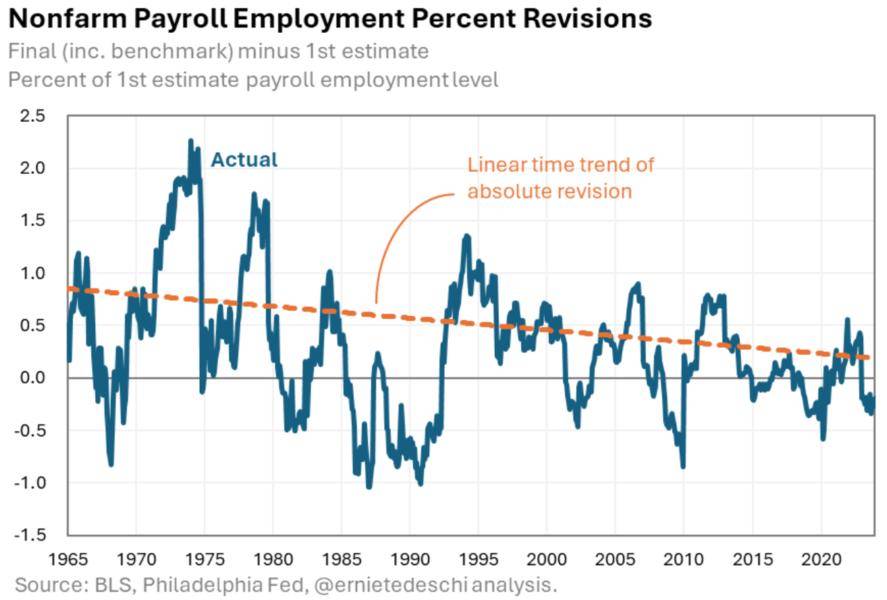

The numbers, especially the net downward revision of 258,000 for May and June payrolls growth, were much weaker than expected. In fact, this was "the largest two-month revision since 1968 outside of NBER-defined recessions (assuming the economy is not in recession now)," according to Goldman Sachs.

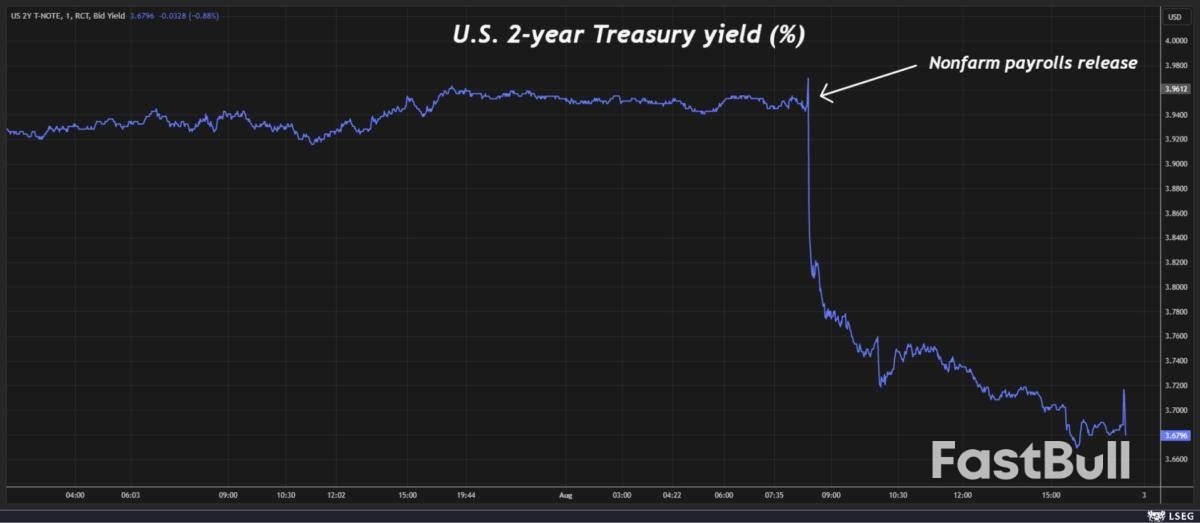

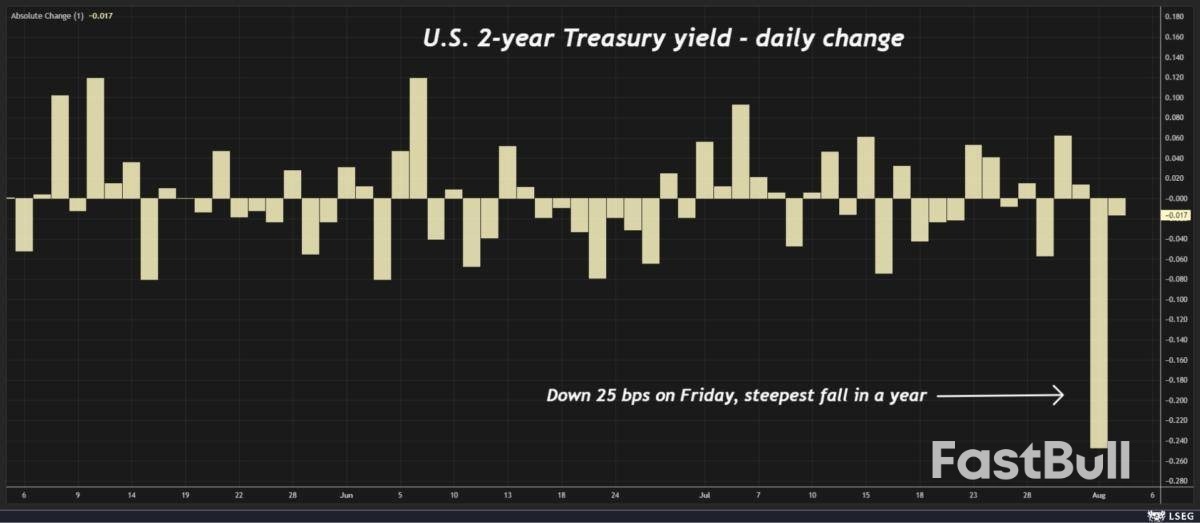

This release sparked a dramatic reaction in financial markets. Fed rate cut expectations soared, the two-year Treasury yield had its steepest fall in a year, and the dollar tumbled.

A quarter-point rate cut next month and another by December were suddenly nailed-on certainties, according to rate futures market pricing. This was a huge U-turn from only 48 hours before when Powell's hawkish steer in his post-FOMC meeting press conference raised the prospect of no easing at all this year.

Trump's constant lambasting of "Too Late" Powell suddenly appeared to have a bit more substance behind it. The Fed chair's rate cut caution centers on the labor market, which now appears nowhere near as "solid" as he thought.

Trump could have responded by saying: "I was right, and Powell was wrong."

Instead, on Friday afternoon he said he was firing the head of the Bureau of Labor Statistics, Commissioner Erika McEntarfer, for faking the jobs numbers. Trump provided no evidence of data manipulation.

So rather than point out that markets were finally coming around to his way of thinking on the need for lower interest rates, Trump has united economists, analysts and investors in condemnation of what they say is brazen political interference typically associated with underdeveloped and unstable nations rather than the self-proclaimed 'leader of the free world'.

"A dark day in, and for, the U.S.," economist Phil Suttle wrote on Friday. "This is the sort of thing only the worst populists do in the worst emerging economies and, to use the style of President Trump, IT NEVER ENDS WELL."

It's important to note that major – even historic – revisions to jobs growth figures are not necessarily indicative of underlying data collection flaws. As Ernie Tedeschi, director of economics at the Budget Lab at Yale, argued on X over the weekend: "BLS's first-release estimates of nonfarm payroll employment have gotten more, not less, accurate over time."

It should also be noted that the BLS compiles inflation as well as employment data, so, moving forward, significant doubt could surround the credibility of the two most important economic indicators for the U.S. - and perhaps the world.

Part of what constitutes "U.S. exceptionalism" is the assumption that the experts leading the country's independent institutions are exactly that, independent, meaning their actions and output can be trusted, whatever the results.

Baseless accusations from the U.S. president that the BLS, the Fed and other agencies are making politically motivated decisions to undermine his administration only undermine trust in the U.S. itself.

"If doubts are sustained, it will lead investors to demand more of a risk premium to own U.S. assets," says Rebecca Patterson, Senior Fellow at the Council on Foreign Relations. "While only one of many forces driving asset valuations, it will limit returns across markets."

This furor comes as Fed Governor Adriana Kugler's resignation on Friday gives Trump the chance to put a third nominee on the seven-person Fed board, maybe a potential future chair to fill that slot as a holding place until Powell's term expires in May. Whoever that person is will likely be more of a policy dove than a hawk.

Policy uncertainty, which had been gradually subsiding since the April 2 'Liberation Day' tariff turmoil, is now very much back on investors' radar.

Japan's service sector activity rose at the fastest pace in five months in July, thanks to brisk domestic demand that offset a sharp drop in export orders and weaker tourist numbers, a private sector survey reported on Tuesday.

The S&P Global final Japan Services purchasing managers' index (PMI) climbed to 53.6 in July from 51.7 in June, marking the strongest expansion since February. A PMI reading above 50.0 indicates growth in activity, while that below the threshold points to contraction.

New service business orders grew at the quickest pace in three months, supported by improved customer numbers, according to the survey.

However, new export orders fell for the first time since December and at the fastest rate in over three years due to low tourist numbers in July, it showed.

Some survey respondents attributed the weak tourist figures to speculative concerns about an earthquake in July.

Employment in the service sector was unchanged from the previous month, ending a 21-month growth streak, with some respondents citing labour shortages and budget constraints as challenges to hiring.

Price pressures continued to ease in July. Input cost inflation was the slowest in 17 months, while output costs rose at the softest pace in nine months.

The composite PMI, which combines manufacturing and services, rose slightly to 51.6 in July from 51.5 in June, marking the strongest overall business activity growth since February.

"However, this reflected a steep increase in business activity at service providers, as factory output fell back into contraction...forward-looking indicators were a little less upbeat in July," said Annabel Fiddes, economics associate director at S&P Global Market Intelligence.

The U.S.-Japan trade deal announced last month could lift Japanese firms' confidence and consumption to offer "a much-needed boost to the manufacturing economy", Fiddes added.

Oil prices were little changed on Tuesday after three days of declines on mounting oversupply concerns after OPEC+ agreed to another large output increase in September, though the potential for more Russian supply disruptions supported the market.

Brent crude futureswere unchanged at $68.76 a barrel by 0036 GMT while U.S. West Texas Intermediate crudewas at $66.27 a barrel, down 2 cents, or 0.03%.

Both contracts fell by more than 1% in the previous session to settle at their lowest in a week.

The Organization of the Petroleum Exporting Countries and its allies, together known as OPEC+, pumps about half of the world's oil and had been curtailing production for several years to support the market, but the group introduced a series of accelerated output hikes this year to regain market share.

In its latest decision, OPEC+ agreed on Sunday to raise oil production by 547,000 barrels per day for September.

It marks a full and early reversal of the group's largest tranche of output cuts, amounting to about 2.5 million bpd, or about 2.4% of global demand, though analysts caution the actual amount returning to the market will be less.

At the same time, U.S. demands for India to stop buying Russian oil as Washington seeks ways to push Moscow for a peace deal with Ukraine is increasing concerns of a disruption to supply flows.

U.S. President Donald Trump is threatening to impose 100% secondary tariffs on Russian crude buyers. This follows a 25% tariff on Indian imports announced in July.

India is the biggest buyer of seaborne crude from Russia, importing about 1.75 million bpd of Russian oil from January to June this year, up 1% from a year ago, according to data provided to Reuters by trade sources.

"India has become a major buyer of the Kremlin's oil since the 2022 invasion of Ukraine. Any disruption to those purchases would force Russia to find alternative buyers from an increasingly small group of allies," ANZ senior commodity strategist Daniel Hynes wrote in a note.

Traders are also awaiting any developments on the latest U.S. tariffs on its trading partners, which analysts fear could slow down economic growth and dampen fuel demand growth.

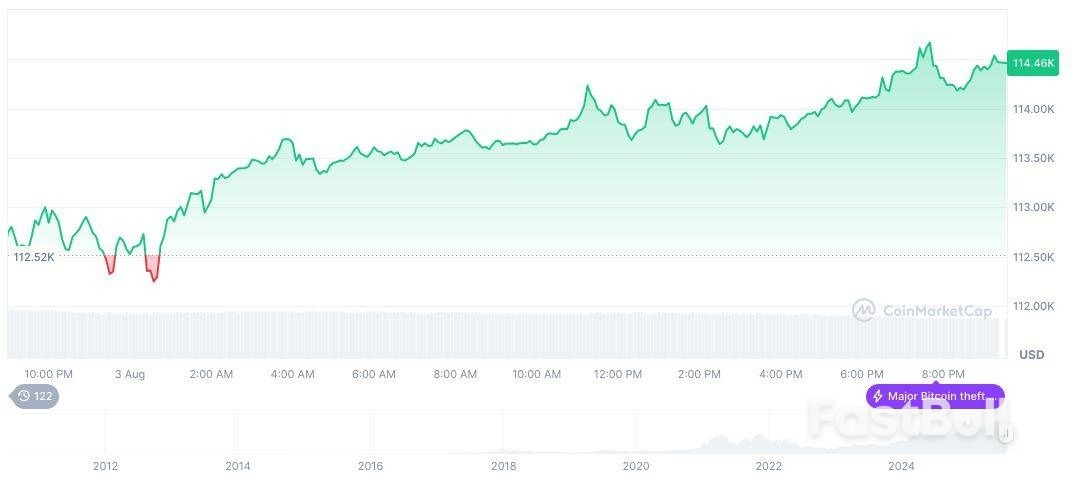

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 20:28 UTC on August 4, 2025.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 20:28 UTC on August 4, 2025. White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up