Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Federal Reserve cut rates by a quarter-point in a near-unanimous decision, signaling unity and independence despite heavy pressure from President Trump for steeper cuts and attempts to reshape the Fed’s leadership.

Gold exports from Switzerland to China jumped 254% in August compared with July to their highest level since May 2024 and supplies to India rose, partly offsetting a slump in deliveries to the United States, Swiss customs data showed on Thursday.

Spot goldprices are up 39% so far this year, heading for their biggest annual gain since 1979, amid demand for safe-haven assets. Bullion hit a record high of $3,707 per troy ounce on Wednesday.

The Swiss data showed that gold exports to China rose in August to 35 metric tons from 9.9 tons in July, while supplies to India, another major bullion consumer along with China, climbed to 15.2 tons from 13.5 tons.

China's wholesale gold demand fell last month as investors directed their attention to equities, but imports to the country are supported by expectations that the wholesale demand would rise towards the end of September, Ray Jia, head of China research at the World Gold Council, said in a note this week.

Meanwhile, India's October festival season is approaching, when buying gold is considered auspicious, against a backdrop of scarce supply of used gold jewellery and coins as many expect bullion prices to continue climbing. This is supporting India's import demand.

Gold exports from Switzerland, the world's biggest bullion refining and transit hub, to the U.S. fell to 295 kg in August from 51.0 tons in July as some refineries paused shipments to the U.S. amid uncertainty about the country's import tariffs.

President Donald Trump said on social media in August that "Gold will not be Tariffed!", but the White House's tariff update confirmed this only in early September.

Swiss total gold exports and supplies to key markets* (in kgs):

August 2025 | July 2025 | August 2024 | |

Total trade: | 104,689 | 129,058 | 88,628 |

- China | 34,997 | 9,871 | |

- Emirates, Arab | 1,326 | 1,610 | 4,882 |

- France | 10,260 | 5,241 | 458 |

- Germany | 1,811 | 1,896 | 1,085 |

- Hong Kong | 367 | 3,308 | 62 |

- India | 15,225 | 13,489 | 48,633 |

- Italy | 633 | 1,552 | 781 |

- Saudi Arabia | 1,893 | 2,757 | 2,958 |

- Thailand | 1,370 | 2,800 | 5,810 |

- Turkey | 4,198 | 2,189 | 4,640 |

- United Kingdom | 23,087 | 30,508 | 10,392 |

- USA | 295 | 50,987 | 552 |

Key Points:

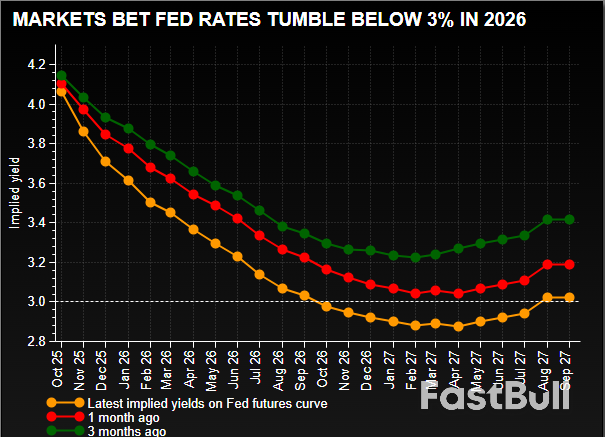

Federal Reserve Chairman Jerome Powell addressed statutory mandates, emphasizing "moderate long-term interest rates" as derivatives of inflation stability and employment maximization at a September 18th press conference.The clarification impacts U.S. economic expectations, possibly influencing USD-denominated and crypto markets, notably BTC and ETH, as long-term rate stability shapes investment strategies.

Federal Reserve Chairman Jerome Powell stressed maintaining low and stable inflation and maximizing employment as the Fed's key focuses. By clarifying that long-term interest rates derive naturally from these goals, the Fed signaled continued attention to its established dual mandate. This communication aligns with historical Fed policy.

Markets may interpret this clear stance from the Fed as maintaining a data-driven approach. USD-denominated assets, often influential on crypto, particularly Bitcoin and Ethereum, are likely to remain stable if inflation and employment targets are effectively managed. The Fed did not propose any immediate policy changes or institutional shifts directly impacting the crypto market, yet historical precedence suggests market reactions could occur indirectly.Jerome Powell, Chairman, Federal Reserve, emphasized the Fed's approach by stating, "We see that moderate long-term interest rates are the outcome of achieving low and stable inflation and maximizing employment."

Did you know? The Federal Reserve has emphasized its dual mandate since the late 1970s, influencing asset repricings during clarified policy updates.

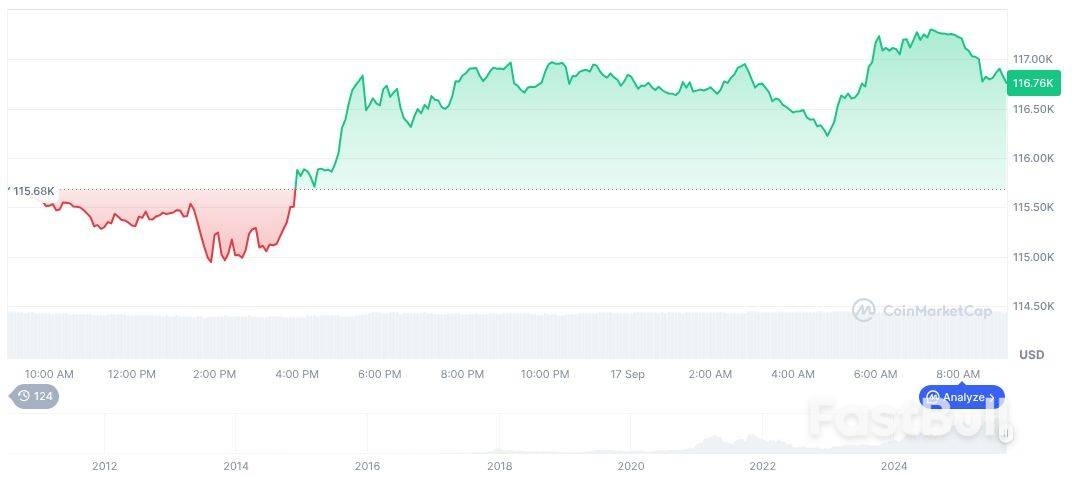

Bitcoin (BTC) holds a price of $116,566.10, per CoinMarketCap. The cryptocurrency's market capitalization is $2.32 trillion, while the fully diluted market cap reaches $2.45 trillion. With a 24-hour trading volume of $63.91 billion, Bitcoin saw a minor 0.12% price decline over the past day but increased by 2.17% over the last week. The cryptocurrency maintains a market dominance of 56.85%, driven by its circulating supply of 19,922,396 out of a maximum 21 million.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 01:34 UTC on September 18, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 01:34 UTC on September 18, 2025. Source: CoinMarketCapSterling traded steadily mixed today, showing little reaction to the BoE’s decision to hold rates at 4.00%. The 7–2 vote leaned slightly dovish, with Swati Dhingra and Alan Taylor backing a 25bps cut, but the outcome was broadly expected given their well-established dovish leanings. Importantly, the MPC’s statement flagged that medium-term inflation risks remain “prominent,” sending a clear signal that policymakers are not yet comfortable opening the door to more near-term easing.

For markets, the key question is whether November will deliver a cut. On that, the announcement offered little clarity. Progress in services and core disinflation remains uneven, and policymakers may conclude there is insufficient evidence by November to justify a move.

Another complication is fiscal policy. The UK government is scheduled to present its budget in late November, and some MPC members may prefer to wait until the impact of tax and spending plans is clearer before adjusting interest rates. That raises the risk that a December or early-2026 move may be more likely.

On the broader FX board, Kiwi remains the weakest performer of the week after a sharp GDP miss fueled calls for a 50bps RBNZ cut in October. Dollar is the second weakest, as its post-FOMC bounce shows signs of fading, while Aussie sits third from the bottom after soft jobs data.

By contrast, Swiss Franc leads as the strongest performer, followed by Euro and Loonie. Yen and Sterling sit mid-table, though Yen could slide lower if U.S. and European yields extend their rebound into week’s end.

In Europe, at the time of writng, FTSE is up 0.17%. DAX is up 1.05%. CAC is up 1.04%. UK 10-year yield is up 0.039 at 4.668. Germany 10-year yield is up 0.035 at 2.709. Earlier in Asia, Nikkei rose 1.15%. Hong Kong HSI fell -1.35%. China Shanghai SSE fell -1.15%. Singapore Strait Times fell -0.26%. Japan 10-year JGB yield rose 0.008 to 1.601.

US initial jobless claims fell -33k to 231k in the week ending September 13, below expectation of 240k. Four-week moving average of initial claims fell -750 to 240k. Continuing claims fell -7k to 1920k in the week ending September 6. Four-week moving average of continuing claims fell -10k to 1933k.

BoE holds at 4.00%, two doves dissent,

BoE left its Bank Rate unchanged at 4.00% today, in line with expectations. The decision came with a slight dovish tilt, as two members of the Monetary Policy Committee—Swati Dhingra and Alan Taylor—voted for an immediate 25bps cut. The MPC also voted by 7–2 to continue reducing the stock of UK government bonds held for monetary policy purposes by GBP70 billion over the next 12 months, taking the total down to GBP488 billion.

Policymakers reiterated that a “gradual and careful” approach remains appropriate, with the timing of further easing dependent on the extent of disinflation. The statement stressed that policy is not on a pre-set course and will respond flexibly to new data.

On inflation, the Bank acknowledged progress but kept risks in focus. CPI was steady at 3.8% in August and is expected to edge slightly higher in September before trending back toward the 2% target. Wage growth has slowed from its peak and is expected to decelerate further, while services inflation has held broadly flat. Still, the BoE cautioned that medium-term upside risks remain “prominent.”, particularly if the temporary uptick in CPI feeds into wages and price-setting.

New Zealand’s economy contracted far more than expected in Q2, with GDP falling -0.9% qoq against consensus forecasts of -0.3% qoq. The release confirmed a deeper downturn, with economic activity now having declined in three of the last five quarters. The breadth of weakness points to rising headwinds that could force the RBNZ into a more aggressive easing cycle.

Goods-producing industries led the contraction with a -2.3% drop, while primary industries fell -0.7% and services output was flat. “The 0.9 percent fall in economic activity in the June 2025 quarter was broad-based with falls in 10 out of 16 industries,” said economic growth spokesperson Jason Attewell. Manufacturing was the single largest drag, contracting -3.5% in the quarter, while construction fell -1.8% following a modest rebound in Q1.

The scale of contraction triggered a wave of forecasts for deeper RBNZ easing. Westpac now expects a 50bp cut in October followed by a further 25bp reduction in November, compared with earlier projections of 25bp moves at both meetings. That would lower the OCR from the current 3.00% to 2.25% by year-end.

Australia’s labor market weakened in August as total employment fell by -5.4k, against expectations for a 21.2k gain. The headline masked stark contrasts, with full-time jobs dropping by -40.9k while part-time roles increased by 35.5k. Hours worked fell -0.4% mom, underscoring signs of cooling demand for labor.

The unemployment rate held steady at 4.2% in line with forecasts, though the participation rate edged down to 66.8% from 67.0%. The data suggest that while unemployment remains low, underlying labor market conditions are softening.

Daily Pivots: (S1) 1.3588; (P) 1.3657; (R1) 1.3694; More…

Intraday bias in GBP/USD remains neutral and more consolidations could be seen below 1.3725. Further rise is expected as long as 55 D EMA (now at 1.3488) holds. Above 1.3725 will bring retest of 1.3787 high first. Decisive break there will resume larger up trend to 1.4004 projection level. However, sustained break of 55 D EMA will indicate that corrective pattern from 1.3787 is extending with another falling leg, and bring deeper fall to 1.3332 support and below.

In the bigger picture, up trend from 1.3051 (2022 low) is in progress. Next medium term target is 61.8% projection of 1.0351 to 1.3433 from 1.2099 at 1.4004. Outlook will now stay bullish as long as 55 W EMA (now at 1.3151) holds, even in case of deep pullback.

Former Treasury secretary Lawrence Summers said Federal Reserve policy is leaning towards being too slack, emphasising that the US economy’s biggest risks lie in inflation rather than the job market.

“My own guess is that policy is currently a little looser — looking at all financial conditions — than people view it as being,” Summers said on Bloomberg Television’s Wall Street Week with David Westin. “The balance of risks is a bit more tilted towards inflation rather than unemployment.”

Summers spoke after Fed policymakers cut their benchmark interest rate for the first time in a year. Jerome Powell, the central bank’s chair, said the decision reflected a shift in the balance of risks, with “the much lower level of job creation and other evidence of softening in the labor market” apparent in data in recent weeks.

“The biggest risk in this situation is being that we lose contact with our 2% inflation target and become a country with an inflation psychology,” said Summers, a Harvard University professor and paid contributor to Bloomberg TV.

“I think we’re a bit on the loose side with respect to monetary policy and monetary policy signalling,” Summers said. “But that’s very much a difference of degree.”

Fed governors and reserve bank presidents, in updated projections released on Wednesday, boosted their inflation forecast for next year. The median estimate shows a 3% increase in the Fed’s preferred gauge, the personal consumption expenditures price measure, for 2025, and a 2.6% rise next year — higher than the 2.4% predicted in June.

“If I were sitting in chair Powell’s shoes, my greatest concern would be very much” on the inflation side, Summers said.

The pressure from President Donald Trump and his allies on the Fed to slash interest rates underscores the need to retain credibility on fighting inflation, the former Treasury chief added.

“I don’t think they’re doing it based on political pressure,” Summers said of the Wednesday rate reduction. “But I think you have to bend over backwards at a moment like this. And I’m not sure they’ve bent over quite as far backwards as I would have liked to see.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up