Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

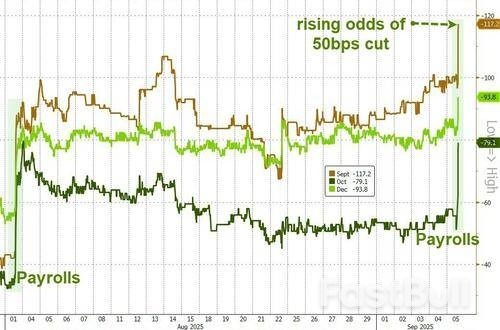

Disappointing employment data released Friday validated fears that the US labor market may be on the brink of a downturn and lifted expectations for how much the Federal Reserve will lower interest rates this year.

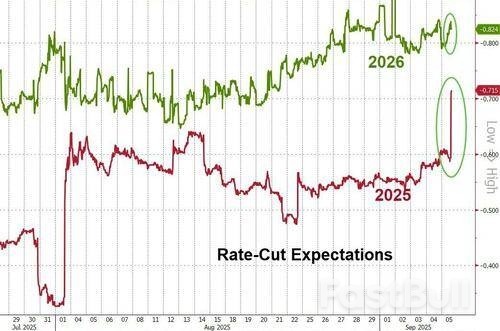

Rate-cut expectations surged this morning following the weak labor market signals from the payrolls report with 2025 now pricing in 3 full cuts...

As we predicted, the chance of a 50bps cut in September are also rising, but for now it appears 25bps in each of Sept, Oct, and Dec is the most likely outcome...

As The Wall Street Journal's fed Whisperer, Nick Timiraos, pointed out in a brief post on X:

"Weak hiring this summer will make it easier for Fed policymakers to agree on a 25 bps cut at their meeting in two weeks but further muddies the debate over the pace of cuts after that."

Consensus across Wall Street appears to be that Powell will cut in September, and continue to cut at each meeting this year at least:

Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities:

“The job market has weakened and the transition between public to private sector job growth will require lower rates. The Fed will begin to lower rates this month and we expect a string of more cuts along the way. The forward curve has us down to neutral by the end of 2026 but that timeline could very well be sooner.”

BI chief US interest-rate strategist Ira Jersey has a first take:

“The bull steepening is no surprise given the overall payroll report. Negative revisions continue and hourly earnings growing more slowly point to the potential for a slowing in non-debt-fueled consumption growth in the next few quarters.”

“Bull steepening should be maintained for the present, and we still target 10-year yields below 4% by year end, with 10-year yields having about a 0.5 beta to 2-year yields.”

Matt Maley, chief market strategist at Miller Tabak:

“[Bad news is good news for stocks] is the initial response. However, history tells us that if lower yields are signaling a significant slowdown in growth, it’s negative for stocks. So, we’re going to see how the market acts once the cash market opens.”

Audrey Childe-Freeman, Bloomberg Intelligence’s chief G-10 FX strategist:

“Dollar bears have just been given another lift, with the August employment report which will not only validate the September 25-bp Fed rate-cut talks, but is also likely to entertain speculation of more aggressive Fed easing going forward.”

“This confirms our US yield-driven euro-dollar bullish case as we consider 4Q, with a break of $1.1750 now looming. Note that the euro context isn’t rosy at all — see French politics in particular — but for now, we expect this pair to be mainly driven by US considerations.”

Brian Jacobsen, chief economist at Annex Wealth Management, goes there in his reaction to the data.

"A 50 basis-point cut is back on the table. Everyone was probably more keyed-in on the revisions than the headline number. With revisions, there was nearly net zero job creation. Aggregate weekly hours were unchanged in August with broad declines across industries. Anything trade or tariff related saw declines in aggregate weekly hours worked.

The diffusion index for private sector employment has been below 50, so it’s a top-heavy economy. You need some better breadth to remove the economic anxiety out there."

BlackRock’s Jeff Rosenberg on the payrolls print on Bloomberg TV:

“What it really puts on the table is a Fed that gets back in motion for cutting rates, and if the economy is not falling off a cliff, that’s a pretty good combination for risk assets.”

Neil Dutta at Renaissance Macro says the numbers are a comprehensive defeat of the policy hawks and growth bulls.

“To borrow from Powell, now is the time to unleash the great monetary power of the United States.”

Seema Shah, chief global strategist, Principal Asset Management:

“Today’s report just about strikes a balance between reinforcing market expectations for a sequence of Fed rate cuts and not yet inviting renewed concerns around recession, so the broad market response should be mildly positive. But concerns about the health of the economy are starting to creep in and a further deterioration in the health of the labor market would soon tip the balance to ‘bad news is simply bad news.’”

Kevin Flanagan, head of fixed income strategy at WisdomTree says,

“The markets are leading the Fed and the jobs report was the last data point needed for a quarter point cut this month. A half point is not out of the question, but at this stage of the game I would still lean to a quarter-point cut, now if we had seen a negative payroll, then a 50bps cut would be on the table.”

Ali Jaffery‘s take at CIBC Capital Markets:

While the macro case for easing policy isn’t so clear cut, with the economy looking fairly resilient in the face of a major trade war and an immigration crackdown, the politics of monetary policy are getting complicated and it’s likely not worth defending keeping rates on hold.

Stephanie Roth, chief economist at Wolfe Research LLC, gave ger first thoughts on the report on Bloomberg Television’s Surveillance:

“First take is another weak summer employment report. Immigration seems to be having another impact on the data. When you look at the household survey, the foreign-born population was again, sort of the weaker part of it.”

“On Sept. 9, once we get the annual preliminary benchmark revisions, that’s going to be revised down to the tune of something like 600,000 — that’s going to be another really bad negative headline. Then beyond that, we think that the signs will look a little bit better.

Finally, the factory sector is clearly showing pain and reflects ongoing uncertainty linked to the new tariffs and the need for lower borrowing costs, Alliance for American Manufacturing President Scott Paul says in a release:

“The August jobs report should hopefully spur on two important actions. First, a cut in interest rates by the Federal Reserve. Second, concluding tariff actions and trade deals to provide businesses with the certainty they need to hire, invest in new capital equipment, and realign supply chains. Manufacturing will be treading water until we see those changes.”

For now, stocks are higher, Treasury yields are significantly lower (and bull steepening), gold hit a new record high, and bitcoin is surging .

The United States has ordered the deployment of 10 F-35 fighter jets to a Puerto Rico airfield to conduct operations against drug cartels, sources say, adding more firepower to intensifying U.S. military operations in the Caribbean that are stoking tension with Venezuela.

The new deployment comes on top of an already bristling U.S. military presence in the southern Caribbean as President Donald Trump carries out a campaign pledge to crack down on groups he blames for funneling drugs into the United States.

The disclosure about the F-35s came just hours after the Pentagon accused Venezuela of a "highly provocative" flight on Thursday by fighter jets over a U.S. Navy warship.

It also follows a U.S. military strike on Tuesday that killed 11 people and sank a boat from Venezuela Trump said was transporting illegal drugs.

At every turn, the Trump administration has sought to tie Venezuelan President Nicolas Maduro's government to narco-trafficking, allegations Caracas denies.

More specifically, Trump has accused Maduro of running the Tren de Aragua gang, which his administration designated a terrorist organization in February.

Venezuela's Communications Ministry did not respond to a request for comment about the F-35s or the allegations that Venezuelan fighter jets flew over a U.S. warship.

The sources, speaking on condition of anonymity about the latest U.S. deployment, said the 10 fighter jets are being sent to conduct operations against designated narco-terrorist organizations operating in the southern Caribbean. The planes should arrive in the area by late next week, they said.

F-35s are highly advanced stealth fighters and would be highly effective in combat against Venezuela's air force, which includes F-16 aircraft.

A U.S. official, speaking on condition of anonymity, said two Venezuelan F-16s flew over the USS Jason Dunham on Thursday.

The Dunham is one of at least seven U.S. warships deployed to the Caribbean, carrying more than 4,500 sailors and Marines.

U.S. Marines and sailors from the 22nd Marine Expeditionary Unit have also been carrying out amphibious training and flight operations in southern Puerto Rico.

The buildup has put pressure on Maduro, whom U.S. Defense Secretary Pete Hegseth has called "effectively a kingpin of a drug narco state."

Maduro, at a rare news conference in Caracas on Monday, said the United States is "seeking a regime change through military threat."

Speaking on Thursday, Hegseth defended Tuesday's deadly strike in comments to reporters and vowed that such activities would continue, citing the threat that illegal narcotics pose to public health in the United States.

"The poisoning of the American people is over," Hegseth said.

Rep. Ilhan Omar, a Democrat from Minnesota, condemned what she called Trump's "lawless" actions in the southern Caribbean.

"Congress has not declared war on Venezuela, or Tren de Aragua, and the mere designation of a group as a terrorist organization does not give any President carte blanche to ignore Congress’s clear Constitutional authority on matters of war and peace," Omar said in a statement.

U.S. officials have not clearly explained what legal justification was used for Tuesday's air strike on the boat or what drugs were on board.

Trump said on Tuesday, without providing evidence, that the U.S. military had identified the crew of the vessel as members of Venezuelan gang Tren de Aragua.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up